The Qorus-Accenture Innovation in Insurance Awards trends 2022

For insurers across the world, innovation is enabling new sources of value for their customers, their ecosystems, and their wider industry and economy. As this year’s Qorus-Accenture Innovation in Insurance Awards submissions show, innovation is shaping the insurance industry’s future.

In partnership with

Accenture

Accenture is a leading global professional services company, providing a broad range of services and solutions in strategy, consulting, digital, technology and operations. Combining unmatched experience and specialized skills across more than 40 industries and all business functions – underpinned by the world’s largest delivery network – Accenture works at...

In the seventh edition of the awards, the pace of innovation in the insurance industry continues. Nearly 400 submissions were received from 251 institutions, including 114 insurtechs, from 44 countries.

The winners emerged from a two-part selection process. Nearly 4,000 voters from insurance institutions chose their top three entries in online voting. This made up 50 percent of the score. The remaining 50 percent came from our awards jury comprising 37 senior insurance executives from around the world, who evaluated the 66 nominees against the three scoring criteria of impact, originality and universality.

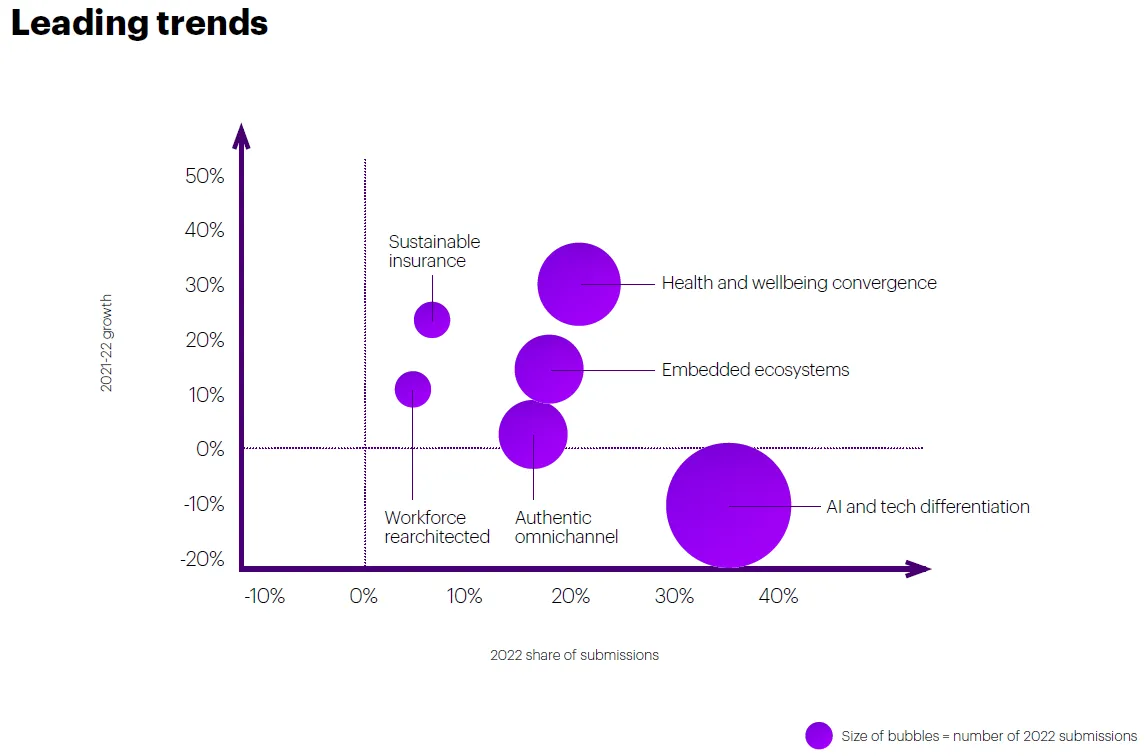

The submissions revealed trends that give a clear indication of the direction of the industry. Across our categories, we saw a 40% increase in Health and Wellbeing convergence submissions, a 20% increase in Embedded Ecosystems, 30% in Sustainable Insurance and 15% in Workforce Rearchitected. While Authentic Omnichannel and AI and Tech Differentiation submissions didn’t illustrate marked growth, they didn’t decrease either.

Prevention-oriented insurance products and services are taking center stage as an increasingly important growth lever for insurers that is also part of their sustainability agenda. From a socio-economic point of view, insurers are at a unique intersection of managing personal risk, as well as the collective risks we face as a planet.

In this brave new world, tech revolution is ongoing, products, services and experiences are reimagined to address the convergence of customer needs and insurers are consciously driving sustainability agendas. This shift will be enabled by future-ready technology and operations, transformative AI applied in tandem with humans, and leveraging the potential of the metaverse. This is the foundation for the future of insurance and what you will see reflected in the Qorus-Accenture Insurance Innovation trends.

These innovation trends define a clear path forward for the total enterprise reinvention of the insurance industry.

Trends 1

Authentic omnichannel

How do customers want to access their insurance, and how does this impact their opinion of their insurance provider? In a consumer landscape in which people are accustomed to accessing products when and how they want them, insurers are now under pressure to provide sophisticated, intuitive digital experiences. Every aspect must be examined, as the end-to-end user experience in and across channels is critical. This extends from the customer experience to how insurers function internally, using data from multiple digital, telephonic and in-person sources together in efficient processes.

From interactive, efficient claims, to proactive risk prevention, it was clear from the entries received that providing customers with a true omni-channel experience was a pressing priority. Using new technologies, AI-capabilities and intelligent ecosystems, innovative insurers from across the world are connecting with customers and brokers in new, authentic ways.

Allianz Partners – Visi´Home

Allianz Partners’ Visi´Home product empowers its partners with a video diagnostic tool to provide efficient remote assistance. This helps customers receive an immediate solution and reduces unnecessary trips and physical contact. In a pandemic context, it allowed cost savings while also reducing the carbon footprint. However, while the pandemic was a trigger for the innovation, it is clear that the innovation has remained relevant as the customer context changes and evolves.

“The pandemic put pressure on homes as they transformed into a school, an office, a childcare facility, and everything in between. In this context, unexpected problems at home can be especially stressful: electrics, gas dysfunction, heating breakdown, etc.

"At Allianz Partners we act as guardian angels protecting what really matters, by combining digital intuitive solutions and the human touch to truly build exceptional experiences throughout key moments of our customers’ lives. Based on this ethos we created a product that, through remote home assistance, connects customers with a professional claim handler at any time, providing immediate diagnosis of the problem and professional guidance to fix it on the spot when it is possible, or directly setting an appointment with the right craftsman.” – José Antonio Molleda, Global Head of Product Management and Innovation Home Assistance at Allianz Partners. (Read the full case study)

Bradesco Seguros – Vida Viva Bradesco

Insurance is moving beyond assistance in a time of need. Smart insurers are building platforms that inspire ongoing engagement. Bradesco Seguros is doing this with its new Life and Pension product that promises to change the perception of the life insurance market. Vida Viva Bradesco is a product that adapts to all stages of the insured's life through 12 assistance options. This shifts the life insurance conversation from one against the financial implications of death to working with an insurer to make the most out of life. (Read the full case study)

Etiqa Insurance Singapore – AI model for customer sentiment analysis

Etiqa captures valuable customer feedback in customer communication channels such as WhatsApp and touchpoint surveys as part of a customer-centered approach. However, it takes a considerable amount of time to manually analyze thousands of records to identify customer sentiments and improvement areas. To overcome this, an AI model was developed to analyze customer feedback automatically. Using the agile methodology, the digital insurer streamlined and reduced operational time and resources, launched several new products with first-in-market features, and enhanced channels to cater to customers’ needs. (Read the full case study)

Trend 2

Embedded ecosystems

With the right ecosystem partners, insurance can be an enabler of customer wellbeing. It is also an opportunity to connect with peers, share data, and amplify wider industry knowledge and impact.

Insurers are extending and enriching their value proposition by creating complementary ecosystems to serve their customers and promote greater efficiency in their organizations. Technology is a vital enabler to efficient ecosystems, and also a fundamental component to embed insurance propositions in new digital distribution channels.

MediConCen – Blockchain medical ecosystem

MediConCen created a platform that automates insurance claims and makes insurance more easily accessible for insurance companies, medical networks and clinics using Hyperledger Blockchain.

Blockchain opened up important opportunities and unlocked new efficiencies in this innovation. “Blockchain enables insurance claims to be done completely automatically. Before its existence, we were able to automate processes and logic through programs, but every automation was ultimately limited by the trust of its users. When the system is controlled by one party, it is almost impossible for all parties to fully trust the result from that system and this results in manual processes, reconciliation and outside system proof that a transaction is correct and real. With blockchain, the smart contract ensures no single party can alter any data or logic without mutual consent by all parties. With this assurance and underlying principle, the last mile of automation is finally made possible.

"Accenture’s vast experience working with insurers was very helpful and we learnt a lot through the lens of their client work. Their in-depth, unmatched understanding of the challenges faced by insurers and their unique concerns helped in analyzing insurance pain points and market insights.

"Our team was empowered to communicate in a way that insurers instantly understood our value proposition. As a result, our sales cycle has shortened significantly and we have onboarded 13 insurers as clients as opposed to the three insurance clients we had prior to our work with Accenture.” – William Yeung, Co-founder and CEO, MediConCen Limited. (Read the full case study)

Nationwide – Nationwide’s Partner Platform

Nationwide has built a connected ecosystem of capabilities to support strategic partnerships and publicly available digital products powered by APIs. The Partner Platform has already enabled the launch of 50+ partnerships. Nationwide was the first incumbent insurance carrier to develop and market a holistic partner platform for enhanced strategic partnerships and marketability. All of these partnerships enhance a customer's experience, embedding protection solutions so that Nationwide can protect its members and reduce the friction typically found in the insurance journey. (Read the full case study)

AXA Group – Digital Healthcare Platform (DHP)

Ecosystems also extend to an insurer’s peers, allowing for groundbreaking new customer propositions and a better industry for all. DHP, by the AXA Group, is creating an open healthcare ecosystem to improve healthcare service outcomes and patient experience by driving market players' direct collaboration, smart service orchestration, secured and compliant data sharing and analytics. The vision underpinning this ecosystem is to move from fragmented journeys, involving multiple isolated health products and services, to a unified experience based on data interoperability and AI.

Facing recent years' challenges in healthcare, the insurance sector had to move away from "the claim payer" role for their clients. We have seen, in all markets, insurers proposing more healthcare services such as teleconsultation, symptom checkers, wellness support and much more. This is great progress but as these services are stand-alone, individuals are left responsible for the organization of their own care pathways between fragmented providers and systems.

"AXA and Microsoft believe the healthcare challenge is a collective one that can’t be solved by one or two actors only. Through DHP, they united their efforts to create an integrated ecosystem connecting not only payers' services but also hospitals, pharmacies, pharmaceuticals and health tech companies to create integrated care pathways. Each of these players has invested in solutions tackling part of the value chain and has a piece of the solution to improve patient engagement. Through a common, compliant and secured technological backbone supporting the interoperability between these assets, different healthcare experiences will be offered.'"

"For example, we are currently working on care coordination and early detection use cases. Many tools and protocols exist on the market but with low connections between them. Connecting them to create orchestrated care pathways, guiding patients towards the next best action for them will improve their experience and the overall system efficiency.” – Delphine Icart, CEO, DHP SAS. (Read the full case study)

Trends 3

Health and wellbeing convergence

Insurers are playing a new, elevated role in enabling individuals and societies to be well. By blending the provision of insurance services with proactive, wellness-centered interventions, this exciting trend illustrates the true power of convergence in insurance. By building innovative new products that address key health concerns, insurers can not only add value to people’s health experience, but proactively manage risk before it happens. This trend overlaps with new technologies in its use of AI and wearable devices, as well as ecosystems, through its collaboration with complementary organizations. It also integrates sustainability objectives from a socio-economic wellbeing perspective.

Aflac – Extended reality (XR) devices

Aflac has developed 3D content on nursing care and cancer to help customers better understand the experience and implications of caring for cancer patients. By using the virtual reality (VR) device and content provided by Aflac, customers can immerse themselves and have an interactive experience in a virtual space that simulates life in a nursing home. These realistic experiences are helping customers understand nursing care and the importance of insurance.

“Aflac uses groundbreaking VR technology to provide customers with new experiences, strengthening touchpoints with its customers and citizens as a result.

“(By simulating) the realistic experiences of cancer and nursing care provided by VR technology, customers are encouraged to change their behavior, such as being conscious of preparing for nursing care and having regular cancer check-ups.

"As an example, customers can experience the difficulties of people who require nursing care and have trouble seeing, eating and using their hands. These realistic simulations help them understand the importance of nursing care.

"We believe that this experience will help get people interested in nursing care issues, which have become a social challenge, and lead to solving them. In the future, our company is considering the creation of sales agencies in the metaverse. Combined with VR technology, we believe they have the potential to provide customers with moving, engaging experiences that inspire action, as if they were in an actual shop.” – Eiichi Matsuo, Vice President, Aflac (Read the full case study)

MAPFRE – Vive Fácil (Live Easy)

MAPFRE has created a product that addresses the needs of the growing aging population. By leveraging technology to gain insights into the reality of daily life for the elderly, MAPFRE is providing tools to help their relatives take better care of them. Live Easy uses a non- intrusive environmental and intuitive technology aimed at safeguarding the wellbeing of the elderly and their relatives or caregivers where they feel safest: at home.

Thanks to the existing Wi-Fi infrastructure, the physical movements of senior citizens can be recognized without the need for cameras, sensors or wearables, allowing them to maintain privacy. Deploying AI means that the application is capable of learning day after day, identifying possible anomalies and issuing alert notifications for early intervention at home in the event of a problem or incident. (Read the full case study)

Confiamed – Closer to you

Confiamed has created an app that allows its customers to reach their most needed services: medical appointment booking, authorization, online doctor, ambulance services and prescription orders. Most importantly, the app enables Confiamed to stay close to its customers anytime, anywhere, being only a click away.

The app also gives customers access to relevant information on their health insurance, such as Confiamed´s medical provider directory, detailed policy information, account verification status and travel assistance. This guarantees total transparency with customers about its health insurance services and benefits. (Read the full case study)

Tends 4

Sustainable insurance

At the heart of it, insurance is about protection against current and future risk. It makes sense, then, that insurance is increasingly being leveraged in the interests of protecting our planet and communities. We witnessed the widening definition of sustainability in our entries, with sustainable innovation moving beyond environmental matters to encompass all Environmental, Social and Governance (ESG) concerns. Insurers are connecting sustainability to their purpose and vision and using technologies such as AI to track their own ESG requirements or build innovative products that add value to customers, as well as to society and the wider environment.

Moonshot Insurance – Soft & multi-mobility insurance

Moonshot Insurance contributes to lowering the carbon footprint by supporting a wide range of transportation. The product covers all journeys made by individuals with rented land vehicles, whether it’s bikes, electric scooters and other personal mobility devices (PMDs) or car sharing- in case of breakage, theft, or even accident of the driver or damage caused to a third party. The innovation has three features: in case of breakage/ theft of a rented vehicle, it covers the costs invoiced by the rental company digitally from underwriting to claim management. In the event of an accident, it compensates the driver's medical expenses. Finally, in case of damage to a third party, it brings bicycle and scooter users liability insurance.

“New types of mobility carry new potential risks, which presents a coverage gap. Not anymore! We see all types of not-so-new vehicles entering the market and coming onto our streets. We have designed our multi-mobility product to guide companies more efficiently in their adoption of soft mobility for their staff, whether it is the latest generation of electric scooter, a carpool or subway ride. If an unforeseen event or accident occurs, the user is covered and quickly compensated thanks to a 100% digital process and a minimum proof requirement.

"While remaining fun and realistic, we wanted our approach to be socially responsible by designing a solution that helps users reduce their carbon footprint by promoting the use of soft and shared mobility. We've never seen an insurance policy that immediately finds an alternative mode of transportation and pays for it in the event of a mere strike, so we just did it! It appears that if users know they are insured they would be more willing to go for smart mobility devices perceived as safer and greener than traditional modes of transportation.

"The insurance of tomorrow must start by being committed to a more sustainable future as of today, and we are excited to be at the forefront of this new wave.” – Nicolas Serceau – Co-founder & Chief Marketing Officer of Moonshot Insurance. (Read the full case study)

Ping An – AI-ESG integrated platform

Demonstrating sustainability is only possible if it is measured and tracked according to clear metrics. Ping An has created an AI-enabled platform that helps insurance companies and institutional investors to further environmental, social and governance (ESG) goals. For insurance companies, it offers a data collection and reporting tool to better manage, report and improve their ESG disclosures and performances. For institutional investors, it provides a comprehensive dataset that helps them assess investee companies’ ESG risks and opportunities.

Unigarant – Improving road safety with ANWB Safe Driving Data

The journey began with the ANWB Safe Driving Insurance product. This connected driving insurance proposition rewards customers for driving safely by calculating a driving score. It also led to the collection of valuable data and insights about road safety in the Netherlands. With this data ANWB is able to provide behavioural insights that are mostly lacking in current traffic models. Road managers can use the data to gain insights on dangerous roads, crossings or other traffic situations. This makes for a unique collaboration between local government, and commercial and advocacy parties in the Netherlands as well as an invaluable contribution to traffic safety for society at large. (Read the full cae study)

Trends 5

AI and Tech differentiation

AI is the transformative technology for insurers. It has brought about a turning point in the industry, where insurers can effectively shift from manual, time-intensive processes to greater efficiency. Rich data analysis and machine learning capabilities mean that data can be used and analyzed in new ways. AI has become a key differentiator for insurers and essential in creating new offerings and efficiencies.

InsFocus Systems – Campaign Management System

Insurance companies often promote sales campaigns to improve profitability or increase participation in certain niches. These campaigns often include terms of sale for insurance agents to receive awards for achieving goals. In general, these campaigns need a programmer to implement them and then someone to control the results. This innovation gives insurers a unique system that allows users to define campaigns using predesigned templates and definition tables. This makes it easy for companies to generate sales campaigns in a matter of hours without the need for developers.

“A central character in the operations of the insurance industry has always been the great need for human resources to do tedious tasks. Technologies such as our Campaign Management System solution allow reduction in clerk intervention to a minimum and, at the same time, boost sales and productivity." – Sebastian Visotsky, Global Business Development Manager, InsFocus Systems. (Read the full case study)

Generali – Generali Smart Automation Platform

The Generali Smart Automation Platform is the first platform created at the group level in collaboration with Generali Italia to provide automation and AI services to Generali operations worldwide. With over 35 APIs and replicable, reusable use cases developed by Generali for Generali, the Smart Automation Platform is a scalable technology across brands, geographies and businesses that combines AI with traditional automation technologies to make processes faster and more efficient. (Read the full case study)

FWD Group – Cloud-first strategy

The FWD Group has focused on becoming a cloud- driven enterprise to rapidly enable business growth aspirations. The cloud-based services and infrastructure allow FWD to provide convenience for customers and employees. On the product side, new workflows can be launched quickly to enable self-service capabilities, on-the-fly processes and configuration changes. In addition, FWD's cloud-based service providers have the elasticity of scaling solutions for future modifications based on new needs. (Read the full case study)

Trends 6

Workforce rearchitected

Insurers can only deliver on the above trends with the right internal skills and resources. Yet, as human and machine capabilities are leveraged more often, the skills required to work in insurance are changing. Our final trend, Workforce Reinvented, illustrates how insurers are reinventing their workforce both post-pandemic and in the context of a reimagined insurance landscape. Entries this year covered the full remit of staffing, from recruitment to upskilling. Technology was key in supporting this, with AI and metaverse innovation improving agent delivery and training, and ecosystems boosting employee engagement and meeting them where they are.

Ping An – The middle platform for life insurance channels using domain-driven design (DDD)

Ping An defined, developed, and launched a pilot digital solution to enhance agent planning, increased sales and overall performance, and improved the management of its life insurance business.

Established in 1988, Ping An is a world-leading retail financial services group. Its legacy technology includes a large number of front-end applications supported by hundreds of system. Each application carried abundant business logic, resulting in less-than-optimal front-end applications and difficulties in system maintenance.

In the past, the business-oriented micro-services system could not provide clear business or application boundaries. This led to insufficient integration between micro-services and a lack of sharing between systems, which together prevented the development of the supportive climate required for innovation within the business. There was duplication in the positioning and functions of the insurer’s multiple platforms, which caused great confusion among users and impeded the unification of data.

The technology stack has been constructed to integrate all aspects of Ping An Life Insurance’s business model. By opening up the general capacity, the service re-use rate is 25%, development time has been shortened by 30%.

“Applications developed under DDD effectively supported channel sales and management. Through digital recruitment and training, efficiency enhancement and cost saving in end-to-end sales productivity are both achieved. Accenture assisted in providing business insights and DDD implementation experience for better understanding and supporting business processes.” – David Wei, Director, Ping An Channel Platform Department. (Read the full case study)

ERGO Versicherungsgruppe – Sales-Mini- Metaverse training

ERGO Versicherungsgruppe is doubling the learning impact for sales agents with VR soft-skill training. With Meta’s Oculus Quest 2 glasses, agents can simulate customer conversations using several sales techniques and meeting different customer personalities. This is an advanced soft-skill learning experience targeting younger tied agents to substantially improve their success with customers. The VR sales training combines situations involving four different client-avatars with natural voices and situated in realistic living room environments. A mentor is present in the meeting to act as a coaching avatar and provide training-related advice. (Read the full case study)

Bajaj Allianz General Insurance Company – Project Economy

Bajaj Allianz General Insurance Company used the pandemic to improve adaptability, innovation, and collaboration. They introduced a new concept of internal gig working within the company called ‘Project Economy.’ Built on an experiential learning and cross- functional collaboration framework, Project Economy enables employees to try out new roles and skills within the organization while carrying out their regular jobs. The program helps unearth and fuel the right skills in the right projects to meet defined organizational objectives, thereby providing a great gig culture where knowledge and projects flow freely across the organization. This enables cross-functional teams to come together to work on a live business project and to be recognized and rewarded based on the business outcome. (Read the full case study)

Conclusion

It is an exciting, hopeful time to be in insurance. Innovation is not only being championed in the name of growth or efficiency, but to actively address the changes ahead with new solutions at scale and at speed. As an industry, we are able to apply an ingrained culture of risk prevention and mitigation, data analysis, and visioning to a new world of human and technological integration.

These trends, and the winning innovations driving them, illustrate how insurers are proactively building exciting new solutions to our greatest challenges and opportunities. Congratulations to all the winners of this year’s awards.

Watch the 2022 Qorus-Accenture Innovation in Insurance ceremony highlights:

Download your study now

Insurance & Embedded Insurance community

With Qorus memberships, you gain access to exclusive innovation best practices and tailored matchmaking opportunities with executives who share your challenges.