NewTech Friday: GK8 – Securing blockchain transactions

GK8’s founders and most of the R&D team are veterans of Israel’s elite cyber-security units, protecting the nation’s strategic assets from state level hackers. Lior Lamesh, CEO and co-founder of GK8, tells us more about his company and its digital assets platform for financial institutions.

GK8’s founders and most of the R&D team are veterans of Israel’s elite cyber-security units, protecting the nation’s strategic assets from state level hackers. Lior Lamesh, CEO and co-founder of GK8, tells us more about his company and its digital assets platform for financial institutions.

What led to the creation of GK8?

I served in an elite team that protected Israel’s strategic state-owned assets, answering directly to the Israeli Prime Minister’s Office. There I met my co-founder and partner, Shahar Shamai. We both share a passion for blockchain. After resigning from the Prime Minister’s Office, our knowledge, experience, and gumption, enabled us to hack one of the most popular crypto wallets on the market within four days and without the use of special equipment.

Blockchain and cryptocurrencies have the potential to create new revenue streams for financial institutions. However, alongside these new opportunities, financial institutions are also exposed to new threat vectors. Hackers have become increasingly sophisticated and brazen in their attacks over the last few years. Both traditional finance and crypto-native institutions find themselves victims of malicious intent.

While these firms often invest billions of dollars to keep their ‘fiat’ assets safe and secure, protecting digital assets requires a totally new mindset. Only an enterprise-grade solution can provide these institutions with the much needed security, alongside the robust functionality required to manage millions of dollars in assets.

This is why we developed the world’s first truly air-gapped cold vault that is able to create, sign, and send secure blockchain transactions with no internet connectivity, hence eliminating all potential cyber-attack vectors.

Could you present GK8's offer?

GK8 offers financial institutions an end-to-end platform for the custody and management of digital assets.

As a strategic partner, GK8 helps accelerate, secure, and empower institutions adopting crypto to generate new revenue streams and business. We provide these institutions with a platform for custody, staking, DeFi, NFTs, tokenization, and management of any coin, token, or smart contract.

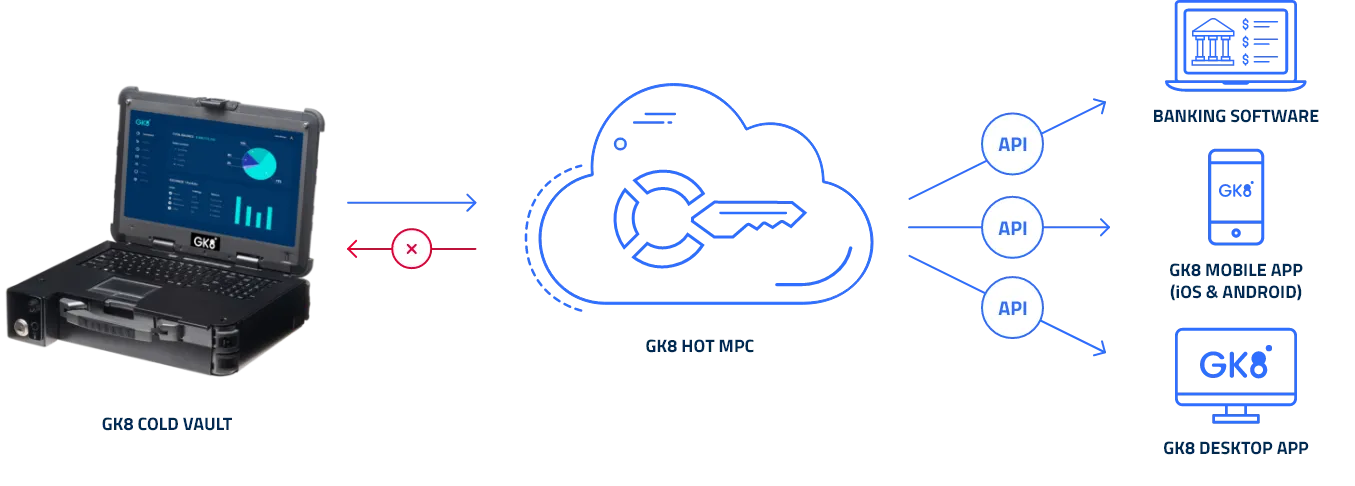

We developed the world’s first TRULY air-gapped cold vault that enables our clients to create, sign, and send secure blockchain transactions offline as well as a highly scalable, patented MPC vault. The cold vault is primarily used for custody, high-risk transactions, and interacting with smart contracts or staking functions. The MPC vault is for high-frequency, automated transactions.

Having a multi-tier solution enables financial institutions to mitigate threats by diversifying their custody solutions. More importantly, the hot and cold solutions can, and should, work in conjunction, for optimal risk balancing according to different use cases with the product (custody/staking/DeFi/NFT/tokenization, etc).

What's coming next for GK8?

We are experiencing an impressive growth trajectory, and our sales and pipeline have expanded phenomenally. I believe this trend will continue as we are always investing in our product by adding advanced strategic feature sets according to the evolving market demands, and offering new capabilities.

I am proud to say that we are already a market leader in our offering, whether through the most diverse coins supported, access to the highest insurance in the market, or the only true cold vault in the market. And our numbers speak for themselves. We are consistently recruiting, adding to our growing resources in the US, Europe, Israel, and, soon in APAC.

Leverage community expertise to redefine finance

Our communities cover diverse topics such as digital transformation, SME finance, or Embedded insurance, providing a platform to learn from industry experts and peers.