Financial Innovation Spotlight – July 2024 edition

This global innovation journey begins in Singapore, where OCBC Securities offers AI-driven personalized stock recommendations. Then we head to the UK, where NatWest uses generative AI for enhanced customer support, while HSBC supports SME clients in measuring their carbon footprint. And across the Atlantic, Guardian helps US dental insurance clients to quit tobacco, while Itaú Unibanco offers Brazilian seniors WhatsApp content focused on avoiding scams and improving financial management.

Banks, insurance companies and fintechs must continually adapt and innovate to meet the rapidly changing needs of their customers. Successful players in this dynamic arena offer exceptional customer experiences that set them apart from competitors, whether enhancing existing services or tapping into new sources of revenue.

In this third edition of the Financial Innovation Spotlight, we showcase five new projects that caught our eye in the past month. This global innovation journey begins in Singapore, where OCBC Securities offers AI-driven personalized stock recommendations. Then we head to the UK, where NatWest uses generative AI for enhanced customer support, while HSBC supports SME clients in measuring their carbon footprint. And across the Atlantic, Guardian helps US dental insurance clients to quit tobacco, while Itaú Unibanco offers Brazilian seniors WhatsApp content focused on avoiding scams and improving financial management.

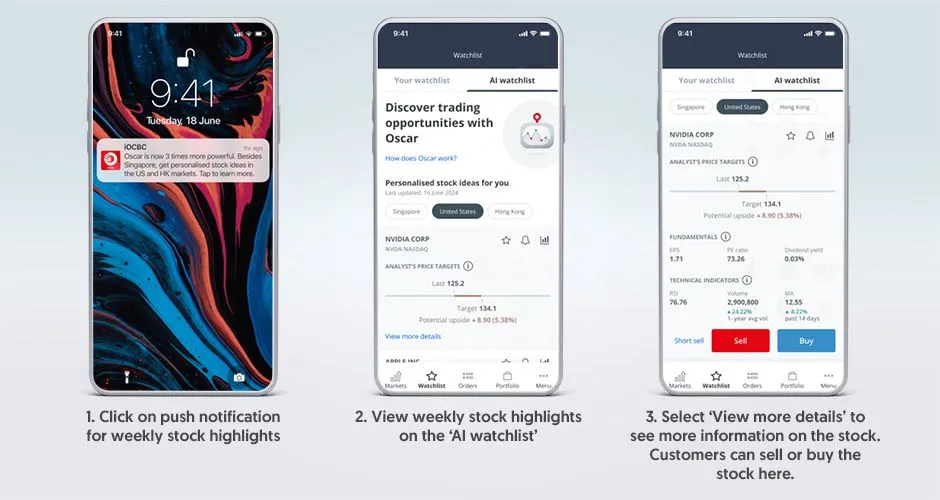

AI-driven tool for personalized stock recommendations

OCBC Securities has introduced A.I. Oscar, Singapore’s first AI-powered stock-picker tool, aimed at tripling its base of active young investors.

Who?

OCBC Securities is a fully owned subsidiary of OCBC Bank, the second top bank in Singapore in terms of total assets acquired. They offer comprehensive brokerage services for trading securities, derivatives and leveraged foreign exchange in global markets. Their extensive range of products and wide network ensure clients gain maximum exposure to the dynamic world of trading.

Why?

Investors have access to a vast amount of information, but the challenge is finding the information relevant to them and turning it into actionable trading ideas. Doing this quickly is crucial in today’s fast-paced world, where digitally savvy young investors prefer self-service solutions.

How?

A.I. Oscar predicts stock price movements and generates hyper-personalized stock ideas. Initially focusing on Singapore stocks, A.I. Oscar's coverage has now expanded to the Hong Kong and US markets following a successful pilot from October 2023 to April 2024. This service is free for all OCBC Securities customers and accessible via the iOCBC app, iOCBC online trading platform, and email.

Using deep learning algorithms, A.I. Oscar analyzes factors such as risk appetite, past trading activity and demographic information to identify and predict each investor’s trading patterns. Every week, it curates a list of 15 hyper-personalized stocks from exchanges in Singapore, Hong Kong and the United States, the top three markets where OCBC Securities customers trade. This personalized approach enables investors to filter and act on stock ideas that match their trading preferences. During the pilot period, young investor trading activity increased by 50% with the help of A.I. Oscar’s recommendations.

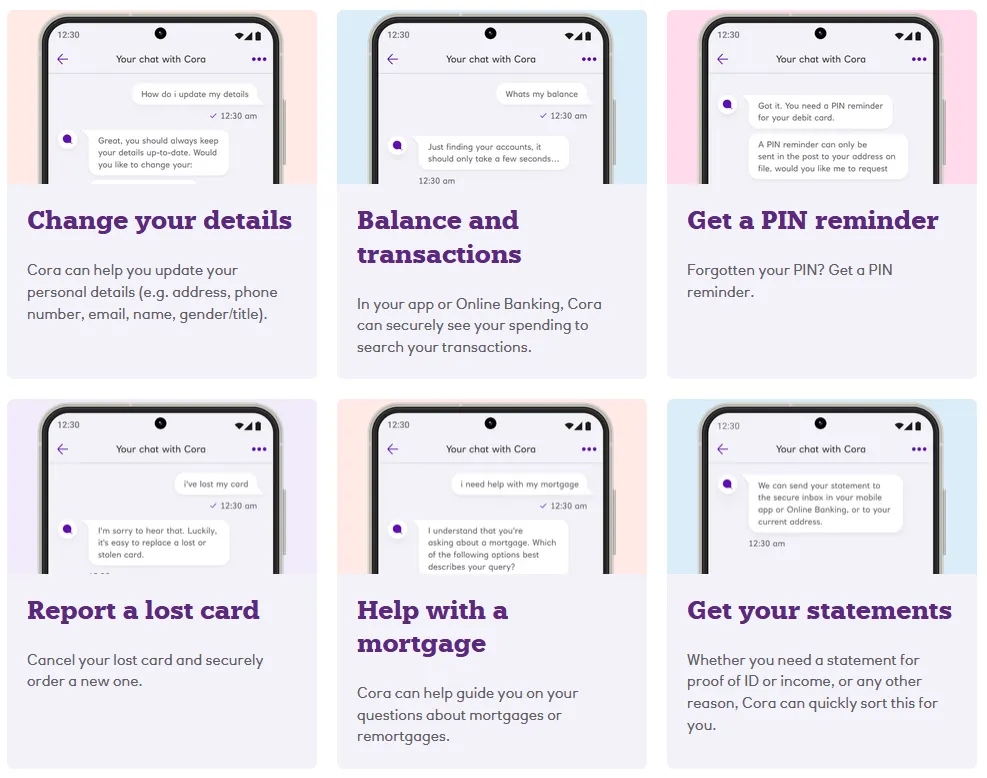

Advanced generative AI for enhanced customer support

NatWest recently launched Cora+, an upgrade to its digital assistant Cora, becoming one of the first banks in the UK to deploy generative AI through a digital assistant.

Who?

NatWest Group is a prominent banking and financial services organization operating primarily in the UK and Ireland. Serving more than 19 million customers, it offers a comprehensive array of financial products and services tailored to the diverse needs of personal, business and corporate clients. Brands under the NatWest Group umbrella include NatWest, Royal Bank of Scotland, Ulster Bank, Coutts, Lombard, and RBS International.

Why?

NatWest already supports customers in answering banking queries 24/7, helping them in their day-to-day banking needs. But the bank needs to provide more intuitive and personalized conversational customer experiences.

How?

NatWest's Cora+ represents a significant leap forward in customer service capabilities. Powered by advanced generative AI, Cora+ can anticipate customer needs, offer personalized suggestions and engage in more natural, human-like conversations. It integrates seamlessly across multiple channels, consolidating information from various secure sources into a unified interface. Developed in collaboration with IBM's Client Engineering team, Cora+ is designed to deliver intelligent, interactive experiences tailored to individual banking journeys. This enhancement allows customers to receive more accurate responses and proactive assistance based on their transaction history and interactions. Cora+ also expands its knowledge base through machine learning, addressing a wider range of banking queries effectively.

Tobacco cessation support for dental insurance members

Guardian has become the first dental insurer to offer members a comprehensive tobacco cessation program included in their dental benefits.

Who?

Currently supporting 29 million consumers across the US, Guardian Life Insurance Company of America is one of the world’s largest mutual life insurance companies. Besides life insurance, they offer a wide range of coverage including disability, annuities, investments and dental insurance. They are committed to enhancing well-being, fostering financial resilience and leaving a positive impact on their customers’ lives.

Why?

Tobacco use significantly affects oral health, contributing to gum disease and other issues. Despite declining overall tobacco usage rates in the US, it remains high among certain industry workers who often receive dental benefits through their jobs. This provides employers with a significant opportunity to impact cessation efforts, employee wellness, and cost efficiencies.

How?

Guardian has partnered with Pelago, a leading digital clinic for substance use management, to offer tobacco cessation support for members with workplace-sponsored dental insurance. Through this collaboration, Guardian members and their families can access personalized digital tools and human coaching aimed at achieving a tobacco-free lifestyle. The program includes dedicated Pelago care coaches, personalized tracking, cognitive behavioral therapy content and nicotine replacement therapy options. This initiative complements Guardian's existing oral health resources, reinforcing the link between oral health and overall well-being, and underscores their commitment to holistic well-being, encompassing mind, body and financial health.

Carbon calculator to help SME clients track and measure their carbon footprint

HSBC UK has partnered with carbon management company Greenly to support clients in measuring their carbon footprint, enabling them to identify their main sources of carbon emissions and spot opportunities to reduce them.

Who?

HSBC UK, part of the multinational HSBC financial services group, serves over 14.7 million active customers across the UK. They offer a complete range of retail banking and wealth management to personal and private banking customers, as well as commercial banking for small to medium businesses and large corporates.

Why?

With almost six million SMEs in the UK, they have a significant role to play in the race to decarbonize emissions. However, a recent HSBC survey on SME customer needs found a lack of advice and support over sustainability measurement remains a significant barrier to achieving effective change.

How?

HSBC UK has teamed up with carbon management firm Greenly to aid clients in tracking and reducing their carbon footprint. Greenly’s platform supports SMEs by offering robust data tracking and reporting tools. Following a successful pilot with 50 clients in 2023, HSBC UK and Greenly developed two tailored packages within HSBC’s Sustainability Tracker. The basic package helps SMEs identify primary carbon emission sources and potential reductions, while the premium option offers detailed emissions insights and expert guidance on reduction strategies. This initiative underscores HSBC UK’s commitment to sustainability, empowering SMEs to make informed environmental decisions and contribute to a low-carbon future.

WhatsApp-based financial education for seniors

Itaú Unibanco has launched Itaú Viver Mais to boost financial literacy for elder Brazilians. The initiative offers free WhatsApp content focusing on avoiding scams and improving financial management for individuals aged 50 and above.

Who?

Itaú Unibanco is the largest Brazilian private bank in market value and the most valuable brand in Latin America. With a comprehensive range of products and services available through the bank, as well as their brands and business partnerships, they meet the needs of all types of individuals and corporate clients in Brazil and other markets worldwide.

Why?

Reports of financial exploitation targeting the elderly have been increasing in Brazil. Empowering elderly individuals with knowledge and tools to protect themselves is crucial.

How?

Itaú Unibanco's Itaú Viver Mais initiative in Brazil aims to boost financial literacy among individuals aged 50 and above through free WhatsApp content tracks. The program focuses on raising awareness about financial scams and frauds, and providing guidance on effective financial management. Rolled out in alignment with National Financial Education Week, it targets over 5,000 participants, including Itaú customers and non-customers, empowering them with essential skills to navigate today's financial landscape.

The content tracks are divided into two modules, each comprising six short video lessons and accompanying learning activities. Participants will also have access to e-books summarizing the key information covered in the tracks, as well as certificates of completion. The first module focuses on family financial education, offering practical tips on budgeting, savings strategies and expense management. The second module addresses digital security, providing insights into safeguarding against online scams and frauds.

Stay ahead with the latest innovations in financial services

Digital Reinvention community

With Qorus memberships, you gain access to exclusive innovation best practices and tailored matchmaking opportunities with executives who share your challenges.