DBS announced that it has rolled out self-directed crypto trading via DBS digibank, enabling wealth clients who are accredited investors to trade cryptocurrencies on DDEx at their convenience. This latest move provides more seamless and hassle-free access to DDEx, one of the world’s first bank-backed digital exchanges.

Previously, crypto trading on DDEx was limited to corporate and institutional investors, family offices and clients of DBS Private Bank and DBS Treasures Private Client only. With this latest initiative, the service is now available to accredited investors in the DBS Treasures segment as well. For a start, an estimated 100,000 investors in Singapore meet this criteria, and are eligible to access the services offered by DBS' digital assets ecosystem.

Sim S. Lim, Group Executive, Consumer Banking and Wealth Management, DBS Bank said: “As a trusted partner that helps our clients to grow and protect their wealth, we believe in staying ahead of the curve and providing access to the solutions they seek. Broadening access to DDEx is yet another step in our efforts to provide sophisticated investors looking to dip their toes in cryptocurrencies with a seamless and secure way to do so.”

Secure and hassle-free crypto trading with DBS digibank

The launch of the crypto trading feature comes at a time when DBS wealth clients are increasingly choosing self-directed options, with nine out of 10 equity transactions executed digitally today.

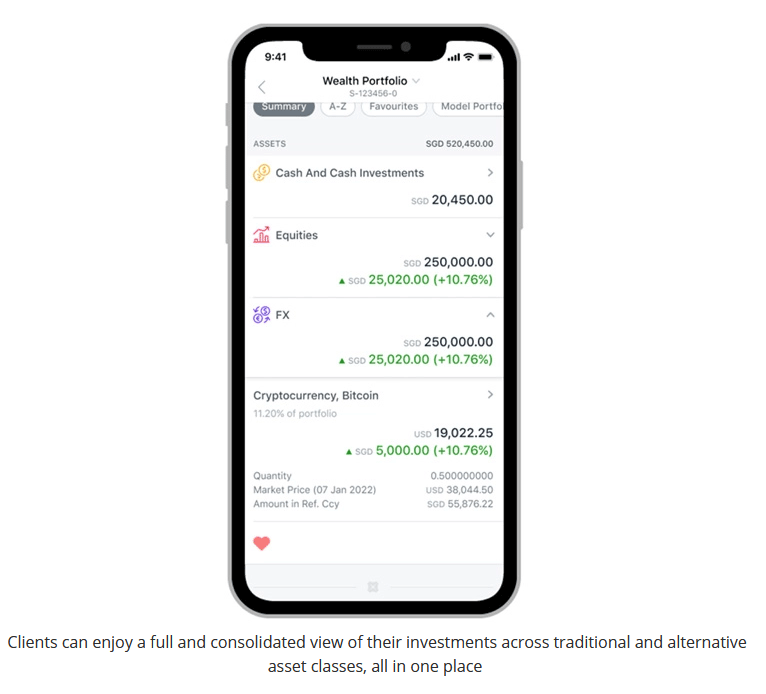

Starting from a minimum investment sum of USD 500, accredited wealth clients can seamlessly trade four of the more established cryptocurrencies (Bitcoin, Bitcoin Cash, Ethereum, XRP) on DDEx at their convenience. Having their cryptocurrency holdings reflected alongside the rest of their portfolio in DBS digibank also makes it easier for clients to stay on top of their investments across traditional and alternative asset classes.

Key benefits of DBS’ crypto offering include:

Security: DDEx taps on DBS’ extensive experience in providing secure custodial services to offer institutional-grade custody, and utilises 100% air-gapped, cold storage technology with multi-layered security architecture to manage cybersecurity risks. Clients can trade within a secure closed loop environment operated by DBS, a well-regulated financial institution, allowing them to trade with confidence.

Convenience: With their DBS bank accounts and DDEx custody accounts seamlessly linked via DBS digibank, clients’ funds can be directly debited to support their transactions on DDEx. This does away with the hassle of common pain-points such as additional wire transfer fees, complex fiat-stablecoin-crypto conversions, and third-party processing.

Full view of their investments: From equities, bonds, foreign exchange to cryptocurrencies – clients now have a consolidated picture of all their investments in one place, rather than having to toggle multiple platforms to keep track of their various holdings. By understanding their portfolio in its entirety, clients are thus better positioned to monitor and manage their wealth, and make more informed decisions.