Financial Innovation Spotlight – November 2025

This month’s lineup includes fresh ideas from Bank of America, U.S. Bank, Starling Bank, BMO, and Narvi.

Patrice Bernard, the voice behind the French blog C’est pas mon idée, is back with his sharp, witty take on what’s new in financial innovation. For Qorus, he’s rounded up five standout innovations from November 2025—all delivered with his signature straight talk.

This month’s lineup includes fresh ideas from Bank of America, U.S. Bank, Starling Bank, BMO, and Narvi. Dive in and discover what caught Patrice’s eye!

Retirement: Bank of America looks beyond the basics

More and more financial institutions are helping customers prepare for retirement. Bank of America is now tackling a different, often overlooked concern that comes after people stop working: how to turn a lifetime of savings into a steady, sustainable income.

It’s an especially urgent issue in the United States, where retirement security depends primarily on individual savings rather than a national pension system—though the challenge is quickly becoming global.

Bank of America is focusing on a specific problem: how retirees can make the most of the money they’ve spent decades accumulating without depleting it too quickly or being overly cautious out of fear of running out. The variables involved—from taxes to inflation to mandatory distribution rules—make this kind of planning difficult to navigate alone, and few institutions are equipped to offer meaningful guidance.

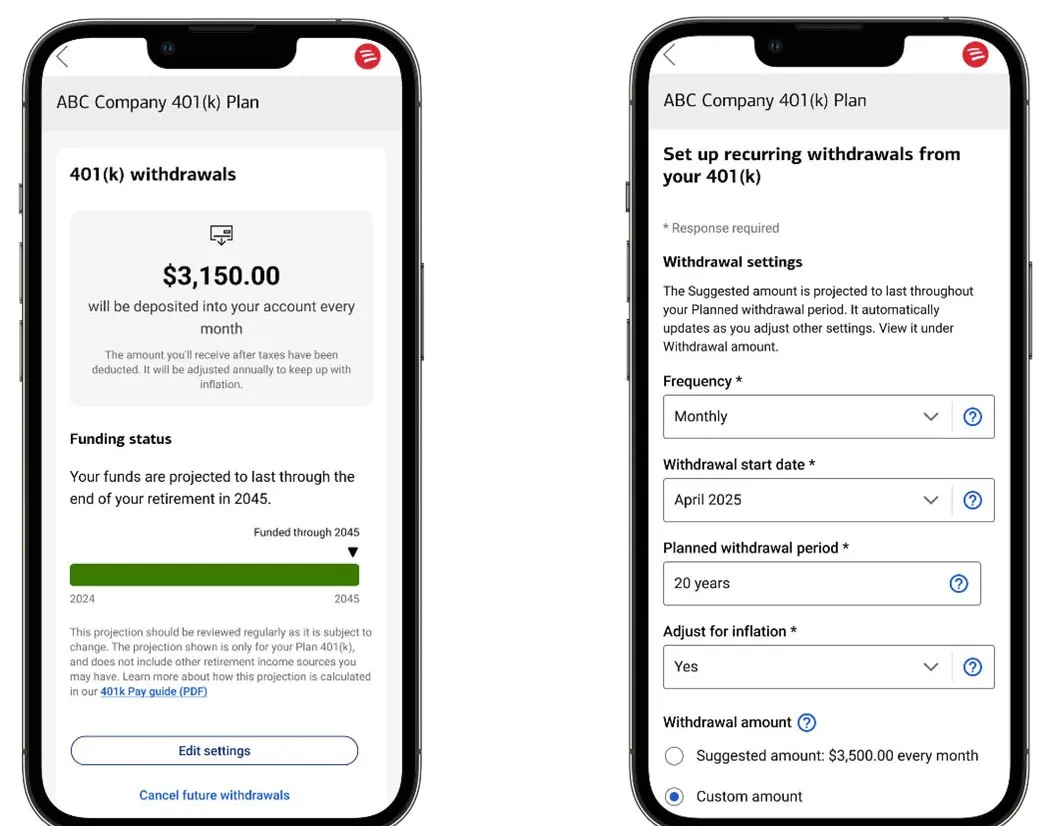

The bank’s new “401k Pay” service—named after the U.S. workplace retirement plans—is a fully digital tool offered free to employees whose companies use Bank of America’s retirement products. It provides balance tracking, flexible withdrawal preferences, and, most importantly, personalized recommendations for building a smart decumulation strategy.

Practically speaking, the tool asks users to enter their personal circumstances and retirement goals, then applies constraints such as inflation, taxes, and required minimum distributions. Users can set their preferred payment frequency and choose any destination account, even if it’s not at Bank of America. The platform also lets retirees adjust their plan at any time and see the real-time impact of any changes.

Bank of America’s approach delivers benefits on two fronts. It empowers retirees with greater control and flexibility over their income, while also embedding proactive guidance to help them navigate what can be complex and unfamiliar decisions—even if the tool’s capabilities are still evolving.

Reinventing the credit card: U.S. Bank’s new BNPL venture

Under mounting pressure from skeptical young consumers and a wave of fintech innovation, the credit card is being pushed into a new phase of reinvention. U.S. Bank, one of the country’s major card issuers, is responding with a new product built around installment payments—better known by the now-ubiquitous acronym BNPL.

This isn’t the bank’s first step into the space. Since 2021, cardholders have been able to use ExtendPay, an option that lets them convert any eligible credit card purchase into a fixed-payment plan, effectively mimicking the model popularized by Klarna and other BNPL players.

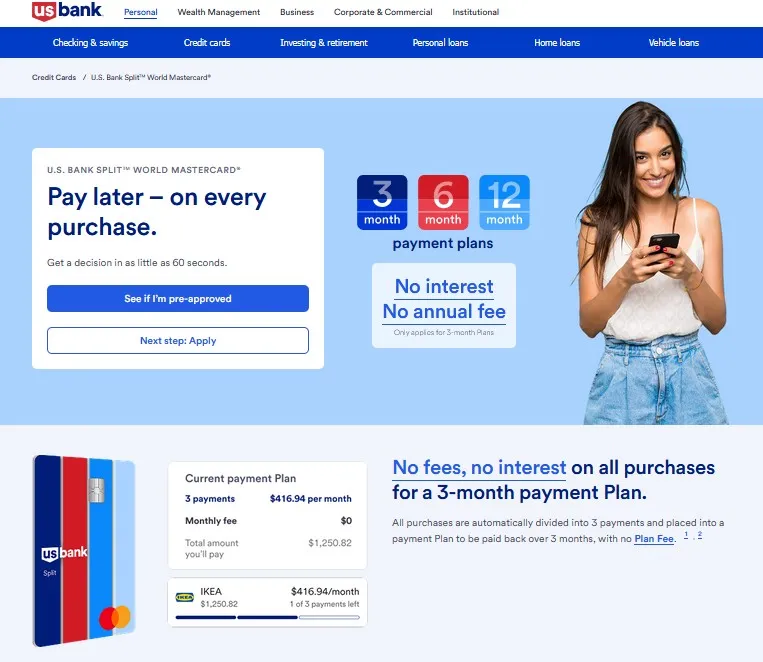

With its new Split World card, U.S. Bank is taking the concept further. Every purchase is automatically divided into three monthly installments with no fees, while still allowing customers to carry other, more conventional cards—including debit cards for everyday, pay-in-full spending. The card works anywhere Mastercard is accepted, both in stores and online, positioning installment payments as a frictionless option woven into day-to-day life.

Sitting somewhere between traditional credit card benefits and BNPL convenience, Split World also offers extended installment plans for purchases over $100. Consumers can stretch payments over six or twelve months for a flat fee—and, importantly, the bank avoids calling these fees “interest.” To activate the longer plan, customers simply select the option in the U.S. Bank mobile app before their next billing cycle closes, within their approved limits.

As you’d expect from an established industry player, Split World doesn’t entirely abandon traditional credit card mechanics. Eligibility isn’t automatic; applicants must first confirm they qualify, signaling that the product is still governed by standard credit risk procedures. Another familiar feature: payments are due on a fixed date—though here, the customer must pay the full installment amount each time.

In short, while the concept echoes a recently launched product from Klarna in the United States, U.S. Bank has tailored its BNPL card to fit its longstanding credit-lending model and culture. For consumers—especially Gen Z, the primary target—the result promises simplicity, flexibility, and the reassurance of a trusted, established brand. The question now is whether those strengths will be enough to win them over in an increasingly crowded space.

BMO launches a credit score coach to boost financial confidence

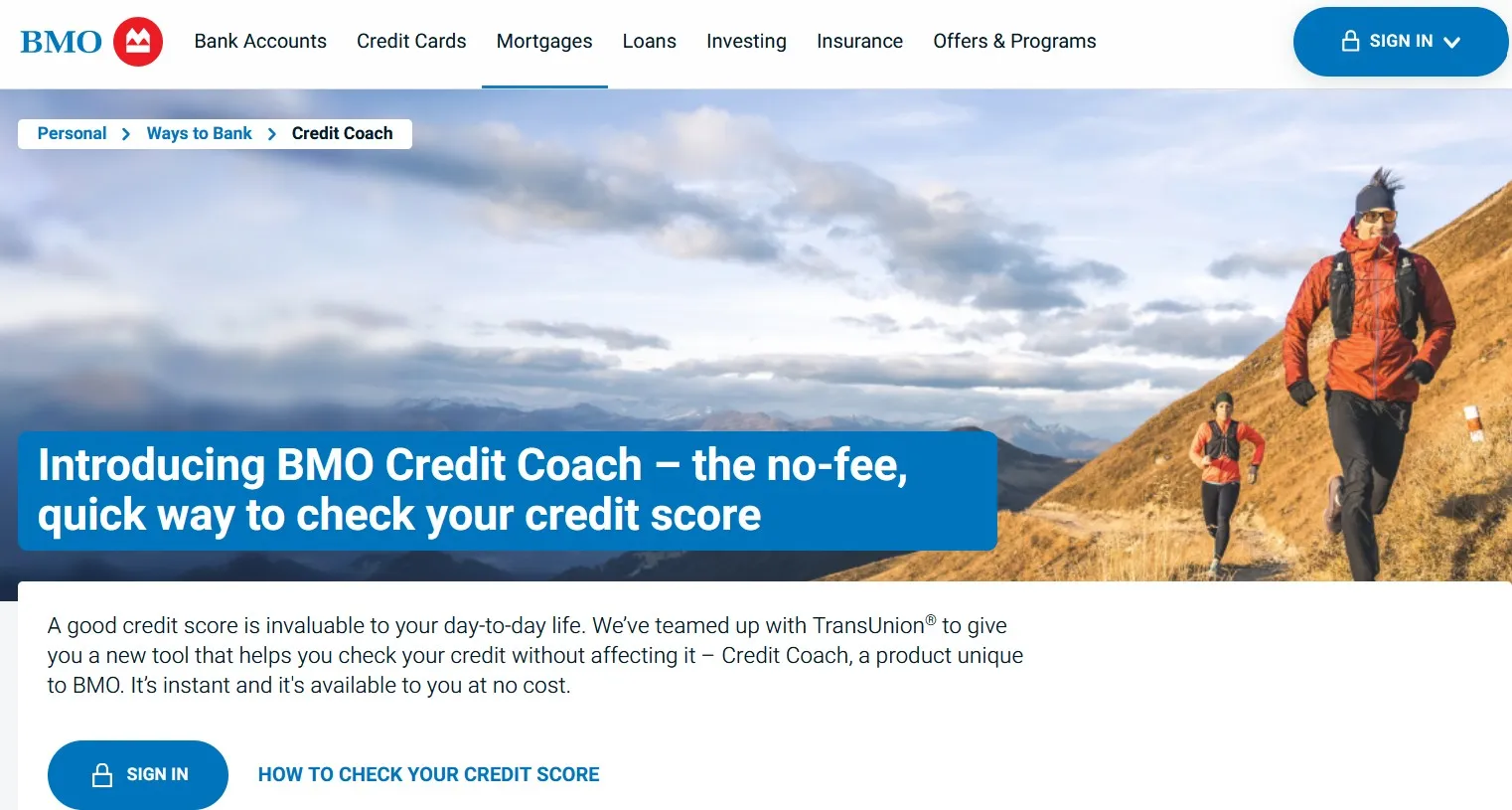

Even as new methods for assessing consumer creditworthiness multiply, the traditional credit score still determines how most North Americans borrow. Recognizing that reality, BMO is rolling out a new tool designed to help customers understand and improve their score—and it’s more comprehensive than previous iterations.

Banks have long tried to educate customers about the primary mechanism they use to decide whether to approve a loan, and at what terms. Many banking apps already show users their current score, sometimes accompanied—in more advanced versions, like Australia’s CommBank app—by detailed explanations of the generic factors that influence it and historical insights into what drove their score up or down over time.

BMO’s new Credit Coach builds on that foundation but adds features that make credit scoring far more tangible. First, the tool displays the customer’s standing across each of the six criteria that feed into the final score, allowing users to pinpoint weaknesses at a glance. Then, in addition to alerts anytime the score changes (ideally with educational context for why), Credit Coach offers a trend analysis module that breaks down how the customer is using credit over time.

But the most powerful feature is the simulator. It lets customers see precisely how their current score would shift under different scenarios: opening a new credit card (with a user-defined limit), taking out an auto loan, or adopting healthier behaviors like paying bills on time. The tool recalculates a new, hypothetical score in real time — using industry-standard methods—so users can immediately understand how each decision might affect future borrowing opportunities.

Progress in financial wellness tools is gradual, but undeniably improving. With Credit Coach, BMO addresses a long-standing issue with earlier solutions: they were too generic in explaining how credit is evaluated, making it hard for users to translate that information into meaningful habit changes. By offering granular detail, personalized insights, and a transparent simulation of real-world outcomes, BMO is finally raising the bar to a level that feels genuinely useful.

Starling Bank adds a scam detector to its app

Fraud prevention remains a space full of untapped opportunity, especially when it comes to stopping scams before they happen. Now, the UK’s Starling Bank is introducing a new tool inside its mobile app designed to help customers spot—and learn to spot—online scams.

A few months ago, Metro Bank rolled out a feature that lets customers upload a photo of a suspicious solicitation to get a legitimacy check. Starling’s new “Scam Intelligence” follows a similar logic, but focuses specifically on listings posted on major online marketplaces such as eBay and Facebook Marketplace—platforms notorious for harboring fraudsters and driving a significant share of consumer losses.

Powered by artificial intelligence (naturally), the tool asks users to upload a screenshot of the listing that caught their eye. It then analyzes the image and text to detect red flags: stock-photo catalog images, prices that seem too good to be true, sellers refusing secure payment methods, and more. It also works on suspicious emails and text messages.

Crucially, Scam Intelligence does not respond with a simplistic “safe” or “unsafe” verdict that could appear arbitrary or untrustworthy. Instead, it provides a clear, concise breakdown of the elements that triggered concern from the AI’s perspective. The customer remains in control of whether to proceed—while gaining a deeper understanding of how scams typically operate.

Behind the scenes, Starling is sharing rare insight into how the tool works. User-submitted images are first sent to Gemini, Google’s cloud-based AI platform, which extracts broad contextual information from the visuals and text. Starling’s own proprietary algorithms then analyze that context to assess potential fraud risk.

The tool is just one piece of a much larger, ever-evolving consumer-protection strategy. It does have limitations—especially the fact that customers must remember to use it at the right moment. But it may also prove engaging enough to build a habit, at least for some users. And its educational approach offers lasting value, helping people internalize fraud-detection instincts even if they use the tool only occasionally.

Narvi unveils a white-label bank to speed up embedded finance

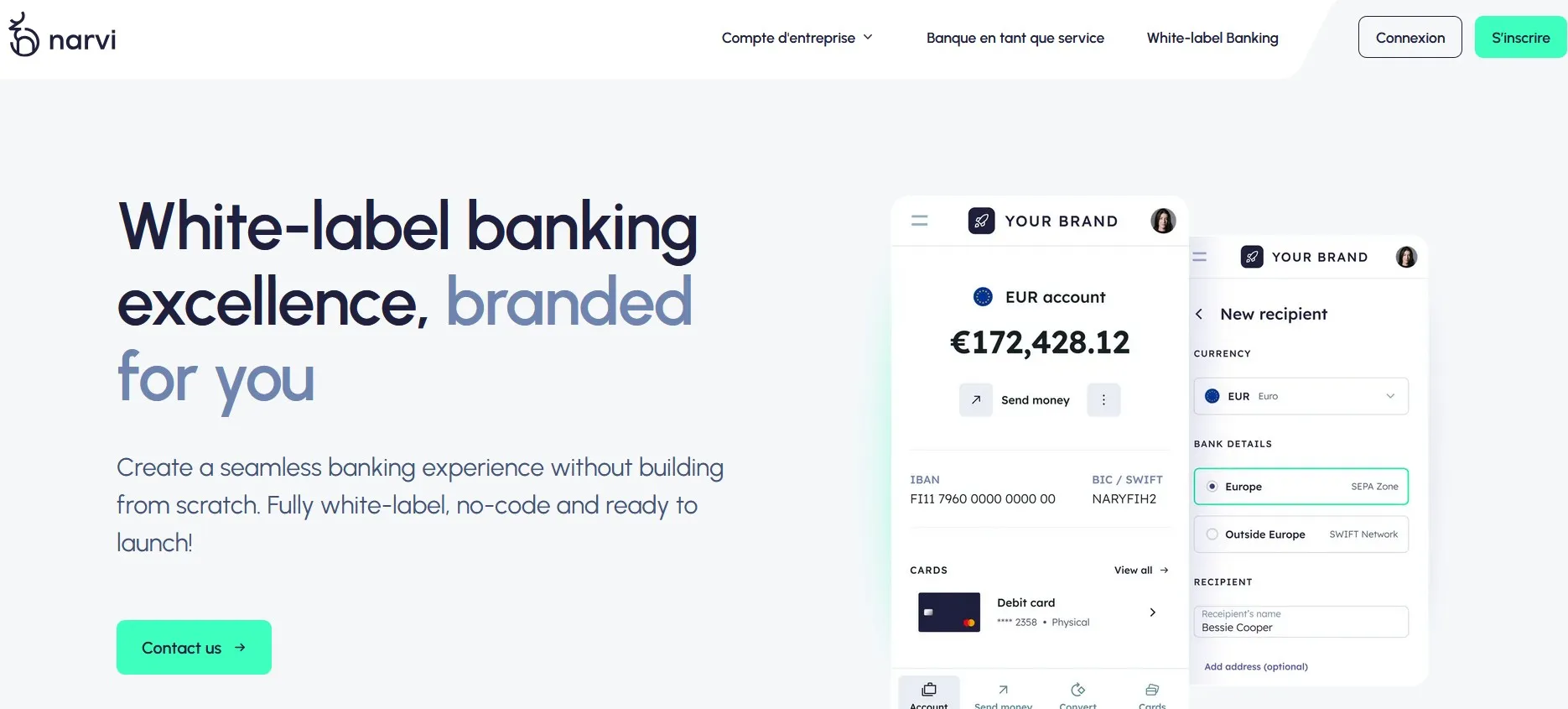

This Finnish-born startup began with a business payment account. Then, building on its proprietary technology, it started offering its banking-as-API platform, allowing any company to create its own financial product. Now, Narvi is taking the next step: launching a white-label version designed for faster adoption.

As more companies across industries explore offering financial services to create a more integrated customer experience, they typically face two choices. They can build their own solution—with or without third-party software—which offers full autonomy and flexibility but comes with high costs and multi-year timelines, including regulatory hurdles. Or they can rely on a banking-as-a-service platform, which is easier and quicker to implement while still allowing for some customization.

But even the latter requires meaningful technical development, a sizable budget, and a project spanning at least several months. That’s why Narvi is now presenting a third option for organizations that want to launch a product in just a few weeks, meeting customer needs without a major investment.

Customization is more limited, of course. In classic white-label fashion, companies get an admin dashboard for managing users and their accounts, plus the ability to apply their own brand identity to the web platform (which is also optimized for smartphone use, though there is no dedicated app). No programming skills are required. To ease the trade-off, Narvi is promoting the Scandinavian design quality of its interface.

For now, Narvi’s offering remains intentionally simple. With its electronic-money license, the startup provides only core banking functions: current-account management with multiple IBANs (useful for reconciliation) and SEPA and SWIFT transfers. Card issuance—physical and virtual—will soon be added through a partnership with Mastercard, and multi-currency accounts are planned for a later release.

This restrained feature set aligns with Narvi’s target market. The goal isn’t to serve companies looking to build a full neobank—that would put them in direct competition with Narvi itself—but rather businesses in fintech, insurtech, or e-commerce that need a basic payment account to round out their offering. By making such solutions extremely easy to adopt, Narvi may well be laying the groundwork for a quiet shift in how companies—and customers—think about banking.

Digital Reinvention community

With Qorus memberships, you gain access to exclusive innovation best practices and tailored matchmaking opportunities with executives who share your challenges.