Climate risk and banks’ portfolio decarbonization: Global outlook and trends

The Glasgow Financial Alliance for Net Zero (GFANZ), comprising over 550 global financial institutions committed to fully decarbonizing their portfolios by 2050, has played a significant role in raising awareness and making climate action a business norm. Decarbonizing portfolios has become crucial for banks as the world moves towards a low-carbon economy. Banks are prompted to take a holistic approach, considering not only the carbon footprint of their investments but also the entire value chain of their financing activities.

In partnership with

TNP Consultants

Created in 2007, TNP is an independent and hybrid French consulting firm specializing in operational, regulatory, and digital transformations. Present in France, Monaco, Italy, Luxembourg, Germany, Switzerland, Morocco, India, and Ivory Coast. TNP is involved in various dimensions and regulatory, operational strategy, information system, business and human capital and projects...

Decarbonizing portfolios has become increasingly important for banks as the world moves towards a low-carbon economy. To achieve this goal, banks are being prompted to take a holistic approach to portfolio decarbonization, considering not only the carbon footprint of their investments but also the entire value chain of their financing activities. This will require significant effort and investment, but it will also create new business opportunities in the low-carbon and sustainable financial markets.

Representing more than 550 global financial institutions that have committed to fully decarbonizing their portfolios by 2050, the Glasgow Financial Alliance for Net Zero (GFANZ) has celebrated its second birthday in April 2023. A lot has changed thanks to GFANZ’s strong presence and awareness creation since its founding in April 2021: attention to banks’ financed emissions and net zero strategy is no longer a nice-to-have, but it is becoming more and more business as usual.

What can we expect from 2023 when it comes to banks’ portfolio decarbonization activities and strategies?

We’ve tried to find answers with the help of global leaders in sustainability and ESG, who shared with us how they are addressing decarbonization and working with GFANZ recommendations, and talked through where they think the potential opportunities are in this space. David Carlin, Head of Climate Risk and TCFD at UNEP FI, shared his perspectives on the global outlook and trends of climate risk and net zero.

David highlighted three major elements that will influence and determine the next steps for banks and their portfolio decarbonization activities, and elaborated the important role of GFANZ in shaping these:

Formalization of commitments

- Target setting guidance

- Target setting protocols for different industries

Operationalization of those commitments

- Emergence and development of transition plans

- Guidance on how transition plans should look (measurable and monitorable)

- Transition plans should be living documents

Financial and regulatory scrutiny

- Addressing greenwashing concerns

- Mandatory transition plan disclosures

Vera Economou, ESG Group Competence Center Lead, underlined best practices of Raiffeisen Bank International as a sustainable finance leader in Austria and CEE when it comes to carbon footprint calculation and management, focusing on how not just to turn away from polluting customers but on how to engage them in the net zero journey.

As we look towards 2023 and beyond, we can expect banks to ramp up their portfolio decarbonization initiatives and strategies. This shift will have a significant impact on the banks themselves, as well as their customers. The environmentally conscious market continues to grow, and banks will need to adapt their strategies to meet this demand.

TNP comment on the topic:

Portfolio decarbonization in the financial industry is driven by the recognition of climate change as a significant financial risk and the growing demand for sustainable investment options. By actively managing and reducing the carbon footprint of investment portfolios, financial institutions can contribute to mitigating climate change while also generating long-term and sustainable value for their clients and stakeholders.

Reaching ESG reporting maturity in financial services

Across the various jurisdictions there is a wave of sustainability, ESG and climate reporting and disclosure requirements heading towards both financial and nonfinancial corporates.

These firms not only have to collect and process a lot of new information to fill in these new disclosures, but also in a number of areas have to adjust their internal processes and strategies to match the expectations and requirements that come with these new reporting frameworks. Examples of such areas include attention to carbon footprint measurement and management, forward-looking climate scenario analysis and net zero decarbonization strategy.

For banks, these new disclosures on one hand represent a lot of effort to comply with, but on the other hand also provide an opportunity to tap into this new source of information on their large customers that will become available as BAU and will help banks to better understand the sustainability related risks and opportunities embedded in their portfolios and large customers.

We explored the key elements of the challenges outlined above and analyzed the latest trends and challenges financial institutions are facing now: lack of standardization, data quality and reliability, regulatory uncertainty, scope and relevance of ESG factors.

Patrick de Cambourg, Sustainability Reporting Board Chair of EFRAG, shared updates straight from the EFRAG kitchen covering the latest developments surrounding the European Sustainability Reporting Standards (ESRS) and Corporate Sustainability Reporting Directive (CSRD), going through the key features of the European legal and regulatory regimes and highlighting the focus on interoperability and double materiality:

- Impact materiality (Inside-out): actual or potential positive or negative impacts of the reporting firm on people or the environment

- Financial materiality (Outside-in): a sustainability matter is material if it triggers or may trigger material financial effects for the reporting firm.

Patrick also emphasized the strong commitment of EFRAG towards having mandatory Scope 3 emissions reporting captured by the ESRS.

We also collected via poll survey valuable perspectives from the financial institutions on how far along they are with the deep diving into CSRD. Despite the closing implementation deadlines (2024 onwards), according to the poll results around one fourth of institutions have not yet started looking closely into this new disclosure framework. Furthermore, not surprisingly, the poll participants clearly identified collecting and managing of ESG data as by far the biggest obstacle to successful implementation of CSRD.

From the perspectives shared, it has become clear that banks are only at the beginning of their journey and there is still a long path ahead for them till they reach ESG reporting maturity, with data gaps being the main obstacle standing in their way. While there are lot of efforts and risks faced by banks along the way, such as dealing with greenwashing accusations, there are also a number of business benefits that banks can leverage from the ESG and disclosures wave and momentum.

TNP comment on the topic:

An efficient and operant implementation of ESG regulations and disclosure requirements, such as the CSRD regulation, should be based on five incremental steps:

- perform a regulatory analysis

- assess the gap compared to as-is operating model

- evaluate the maturity of each requirement

- design the target

- deploy an integrated ESG reporting framework

Our conviction is that to ensure a good start in the implementation of CSRD reporting norms, institutions need to define a clear ambition, to leverage on the as-is, to ensure a good auditability of the approach, and to rely on reliable and granular data.

ESG data strategy: Emerging initiatives and lessons learned from the leading institutions

Addressing ESG and sustainability objectives and building a sustainable financial system requires a solid ESG information architecture based on high-quality, reliable, and comparable data.

However, the lack of transparency and costs of ESG data can be significant challenges preventing firms and banks from properly performing their sustainability, ESG, and climate-related activities. Some data just does not exist yet, some is difficult to trust and some is just too difficult to get. And these challenges are often rather segment specific; whereas corporate sector data is becoming more common thanks to the upcoming ESG disclosures, the data for SME and retail segments are more problematic.

Nevertheless, the disclosure requirements and regulators are pushing banks to move ahead despite this lack of data, and thus banks often have to rely on imputing the missing information using proxies, expert judgments, and models, and thus make decisions based on incomplete data.

Leading financial institutions representatives shared with us which ESG data challenges they have and what steps they are taking to improve their ESG reporting and transparency, recognizing the importance of ESG data. Our experts discussed a number of emerging innovative ESG data initiatives that could potentially resolve various issues around the missing ESG data, for example, industry data pooling initiatives

from OeKB (Oesterreichische Kontrollbank).

Nastassja Cernko, Director of Sustainability, Project Analyses, and Strategy at OeKB, presented their innovative industry collaboration, ESG data pooling and sharing service in Austria – the OeKB ESG Data Hub. This collaborative platform, developed jointly by Austrian banks for their corporate and SME customers, aims to provide a single point of truth where bank customers can provide the ESG related data that banks need in their loan assessment and underwriting processes.

The OeKB ESG Data Hub not only simplifies and standardizes the ESG data collection process for the collaborating banks, but also acts as a know-how and collaboration center for the non-financial corporates from different industries debating the information to be provided together by banks, benchmarking their approaches and facilitating know-how transfer.

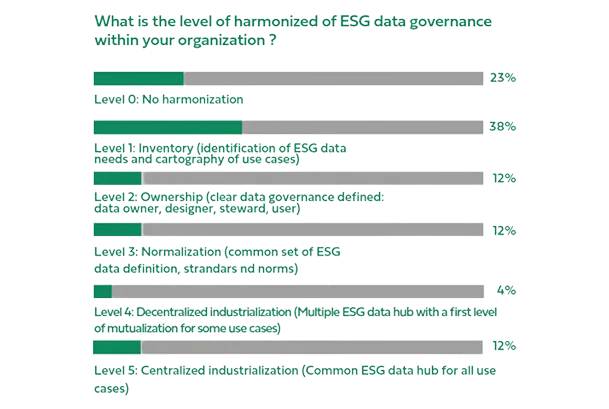

Via poll survey, we also collected valuable perspectives from the experts on the level of harmonization of ESG data governance within their organizations. The results confirmed the variety of maturity levels among the banks, with the majority being in the early stages.

ESG data challenges are not going away anytime soon, and financial institutions cannot afford to wait till they get resolved. However, from the perspectives shared and discussions led by our experts it became clear that there are emerging initiatives and lessons learned already available from the leading institutions that can be leveraged now to provide valuable support in addressing the current challenges faced with ESG data.

TNP comment on the topic:

It appears essential to adopt a structured approach to build a robust and efficient ESG data management framework fully integrated in the company’s global data governance strategy. The main challenges of that process are considered to be data collection and sourcing; calculation and processing; IT infrastructure and tools; data governance. We suggest six tips for an efficient ESG data management within your organization:

- engage stakeholders

- map the right data source

- build a strong data quality framework

- harmonize standards

- digitally transform ESG

- use data effectively

Latest trends and innovations in climate risk management

According to leading regulators, climate change presents significant financial risks, and they demand banks to take actions accordingly. Regulatory exercises such as climate stress tests, paired with the first climate-related losses already hitting banks’ P&Ls around the world, are pushing climate risk management to the forefront of the agenda of banks’ risk management and strategy teams.

Compared to the ‘vanilla’ or ‘classical’ financial risks, managing climate, physical and transition risks require new data, new models, new approaches and longer time horizons impacting banks’ business strategies.

However, due to the shortage of available data and capabilities, lack of global harmonization and alignment on the methodologies, and already very volatile economy and markets, lots of banks are still struggling to properly and efficiently address these new risks.

Our experts explored the key lessons learned so far and main 2023 attention points and emerging trends for climate risk management.

Marc Irubetagoyena, Head of Stress Testing at BNP Paribas, gave us an overview of current climate scenario analysis practices and shared insights into the challenges that need to be resolved to meet supervisory expectations:

- Data gaps

- Use of plausible scenarios and their linking to models

- Adaption of existing models to these new risks

- Lack of resources

- Communication to different stakeholders

Maxime Druais, Head of ESG at Natixis Assurances, BPCE Group, touched on the latest progress of the Net Zero Banking Alliance’s work on the setting of portfolio 2030 decarbonization targets, particularly in the oil and gas and energy sectors, She emphasized the importance of decarbonization for climate risk management but at the same time highlighted the need for forward-looking approach applied by banks when supporting their customers on their transition.

Gabriel Marosi, ESG Advisor to the Board at Erste Group shared his perspective on how climate related risks are different from traditional risks. The recent ECB research and stress test results show that short-term costs of transition are relatively small in comparison with the costs of unfettered climate change in the medium to long term. Compared to an orderly transition scenario, they estimate a 3.5% expected loss on euro area banks’ credit portfolios in case of disorderly transition over a 30- year horizon, while losses in a no-transition scenario would lead to expected losses of up to 8.5%. This roughly puts an annual erosion of banks’ assets at 30 bps, which is already visible in banks’ annual running costs of risks. The first assets that are likely to impacted are low energy efficiency building and the high emission sectors.

What banks could and should do:

- First, banks need to build a robust carbon footprint calculator of their financed assets. This is essential for understanding where transition risk concentrations reside and identifying the most exposed assets. What gets measured, gets monitored, and gets managed.

- Second, they need to build up forward-looking transition plans to identify portfolio assets that are fit for the future, which are like gold treasures for banks and should be kept and protected; then assets that will require transition work; and assets that require intensive care by the bank.

Gabriel highlighted that banks should see the various forward-looking requirements from the various disclosure frameworks as more than just a reporting exercise, and rather see this as an opportunity to gain important business insights into their portfolio to identify the future needs of the various segments and customers in their portfolios. They can then use this information to formulate the corresponding financing strategy that would best fit these expected needs and derive business benefits for both banks and their customers.

The work of regulators on capital requirements and climate risks will be also crucial for the next steps of how banks will steer their portfolios into the future. The two main Pillar One approaches that are currently considered by regulators, namely the ‘green supporting factor’ and the ‘brown penalization factor’, each have their pros and cons, and can have an important influence on the decarbonization strategies of banks and their impact on the real economy.

TNP comment on the topic:

Climate risk management is a key challenge for all financial institutions, as the impact of climate change significantly affects financial stability and reputation. FIs need to be proactive and comprehensive in their approaches to assessing, disclosing, and mitigating their exposure to climate-related risks: physical, transition, and reputational risks.

Some of the latest trends in climate risk management could include integrating climate scenarios into stress testing and capital planning. FIs can use scenario analysis to evaluate how different climate pathways could affect their assets, revenue, and costs. This can help them a lot in identifying potential vulnerabilities and opportunities, as well as in forming strategic decisions and capital allocation.

Key findings

The first half of 2023 was a busy period in the ESG, climate and net zero arena both for financial services institutions and for their main customers in the non-financial corporate domain. We have seen a number of major developments reshaping the way both firms and authorities look at climate change, including:

- March: The release of the IPCC’s AR6 Synthesis Report: Climate Change 2023 marked the closing of the sixth assessment cycle of IPCC’s climate change research. This ‘bible’ of climate change science comprising the latest evidence and forward-looking forecasts on climate change, with contributions from hundreds of scientists spanning more than 10,000 pages, forms the basis for the Network for Greening the Financial System (NGFS)’s climate scenarios which are used by regulators and financial institutions around the world.

- March: The EU approved the Net Zero Industry Act, which puts forward a number of requirements and financing options pushing for extensive emissions reduction in key EU industries, making decarbonization very real and very concrete for EU firms and their financing banks.

- June: Publication of the International Financial Reporting Standards (IFRS) S1 and S2, setting out sustainability and climate-related disclosure requirements. This long-awaited milestone is crucial for shaping and pushing the sustainability and climate disciplines to further maturity across the globe, particularly on the non-financial corporate side.

It is clear that the climate and decarbonization movement is only gaining momentum and is climbing up firms’ agendas as it demands more and more attention from senior management. As a matter of fact, just within one year, the percentage of CEOs that have their compensation tied to ESG goals rose to 50% from 15% the year before, according to a recent survey by IBM.

At Qorus communities, by bringing together the leading firms and experts, sharing the best practices, and stimulating valuable discussions and exchange of ideas among our members, we are privileged to contribute to further development and efficient engagement in the constantly evolving field of climate change response, sustainability, and ESG.

Download your study now

ESG community

With Qorus memberships, you gain access to exclusive innovation best practices and tailored matchmaking opportunities with executives who share your challenges.