Financial Innovation Spotlight – August 2025 edition

This edition covers innovative moves from ANNA Money, DBS, NAB, Nationwide, and U.S. Bank, illustrating how technology and strategy are reshaping the industry.

Each month, Patrice Bernard analyzes emerging trends shaping financial services, sharing his candid commentary on his blog C’est pas mon idée !. In this special collaboration with Qorus, he zooms in on five noteworthy initiatives that caught his eye in August. From the latest AI solutions to branch expansion and personalized support, this edition covers innovative moves from ANNA Money, DBS, NAB, Nationwide, and U.S. Bank, illustrating how technology and strategy are reshaping the industry.

An AI agent to register a business for ANNA Money

While the promise of intelligent agents is enticing, most real-world applications so far have been limited to simple use cases. That’s why ANNA Money’s demonstration of an AI completing the full legal process of registering a business in the UK marks a significant step forward.

The real value of AI comes from the effort it can save users—making it particularly well-suited for administrative processes that are time-consuming and paperwork-heavy. Company formation is a perfect example: filling out forms, submitting required documentation (including identity checks), and paying fees.

Since business registration already sits within ANNA’s suite of services—alongside banking, invoicing, and accounting—the fintech naturally chose this process to test whether a large language model could handle it end-to-end with minimal human intervention by directly interacting with ANNA’s web platform.

The initial test is described as a success, though with caveats: it likely didn’t cover every edge case or error that could occur along the way. The next step is to scale the concept so partners can manage both company registration and ANNA account opening through their own AI agents, offering a streamlined experience for users.

Whether the rollout will succeed remains uncertain. Key challenges include managing risks—especially when dealing with customers—and persuading third parties to adopt the solution. Still, the principle of using AI agents to automate complex processes is a powerful one, and financial services provide nearly endless opportunities to apply it. ANNA’s experiment is an important proof point, but many more will be needed before such systems become mainstream.

The initiative also raises questions about business models. Neobanks like ANNA have built their value proposition on bundling multiple services—financial and non-financial—into a single, integrated experience. But if each individual service eventually offers its own AI interface (as with the UK’s company registrar in this case), that advantage could erode quickly.

A virtual coach for every DBS employee

As financial institutions compete to remain attractive employers and as workers face mounting professional challenges, Singapore’s DBS Bank is offering all employees a new way to shape their career paths: a virtual coach powered by artificial intelligence.

Traditionally, career coaching has been reserved for senior leaders or a small group of high-potential employees. The reason is simple—personalized coaching is expensive, and extending it to an entire workforce has long been considered impractical. Yet having an expert guide to navigate career decisions, skills development, and growth opportunities can make a significant difference in both performance and job satisfaction—two critical factors for retention.

DBS set out to break that exclusivity by creating a more democratic alternative: an intelligent software assistant that acts as a coach. Beyond its affordability, the virtual coach is available 24/7 and replicates the role of a human counterpart. It provides advice not only on professional development and career progression but also on broader issues such as work-life balance and mental health.

Can a digital coach truly match the impact of a human one? DBS has gone to great lengths to make sure its virtual version feels credible. The bank tapped into the expertise of a veteran coach with more than 40 years of experience to design the system, and it trained the AI with detailed internal knowledge, including DBS’s job roles, career pathways, and organizational structures.

The approach reflects DBS’s broader philosophy: using modern technology to democratize services once reserved for a select few. It’s a playbook familiar from the early days of fintech in 2007–2008, when automation helped extend financial tools to wider audiences. In many ways, DBS’s virtual coaching platform feels like a preview of what could be next—one day offering regular employees the kind of personalized guidance that private banking clients have long enjoyed.

NAB doubles down on branch modernization

Around the world, traditional banks have split into two camps: those moving toward an almost fully digital model, with branches serving only specific needs, and those—now increasingly rare—who still see value in a broad physical network. National Australia Bank (NAB) is firmly in the second camp, and in recent months it has underscored that commitment with a sweeping branch modernization program.

The project, backed by a $55 million investment, has already transformed 100 branches nationwide, including locations in rural areas where maintaining a community presence is a core goal. Nearly 50 more renovations are scheduled before the end of the year.

These are not minor facelifts. NAB is redesigning its branches with a warmer, more welcoming layout. Spaces are being reorganized for accessibility, comfort, and—most importantly—face-to-face conversations. The intent is to create environments where customers feel at ease discussing financial concerns, while subtly reinforcing the message: NAB is here to stay in your neighborhood.

If the concept sounds familiar, that’s because it is. For two decades, banks worldwide have experimented with “branches of the future,” testing new formats and refreshing aging spaces. Yet despite the glossy redesigns, results have been underwhelming—especially in the face of steadily declining branch traffic.

The reality is that upgrading physical spaces can only go so far. The real driver of stronger customer relationships isn’t new furniture or modern décor but the quality of human expertise inside the branch: empathetic, consultative bankers who can offer meaningful advice and support. That kind of investment—which is far more critical than cosmetic upgrades—rarely receives the same level of funding or focus.

Nationwide makes it easier to access financial support

Only a handful of banks worldwide—like Australia’s CommBank—actively help customers claim the government benefits and allowances they’re entitled to. In the UK, Nationwide has expanded its service in this area, adding a new layer of support designed to tackle one of the biggest barriers: the difficulty of actually applying.

The problem is significant. Every year, an estimated £23 billion in benefits go unclaimed in Britain, often by the households that need them most. For many families, that support could make a meaningful difference in their standard of living. While stigma plays a role—some see government aid as shameful, even though four in ten beneficiaries are employed—the main issues are lack of awareness and the sheer complexity of the application process.

Nationwide’s entry point is the Better Off Calculator, which asks users a few basic questions about their household, income, and location. It then generates a personalized list of benefits they may qualify for. Crucially, the process doesn’t stop there: the tool can guide users step by step through the full application journey.

Because those final steps can still feel overwhelming, Nationwide offers an alternative. Users can call an advisor for direct support—especially critical for those uncomfortable with online services or at risk of digital exclusion. And the platform isn’t limited to members: it’s open to any UK resident, whether or not they bank with Nationwide.

Launched in partnership with Policy in Practice, the service has already shown impact. Just four weeks in, about 2,200 households discovered they were eligible for an average of £554 per month in additional support. For customers, that’s transformative. For Nationwide, it’s a win-win: stronger brand trust, increased loyalty, and healthier household finances that in turn reduce risk for the bank.

U.S. Bank expands support for small businesses

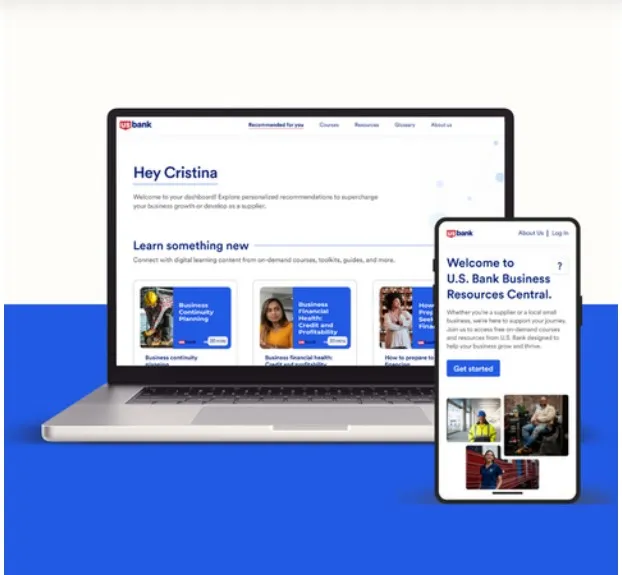

Bankers who work with small business owners often see a reality that goes beyond finances: many entrepreneurs lack knowledge in areas critical to running a company. That gap is exactly what U.S. Bank hopes to address with the launch of its new educational platform, Business Resources Central.

Developed in close partnership with small business support specialist Next Street, the platform is free to use for any organization—whether or not it’s a U.S. Bank client. After completing a short onboarding questionnaire, users receive a tailored learning path designed to strengthen their business performance and, in some cases, position them as potential suppliers to U.S. Bank itself.

Participants gain access to a library of online courses created by Next Street. Topics range from preparing for financing requests and managing operational risks—such as setting up a business continuity plan—to best practices for working with large corporations.

U.S. Bank has layered in its own content, focused on financial education and its products, and the platform also provides direct access to the bank’s small business advisors. These advisors can connect entrepreneurs with the expertise, relationships, and funding sources they need. For those interested, U.S. Bank’s procurement team is also available to support small businesses looking to become suppliers.

At face value, the platform is a generous resource for business owners who may be experts in their craft but lack the full toolkit to run a company—and who aren’t yet large enough to hire specialists. Helping them succeed ultimately benefits the bank too, reducing the risk of costly mistakes and building stronger, more resilient clients.

There’s also a strategic side. By embedding its own resources and financial guidance into the learning experience, U.S. Bank subtly promotes its services while widening its reach. Opening the platform to the general public allows the bank to attract new prospects—first drawn in by education, and potentially converted into clients as their needs align with the bank’s offerings.

Digital Reinvention community

With Qorus memberships, you gain access to exclusive innovation best practices and tailored matchmaking opportunities with executives who share your challenges.