Recent natural disasters, including Alpine hailstorms, European floods, and a Moroccan earthquake, have caused significant property damage. Imagine having a personalized tool to assess natural hazard risk and help homeowners prevent damage from floods, storms, wildfires, and earthquakes. Presenting the individual risk assessment tool, known as GloRiA (Global Risk Assessment), jointly developed by Allianz Versicherungs-AG, Allianz Re, and Group Strategy, Marketing, and Distribution (GSMD), already operational in Germany as 'Wohnort-Risikobewertung.

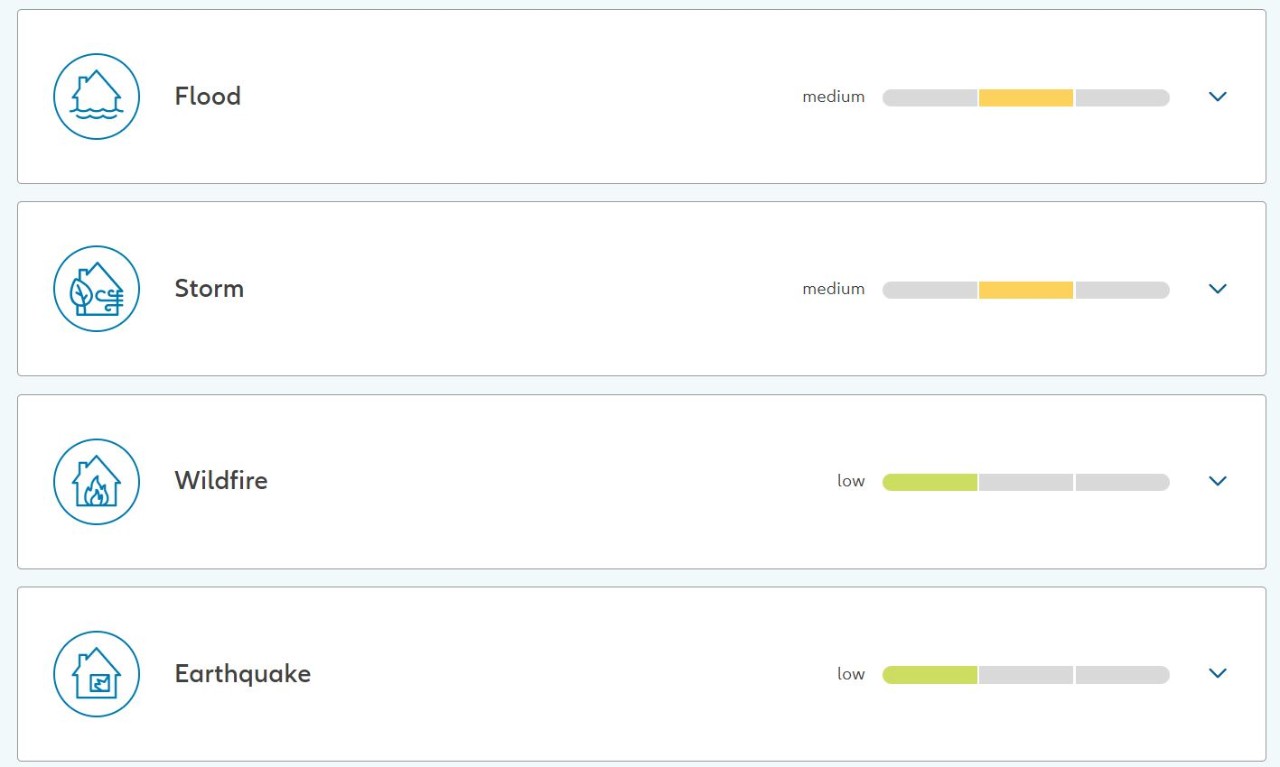

By simply entering their address on a web page, any user can receive an immediate view of the risk for four common natural hazards at their home’s location: flood, storm, wildfire and earthquake. This individual assessment is based on the tools Allianz uses to evaluate and calculate natural hazard risk around the world, but in a way that is easy to understand and act upon. As a very first step, the tool is designed to create awareness what potential risks homeowners face. Additionally, checklists and explainer videos around preventative measures provide guidance on what they can do to protect themselves and their property.

“With the help of the GloRiA tool, users can form their own picture of their risk situation with regard to natural hazards,” says Sibylle Steimen, Managing Directory Advisory & Services at Allianz Re. Sibylle heads a team of over 40 scientists dedicated to understanding natural hazard risks. Their work forms the scientific foundation of the tool. “Research has shown that the subjective perception of risk and the actual risk are often not congruent. We remember a recent catastrophe, but not something that happened 100 years ago, or we assess the event as less serious,” Sibylle explains. The new tool, GloRiA, uses an easy-to-understand risk scale to provide an objective assessment of the hazard at the user’s location. The user can then decide for themselves what the right choice is for them: accept the risk and at best set aside money for the event of a disaster, take out insurance cover, and/or protect themselves better with the resilience measures suggested in the GloRiA tool, e.g. by implementing structural measures such as flood windows or adjusting their behavior in an event of a disaster.

Based on data – lots of it!

The GloRiA tool is based on our globally valid Allianz natural hazard maps. The foundation for these maps are elaborately derived models that are in turn based on vast amounts of data that stem from long-term measurements. These maps can model for any point on earth the probability and intensity with which, for example, certain flood heights, wind speeds or earthquake intensities could occur.

“We use the hazard maps as a basis to see how vulnerable a property is for which we provide natural hazard insurance coverage. We then relate the values of the hazard maps to the loss amounts of past natural catastrophes and can derive how high the insurance premiums need to be in order to be able to pay for future damages,” Sibylle explains. These maps are therefore very closely linked to our insurance products and are extremely important for appropriately managing risk.

Fortunately, we don't have to expect the worst effects at every point on the planet. A quake of the magnitude we saw in Turkey in the spring of 2023 is hardly to be expected in Germany. Hailstorms like in Italy and Bavaria this summer are not as likely in the UK – all this knowledge is stored in our hazard maps. “At every point on earth there are certain hazards that can be relevant for an insurance customer,” says Sibylle, “and we would like to point this out to our customers and any potential user with the GloRiA tool.”

Factoring in our changing climate

In many places, climate change could change the frequency and / or intensity of certain natural hazards, such as floods or tropical storms, so looking into the future is just as important as understanding today's risk. In the next version of GloRiA, the tool will show how the risk of certain natural hazards may change as a result of climate change.

“To be clear, things will not always get worse,” says Sibylle. “In some places, the risk for a hazard will remain the same, in others it may even decrease somewhat”. And for earthquakes, climate change has no effect at all. What is certain, however, is that the effects of climate change will increase the uncertainty surrounding exposure to natural hazards. Insurance can therefore be a good solution to protect yourself and your property against the unexpected.