Empowering smallholder farmers: How financial institutions lead the way towards sustainable agriculture

Smallholder farmers face numerous struggles, including limited digital access, financial constraints, and difficulties in establishing connections with buyers and accessing larger markets. They also lack crucial agricultural knowledge and face challenges in adopting sustainability standards. Fortunately, numerous financial institutions are driving change and empowering smallholder farmers worldwide.

Despite their significant contributions, smallholder farmers face numerous challenges that threaten their livelihoods and exacerbate prevailing disparities. “Smallholder farmers, who operate on modest plots of land, play a critical role in global food production. They contribute around one-third of the world’s food supply, with five out of six farms falling into this category,” emphasizes Sylvian Morel, Vice President, Business Relations and Development, Agriculture and Agri-Food Markets at Desjardins.

The year 2023 brings both worrisome trends and promising opportunities for smallholder farm innovation. Global food insecurity persists due to conflicts, insufficient investments and geopolitical challenges, resulting in high food prices. However, advancements in precision farming techniques and increased investments in sustainable practices offer hope for improving productivity and livelihoods. Nonetheless, smallholder farmers are particularly vulnerable to climate change, with projected impacts leading to decreased crop suitability and agricultural productivity. Additionally, new legislation aimed at combating deforestation poses challenges for smallholder farmers, who often lack the necessary digital records to comply with traceability requirements.

Smallholder farmers face numerous struggles, including limited digital access, financial constraints, and difficulties in establishing connections with buyers and accessing larger markets. They also lack crucial agricultural knowledge and face challenges in adopting sustainability standards. These issues highlight the urgent need for collaborative efforts from the public and private sectors to bridge the digital divide and provide smallholder farmers with the necessary tools and opportunities to thrive.

Fortunately, numerous financial institutions are driving change and empowering smallholder farmers worldwide. José A. Carrera Espinosa, Senior Advisor for International Relations at Banco Pichincha, sheds light on their approach: “By providing custom-made products, extending the grace period and terms of the loans, adapting the frequency and the payments to meet the cycle of the crop and the cash flow, we are better serving our agricustomers. We use alternative data to create models and specialized credit scorings that help the bank in risk reduction and decision making."

Farmers are the economic backbone of many developing countries, such as South Africa, where Nedbank is striving to support the sector through innovative technologies, partnerships, new product development and a relationship-based approach. “Nedbank views agriculture as a long-term investment which plays a vital role in our economy – not only in terms of economic activity, exports and job creation, but importantly in ensuring food security. A vibrant, competitive and inclusive agricultural sector is paramount for South Africa, and we continually seek to enhance and innovate our offering to South African farmers and agribusinesses,” explains John Hudson, National Head of Agriculture and Business Banking at Nedbank.

Banks also have a key role to play in promoting sustainable agriculture. Donal Whelton, Head of Agri, Food & Fisheries at Allied Irish Banks (AIB), highlights his institution’s commitment to environmental stewardship: “Given the importance of the sector to AIB and indeed the wider economy, our focus over the next 2-3 years will be on supporting the sector’s transition to a low-carbon economy and supporting our individual farming customers as they take actions on their own farms to make them more sustainable."

Across the Atlantic in Canada, Desjardins is taking a similar approach. “Our priorities include developing ESG products and services for agricultural businesses; educating and equipping our front-line teams in sustainable farming practices and helping them identify ESG risks; and educating and equipping our members in the various practices that help reduce GHGs and any other practices that help build resilience to climate change,” explains Sylvain Morel.

In parallel with all these efforts, a wide range of initiatives is emerging, aimed at enhancing the lives of smallholder farmers and promoting sustainability in agriculture. From mobile apps that facilitate direct purchases from disadvantaged regions, to pay-as-you-go tractor sharing and climate insurance solutions, these innovations aim to improve the livelihoods of farmers and promote sustainability in agriculture. Through these transformative initiatives, smallholder farmers have the opportunity to overcome challenges, increase their productivity, and contribute to a more sustainable and prosperous future in agriculture.

Authors

Emerging trends in smallholder farming

In a recent study conducted by the Food and Agriculture Organization of the United Nations, it has been revealed that smallholder farmers occupy 70-80% of the world’s farmland, generating 80% of the global food output. These findings underscore the vital role of smallholder farmers and the need to support their efforts in sustaining the global food system.

Despite their crucial contributions, smallholder farmers now face a growing threat to their livelihoods in the form of land inequality. This distressing trend is characterized by rising disparities and imbalances in land ownership, exacerbating the challenges faced by the most vulnerable among us. A recent report from the International Land Coalition brings these issues into sharp focus, revealing an alarming reality: the wealthiest 10% of rural populations control a staggering 60% of agricultural land value, while the poorest 50% have access to a mere 3%. These stark inequalities not only jeopardize the well-being of smallholder farmers but also contribute to the pressing global crises of our time, including climate change, mass migration and unemployment.

Global food insecurity remains a pressing issue, exacerbated by conflicts and insufficient investments that hinder the improvement of small farm yields. Soaring food prices might be expected to benefit farmers, but parallel hikes in the price of fertilizers and other inputs largely negate this. At the same time, geopolitical challenges and political instability add another layer of complexity, casting a shadow on food security worldwide.

However, in the midst of these obstacles, there’s reason to be hopeful. Opportunities for smallholder farm innovation are emerging, ready to uplift productivity and livelihoods. Thanks to cutting-edge technologies and real-time data, precision farming techniques tailored to smaller-scale farms are gaining momentum, shining a light on the path ahead. Moreover, the forecast indicates a promising direction with increased investments in sustainable farming practices, climate adaptation and the crucial reduction of livestock emissions.

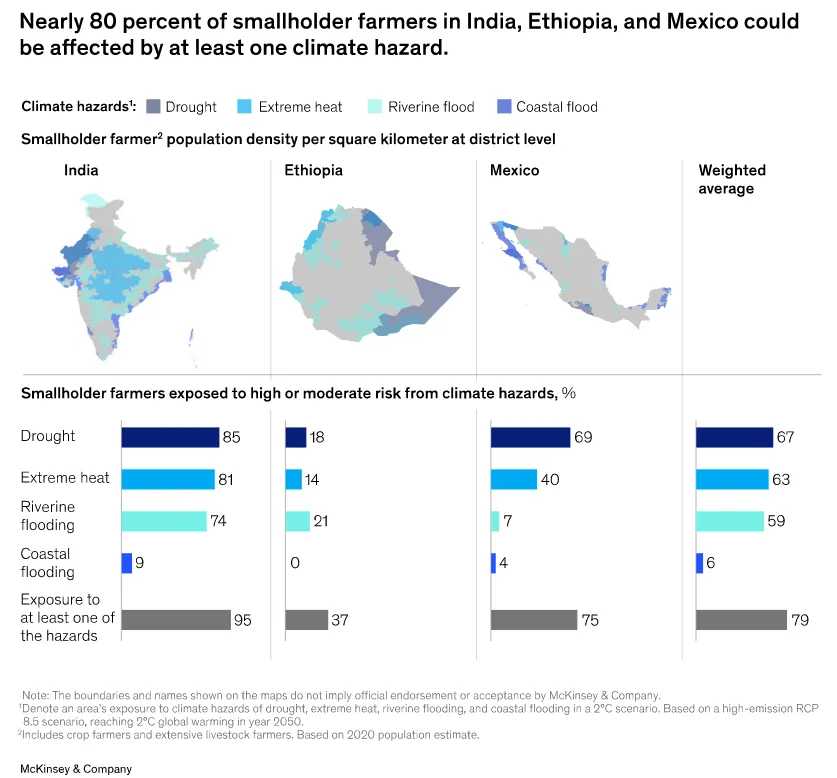

Despite increased access to new technologies, farmers face a major hurdle in the form of climate change. Its impacts pose a significant challenge for smallholder farmers, leaving them particularly vulnerable. According to McKinsey, by 2050, a staggering 80% of smallholder farmers in countries like India, Ethiopia and Mexico could directly face the brunt of various climate hazards. But that’s not all. The suitability of land for crop production will also be disrupted by climate change, with India alone projected to lose a massive 450,000 square kilometers of land suitable for rainfed rice cultivation by 2050. The reality of climate change’s influence is already apparent, as global agricultural productivity has witnessed a significant decline of 21% since 1961.

This reality highlights the urgent need for measures such as the European Union’s legislation aimed at combating deforestation caused by commodity production. However, the effectiveness of the new law hinges on the availability of detailed data on smallholder farmers operating within informal supply chains. The EU regulation requires companies to provide a due diligence report containing specific information on the origin and deforestation status of commodities in their supply chains. While the intention is to ensure traceability, there are challenges in obtaining accurate and granular data, particularly in supply chains involving smallholder farmers. Many of the commodities targeted by the regulation, such as palm fruit, rubber, cocoa and coffee, are produced by smallholders in informal supply chains that lack digital records of transactions. Their inability to demonstrate traceability in their supply chains could result in their exclusion from European markets.

Connecting the dots: The struggles of smallholder farmers

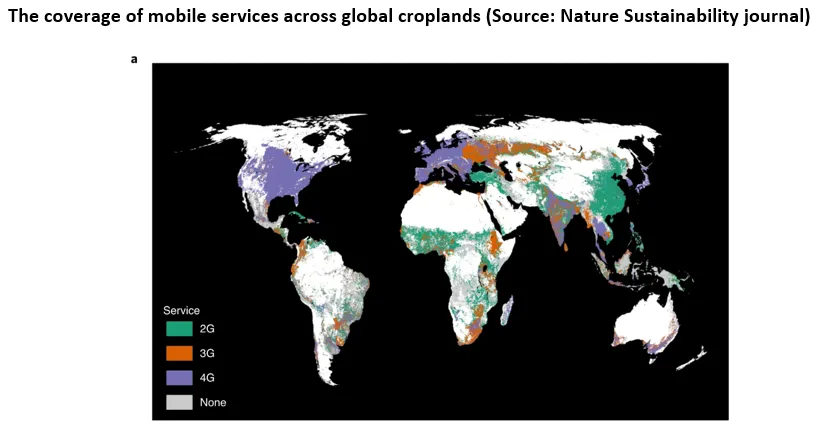

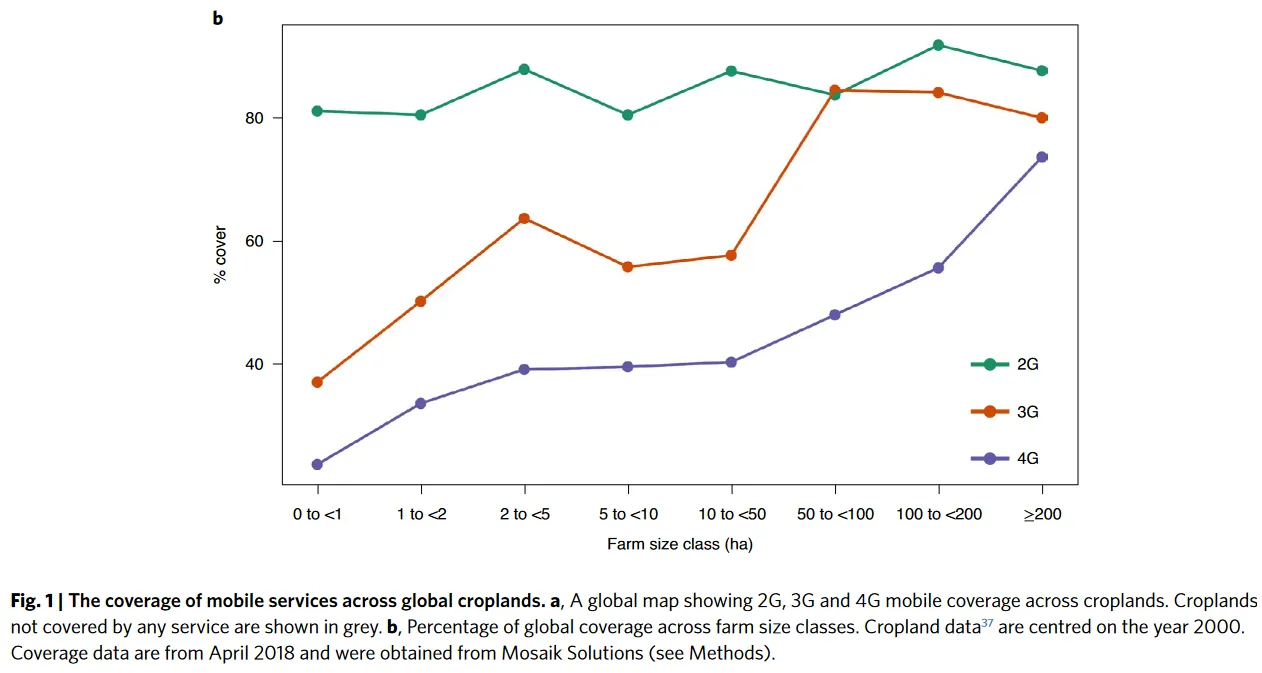

In today’s fast-paced digital era, it’s disheartening to see smallholder farmers left behind, struggling with limited digital access, which prevents them from accessing the technology and market opportunities they deserve. In a world where leveraging technology is vital for enhanced productivity and efficient operations, only 24-37% of farms smaller than 1 hectare have access to 3G or 4G services, while larger farms enjoy coverage of 74-80%. This disparity is particularly distressing in regions facing severe yield gaps, climate stress and food insecurity, as these areas also suffer from poor service coverage.

However, the challenges faced by smallholder farmers extend beyond digital access. Financial constraints often pose significant barriers to their access to modern agricultural technologies. Despite the huge demand for agricultural finance, estimated at around $450 billion for various financial services, access to finance remains limited for smallholders, with less than 10% benefiting from approaches like value chain finance, which primarily caters to established value chains focused on high-value cash crops.

These financial limitations further compound the hardships endured by smallholder farmers in the face of climate change, which – as mentioned in the last section – casts a shadow of decreased productivity and heightened vulnerability over their livelihoods. The very conditions that emerge as a result of this global phenomenon serve as a breeding ground for pests and diseases, wreaking havoc on crops and leading to substantial losses. Particularly in Africa, the heartland of staple crops such as maize, rice and wheat, projections indicate an alarming surge of 50% in pest-driven losses. As if that wasn’t enough, alterations in rainfall patterns and mounting water stress compound the problem, exacerbating water scarcity issues that directly impact smallholder farmers heavily reliant on rainfed agriculture.

However, it is not just the crops that suffer. The agricultural workforce, too, stands on the frontline of vulnerability, experiencing a heightened risk of adverse health outcomes due to the escalating global temperatures. It is shocking to discover that agricultural workers face a staggering 35 times higher mortality rate from heat-related incidents compared to workers in other industries. Often obliged to work in sweltering conditions that exceed international standards, they are at significant risk of heat stress. Their vulnerability is further amplified by factors such as intense manual labor, piece-rate payment systems that discourage breaks, and the lack of control over workplace health and safety practices.

Smallholder farmers face a major hurdle in establishing connections with buyers and accessing larger markets, limiting their growth and potential. In sub-Saharan Africa, the prices of staple foods such as maize, beans and rice exhibit significant variations, impacting the well-being of both producers and consumers. While transportation costs often shoulder the blame for the imbalanced food supply, other factors also impede the smooth flow of crops across markets, such as limited access to market information.

In this context, the saying ‘knowledge is power’ rings true for farmers. A recent study conducted in sub-Saharan Africa emphasized the urgent requirement for agricultural knowledge among farmers in the region. These farmers expressed a strong eagerness to enhance their understanding across a range of subjects, including efficient farming techniques, effective pest control, broader agricultural education, market connections, optimal use of inputs, and insights into climate patterns. However, the study simultaneously revealed a significant gap in awareness among farmers regarding crucial agricultural knowledge, hindering their ability to make informed decisions in their daily farming practices.

While farmers strive to bolster their knowledge and improve their practices, consumers, especially in developed countries, are becoming increasingly conscious of food quality, safety, environmental concerns and human rights within the realm of agriculture. However, smallholder farmers face challenges in adopting sustainability standards due to bureaucratic processes and high certification costs. Additionally, standards like Organic certification, which prohibit chemical inputs, can result in lower yields, requiring higher price premiums to compensate. The overall impact of sustainability standards on poverty reduction is debated, with critics arguing that increased prices paid by consumers often do not reach farmers in developing countries, despite the potential for higher output prices and other benefits.

In sum, smallholder farmers are facing an uphill battle in the modern digital age. Their struggle stems from limited access to technology and markets, which only widens the gap between smaller and larger farms. It’s clear that tackling these challenges requires a collaborative approach from both the public and private sectors. By coming together, stakeholders can work towards bridging the digital divide and ensuring that smallholder farmers have the necessary tools and opportunities to thrive in today’s fast-paced world.

Empowering farmers and driving change: Innovations shaping agriculture worldwide

So here’s the good news. The agricultural sector is undergoing an astonishing transformation as a result of innovations that aim to address the pressing challenges faced by farmers worldwide. These initiatives not only strive to improve the livelihoods of farmers but also pave the way for a more sustainable and prosperous future in agriculture. From empowering impoverished families to sustainable agriculture promotion, these initiatives are bringing hope and transforming the lives of farmers and rural communities around the globe.

In a remarkable initiative to combat poverty, Bank of China has introduced a new mobile app that is making a tangible difference in the lives of struggling farmers. This app, developed as part of the Charity Bank of China platform, empowers customers to purchase specialized agricultural products and fresh produce directly from disadvantaged regions in China, such as apples, walnuts and millet. What sets this app apart is its immediate impact – the money from each purchase is swiftly transferred into the personal accounts of the rural producers. Since its trial phase, the app has witnessed incredible success, with over 230,000 purchases made, totaling 24 million yuan (US$35 million) in transactions. These funds have reached more than 90,000 individuals living in poverty, bringing hope and improving their livelihoods.

Hello Tractor is revolutionizing agriculture in Africa with its innovative pay-as-you-go loan technology finance model. By tackling the lack of mechanization in the region, the company is empowering farmers through tractor co-sharing. Through their user-friendly Farmer Booking app and Tractor Owner app, agents can conveniently book services for farmers, while equipment owners can efficiently manage their machinery and bookings. Hello Tractor’s groundbreaking pay-as-you-go tractor financing, backed by SaaS and IoT technologies, minimizes risk for all stakeholders. Since its remarkable win at Catapult 2022, the Kenyan startup has been laser-focused on expanding its operations into Uganda and Nigeria. Moreover, they have responded to the global call for sustainability by developing climate-specific tractor implements that significantly reduce carbon emissions. Their commitment to accessibility ensures that these advancements benefit their growing customer base.

Meanwhile, in France, FEVE (Fermes en Vie) is leading the charge in promoting sustainable agriculture and facilitating the ecological conversion of farms. With an aim to accelerate the agro-ecological transition, FEVE acts as an intermediary in the takeover and conversion of farms, while also offering investors an opportunity to build capital and support economic activity in rural areas. Their services include a real estate company that purchases farms, which are then rented to project leaders committed to sustainable practices, with an option to buy. By providing an alternative to traditional channels, FEVE addresses the challenges faced by new farmers who struggle with high land acquisition costs and the need for substantial personal contributions to secure bank loans.

Insurance is more crucial than ever for farmers faced with the perils of climate change, and a number of insurers are stepping in with new solutions to address these risks. Among them are global reinsurer SCOR, which has partnered with digital farming company ITK and parametric insurance specialist Skyline Partners to launch an innovative insurance product called Heat Stress Protect. This climate insurance solution aims to protect dairy farmers and milk collecting companies from economic losses caused by heatwaves. Heat Stress Protect utilizes an index calculation based on temperature and humidity conditions to determine economic losses. Farmers receive financial compensation in exceptionally hot years, providing them with much-needed support. The product also offers additional services to help farmers predict heat stress, adapt their management practices, and measure their farm’s resilience. Cooperatives and dairy groups can differentiate themselves and address climate change concerns by providing this financial warranty to their producers.

Another noteworthy initiative comes from Sompo Insurance Thailand, which is revolutionizing crop insurance for Thai farmers through the use of innovative satellite weather indexing. Recognizing the challenges posed by climate change and its impact on agricultural yields, Sompo Insurance Thailand aims to provide protection against weather-related crop damage. By partnering with Thailand’s Bank for Agriculture and Agricultural Cooperatives and utilizing a precipitation volume index, the insurance policy offers indemnity to insured farmers when satellite data indicates low or below-drought index precipitation. This unique approach eliminates the need for in-person surveys and allows for efficient damage assessments. Starting with longan fruit farmers and expanding to rice and sugar cane farmers, Sompo Insurance Thailand’s weather index insurance, facilitated by their AgriSompo platform, combines local knowledge with technical support to boost the resilience and sustainability of Thai agriculture.

Fintechs are also well positioned to make a difference in the lives of rural producers. One such pioneer is Agrix Tech, a Cameroon-based agri-fintech firm which is supporting smallholder farmers as they transition from subsistence farming to commercial farming. Recognizing the financial exclusion faced by rural farmers, the company offers a comprehensive package of services including financing, farm inputs, advice, insurance, and market access to empower these farmers and improve their livelihoods. They also source high-quality produce from local producers and connect them with industrial crop buyers. Looking ahead, Agrix Tech is working to establish a microfinance institution, which will enable them to further expand their reach and impact in the market. With their innovative approach, Agrix Tech is making commercial farming more profitable and sustainable for all stakeholders involved.

Recognizing the potential for digital solutions in bridging the knowledge gap and expanding access to financial services among farmers, a number of banks and insurance companies have created apps especially targeting agricustomers. In India, for example, leading insurer Bajaj Allianz has launched Farmitra, under the slogan 'farming at your fingertips’. Leveraging advanced technology, the app provides farmers with personalized insights into crops, market prices and weather conditions, as well as easy access to insurance details and servicing. Bajaj Allianz, an established leader in digital transformation, has also embraced the use of drones to assess crop health, land conditions and water resources, providing valuable insights for agricultural insurance.

French farmers can likewise benefit from digital insights through Groupama’s GARI, a comprehensive app designed to help its users streamline their daily activities and protect their farms. The leading agricultural insurer launched the app in 2019 following extensive research into their clients’ needs, offering a unique combination of information, tools and services to support farmers. GARI includes free features like agriculture weather information, farm task management and market rates for key crops, as well as purchasable services such as video surveillance, hay stack sensors and precision weather forecasts. The tool proved an instant hit among farmers, with 17,000 downloads within just two months of its launch. Groupama plans to expand the app’s services in collaboration with their regional units and the agricultural ecosystem in France.

Another pioneering digital development is DenizBank’s Augmented Agriculture Intelligence app, designed to tackle the pressing challenges faced by Turkey’s agricultural sector. In light of issues like an aging farming population and low profitability, DenizBank’s vision is to modernize and make farming a lucrative profession while alleviating the manual labor burden on farmers. This groundbreaking app boasts a ‘Phenology Engine’ which emulates crop growth, offering valuable insights for achieving optimal yields. Moreover, the ‘Ask an engineer’ feature allows farmers to effortlessly seek advice from agricultural experts. Although met with initial resistance from older farmers, DenizBank actively engaged young digital natives from farming communities to spearhead this digital transformation.

The Turkish bank’s commitment to supporting famers is further evidenced by its subsidiary Neohub, which is dedicated to agricultural innovation and incubation. Neohub plays a pivotal role in fostering agricultural technologies such as sensors, soil analysis equipment, satellite technologies and livestock management systems. By actively identifying and supporting startups and initiatives that focus on agribusiness, Neohub extends financial and practical support.

And in Morocco, climate-smart farms are becoming a reality thanks to the efforts of Crédit Agricole du Maroc. With a strong commitment to sustainable development, the bank launched the Foundation for Sustainable Development in 2011 to support projects that increase farmers’ incomes while preserving the environment. The foundation focuses on professionalizing sustainable rural economic activities, conserving natural resources, promoting renewable energy and adapting to climate change. Climate-smart farms across Morocco – including small and medium-sized farms that are often excluded from traditional financing – can benefit from funding provided through Crédit Agricole’s traditional banking system, as well as microfinance and meso-finance institutions. In addition to financial assistance, the foundation offers capacity building, technical support and knowledge sharing to empower farmers.

Conclusion

Although smallholder farmers play a vital role in global food production, they face numerous challenges that hinder their access to technology, markets, and financial resources. Climate change poses a significant threat to their livelihoods, exacerbating the already existing disparities and inequalities they face. Despite these challenges, innovative solutions and initiatives are emerging to empower smallholder farmers and drive positive change in the agricultural sector.

From mobile apps that facilitate direct purchasing from disadvantaged regions to pay-as-you-go tractor financing and climate insurance solutions, various innovations are transforming the lives of smallholder farmers. These initiatives not only address their immediate needs but also promote sustainability and resilience in agriculture.

Efforts are being made to bridge the digital divide and provide smallholder farmers with better access to technology and markets. Collaborative approaches involving the public and private sectors are crucial in ensuring that smallholder farmers have the necessary tools and opportunities to thrive in today’s fast-paced world.

Additionally, promoting sustainable agriculture and supporting the agro-ecological transition are key to creating a more equitable and resilient food system. Initiatives that facilitate the adoption of sustainable practices while addressing financial constraints and bureaucratic processes can empower smallholder farmers to meet the increasing demand for quality, safe and environmentally-friendly food.

In conclusion, while smallholder farmers continue to face significant challenges, innovative solutions and collaborative efforts are driving positive change in the agricultural sector. By empowering smallholder farmers, we can create a more sustainable and prosperous future for agriculture, ensuring food security, reducing inequalities and promoting environmental stewardship. It is essential that the financial sector continues to support and invest in the innovation and empowerment of smallholder farmers to build a more inclusive and resilient food system.

See more Qorus Digest reports

Interviews

SME Banking community

With Qorus memberships, you gain access to exclusive innovation best practices and tailored matchmaking opportunities with executives who share your challenges.