Building a unique, European-grown instant payment solution – The European Payments Initiative (EPI) welcomes four additional shareholders and announces two acquisitions. EPI Company confirmed its planned acquisition of payment solution iDEAL and payment solutions provider Payconiq International (PQI). EPI, iDEAL and PQI will join forces to realise EPI’s vision to set up a new, innovative and unified payment solution for Europe.

Currence iDEAL is the leading Dutch payment scheme, and PQI is a Luxemburg-based payment solutions provider that currently serves iDEAL in the Netherlands, Bancontact Payconiq Company in Belgium and Payconiq in Luxembourg. Agreement with the shareholders of these companies has been reached, and the acquisition is planned to go ahead, subject to approval by the competent national and European authorities.

The EPI shareholders—BFCM, BNP Paribas, BPCE, Crédit Agricole, Deutsche Bank, DSGV, ING, KBC, La Banque Postale, Nexi, Société Générale and Worldline—by combining their expertise over the past two years, have proven their determination and ambition to build a solution that will ensure Europe’s payment sovereignty. They also welcome four new shareholders: Belfius and DZ Bank, who joined at the end of 2022, and ABN Amro and Rabobank, two more major Dutch banks, who are now coming on board alongside existing Dutch shareholder ING.

Martina Weimert, CEO of EPI Company: “EPI is delighted to welcome Currence iDEAL and PQI. Together we will join forces to realise EPI’s vision as we build an innovative solution based on a new, unified instant payment scheme and platform for Europe. EPI will leverage the strong operational experience, know-how and local market knowledge of these companies. We are developing a new, scalable platform to address the modern and evolving payment needs of European consumers and merchants in the best possible way, with efficient, state-of-the-art technology.”

Built for Europe by European payment industry leaders

The EPI solution is built for Europe by European payment industry leaders and leverages the instant, account-to-account payment scheme that is widely available in the region. EPI will enable European banks and acquirers to join forces, delivering greater efficiency and value for customers through direct and instant payments between bank accounts.

EPI is positioning itself as the common solution and innovation platform of the European payment ecosystem. It will serve as a foundation for the fulfillment of the European Commission's and European Central Bank/Eurosystem’s pan- European retail payments strategy and a further catalyst to enhance Europe’s position as a global leader in payment innovation.

Daniel van Delft, CEO of Currence iDEAL: “The acquisition of Currence iDEAL by EPI marks the beginning of a new international adventure. In the short term, we will continue our focus on the scheduled roll-out of the new iDEAL and value-added services to improve the use of iDEAL for consumers and merchants. For the long term, we look forward to working together with our partners to realise the strongest foundation possible for this truly European payment scheme.”

Guido Vermeent, CEO of Payconiq International: “Payconiq is thrilled to fast-track its mission to contribute to an innovative payment solution for consumers and businesses throughout Europe with EPI. This transition is a testament to the hard work done by the Payconiq team, the continued support of our committed shareholders over the past years and the success of our advanced payment technology and capabilities. We look forward to working with the EPI team.”

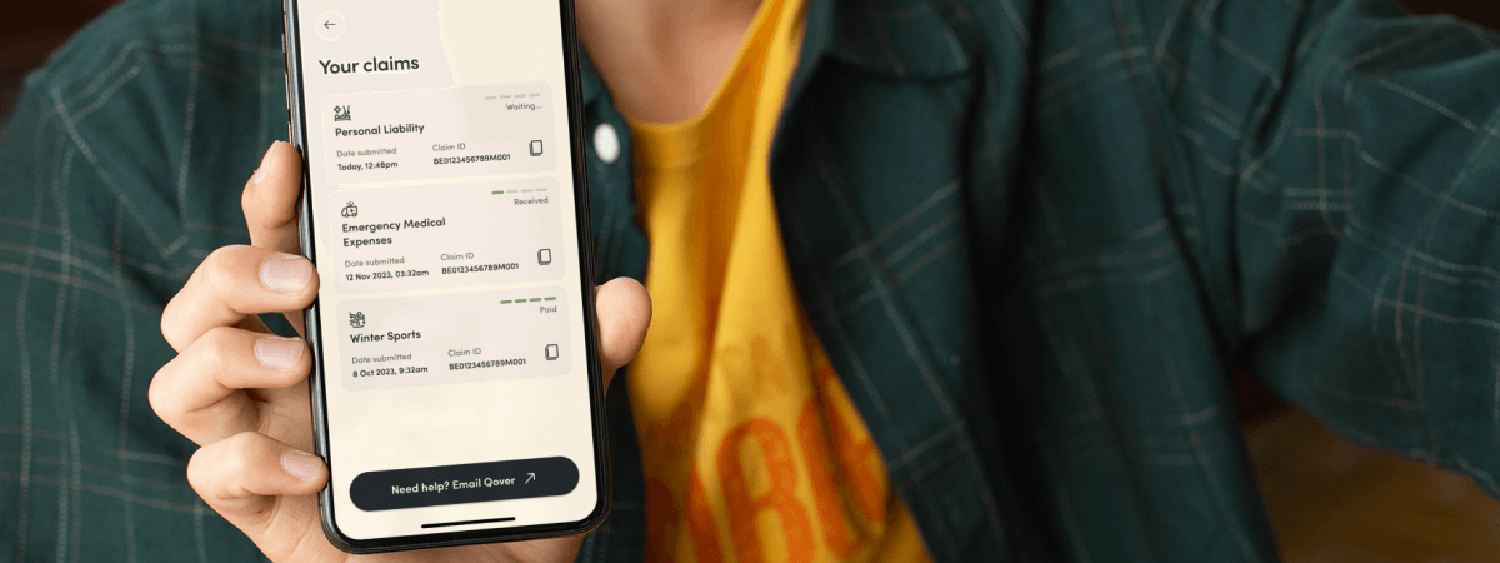

An all-in-one digital wallet solution

EPI’s shareholders are united in their mission to jointly deliver more value for consumers and merchants in Europe. The EPI product will be a multi-faceted digital wallet solution and an instant, account-to-account payment means under one brand, unified across European countries.

The company’s product roadmap is ambitious, addressing a comprehensive range of use cases. EPI will initially enable person-to-person (P2P) and person-to-professional (P2Pro) payments, followed by online and mobile shopping payments and then point-of-sale payments. A comprehensive range of transaction types will be supported, including one-off payments, subscriptions, installments, payments upon delivery and reservations. Additionally, value-added services will be incorporated into the solution over time, including responsible ‘Buy Now, Pay Later’ (BNPL) financing, digital identity features and integration of merchant loyalty programmes.

The EPI digital wallet with P2P payment functionality will be launched for the first users in a pilot phase by the end of 2023 across two countries: France and Germany. A broader market launch in Belgium, France and Germany will happen in early 2024. These markets together represent more than half of all non-cash payments in the Euro area. Expansion to other European countries will follow.

EPI is actively working with its members to develop the solution and prepare for its implementation and roll-out.