Wealth managers highlight impulsive decisions as the most common mistake made by clients with their investment portfolios, new European research from behavioural finance experts Oxford Risk shows.

Its study with wealth managers across Europe who collectively manage assets of around €327 billion, asked them to identify the top three mistakes they see clients make.

The most common error wealth managers questioned in the UK, France, Italy, Spain, and Ireland see is clients making impulsive decisions to the detriment of their long-term plans.

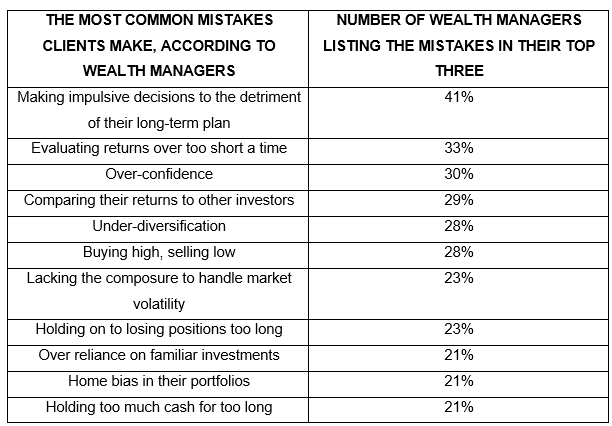

More than two out of five (41%) identified impulsive decision-making as one of the top three mistakes, followed by evaluating returns over too short a time period which was selected by 33%, and over-confidence, chosen by 30% of respondents.

Other mistakes that are made due to the effect of emotions on investing include, investors comparing their returns with other investors, or too much reliance on familiar investments.

Oxford Risk believes wealth managers can address these errors by making more and better use of available technology to provide a deeper assessment of investor’s financial personality and likely behavioural investing traits, helping the adviser better personalise their processes to meet investor needs.

The table below shows the most common mistakes that wealth managers believe clients make.

Greg B Davies, PhD, Head of Behavioural Finance, Oxford Risk said: “An adviser can devise an excellent investment strategy; indeed, it could be the “perfect” portfolio for the individual in theory.

“Yet if the person can’t stick to the plan or feels anxious while doing so, then sub-optimal behaviours leading to sub-optimal outcomes are the likely result. The right investing decisions are not about financial circumstances alone, but financial personality too, and we ignore that at our peril.

“Emotions and personality are at the root of most of the common mistakes wealth managers see and need to be factored into how advisers support their clients.”

Oxford Risk, which builds software to help wealth managers and other financial services companies assist their clients in making the best financial decisions in the face of complexity, uncertainty, and behavioural biases, has developed proprietary algorithms which rank products, communications, and interventions for their suitability for each client at a particular time.

Its behavioural tools assess financial personality and preferences as well as changes in investors’ financial situations and, supplemented with other behavioural information and demographics, build a comprehensive profile. Oxford Risk’s financial personality tests can measure up to 20 distinct dimensions, of which six reflect preferences for ESG investing.

It believes the best investment solution for each investor needs to be anchored on stable and accurate measures of risk tolerance. Behavioural profiling then provides an opportunity for investors to learn about their own attitudes, emotions, and biases, helping them prepare for the anxiety that is likely to arise. This should be used to help investors control their emotions, not define the suitable risk of the portfolio itself.