Financial Innovation Spotlight: June 2024 edition

We've handpicked five new and intriguing projects that caught our attention.

When it comes to financial services, banks, insurance companies and fintechs are in a constant race to meet the ever-evolving needs of their customers. The goal is to innovate, distinguish themselves from competitors, enhance the customer experience and journey, and even uncover new revenue streams.

In this second edition of the Financial Innovation Spotlight, we've handpicked five new and intriguing projects that caught our attention. It's a global journey that begins in Brazil, where Nubank offers a travel planning platform for its affluent customers. Then, we head to Australia, where Westpac sends out notifications to help its customers maximize their earnings. Next stop: Malaysia, where Hong Leong Islamic Bank provides an all-in-one integrated Islamic banking solution for SMEs. Meanwhile, in Canada, insurer Sun Life introduces a life insurance product tailored for individuals living with diabetes. Finally, in France, Banque Populaire steps up with a zero-interest loan to facilitate the establishment of healthcare practitioners in medical deserts.

An exclusive travel solution for affluent customers

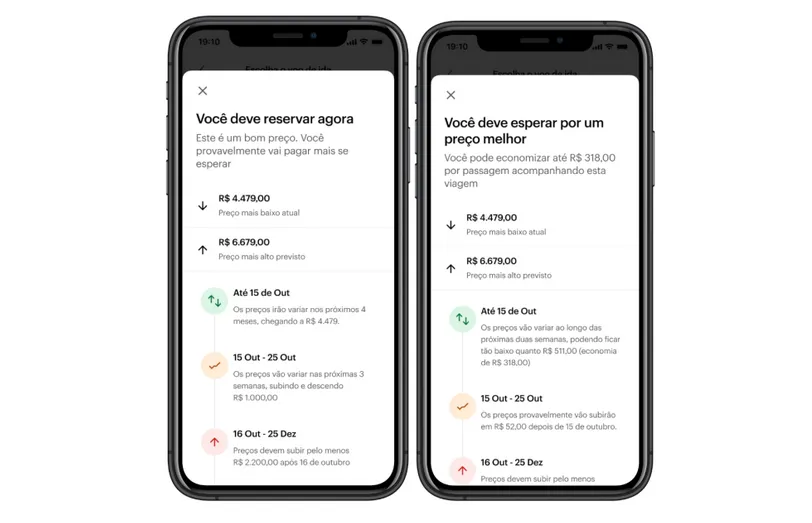

In Brazil, Nubank Ultravioleta has introduced NuViagens, an exclusive platform integrated into the Nubank app. Aimed at offering more convenience and reliability in travel planning, it guarantees the best price and other exclusive benefits for the bank’s high-income customers.

Who?

Nubank Ultravioleta is the exclusive experience for high income customers by the world’s largest digital banking platform outside of Asia, serving over 100 million customers across Brazil, Mexico and Colombia.

Why?

Travel is a key area where financial institutions can expand their services and position themselves as trusted lifestyle partners, offering clients convenience, reliability and value – from planning and booking to 24/7 support during the trip. Nubank Ultravioleta’s latest offer underscores its commitment to serving its high-income customers across various financial and lifestyle needs.

How?

Thanks to a partnership with global travel platform HTS, NuViagens offers convenient air ticket and hotel bookings at competitive prices via the Nubank app. NuViagens guarantees the best price and monitors flight prices, recommending the best purchase times and offering reimbursement if prices drop within 30 days. Customers can pay in up to eight interest-free installments using NuPay and receive 1% cashback. Dedicated 24-hour travel-related support is available via the Nubank app or phone, providing peace of mind from start to finish of the trip.

Additionally, Nubank Ultravioleta customers benefit from two existing advantages of the Nubank Global Account:

• Instantly convert balances in Brazilian reals to dollars and euros directly through the Nubank app, at favorable exchange rates

• Free internet abroad through Nubank’s eSIM offering, enabling customers to stay connected without the fear of exorbitant roaming fees.

Push notifications which help customers to earn more

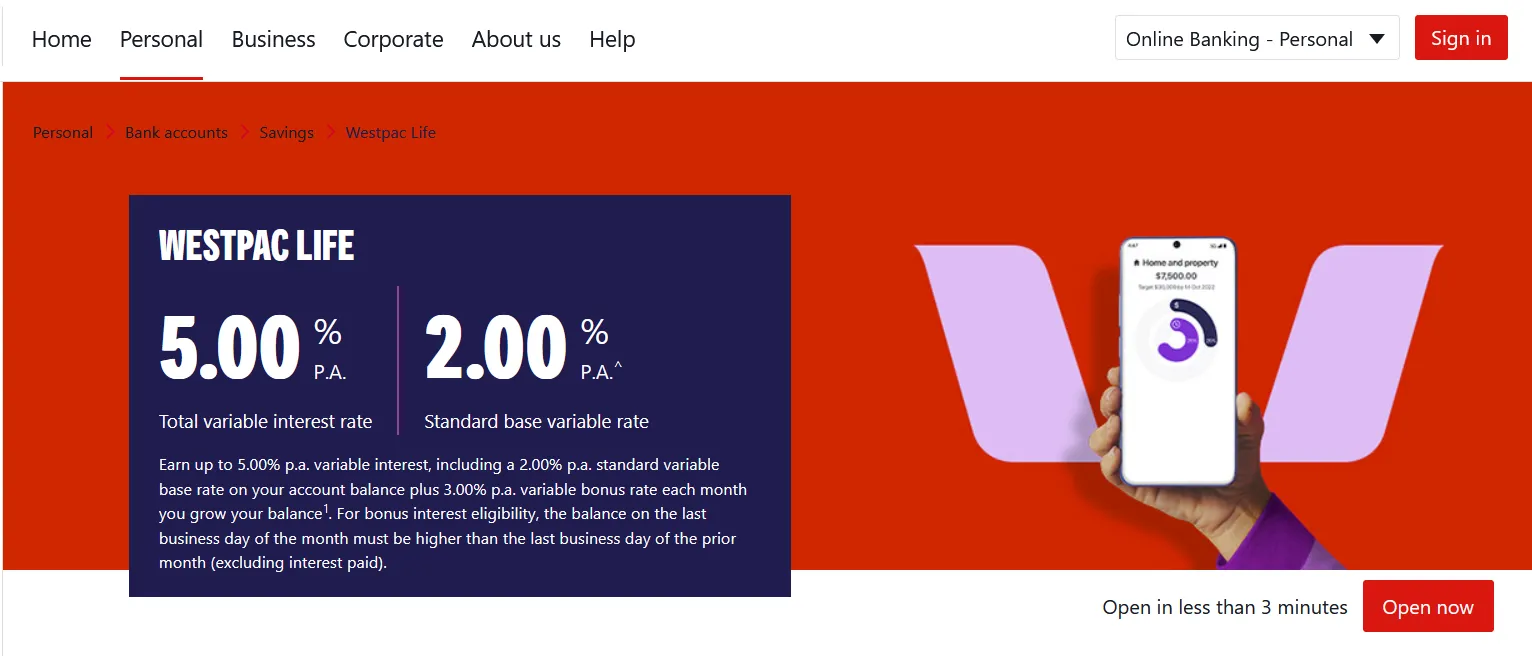

Australian bank Westpac is using mobile phone push notifications to alert customers about how they can earn bonus interest on their savings.

Who?

Westpac is Australia’s first bank and oldest company, one of four major banking organizations in Australia and one of the largest banks in New Zealand.

Why?

There are a few tricks savers often don't know how to use to increase their savings effortlessly and without risk. Westpac is dedicated to helping its customers make better financial decisions to improve their financial wellness.

How?

Westpac has introduced mobile push notifications to alert customers about ways to earn bonus interest on their savings. These notifications are being rolled out progressively to customers with a Westpac Life Savings account, one of the bank’s most popular savings accounts. So far, around 107,000 customers have acted on the prompts and earned an average of AU$201 each in interest.

In addition to the bonus interest prompts, Westpac has introduced alerts in online and mobile banking to notify customers with an eSaver account before their introductory bonus rate expires, helping them plan ahead to find the best deals. Westpac also sends push notifications on mobile about the maturity date of term deposits, supplementing the standard email and letter communications to customers.

An all-in-one integrated Islamic banking solution for SMEs

In Malaysia, Hong Leong Islamic Bank's BizHalal offers both Shariah-compliant financing facilities and Halal advisory support to help businesses venture into the Halal economic landscape.

Who?

Malaysian Hong Leong Islamic Bank Berhad (HLISB), a wholly-owned subsidiary of Hong Leong Bank (HLB), was launched in July 2005. It operates through five Islamic branches, a shared network of HLB branches, and over 1,100 self-service terminals nationwide, offering Shariah-compliant banking products and services as an alternative to conventional banking.

Why?

HLISB sees substantial growth potential in the Halal industry and has enhanced its expertise by adding Halal specialists to the team in 2023. The bank also notes increasing demand for financing among customers within the Halal industry. Developing BizHalal as an all-inclusive advisory package demonstrates Hong Leong Islamic Bank's commitment to nurturing the growth and success of businesses, especially SMEs, in the Halal sector.

How?

The innovative all-in-one offering was launched at a Memorandum of Understanding signing ceremony between HLISB and the Halal Development Corporation (HDC), officially making the bank HDC’s partner in promoting the Halal industry.

Aligned with Hong Leong Islamic Bank’s brand promise of being ‘Built Around You’, BizHalal provides financing opportunities and tailor-made Halal advisory support catering to customers’ specific needs. The Malaysian bank envisions this program as a catalyst for a thriving Halal ecosystem that benefits businesses and the economy.

HLISB is committed to uplifting the economy by leveraging digital solutions like the Halal Integrated Platform, which ensures efficient processing of the entire Halal application journey. Under BizHalal, customers have access to a dedicated team of Halal industry specialists who guide them through obtaining Halal certification. The Halal Advisory Support consists of three main segments: Readiness Assessment, Advisory Assistance, and the Halal Digital Ecosystem.

Life insurance product tailor-made for people living with diabetes

In Canada, Sun Life has launched a life insurance product tailor-made for diabetic clients, with a higher chance of approval, affordable premiums, and personalized care every step of the way.

Who?

Sun Life is a leading international financial services organization providing asset management, wealth management, insurance and health solutions to individual and institutional clients. With operations in numerous markets worldwide, including Canada, Sun Life serves a diverse range of customers globally.

Why?

One-third of Canadians are living with diabetes or pre-diabetes, and rates continue to rise rapidly. It's crucial that everyone living with diabetes has access to the care and treatments necessary to manage this complex chronic condition and ensure the best possible health outcomes.

How?

Sun Life has developed Sun Life Term Insurance for Diabetes, a comprehensive life insurance product that not only provides a higher chance of approval and affordable premiums but also includes access to a customized care plan. The Sun Life Diabetes Care Program offers clients a personalized care plan, one-on-one support, access to virtual education sessions with healthcare professionals and diabetes-related resources.

This groundbreaking product was launched alongside a broader suite of innovative term insurance offerings from Sun Life. Notably, the new Evolve Term Insurance offer allows clients to increase their coverage at certain life stages, such as getting married, adopting a child, or increasing a mortgage, with a simplified underwriting process while offering affordable insurance to meet their needs.

A loan to facilitate new healthcare practices in medical deserts

In France, Banque Populaire is taking strides to improve access to healthcare across all regions by introducing the Zero Medical Desert Loan, aimed at new healthcare professionals.

Who?

The French bank Banque Populaire (BPCE Group) supports individuals and professionals in achieving their goals, whether small or large. Its network consists of 14 cooperative banks. These banks offer all banking and insurance services in close proximity to their clients. They have 9.7 million customers and 12,425 advisors.

Why?

Access to healthcare for all in every region is a significant societal challenge in France, with the country facing numerous medical deserts. Additionally, Banque Populaire has adopted a strategy to emerge as a leading bank in the healthcare sector.

How?

To address the pressing issue of medical deserts by encouraging new healthcare professionals to establish practices in these underserved areas, Banque Populaire has introduced the Zero Medical Desert Loan. This zero-interest loan ranges from €3,000 to €20,000 and lasts up to seven years. It can be combined with other loans and covers various needs such as setting up practices, purchasing patient lists, business development and renovations.

In addition to this initiative, Banque Populaire has launched several other programs this year to support these objectives. These include the NextSanté platform for advice and expertise, a solution for third-party payer management and cash advances, and a €150 million loan facility from the European Investment Bank for the establishment and development of healthcare professionals.

Stay ahead with the latest innovations in financial services

Digital Reinvention community

With Qorus memberships, you gain access to exclusive innovation best practices and tailored matchmaking opportunities with executives who share your challenges.