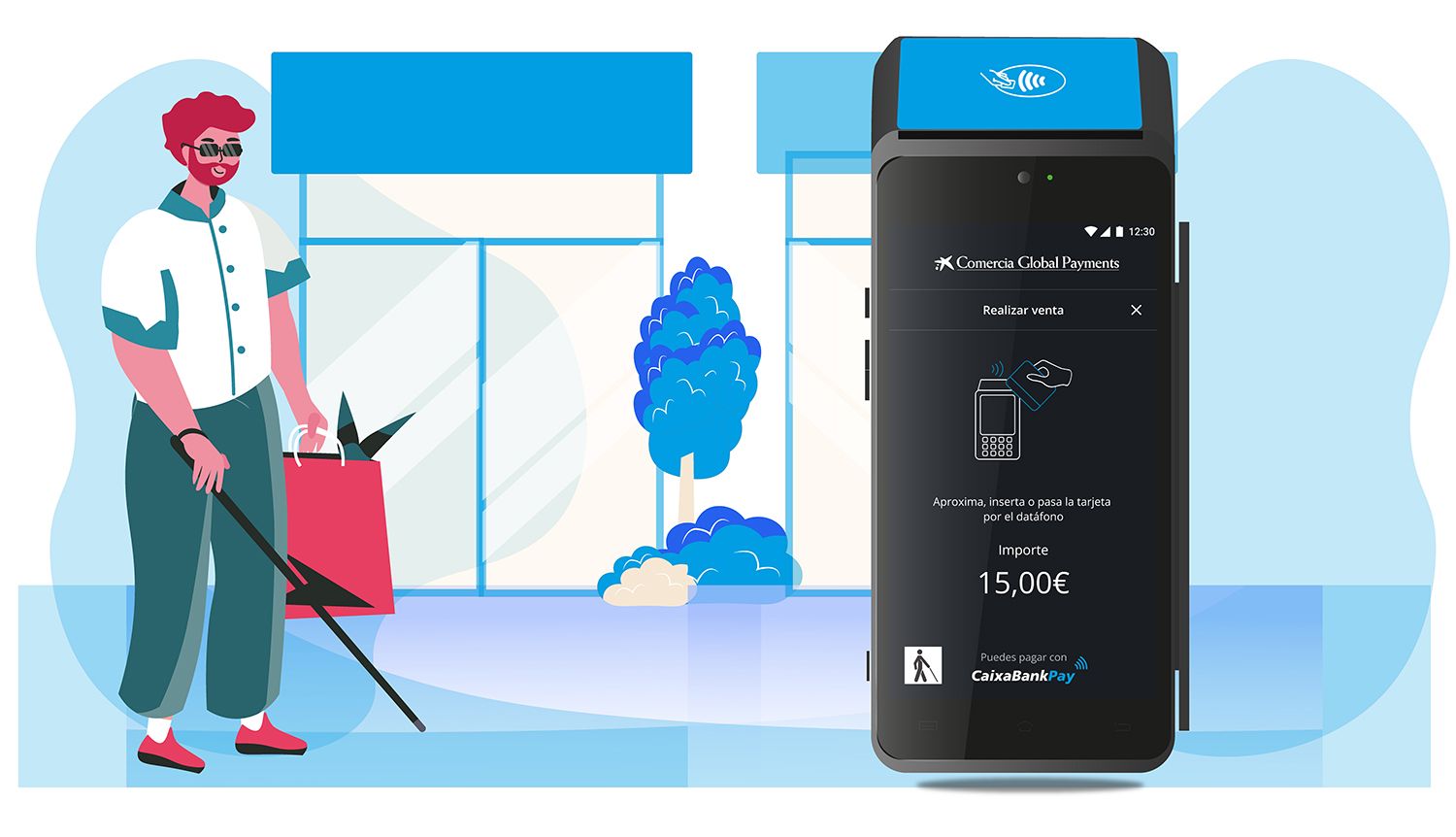

CaixaBank, in collaboration with ONCE and through Comercia Global Payments, has introduced an innovative functionality to its Android POS terminals, improving accessibility for blind individuals during the purchase process. This initiative aims to empower those with visual impairments, providing them with greater independence in making payments at establishments.

NewTech Friday: OOrion – Locating assistance for visually impaired individuals

Key features:

• Independence for the Visually Impaired: The new functionality, developed with ONCE, enables blind individuals to make secure purchases independently, eliminating the need for assistance in entering PINs during transactions.

• Accessible Mode Activation: Users can activate the "Accessible Mode" on the POS terminal by a simple double tap on the button at the bottom left of the payment screen. A voiceover then provides information on the payment amount and instructions on completing the transaction.

• Enhancing Safety: By automating updates on the latest Android POS terminals, CaixaBank reinforces the security of payments for visually impaired customers, reducing dependence on others.

• Rollout Schedule: The new feature is already available for newly activated terminals, with updates for existing terminals scheduled between December and the first quarter of 2024.

• Braille Pack Service: This initiative follows the "Braille Pack" service launched by CaixaBank last year in collaboration with ONCE. The service facilitates the use of any card with Braille reading/writing code for people with visual impairments.

CaixaBank's commitment to accessibility extends beyond the digital realm, encompassing physical branches where 86% apply the "no barriers" concept. Furthermore, 99% of branches are adapted for people with disabilities, offering features like voice-guided navigation and Braille keyboards.

By embracing technology and innovation, CaixaBank aims to create inclusive banking solutions that cater to diverse customer needs and eliminate barriers hindering accessibility. This recent enhancement aligns with the bank's dedication to fostering financial inclusivity and ensuring that its products and services are accessible to all.