Innovation Radar: Banking Innovation Awards winners 2025

This year, Qorus and Infosys Finacle received over 320 submissions from 130 financial institutions across 53 countries. The winners were revealed at an in-person ceremony in Athens on October 29th, celebrating the cutting-edge ideas driving the industry forward.

Since 2013, the Qorus Banking Innovation Awards have been spotlighting the ideas and practices reshaping banking. The Banking Innovation Library collects top projects from banks, fintechs, and tech firms, offering a go-to resource to track trends and benchmark innovations.

This year, Qorus and Infosys Finacle received over 320 submissions from 130 financial institutions across 53 countries. The winners were revealed at an in-person ceremony in Athens on October 29th, celebrating the cutting-edge ideas driving the industry forward.

Business Banking Innovation

This category highlights banks that are leading breakthrough innovation and digitization in corporate banking, covering channels such as cash management, payments, treasury, trade finance, and more. It celebrates institutions delivering tailored, efficient digital solutions that empower large corporates, mid-sized businesses, and SMEs to thrive in a rapidly evolving financial landscape.

Gold winner

District Marketplace by Danske Bank (Denmark)

Danske Bank has extended its District digital banking platform to include an online marketplace that gives SMEs easy access to more than 100 financial products. Developed with Infosys as part of the bank’s Forward ’28 digital transformation strategy, the District Marketplace allows business clients to evaluate and order financial offerings directly from the banking platform. The bank has sold over 10,000 products on the District Marketplace in two years. (Read the full case study)

Silver winner

Corporate Homebanking by Millennium bcp (Portugal)

Millennium bcp has built a digital platform that provides SMEs with a range of integrated financial services that streamline business banking. The Corporate Homebanking platform, designed with input from 1,300 SMEs, offers real-time views of multiple accounts, AI-guided cash flow forecasts, online credit approvals, Open Banking integration, and a centralized payments hub. (Read the full case study)

Bronze winner

Customer Information Platform by novobanco (Portugal)

novobanco has improved the efficiency of its enterprise lending by developing a digital platform that consolidates certified financial and economic data for business banking clients. The Customer Information Platform provides relationship managers and credit analysts with an integrated dashboard that shows real-time, auditable data on loans, collateral, risks, and other key metrics. (Read the full case study)

Neobanks and Fintech Player special award

Business Rewards Account by Allica Bank (UK)

Allica Bank has enhanced the services it provides established SMEs by launching a business rewards account that offers cashback incentives on card transactions as well as instant access to a savings facility. Account holders can also use the bank’s digital platform to link to accounting service providers such as Xero, QuickBooks and Sage or get personal assistance from a relationship manager. (Read the full case study)

Business Model Innovation

This category celebrates creative products and initiatives that transform a bank’s business model, expanding or redefining its role in the evolving financial ecosystem. It recognizes banks that are leading the charge in “new-age banking,” scaling novel approaches such as digital-first propositions, embedded finance, marketplace banking, super apps, BaaS, and other groundbreaking innovations.

Gold winner

Facilitea Coches by CaixaBank (Spain)

CaixaBank has teamed up with a range of car dealerships to create an online portal that combines vehicle sales and financing. Launched early in 2025, the Facilitea Coches portal displays new and used vehicles from more than 700 dealers. It has facilitated the sale of over 10,000 vehicles while enabling the bank to provide €170 million in financing as well as sell more than 5,000 auto insurance policies. (Read the full case study)

Silver winner

Speech Analytics System for Sales Leads by Yapi Kredi (Turkey)

Yapı Kredi has increased sales revenue by implementing a speech analytics system that reviews calls to its contact center and identifies potential product demand. In a pilot project, the analytics system, which uses Nexidia Interactions Analytics software, identified a rising number of inquiries about term-deposit products and provided the bank with sales data that has enabled it to double its conversion rate to 5%. (Read the full case study)

Bronze winner

SC Ventures Fintech Ecosystem for Digital Assets by Standard Chartered (Singapore)

Standard Chartered is using its SC Ventures business unit to build a collaborative ecosystem of nearly 50 fintech firms advancing the use of digital assets in financial services. Founded in 2018, SC Ventures seeks long-term investments that combine the regulated infrastructure of a traditional financial services provider with the agility of decentralized finance (DeFi) start-ups. It has incubated more than 25 start-ups and made minority investments in a further 20 firms. (Read the full case study)

Neobanks and Fintech Player special award

Wenia by Bancolombia (Colombia)

Wenia, a digital assets company launched by Bancolombia, provides customers with a secure, reliable and regulated platform to buy, sell, store and convert cryptocurrencies. The platform, built on blockchain technology, can be accessed directly from Bancolombia accounts as well as supported bank cards and external wallets. It earns revenue for the bank from transaction commissions, opens new digital monetization opportunities, and serves a growing market of young, digitally-savvy investors. (Read the full case study)

Customer Experience Innovation

This category celebrates initiatives that use digital technologies to engage clients and create a truly customer-centric approach. It recognizes innovations that boost loyalty, satisfaction, and advocacy, including improvements in marketing, sales, distribution, and customer channel management—both digital and physical.

Gold winner

CaixaBank App Enhancement by CaixaBank (Spain)

CaixaBank has improved the customer experience it offers clients by making its mobile banking app more convenient and efficient. Drawing on feedback from more than 10,000 customers, the bank has simplified the app’s user interface, introduced a flexible architecture that allows it to add new features without app store updates, and incorporated AI search capabilities. The improvements have given customers greater autonomy and reduced friction when conducting mobile banking. (Read the full case study)

Silver winner

Trust Call by Standard Bank (South Africa)

Standard Bank is strengthening customer trust in its digital banking services and curbing financial crime by incorporating a security feature in its mobile app that helps users verify calls from bank representatives and alerts them to approaches from potential fraudsters. The Trust Call facility, which has been adopted by more than 1.5 million clients, flags incoming calls from Standard Bank agents as authentic and triggers an on-screen warning prompt if it suspects a call is an attempted fraud. (Read the full case study)

Bronze winner

My Financial Progress by BMO (Canada)

BMO is helping its customers reach their financial goals by incorporating a digital planning tool in its online and mobile banking services. Customers can use the My Financial Progress tool to build personalized financial plans, review their current status, and receive tailored recommendations from the bank. By May 2025, more than 30% of the bank’s core retail customers were using the tool. (Read the full case study)

Emerging Tech Innovation of the Year

This category celebrates banks leveraging cutting-edge technologies to shape the future of banking. From Cloud and Gen AI to Blockchain, Open APIs, IoT, and Mixed Reality, these innovations bring tomorrow’s banking to life. It recognizes institutions that inspire better banking by architecting future-ready solutions and pushing the boundaries of what technology can achieve.

Gold winner

Citi Token Services by Citi (USA)

Citi has launched a payments service that allows multinational clients to execute 24/7, real-time cross-border payments and trade finance deals using tokenized bank liabilities on a private permissioned distributed ledger. Citi Token Services uses tokenized liquidity transfers on the bank’s blockchain infrastructure to enable clients to move money instantly across USD corridors in the United States, United Kingdom, Singapore and Hong Kong. For trade finance, a smart contract layer is added to the transfer to facilitate conditional payment. (Read the full case study)

Silver winner

Next Generation Cash Pooling by ABN AMRO (Netherlands)

ABN AMRO is helping its corporate and business clients improve their liquidity management by introducing a cash pooling system that customers can manage themselves through the bank’s internet portal. Built using Infosys Finacle’s Liquidity Management Solution, the system gives clients an overview of their cash management structures, conditions and sweeps and lets them adjust cash pools without contacting the bank’s staff. (Read the full case study)

Bronze winner

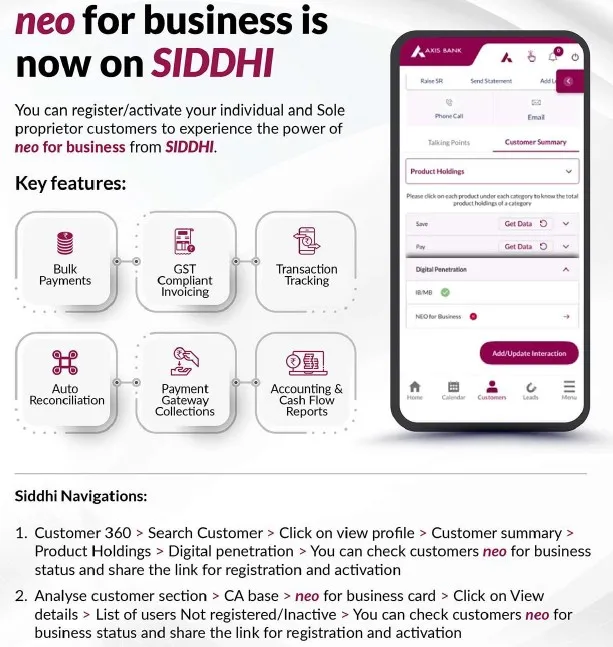

Siddhi Integrated Wealth Platform for Burgundy Private by Axis Bank (India)

Axis Bank has enhanced the customer service its Burgundy Private banking business provides high-net-worth clients by consolidating the many systems, databases and application interfaces used by relationship managers into a single integrated platform. The Siddhi platform, which enables relationship managers to respond to client needs and execute tasks without switching systems, has quickened turnaround times, reduced errors, increased customer satisfaction, and streamlined customer onboarding. (Read the full case study)

Neobanks and Fintech Player special award

Banking Transformation by Zand (United Arab Emirates)

Zand Bank has strengthened its digital capabilities by migrating its core banking applications and related customer data to the Infosys Finacle banking platform. The move, which provides the digital bank with a scalable, cloud-agnostic core banking platform that offers greater security, compliance, and operational efficiency as well as faster product delivery, was completed in just 100 days with little disruption to client services. (Read the full case study)

Operations and Workforce Transformation

This category honors banks that have successfully tackled operational complexities through process re-engineering, driving efficiency and laying the groundwork for profitable growth. It recognizes initiatives that scale processes to boost revenue and asset growth while managing costs, as well as transformative projects that empower and elevate the workforce, from employee experience to organizational capabilities.

Gold winner

Data Guru intelligent assistant by Banco do Brasil (Brazil)

Banco do Brasil has improved the efficiency of its workforce and given employees greater autonomy by introducing into its workflows an intelligent assistant that responds to natural language commands to locate, explain or suggest data. Data Guru, an AI-powered assistant integrated into the bank’s Microsoft Teams platform, handled 6,000 interactions with more than 1,000 users in its first month and cut data search time by 60%. (Read the full case study)

Silver winner

AROPIS (Artificial Operations Intelligence System) by BCA (Indonesia)

BCA has developed a predictive platform that uses machine learning to improve the management of the bank’s extensive network of ATMs, cash recyclers, electronic tellers and card devices. The AROPIS (Artificial Operations Intelligence System) platform automatically optimizes cash replenishment, stock management, and maintenance planning. It has improved the bank’s efficiency, reduced costs, and enhanced customer satisfaction by increasing device availability. (Read the full case study)

Bronze winner

Union Advith by Union Bank of India (India)

Union Bank of India is raising the skills and capabilities of its future leaders by introducing an in-house development program that promotes innovation and business competence. Created with Boston Consulting Group India, the Union Advith program uses a mix of education methods to instruct 600 emerging leaders each year in subjects such as AI, design thinking, digital banking, and cybersecurity while building a range of behavioral skills. (Read the full case study)

Neobanks and Fintech Player special award

CX Scouting empathic listening program by imagin (Spain)

imagin, a digital financial services provider formed by CaixaBank, is improving its employees’ understanding of their customers by enrolling them in a regular empathic listening program. The CX Scouting program, which requires employees to listen to five anonymized customer calls each month, analyzed 2,700 conversations last year, gained 2,000 product or service insights, and initiated over 100 projects that enhanced the organization’s offerings. (Read the full case study)

Social, Sustainable & Responsible Banking Innovation

This category celebrates banks that lead the way in ESG, both within their organization and through customer-focused offerings. It recognizes innovations that advance social purpose, reinforce corporate responsibility, and position the bank as a trusted ally to its customers in their journey toward a more sustainable future.

Gold winner

Scale it Agro by KBC (Belgium)

KBC is using its Start it@KBC business accelerator to help early-stage sustainable agriculture firms scale their businesses. The Scale it Agro program offers companies in Europe mentorship, education, and specialist support across the sustainable agriculture value chain. Backed by Start it@KBC, KBC Bank and Insurance, CERA, Boerenbond, Agri-Investment Fund, and Arvesta, the program is supporting 12 firms in its first cohort. (Read the full case study)

Silver winner

Vesto investment platform by Cread (Andorra)

Creand has created a digital platform that offers retail investors access to tokenized US stocks as well as curated groups of thematic shares, online education, an interactive community, and guidance from financial influencers. Built to provide young people in Spain with an accessible gateway to investing, the Vesto platform has attracted 20,000 users and 15% of them have become active investors. Creand is looking to introduce Vesto to other Spanish-speaking markets. (Read the full case study)

Bronze winner

Agrifuture by Şekerbank (Turkey)

Şekerbank teamed up with agri-tech firm Farmolog and the Union of Beet Growers’ Cooperatives (Pankobirlik) to create a digital platform that encourages local farmers to practice sustainable agriculture. The Agrifuture platform tracked in real-time agricultural inputs, such as fertilizers, pesticides, water, tractors, labor, and seeds, from 180 farmers and calculated the carbon emissions and environmental impact of their crops. The pilot project showed how digitally mapped data can be used to support sustainability compliance in export-focused food and textile industries. (Read the full case study)

Neobanks and Fintech Player special award

Digital Bank for People with Disabilities by Parabank (Brazil)

Parabank, a digital bank formed by a community of people with disabilities for people with disabilities, has established a financial services ecosystem that combines innovative adaptive banking solutions with a dedicated institute that provides career training and financial education. Established in partnership with Visa and several disability organizations, Parabank aims to overcome the barriers to financial inclusion and equality that confront people with disabilities. In its first year it has onboarded more than 70,000 clients. (Read the full case study)

Product and Service Innovation

This category highlights creative products and offerings—developed independently or through partnerships—that meet customers’ evolving digital lifestyles and drive sustainable growth. It celebrates breakthrough concepts that transform, enhance, or tailor banking services across deposits, credit, payments, investments, and advisory solutions for specific market segments.

Gold winner

Decentralized Digital Identity by Bradesco (Brazil)

Bradesco is offering its customers a decentralized digital identity that allows them to control, share and manage personal data securely, quickly and transparently. Built on blockchain infrastructure, the digital identity eliminates the need for multiple platform registrations or passwords. In trials for credit card onboarding, it reduced processing time by 75% to four minutes and increased acquisition conversions by as much as 300%. (Read the full case study)

Silver winner

Ads Manager by Bank of Georgia (Georgia)

Bank of Georgia has embedded a digital advertising platform in its mobile and internet banking channels that allows SMEs to launch focused, data-driven marketing campaigns to an audience of more than 1.5 million potential customers. The Ads Manager platform, which comprises self-service analytics tools, a campaign builder dashboard, and AI-powered performance analytics, has run more than 1,000 campaigns for 500 businesses. It has strengthened the bank’s ties with SMEs and opened new revenue streams. (Read the full case study)

Bronze winner

NameCheck by Commonwealth Bank of Australia (Australia)

Commonwealth Bank of Australia (CBA) has developed a payment verification system that uses machine learning and the bank’s extensive data resources to check the account details of payment recipients and alert customers to suspicious transactions. The NameCheck system has screened 80 million transactions on CBA’s banking platforms and prevented scam or mistaken payments worth AUD650 million. It has also stopped losses of AUD72 million among other organizations that access NameCheck via API links. (Read the full case study)

Predictive, Generative, and Agentic AI Innovation

This category celebrates banks leveraging cutting-edge AI solutions to create real business impact. It highlights initiatives using predictive analytics, generative AI, and agentic AI to optimize operations, enhance decision-making, deliver superior customer experiences, and drive innovation across the organization.

Gold winner

GenAI incubator by mBank (Poland)

mBank has created an in-house incubator that promotes the development of scalable, secure, and compliant GenAI applications that improve the organization’s efficiency, decision-making, and customer experience. Built in collaboration with more than 100 bank employees as well as specialists from local universities, the incubator has already produced four GenAI solutions that have enhanced complaints handling, data access, client conversation analysis, and information retrieval at the bank. (Read the full case study)

Silver winner

AML Analytics and Investigation by Eurobank (Greece)

Eurobank has strengthened its ability to detect and investigate financial crime by integrating a range of AI technologies into its anti-money laundering (AML) processes. The bank’s AML Analytics and Investigation project combined machine learning, graph analytics, and GenAI capabilities with established transactional and customer datasets to create a unified surveillance platform that has improved alert accuracy and reduced investigation times. (Read the full case study)

Bronze winner

Machine Learning Stock Market Insights by Akbank (Turkey)

Akbank has introduced a stock market analysis feature on its mobile banking app that uses machine learning to provide real-time analysis in Turkish of shares listed on the NYSE and Nasdaq exchanges in the US. Customer engagement with the banking app has increased 40% since the introduction of the stock market tool, while retail investor activity has climbed 25% and customer satisfaction with the new feature reached 90%. (Read the full case study)

Innovation Awards Hub community

With Qorus memberships, you gain access to exclusive innovation best practices and tailored matchmaking opportunities with executives who share your challenges.