The last month has supplied a number of examples of the challenges in the AutoMobility Transition. The BEV disenchantment has resuscitated the interest for hybrid technologies, which buys us time… But which could actually be dangerous for players if they take their eyes of the ball, of getting their BEV model worked out. One of the gaps is in EV remarketing, which is about to scale up, without all pieces yet in place (Battery Certification…). Also in distribution, where there is a sort of “agent model disenchantment”, Jaguar is a further case of players abandoning the agent model, likely improving efficiency and capabilities of the dealer model. This hesitation is quite aligned with the opinion of the financial services industry issued in our Qorus-CVA Mobility Community, where 87% of the audience state that concerning EV management, the industry “is on the way, but the major part still needs to be addressed”.

Stable PHEV sales in times of slowing down electrification

PHEV sales have been growing gradually before & during Covid with a growth in market share of European NC sales from 0.8% in 2018 to 9.5% in 2022, reaching sales of ~1m vehicles in Europe. However, 2023 represents a turning point, as PHEV sales declined (to a market share of 7.7%), while BEVs continued to grow (15.7% market share). PHEV sales for the coming years are expected to stay relatively stable, reaching ~1m new registrations in 2030.

While BEVs experience a temporary slow-down and PHEVs being stable, HEVs (hybrid electric vehicles) are currently growing significantly – HEVs are non-chargeable and not classified as electric vehicles, with prices on average 27% lower compared to EVs and a consumer purchasing behaviour that is closer to conventional ICE vehicles than to electric power trains.

CVA perspective:

The current slowdown in electric vehicle sales in Europe provides a unique opportunity for hybrid electric vehicles (HEVs) to gain market share. Regulatory changes with reduced subsidies and strong price uncertainties of electric vehicles are temporarily influencing the consumer purchasing behaviour. BEV sales are most impacted due to their high price level, ongoing RV challenges and significant price volatility (cf. Tesla’s price reductions). PHEVs on the other side are getting pushed by new technological innovation (e.g., BYD’s new plug-in technology) while offering a balance between electric-only driving and the flexibility of an internal combustion engine. However, in the medium-term, sales of BEVs will outperform plug-in hybrids as new CO2 targets after 2025 and 2030 will penalize PHEV sales. For all players in the automotive ecosystem, this means that BEV challenges still need to be addressed with highest priority as the current growth of HEVs and stable outlook for PHEVs will not eliminate the pre-dominance of BEVs in the mid- to long-term.

Jaguar gives up on the Agency Model

Jaguar and Land Rover have decided to step back from the plans of shifting their dealer model to an agent model. This ensures that vehicles are only sold at certain dealerships that fulfill the necessary framework conditions. Jaguar is thereby stepping back from the shift to the agency sales model in Germany and in the following on the entire European level. This decision was made in the face of a recent market transition, returning from a seller's market to a buyer market. Land Rover had previously chosen to continue with its traditional dealer based sales system in March.

The decision to continue the dealer model partially reverts JLR's sales reorganization, which started in November 2022. The updated dealer contracts were effective from July 2023 and included reduced dealer remuneration, scaled-back investment protections, and increased intervention capabilities for JLR Germany with end customers. Dealers without new contracts can operate under old terms until fall 2024. The decision to step back from this reflects a broader industry trend of neglecting agency models and is a consequence of JLR's performance in the market. According to the Federal Motor Transport Authority (KBA), Jaguar registered fewer than 1,200 new vehicles in the first five months of 2024 in Germany, marking an 11.2% decrease from the previous period. In contrast, Land Rover experienced a marginal increase of 0.6%, with approximately 5,400 new registrations.

CVA perspective:

By sticking with the dealer model, Jaguar not only stabilizes its current market presence but also ensures a gradual transition to battery electric vehicles, mitigating risks associated with implied changes. The strategic direction indicates a broader trend among OEMs navigating these transformative times with a cautious yet deliberate approach. We belief that existing dealer models can be made radically more efficient even without doing the step towards an agent model. The main required changes in the operating model can be achieved by deeper integration, and end-to-end process perspective, data sharing models and many more. Most of these improvements are from our perspective pre-requisites for a successful introduction of agent models. We therefore belief that Jaguar's decision is a wise one, as the build-up of these capabilities requires time and an improved dealer model can be a good intermediary step.

Growth of used BEV sales

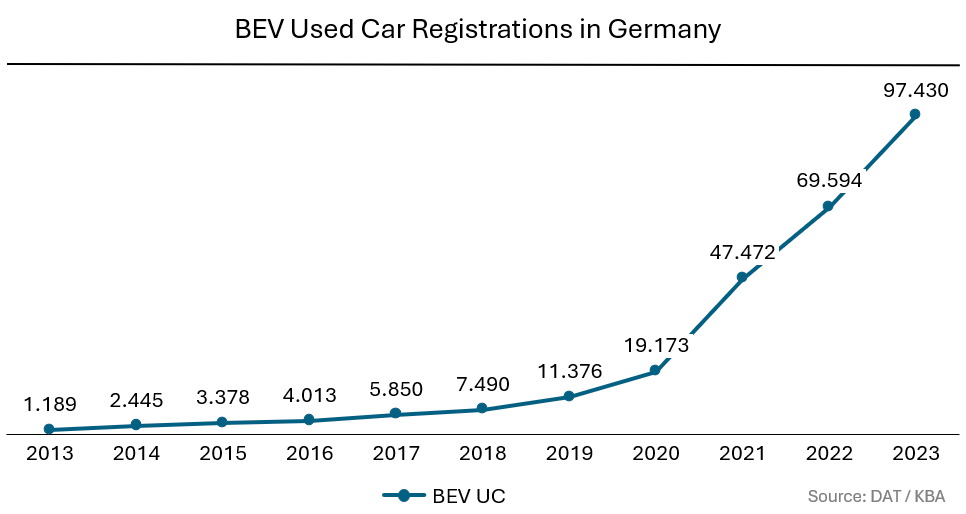

As the electric vehicle market adapts to the end of state subsidies in Germany, there's a noticeable pivot from new to used BEVs, introducing new challenges and opportunities for automotive players. As shown in the graph, the number of used BEV registrations in Germany has been increasing steadily, leading to ~97k registrations in 2023, representing a 1.62% share of all used car registrations. Especially between 2020 and 2023, registrations increased sharply (at a CAGR of ~72%). Residual value curves remain the key topic around used BEV sales. Recently, they have decreased significantly for 3-year-old electric vehicles and now stand at only ~54% of their original value compared to ~65% for ICE vehicles. Therefore, selling used BEVs requires dealers and OEMS, but also all other stakeholders active in BEV UC sales (insurers, banks...) to adapt their business and sales strategies.

CVA perspective:

To establish a robust market for used BEVs, it is essential to implement targeted strategies that address consumer concerns and optimize distribution efficiencies. Key to enhancing buyer confidence and ensuring vehicle reliability is offering comprehensive battery warranty programs, which should be closely integrated with State-of-Health (SoH) Certificates. These certificates provide crucial insights into a battery's condition and remaining lifespan, allowing warranties to be more accurately tailored to the vehicle's actual state, thus enhancing consumer trust and satisfaction. Additionally, effective international distribution strategies are vital for placing used BEVs in high-demand markets, which maximizes sales opportunities and expands access to sustainable transportation options globally. Addressing these concerns cohesively will not only improve operational efficiency and market reach but also support substantial market growth. Understanding such implications and movements is becoming more and more important as the market for used BEVs, although currently small, is expected to expand significantly, in line with increasing BEV new car sales. It's crucial for all parties involved in the used BEV market to fully understand and address these challenges holistically.

Qorus Webinar on Electric Vehicles

The Qorus-CVA webinar on electric vehicles (EVs) took place amid growing questions about the EV transition and the role of financial services in this context. Online polls among industry participants revealed significant challenges related to profitability and specific risks such as residual values. The webinar emphasized the crucial role of finance and insurance in facilitating the EV transition, highlighting that the financial services industry is still at the early stages of the electromobility learning curve, indicating a challenging period ahead.

CVA perspective:

Despite uncertainties about future government subsidies and incentives, the shift to EVs is gaining momentum and it will not go away. If banks, insurers, and finance companies may have come to terms how to technically treat first volumes of EVs, there are still quite fundamental questions about how to scale up into a large scale EV ecosystem. If residual values are volatile, how to write affordable financing contracts? If used car battery quality is unknown, how to charge for them when selling the car? If batteries need to be changed when they have minor defects, how to make motor insurance affordable? Up to now, risks have been limited and hence integrated in "cost of doing business". When volumes scale up, these risks / difficulties will seriously hamper growth, especially when covering the mass market, which is less forgiving as to price levels. A challenge for the ecosystem, but clearly an opportunity for players who figure out how to scale up their EV activities.

Authors

Markus Collet

Corporate Value Associates

Partner & Head of Automobility Platform

Amelia Bradley

Corporate Value Associates

Associate Partner – Automobility Platform

Patrick Schiebel

Corporate Value Associates

Senior Manager

Max Müller

Corporate Value Associates

Strategy Consultant

Other editions

AutoMobility Insights - August 2024 edition

The latest news from the automotive industry curated and commented by the experts at Corporate Value Associates (CVA).

AutoMobility Insights - June 2024 edition

The latest news from the automotive industry curated and commented by the experts at Corporate Value Associates (CVA).