Financial Innovation Spotlight – January 2025 edition

In this month’s Financial Innovation Spotlight, we zoom in on five exciting new projects by Atom, Revolut, Crédit Agricole's Khome, bunq, and TBC UZ.

In this month’s Financial Innovation Spotlight, we zoom in on five exciting new projects from around the world. The UK’s trailblazing digital banks are first under the spotlight: Atom is empowering homeowners with personalized energy-saving solutions, while Revolut is protecting its customers against fraud with in-app phone support. In France, Crédit Agricole’s proptech Khome has rolled out an enticing offer for clients seeking to buy real estate: a co-investment model that covers 10% of the downpayment. Meanwhile bunq, Europe’s second-largest neobank, is breaking language barriers with real-time speech-to-speech AI translation for in-app phone calls. Finally, in Uzbekistan, TBC UZ has launched a subscription service that seamlessly combines banking and lifestyle benefits.

A tool empowering homeowners with personalized energy-saving solutions

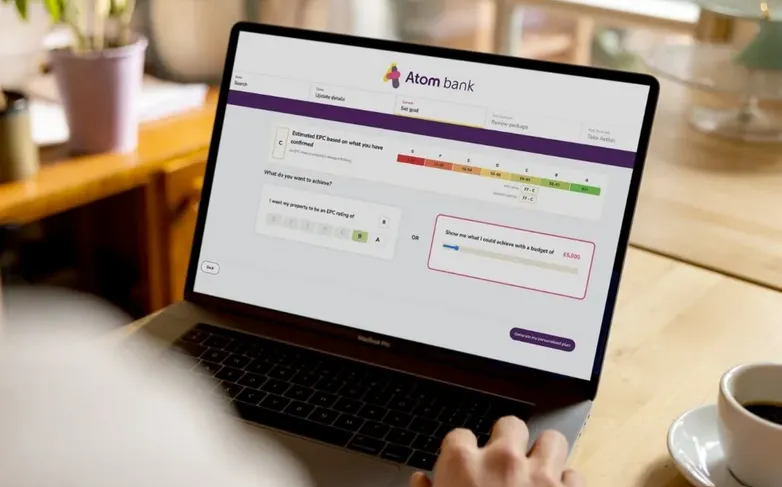

UK mobile bank Atom has launched Retrofit Explorer, an intuitive tool that provides homeowners with customized energy-saving recommendations.

Who?

Fully launched in 2016 as the UK’s first app-based bank, Atom provides market-leading fixed saver accounts, secured loans for SMEs and mortgage products tailored to meet modern customer needs. In 2024, Atom's operating profit was GBP 27 million, a remarkable 600% increase from the previous year.

Why?

Retrofitting boosts energy efficiency and can raise property values by 12%, offering homeowners savings and long-term gains. Yet, with 29 million UK homes needing upgrades by 2050, many lack clear information on Energy Performance Certificate (EPC) ratings and options, leading to cost misconceptions that hinder progress.

How?

To tackle the challenges and misconceptions surrounding EPC ratings, Atom has partnered with data firm Kamma to launch the Retrofit Explorer tool. This tool helps homeowners better understand their current EPC rating and provides a tailored plan for improvement through retrofitting or other methods. Once the plan is created, the tool suggests local tradesmen to complete the work.

In-app phone support to combat fraud

Revolut has developed an innovative in-app phone support feature to enhance security and protect customers from identity theft scams.

Who?

Revolut is a global financial technology company and licensed European bank, founded in 2015. It serves 50 million customers worldwide. Revolut offers a wide range of products, including banking services, currency exchange, debit and credit cards, virtual cards, Apple Pay, interest-bearing ‘vaults’, personal loans, BNPL, stock trading, cryptocurrency, commodities and human resources tools.

Why?

Identity theft scams occur when someone impersonates a bank, authority or trusted individual to trick their victim into sending money or sharing sensitive information, compromising the security of their funds. These scams often occur by phone call, posing a major risk to many customers and making it essential to provide solutions to prevent such fraud.

How?

Revolut has been testing and developing in-app calling features for several months, honing a native functionality that scammers cannot replicate. The new feature allows customer support agents to initiate calls directly through the app, giving customers 100% certainty that they are interacting with Revolut, not a fraudster. The company emphasizes that henceforth the vast majority of calls from Revolut customer support will be conducted in-app, heightening customers’ vigilance to scam calls by regular phone.

In-app customer support calls are initially being rolled out to personal account holders, with business customers to follow soon.

Innovative co-investment model to help buyers access real estate

Khome, a subsidiary of the Crédit Agricole Group, has unveiled a novel solution aimed primarily at affluent clients seeking to purchase real estate. The initiative, called Apport+, offers a co-investment model designed to help those who might otherwise struggle to cover the entire cost of their desired property.

Who?

The French proptech company Khome, a subsidiary of the Crédit Agricole Group, specializes in real estate analysis. It assists clients with property valuation, real estate expertise and climate risk assessment.

Why?

Soaring real estate prices have impacted prospective buyers across the socioeconomic spectrum, including the affluent segment, with many falling short of the funds needed to secure their dream home or property investment.

How?

Khome’s Apport+ offers a real estate co-investment solution through a property investment company that directly acquires part of the asset at the notary’s office. With this solution, the individual retains full use of the property but pays only 90% of its cost. This legal and financial innovation eliminates the need for financial outflows for up to ten years. To generate a return, the property investment company will either claim 15% of the property's value at the time of sale or the owner will buy back that share.

Apport+ is primarily aimed at affluent clients or investors with specific financing needs, ensuring no risk of over-indebtedness.

In-app real-time speech-to-speech AI translation

Neobank bunq has become the first bank to offer real-time AI speech-to-speech translation in its app, breaking language barriers and simplifying user interactions with banking support.

Who?

Founded in 2012 in the Netherlands, bunq has grown into Europe’s second-largest neobank, catering to digital nomads and simplifying how they manage money. With a focus on user-driven innovation, it was the first EU neobank to achieve structural profitability at the end of 2022.

Why?

Being able to communicate effectively with all customers, regardless of their language, is essential – especially for a mobile bank operating in multiple countries. By breaking language barriers, the app becomes accessible to a wider audience.

How?

Bunq has significantly enhanced its AI assistant, Finn, becoming the first bank worldwide to offer real-time speech-to-speech translation within its app. Finn can now instantly translate both the user's speech and the support agent's responses, enabling seamless in-app phone conversations without relying on external translation tools. Additionally, Finn can process visual information and make the bunq app available in over 30 languages, further improving accessibility and user experience.

A seamless solution to manage banking and lifestyle needs

TBC Uzbekistan (TBC UZ) has launched Payme Plus, a subscription service that combines financial and lifestyle benefits.

Who?

TBC UZ is the leading digital banking ecosystem in Central Asia and part of the London-listed TBC Bank Group. Launched in 2020, it now boasts 17 million unique registered users – more than 40% of Uzbekistan’s population. In 9M24, the company recorded a net profit of USD 27 million, with its loan and deposit books growing 99% and 66% year-over-year, respectively.

Why?

This offering aims to enhance the TBC experience and support the bank's strategy to expand its digital product range, accelerate new launches and profitably grow its presence in Uzbekistan. It will also help convert more customers into multi-product users, boosting engagement, loyalty, and average revenue per user.

How?

Payme Plus enhances TBC’s customer experience by offering a seamless solution to manage banking and lifestyle needs. Subscribers can access financial tools like automated spending analysis and interest-free transfers, plus enjoy lifestyle services at special rates through Yandex Plus and Setanta. The service will be provided through Payme, a leading payment provider and key part of TBC UZ’s digital ecosystem.

See the previous editions

Digital Reinvention community

With Qorus memberships, you gain access to exclusive innovation best practices and tailored matchmaking opportunities with executives who share your challenges.