Conferences reveal the industry's state of mind in real time, and FT's "Future of the Car" event showed the pressure and pain of Transition. After significant hype about electromobility and ADAS / Autonomous Driving, fed by cheap money, reality is catching up with AutoMobility on a number of fronts. Chinese competitors have embraced the challenges of Electromobility and Software early and vigorously, prompting US and Europe into a defensive stance raising taxes. European radical action, e.g. through co-development of vehicles between Renault and VW, seems to make sense, but proves to be a challenge. At the same time, OEMs' Value Strategies are questioned by courts challenging OEM control on A/S (after-sales) through gateways. A/S costs bringing a further hurdle for EV / Digital transition: high component costs, limited repairability and fledgling A/S set-ups make repairs slow and costly, increasing insurance premiums. So the EV / Digital transition is still bringing more pain than gain, and lots of problems to be solved.

We look forward to seeing you on June 18 for the Qorus-CVA Mobility Community's next online event 'Electrifying the future: Navigating insurance and financial landscapes in the era of electric vehicles'. Register now.

Financial Times Conference: Future of the Car Summit

The Future of the Car Conference of the Financial Times has clearly established itself as a prime rendez-vous for leaders of the automotive industry. Top managers from OEMs of all continents have shared their latest vision of where the industry is and where it is going to. We saw Volkswagen, Seat, Porsche, Hyundai, General Motors, Ford, Nissan, Peugeot... but also NewOEMs like BYD, Nio, Lucid and Rimac representing the entire continuum of OEMs in the industry. There were also a number of Tech players such as Qualcomm, Waymo, Uber, Wayve, NXP and Service Providers such as Cox Automotive, MSXI, Ayvens, CA Autobank... A true reflection of the ingredients necessary to transition AutoMobility to its future state.

CVA perspective:

The FT Conference showed the AutoMobility Ecosystem is in a feverish state as EV and mobility transitions face reality, and competitive dynamics are complex & shifting. The feasibility of the EV transition, particularly within the planned timeline, is under scrutiny, with questions on both consumer & government behaviours. New OEMs, especially from China, are proving to be more than just low-cost imitators, they represent a new S-Curve beyond Tesla. There's growing doubt about whether incumbents' strategies, like cost reduction and direct distribution, are feasible, sufficient and in-time to maintain market share. More questions than answers abounded by the end, but sharing convictions has been inspiring.

Partnership between VW and Renault for developing a below €20k electric car failed

Luca de Meo confirmed the end of negotiations between VW and Renault regarding a budget-friendly electric vehicle and refers to a missed opportunity for a European automotive collaboration. Disagreements over the location of production are said to be central to the breakdown, as Renault proposed building VW's model alongside its upcoming Twingo successor at one of its factories, while VW wished to prop up its own factory utilization. The discussions, which had been nearing completion, were further complicated by objections from VW's workers' council. VW now considers developing the vehicle on its own, whereas Renault remains committed to launching its electric Twingo successor by 2027.

CVA perspective:

The European industry will need to change radically and fast. This makes partnerships and M&A an obvious strategic tool. A collaboration between VW and Renault on a much needed small electric car made sense for these two players who have proven elsewhere to be embracing disruptive partnership rationales (e.g. Renault with Geely, VW with XPeng in China...). This turn of events will delay potential synergies and scaling benefits for Renault and forces VW to find a way to "fast-forward" own development of an affordable electric vehicle, giving Chinese progress on this topic (e.g. BYD Seal). This poses the question of how incumbent OEMs can develop what Group CEO Blume calls "Europe speed", standing for fast, efficient and effective development. Political support and societal flexibility will be necessary ingredients. In any case, this turn of events shows the difficulty for incumbents to compete against a frenetic Chinese speed with current European constraints.

Tariffs for Chinese OEMs

The European Union is planning to impose tariffs of up to 30% on electric vehicles (EVs) imported from China, as indicated by Valdis Dombrovskis, the EU Trade Commissioner. This move aims to counteract market distortions caused by state subsidies for Chinese EV manufacturers. The existing 10% tariff might increase to 25-30%, affecting not only Chinese brands like MG and BYD but also models made in China by Tesla, BMW, and others. This decision follows similar actions by the US, which recently increased its tariffs on Chinese EVs to 100%.

CVA perspective:

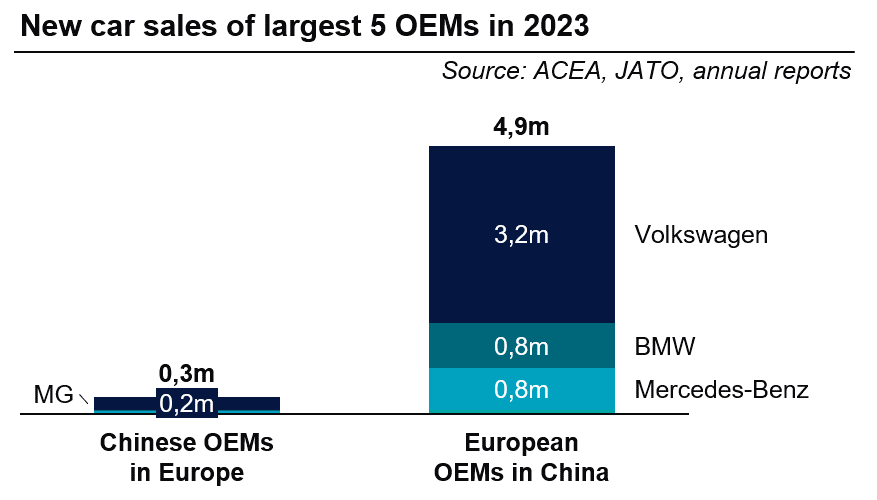

China has already signaled that it will plan counter-measures, particularly targeting vehicles with bigger engines sold in China. This will drastically impact the sales of the largest five European OEMs (VW Group, BMW, Mercedes, Stellantis, Renault), which sold ~4.9m in China in 2023. In comparison, Chinese OEMs have only sold~330k vehicles in Europe in 2023. Increasing production capacities in China force Chinese OEMs to export, increasing European competition, particularly in the more price-sensitive volume segment. Whether or not taxes will slow down Chinese groth in Europe, there is a need for European OEMs to increase the pace of their development of affordable electromobility as the mass market requires it.

European legislation easing data access for independent service providers

A recent ruling by the Landgericht Köln, following a decision by the European Court of Justice, has strengthened the rights of independent automotive repair shops (IAMs) to access repair data from car manufacturers (OEMs). The verdict is part of a broader dispute over access to vehicle data necessary for repairs, which manufacturers have increasingly tried to restrict. The court mandated the removal of "Secure Gateways," which have been used to limit third-party repair shops' access to crucial onboard diagnostics and other data unless they pay licensing fees or connect to the manufacturer’s servers. This ruling obviously supports IAMs and consumer choice in the automotive service market.

CVA perspective:

OEMs generate a significant share of their profits within the vehicle lifetime (after the first sale), where parts & regular maintenance are critical for the dealers to make a margin, allowing to accept lower New Car "metal margins". Transition towards EVs reduces regular maintenance revenues, even if somewhat counter-balanced by higher after-sales (A/S) tickets for repairs. Securing a maximum share of A/S for the OEM Ecosystem is becoming critical for parts revenues and dealer margins (labor). Opening the market to independent players is beneficial for the customer (price competition), and will force OEMs to find different ways for becoming competitive with IAMs, e.g. through Economy offers that some of them have launched for older used cars. It definitely is a set-back for OEMs trying to make vehicle related revenues captive to counter-balance reduction of A/S margin in the EV Transition.

Rising repair costs drive up German motor insurance premiums

Motor insurance costs in Germany are expected to increase due to a deficit of two billion euros in the current year's balance sheet, as announced by the German Insurance Association (GDV). Last year's loss of around three billion euros caused many policies to become more expensive, and according to a study by Verivox, premiums increased for 84% of policyholders at the turn of the year.

The rising repair costs are the primary cause for these losses, with the average financial outlay for a liability claim projected to be €4,000 this year, up from €2,500 in 2014. Cost of spare parts, inflation, energy prices, and intricate technology of assistance systems / safety requirements for e-car repairs all contribute to rise.

CVA perspective:

The situation in the German market mirrors an evolution in all European countries due to rising repair expenses (across European markets) caused by higher costs for spare parts, labor, and the complexity introduced by advanced driver-assistance systems (ADAS) and electric vehicles (EVs). Supply chain disruptions and inflation are increasing insurance costs, especially for EVs. But high A/S costs are also an Ecosystem issue: OEMs still need to increase repairability of vehicles (e.g. changing battery cells, not writing off entire batteries) and build A/S set-ups that correspond to repairs of higher-complexity vehicles. Insurance companies need to seek rate increases and adapt their policies, e.g. through specialized products for EVs and high-tech vehicles. The takeaway is clear: A rise of insurance premiums may be the price to pay for transitioning towards Electromobility. However, the entire value chain will need to quickly minimize these costs by designing repairable vehicles, putting in place A/S set-ups at scale, preventing damages (e.g. preventive maintenance) and adapting premiums to the real risk through UBI.

We look forward to seeing you on June 18 for the Qorus-CVA Mobility Community's next online event 'Electrifying the future: Navigating insurance and financial landscapes in the era of electric vehicles'. Register now.

Authors

Markus Collet

Corporate Value Associates

Partner & Head of Automobility Platform

Amelia Bradley

Corporate Value Associates

Associate Partner – Automobility Platform

Patrick Schiebel

Corporate Value Associates

Senior Manager

Max Müller

Corporate Value Associates

Strategy Consultant