HSBC will roll out on 23 March a pioneering solution that enables personal and commercial customers to deposit cheques via mobile banking apps of the Bank whenever and wherever it suits them.

Building on HSBC’s already comprehensive suite of digital solutions, the innovation further helps customers manage their daily finances in the socially distanced and remote working environment. At present, over 20 million cheques are deposited annually by personal and commercial customers through different HSBC service outlets. The new solution is set to significantly simplify the service journey and enhance convenience to individuals, SMEs and other sectors across the city.

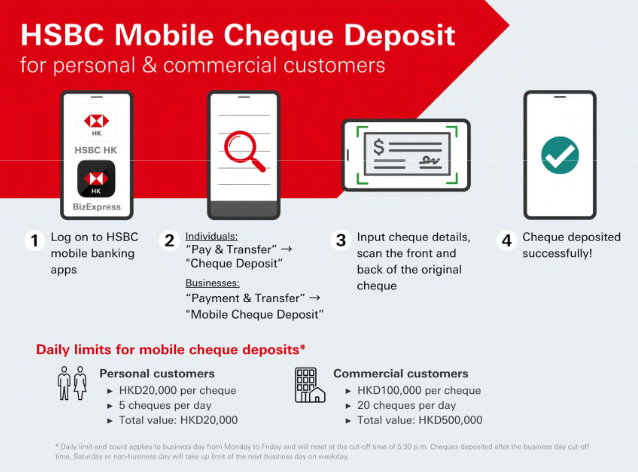

The new mobile cheque deposit function is available to all HSBC Hong Kong customers through the HSBC HK Mobile Banking App for individuals and the HSBC HK Business Express Mobile App for businesses. It will support the remote deposit of Hong Kong Dollar cheques, cashier’s orders, customised cheques and dividend cheques issued by HSBC and Hang Seng Bank.

Maggie Ng, Head of Wealth and Personal Banking, Hong Kong, HSBC, said: “Digital adoption is vital in future-proofing our services to customers. In 2021, we introduced over 200 new digital features for our retail customers in Hong Kong, covering different aspects of their banking needs, such as account opening, cash withdrawal and global payment tracking. The new service is another example of how we continue to embrace technology for enriching banking services in the pocket of our customers.”

Frank Fang, General Manager, Head of Commercial Banking, Hong Kong and Macau, HSBC, added: “We are dialling up our remote and digital support for the business community in Hong Kong through the challenging market environment. Mobile cheque deposit is another timely digital enhancement that enables SMEs to manage their daily finances at greater ease. Hong Kong companies are well known for their agility and many have opted for digital ways to operate since the start of the pandemic. In February 2022 alone, we observed a 30% year-on-year growth in the number of logons to HSBC HK Business Express Mobile App.”

Through this new mobile service, personal customers can deposit as many as five cheques with an aggregate transaction value of HKD20,000 per business day. Meanwhile, commercial customers will be subject to a daily limit of 20 cheques per company, with a ceiling of HKD100,000 per cheque and maximum value totaling HKD500,000.

To make a mobile cheque deposit, customers simply need to follow a few steps:

• For individuals: Log on to HSBC HK Mobile Banking App, choose “Cheque deposit” under “Pay & Transfer”

For businesses: Log on to HSBC HK Business Express Mobile App, choose “Mobile Cheque Deposit” function under “Payment & Transfer”

• Input cheque details

• Scan the front and back of the original cheque

Same as the current practice, customers will be able to check transaction history on the Bank’s mobile banking app or internet banking portal instantly after successful submission. The cheque issuer will also receive an SMS and an email notification when the cheque has been processed. Customers will not be required to submit the physical copy of the cheque to the Bank.

HSBC has been at the forefront of digital innovation with a number of pioneering initiatives, such as mobile cash withdrawal to enhance everyday banking for personal customers; as well as Hong Kong’s first remote business account opening solution and one-stop business management platform HSBC Smart Solution to help SMEs simplify daily operation flows.