Partnerships prove critical to embedded travel insurance success

Insurers are turning to embedded insurance to expand and extend their travel offerings. But to succeed they need to select the right business and technology partners.

Insurers are turning to embedded insurance to expand and extend their travel offerings. But to succeed they need to select the right business and technology partners.

A surge in innovation has pushed embedded insurance from the fringes of travel insurance to center stage. It has opened an array of opportunities for insurers to launch personalized “in the moment” embedded products that strengthen customer loyalty and open new revenue streams.

Critical to the success of new embedded travel insurance offerings, however, are the right business and technology partners. Without best-fit business partners insurance providers will struggle to reach new customers beyond their traditional markets. And the absence of key technology services will undermine efforts to build a robust and extensive ecosystem of business partners.

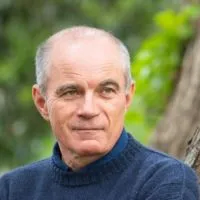

Successful embedded insurance partnerships require deep relationships that understand the contexts and objectives of the participants, says Sébastien Fabre, head of marketing strategy and research at Allianz Partners.

“Our embedded insurance business model provides us with many different moments to interact with customers and it also gives our business partners more opportunities to engage with their customers. It is transforming us from being a reactive risk manager to become a proactive travel companion and enables us to build customer trust and strengthen long-term relationships with partners.”

Fabre was speaking at an online event hosted by Allianz Partners and the Qorus Embedded Insurance community. Aligning with the correct partners was identified by business leaders polled at the event as the biggest challenge confronting insurers that are looking to market embedded insurance in the travel industry. It ranked ahead of difficulties related to regulatory compliance and technical integration. The main benefit of embedded insurance innovation for the travel industry was real-time coverage adjustments, according to business leaders at the online event, followed by personalized insurance plans and automated claims processing.

“We think of the customer not just as a traveler but as a person who is perhaps a parent, someone who owns or rents a home, who uses a vehicle or who possibly has health difficulties.” - Sébastien Fabre, Allianz Partners.

Allianz Partners has expanded its embedded travel insurance offering to encompass what it terms the dreaming, planning, booking and traveling stages of the customer journey. It uses a variety of digital platforms to engage with consumers while they are “dreaming” about new travel experiences, planning their journeys and booking their trips. Its allyz app-based platform launched early this year provides customers with a range of services while traveling. They include an insurance policy management facility, a trip organizer and real-time safety alerts. Fabre says the insurer plans to extend these offerings to other aspects of customers’ lives and provide services such as home, transport and health protection.

“We think of the customer not just as a traveler but as a person who is perhaps a parent, someone who owns or rents a home, who uses a vehicle or who possibly has health difficulties. This approach requires us to break down siloes. It’s a reinvention. It demands a mindset of innovation.”

Allianz Partners is not only working with business partners to deliver its embedded insurance offerings to consumers. It also provides partners with the technology, services and support they need to market embedded insurance to their own customers. The insurer is also providing embedded insurance capabilities into the ecosystems of business partners such as Delta Air Lines, Air France/KLM and Singapore Airlines.

“In the first month, we sent more than 22,000 push notifications and measured a 22% opening rate.” – Balint Bese, Erste Bank.

The company offers its business partners support that goes beyond giving them API links to its technology and middle office applications, says Fabre.

“We also support them while they integrate and test applications to ensure they can provide their customers with the best user experience. What’s more we share our expertise; our knowledge of online distribution as well as our expertise in marketing, user experience and regulatory compliance.”

Balint Bese, head of bancassurance and online sales at Erste Bank in Hungary, credits a technology partnership with insurtech firm Companjon for enabling the institution to market an embedded travel insurance product to its customers. The launch of the product in May was the first step in Erste Bank’s strategy to provide its clients with more personalized and relevant digital products and services. The app-based embedded insurance offering automatically credits a client’s bank account with a €40 refund should their flight be delayed by more than an hour.

“In the first month, we sent more than 22,000 push notifications and measured a 22% opening rate. That shows we can create relevant and personalized messages to send to our customers. We’ve sold more than 200 policies and settled around 30 claims without any user interaction or friction for our customers.”

“Instead of customers having to come to us if they have a claim, we go to them. And best of all, the entire process is automated.” - Matthias Ruefenacht, Baloise.

Swiss insurer Baloise teamed up with three insurtech partners to launch its parametric range of travel insurance products. The parametric offerings automatically compensate policyholders if a predefined event, such as a specific amount of rainfall or the duration of a flight delay, is recorded by the provider. The Baloise products offer cover for bad weather, flight delays and lost luggage.

Baloise worked with German insurtech Wetterheld to build its bad weather offering and collaborated with Blink Parametric in the Ireland to create its flight delay and lost luggage insurance products. It uses UK firm Kasko to manage the integration of these products with its core insurance applications.

Baloise is reinventing the traditional travel insurance experience, says Matthias Ruefenacht, innovation manager at the insurer.

“Instead of customers having to come to us if they have a claim, we go to them. And best of all, the entire process is automated. There’s no need for customers to provide proof to support their claims and there are no more long waiting periods for payouts.”

Ruefenacht points out that the parametric products are embedded in the customer journey that Baloise offers its customers and can be further embedded in the online customer journeys that are offered by travel agents that are partners of the insurer.

Embedded insurance products shift complexity from the customer and transfer it to the insurer, says Perry McShane, director of strategic accounts at Blink Parametric. And Blink manages such complexity on behalf of insurers, adds McShane.

“We sit behind the insurer. We deliver the full tech stack and integrations that an insurer would need to launch its own parametric products.”

“Brands are actively seeking products and solutions that can engage their customers, drive usage, promote card spend, and also provide valuable insights into consumer behavior.” - Perry McShane, Blink Parametric.

McShane points out that before starting to build a parametric travel product, insurers need to identify the processes they intend automating. This selection will often be determined by the data sources available to the insurer. However, some key processes, such as customer care, are best handled by specialist staff and shouldn’t be automated, adds McShane.

He points out that insurers then need to define the offer they want to present to customers.

“Is it an enhancement to a premium product to incentivize people to buy further up the booking tier? Or maybe it's just an inclusion within a travel insurance policy to offer customers more benefits and drive frontline sales.”

The insurance provider should finally choose the benefits they are going to offer customers, says McShane.

“If they’re an airline, they could offer airline reward vouchers, or maybe they could offer customers points that link back to their ecosystem to spend on future trips.”

Blink provides insurers with a range of parametric services. They include communications facilities such as email and SMS notifications to customers; data and business intelligence tools; API integrations with real-time data sources that provide information about among other things weather events, flight cancelations and luggage delays; assistance and resolution products including cash payouts, hotel reservations and flight bookings; and refund payments in multiple currencies.

McShane says Blink’s partners tend to be insurers keen to show regulators their products offer fair value or insurance providers eager to differentiate themselves from competitors. Parametric services can help both groups achieve their goals, he says.

“We're paying out claims in real time and the engagement rates speak for themselves. In a traditional flight delay product that we embed within a partner's solution, we tend to see customer engagement of 25% to 30%. And among the top brands we work with, engagement rates can reach 60%. This is huge compared with some travel products that are embedded.“

“In the second camp, insurers that are seeking differentiation and digital solutions, a really good example is the NAC (no additional cost) market. Credit card businesses, for example, have a laundry list of services that are intended to entice customers to buy their credit card. But they tend to have very low usage on those benefits. Now, we're finding a big shift in that market. Brands are actively seeking products and solutions that can engage their customers, drive usage, promote card spend, and also provide valuable insights into consumer behavior.”

McShane adds that insurers can use the customer data they source from their embedded parametric offerings to cross-sell and upsell further travel services.

As insurers look to embedded insurance to expand and extend their travel services, they will need to ensure they have secured ties with business and technology partners that will enable them to deliver offerings that continue to entice and delight customers.

Qorus Embedded Insurance Community, in partnership with Allianz Partners, is now open for new members. Grab this opportunity and join us in this community: https://lnkd.in/gwSnnVuy

For further information contact Jana Hola: jana.hola@qorusglobal.com

Insurance & Embedded Insurance community

With Qorus memberships, you gain access to exclusive innovation best practices and tailored matchmaking opportunities with executives who share your challenges.