EV battery data is the super fuel that will power winners in the electromobility arena

Finance and insurance providers that gain access to accurate ongoing information about the condition and performance of EV batteries, a big part of electric vehicle prices, will gain a significant advantage over competitors.

In partnership with

Corporate Value Associates

Corporate Value Associates is a Global Strategy Boutique supporting market leaders in creating value through its customer-centric approach.

Finance and insurance providers that gain access to accurate ongoing information about the condition and performance of EV batteries, a big part of electric vehicle prices, will gain a significant advantage over competitors. They’ll be able to determine the real value of battery assets, not rely on estimates, when they set terms for loans or insurance cover.

The rise of electric vehicles (EV) is forcing banks, leasing firms, and insurers to rethink how they value automotive assets. That’s because EV residual values are far more volatile and complex than those of traditional petrol and diesel vehicles.

However, many financial services companies are overlooking one of the most critical components of the asset value of EVs – the battery. EV batteries can make up a third of the price of a new electric vehicle. What’s more, their value is not tied to the age or condition of the vehicle they are powering. Instead, it’s governed by factors such as the battery’s charging history, usage, internal technology, earlier applications and environmental conditions, as well as the performance of the EV driver.

“Batteries are the most critical and probably the most underrated component of the electromobility ecosystem,” says Markus Collet, Partner at consulting firm Corporate Value Associates (CVA). A battery is more than just part of a car, adds Collet.

“It is an asset by itself, with a beginning and an end that is circular, through refurbishing, recycling, or second-life applications.”

Banks, leasing firms and insurers that can access accurate ongoing information about the condition and performance of EV batteries will gain a significant advantage over competitors. They’ll be able to determine the real value of battery assets, not rely on estimates, when they set terms for loans or insurance cover. Such insights will reduce the provider’s risk and sharpen their pricing capabilities.

“State of health (SOH) is one of the most important issues when discussing EV batteries because it determines the residual value of the vehicle, the value of the battery as an asset, and how the battery can be used in the future,” adds Raffael Caldonazzi, Senior Strategy Consultant at CVA.

Caldonazzi points out that the importance of battery state of health stretches beyond just financial services firms. It affects participants across the entire electromobility ecosystem. Vehicle manufacturers, dealers, resellers, rental firms, fleet operators and consumers all need access to battery state of health data to enable them to evaluate, manage and mitigate risk related to EV batteries.

CVA’s Collet and Caldonazzi highlighted the growing importance of EV battery data at an online event the consulting firm hosted with Qorus. Other speakers included representatives from EV battery and vehicle manufacturer BYD, battery management specialist Bib Batteries, and financial services conglomerate Société Générale.

How firms across the electromobility sector can benefit from access to real-time battery State of Health (SOH) data:

- Banks and vehicle leasing companies: More accurate EV residual value forecasting reduces risk exposure and enables firms to offer competitively priced loans based on the actual asset value of batteries.

- Insurance providers: Real time SOH data enables insurers to better determine the value of the assets they cover, improve the pricing of their policies and offer EV owners usage-based cover that rewards responsible driving and efficient battery charging.

- Used vehicle dealers and buyers: Certified SOH reports enable purchasers to determine more accurate valuations of the battery component of EVs and thereby strengthen consumer trust and confidence.

- Vehicle OEMs and fleet operators: Proactive monitoring of EV battery health improves vehicle preventative maintenance, increases uptime and reduces repair costs.

- EV drivers: Real time SOH insights encourage better driver behavior and charging habits that can preserve battery life, enhance the unit’s long-term performance and earn attractive finance and insurance options.

- Energy companies and battery recyclers: Accurate SOH information helps companies better identify second-life applications for EV batteries, such as energy storage units, powering electric boats or alternatively being earmarked for refurbishing or recycling.

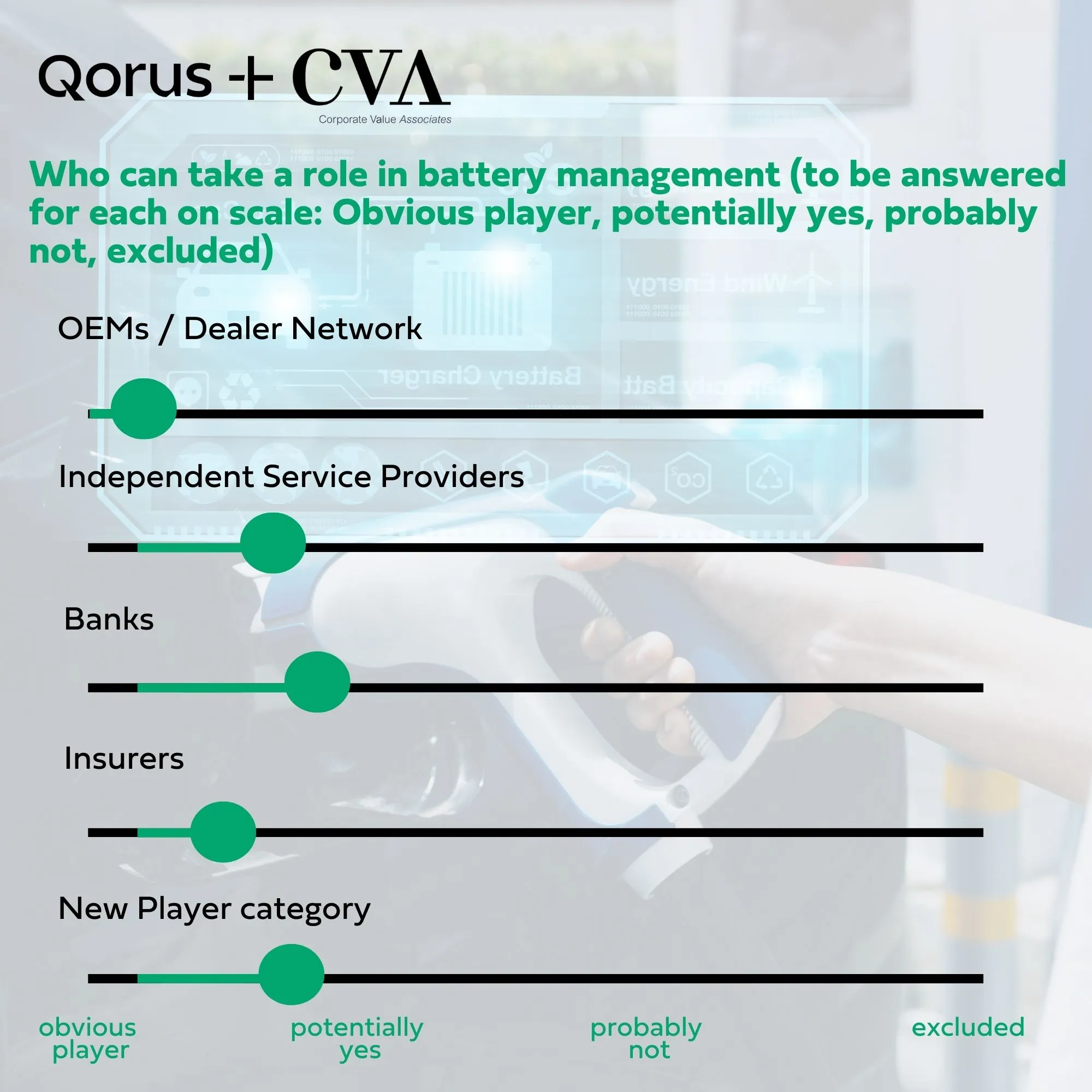

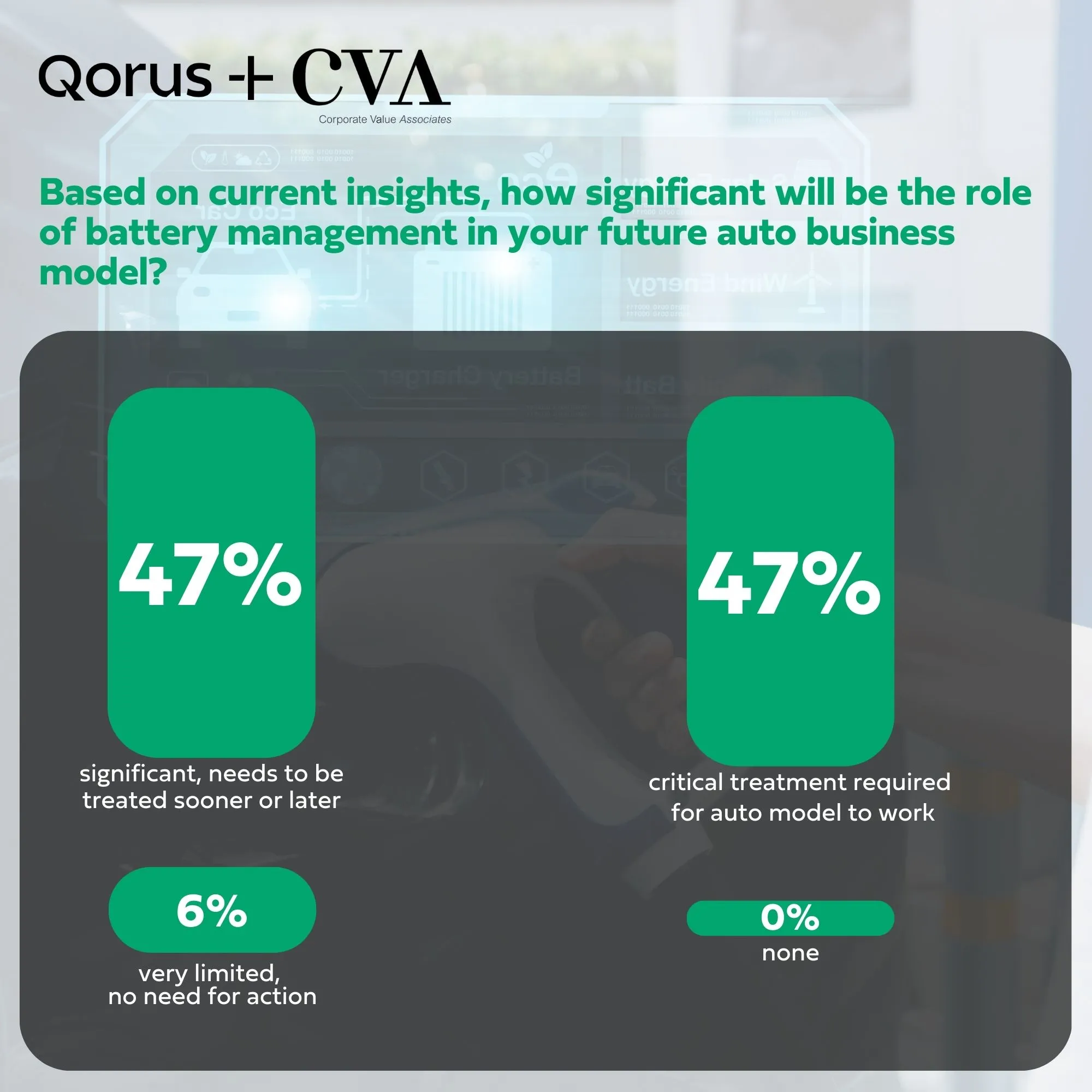

Financial services executives are starting to appreciate the value of real time battery data. Nearly 95% of the executives who responded to a poll during the online event reported that battery management will be either significant or critical to their auto business models. A follow-up poll identified banks together with vehicle OEMs and dealers as likely leaders in battery management.

Société Générale, for example, has extended its banking and advisory services beyond the traditional automotive sector and now supports a wide range of projects related to the production, sale and reuse of EV batteries. Its projects span the extraction of raw materials, with clients such as Pilbara Minerals and Verkor, building EV battery factories with the likes of AESC and Stegra, through to financing high-tech facilities, including Intel’s new microprocessor plant, that are powered by large scale batteries.

Christophe Hadjal, head of advisory and business development for natural resources, mining, metals and industries at Société Générale, says the revolution sweeping the automotive industry that’s fueled by the shift to low-carbon vehicles is creating opportunities for an array of new alliances and partnerships.

He adds that Société Générale’s support for the projects across the battery supply chain is key to the institution’s sustainability goals.

“We are committed to the low-carbon transition. Société Générale is a member of the Net-Zero Banking Alliance. Our portfolio needs to be net zero by 2050.”

Several of the projects that Société Générale is backing are intended to help countries in Europe better manage and retain materials critical to the production and recycling of EV batteries. The EU plans to introduce a compulsory Battery Passport in 2027. It will require battery manufacturers and importers operating in the EU to issue a digital record for all batteries over 2 kWh that identifies the unit’s composition, origin and lifecycle.

EV battery data providers

- Vehicle OEMs and battery manufacturers.

- EV fleet telematics and IoT platforms.

- Battery analytics startups and third-party platforms.

- Regulatory authorities and industry associations.

- EV fleet operators and charging networks.

EV suppliers that also manufacture the batteries that power their vehicles are especially well positioned to capitalize on the increasing importance of battery data. Tesla and BYD, for example, are able to access and analyze real-time data about the performance of their vehicles as well as their batteries. Other EV suppliers, such as General Motors and Ford, as well as independent battery producers, notably Panasonic and LG, are also promoting the use of onboard battery management systems (BMSs) that monitor the performance and health of EV batteries.

Steve Beattie, sales and marketing director at BYD UK, says the company’s battery technology gives it a significant competitive advantage in the EV market.

“We're introducing a used-car program that is going to have a battery state of health certificate issued with every vehicle that's sold. It will be a first. I don’t think anyone else has done that in the UK.”

BYD began business in 1995 making mobile phone batteries for firms such as Motorola and Nokia and is now a leading manufacturer of EV batteries and vehicles. Since BYD entered the automotive market in 2005, it has closely integrated its battery technology with its development of new vehicles. The company’s lithium iron phosphate (LFP) Blade Battery, for example, is more compact, durable and efficient than most competitive products and is also much safer in the event of a vehicle collision, says Beattie.

Growing demand for battery data has attracted many new entrants into the electromobility ecosystem. Bib Batteries in France, for example, monitors EV battery health and residual values.

“Our goal is to turn the black box of the battery into a crystal-clear asset that companies can understand and manage,” says Pierre-Amans Lapeyre, co-founder and CEO at Bib Batteries.

The company’s battery SOH monitoring and data analysis provides buyers and sellers of EVs with accurate information about the residual value of the batteries in their vehicles. It also enables EV manufacturers to identify the most cost-effective destination for used batteries. The cost of disposing batteries is a significant factor that sustainability initiatives need to address, says Lapeyre.

“The used EV battery market is still immature. But it has a floor, which is the cost of recycling the unit to recover the value of its component materials, and it has a ceiling which is the price of new LFP (lithium iron phosphate) batteries, that’s around €50 to €100 per kWh. We need to connect the dots and make sure the best batteries with the highest SOH are sent to buyers willing to pay the most, while batteries that cannot be reused go directly to recycling without incurring extra logistics or testing costs for the asset owner.”

Access to battery data is becoming a key factor in the race among companies in electromobility ecosystem to develop new business models and unlock revenue opportunities. Businesses that gain access to real time battery data will be able to outperform competitors by improving their EV valuations, developing better pricing models, and staying ahead of new regulations that require greater battery SOH transparency.

Factors affecting EV battery residual values

- EV driver behavior

- Charging history

- Post EV usage

- Internal technology

- Chemical composition

- Age

- Environmental conditions

Mobility community

With Qorus memberships, you gain access to exclusive innovation best practices and tailored matchmaking opportunities with executives who share your challenges.