To support Singapore’s Smart Nation efforts, DBS, in collaboration with the Government Technology Agency (GovTech), is partnering the Health Promotion Board (HPB) and NETS to introduce a digital payment feature in HPB’s Healthy 365 mobile app.

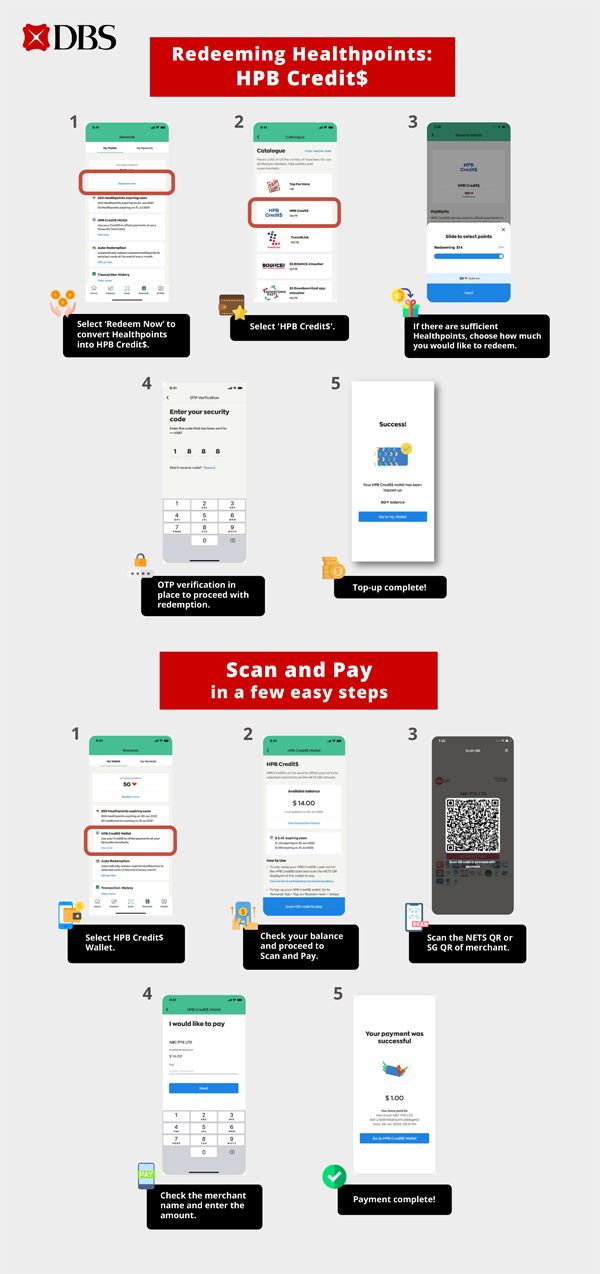

From Monday, 25 April 2022, Healthy 365 app users can convert their Healthpoints to HPB Credit$ in the app, and utilise them at more than 500 participating local F&B merchants that sell healthier options island-wide by scanning the NETS QR or SG QR code at the merchant’s store via the app. The transaction takes seconds to complete.

With this initiative, DBS aims to encourage more merchants, many of which are SMEs, to go cashless and paperless. With this scan-and-pay solution, all sales will be automatically consolidated in a report at the end of each day and the funds received from the transaction would be credited to the merchant’s bank account by the next business day. More than 2,500 F&B merchants are expected to be onboarded as participating outlets by end March 2023 for the acceptance of HPB Credit$.

Lim Soon Chong, Group Head of Global Transaction Services, DBS, said, “It is increasingly relevant for merchants to embrace digital forms of payment as the pandemic has dramatically boosted the use of contactless payment options. We are glad to partner GovTech, Health Promotion Board and NETS to develop the technological infrastructure to bring the scan-and-pay solution to life, so as to provide Healthy 365 app users and participating merchants greater convenience in the way they live, work and play.”

Foo Wei Young, Director of Corporate and Industry Partnerships, HPB, said, “We are pleased that through this partnership with GovTech, DBS and NETS, we are able to enhance our rewards programme so that our Healthy 365 users can directly use the rewards they have gained on healthier meals at hawker and coffeeshop stalls. These stalls, which are onboard our Healthier Dining Programme, offer healthier options such as wholegrain meals and lower sugar beverages, which users can now conveniently spend their rewards on just by converting their Healthpoints to HPB Credit$.”

Steven Koh, Director, Government Digital Services, GovTech, said, “We are happy that this new application for GovWallet – where users of the Healthy 365 app can convert their Healthpoints to HPB Credit$ – brings greater ease and convenience for our citizens. GovWallet also enables us to help government agencies disbursing monies and credits to citizens, by enabling them to partner local banks and tap on the latter’s e-payments infrastructure as well as customise the list of merchants with which citizens can use their payouts in a secure and convenient way."

Lawrence Chan, Group Chief Executive Officer, NETS (Network for Electronic Transfers), said, “We are proud to partner DBS, GovTech and Health Promotion Board in this meaningful initiative. More merchants are adopting QR as a means of payments and usage has accelerated significantly in the last two years across the extensive NETS’ merchant network. As Singapore progresses towards a smart nation, we are committed to increasing our acceptance points and staying focused on ensuring the best user experience at Point of Sale.”

Cho Ai Min, a 3rd generation owner of Cho Kee Noodle at Old Airport Food Center, said, “We are excited to be one of the early adopters of this scan-and-pay QR solution as it will provide our customers greater convenience and help to further grow our customer base. The solution also reduces the volume of cash we handle daily and the frequency of visiting a bank branch to deposit our earnings.”

Cindy See Seow Hwee, a DBS customer and a regular user of the Healthy 365 app, said, “As a Healthy 365 user for the past few years, I look forward to this latest feature that allows me to convert my Healthpoints to digital credits that I can use to treat my family with healthier food from participating merchants.”

Supporting the digitalisation of businesses

To support the digital transformation of businesses in Singapore, DBS has been working closely with its corporate clients, especially SMEs, to encourage their transition to digital payment options and stay abreast with the latest measures to fend against digital scams. In 2021, the bank engaged 13,000 SME customers in digital workshops between July to September alone.

There also continues to be healthy pick-up in adoption rates for DBS digital payment solutions, such as DBS MAX – the bank’s mobile-based QR payment collection solution launched in 2018 to help SMEs and large corporates receive payments digitally and instantly with real-time notification. In 2021, DBS MAX’s transaction volumes increased almost 300% year-on-year. The bank has also seen robust increase in PayNow Corporate registrations, with more than one-third market share of Singapore’s PayNow Corporate registrations and largest industry’s market share in terms of transaction volumes.

As a result of these collective efforts, 97% of payment transactions carried out by DBS’ corporate customers were done digitally in 2021.