imagin, the lifestyle and digital services platform launched by CaixaBank, in just three years has been able to offset 452 tonnes of CO2, collect more than 21 tonnes of plastic from the sea, plant 340,000 trees and mobilise 9,500 digital volunteers to collaborate in solidarity causes through digital channels. These figures are proof of the positive impact that imagin has had on the planet and society thanks to its strategy based on generating a positive impact from the digital environment and to the support of its community.

In its strategy launch in 2020, imagin stated its objective of connecting and awakening the interests of its community of users in sustainability, by offering tools to reduce the negative impact of its actions and focusing on channelling the support to collaborative social and entrepreneurial initiatives that benefit the environment and society.

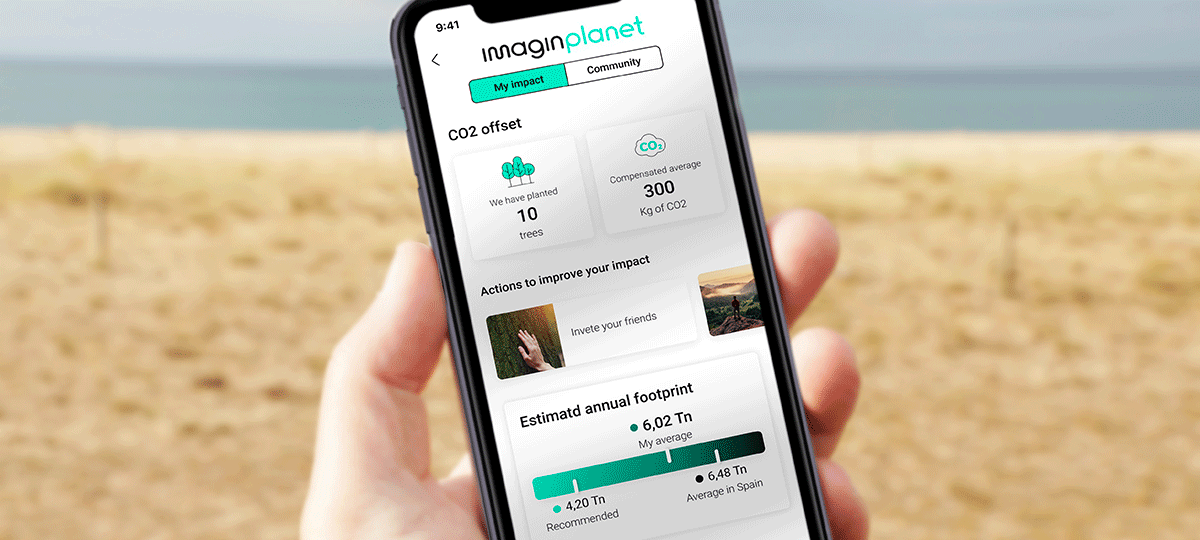

Three years later, through its app, the platform has been able to connect in an innovative way and within a digital environment with the sustainable interests of a community of imaginers that today amounts to over 4 million people. To that end, imagin develops products, services, content, agreements and initiatives that help improve the planet and those who inhabit it, and these initiatives are carried out through imaginPlanet.

This commitment has established imagin as the benchmark in the field of sustainability and social impact. In July 2020, imagin became the first mobile only platform for financial services to obtain the B Corp certification, an acknowledgement that positions the online bank among the best companies in the world that use their potential to generate a positive impact.

With the aim of concentrating its efforts and obtaining the best possible result, imagin has focused on three major objectives: protecting the forests, preserving seas and oceans and achieving social transformation, causes which the platform has rallied behind through various collaborations and actions that have scaled and expanded the resulting impact.

Three major objectives

With the aim of concentrating its efforts and obtaining the best possible result, imagin has focused on three major objectives: protecting the forests, preserving seas and oceans and achieving social transformation, causes which the platform has rallied behind through various collaborations and actions that have scaled and expanded the resulting impact.

The protection of woodlands is one of the most powerful tools we have to promote biodiversity, revert soil erosion and halt desertification, and it has a positive impact on the life of people whose existence depends on the resources provided by forests. Thanks to the actions initiated by imagin together with its community, the platform has planted over 340,000 trees in areas devastated by fire, such as the Iruelas Valley (Ávila, Spain), and where forests have been destroyed, such as in Mahajanga (Madagascar).

Another of imagin's priorities is to help protect our seas and oceans. The amount of waste in these bodies of water has an effect on the capacity they have to act as weather and climate regulators and to capture CO2. With the aim of contributing to cleaner seas, imagin has installed a network of nine floating sea containers throughout various ports in Spain, called ‘imagin Seabins’, that filter the water and capture waste, thus avoiding it from reaching the ocean. imagin has also promoted commercial actions linked to this objective, such as collecting 10 kg of plastic from the sea for every new salary directly paid into an account. Through these initiatives, imagin has been able to collect more than 21 tonnes of plastics from the ocean.

Supporting social transformation is the third major objective set by imagin. Social equity and inclusion not only contribute towards social welfare, but it also helps drive greater economic growth that is more sustainable over time and within everyone's reach. This is why imagin launches digital volunteering actions in which the community of imaginers can participate through their mobile phones without leaving their home. These activities consist in, for example, users interacting and supporting people at risk of exclusion or collaborating with NGOs, initiatives in which more than 9,500 volunteers have already participated.

All this positive impact generated by imagin through its sustainability strategy has been enhanced by impactful collaborations and actions, such as encouraging the development of entrepreneurial projects within the field of sustainability, imaginPlanet Challenge, in which more than 2,000 young people have partaken; and the collaborations with Too Good To Go, which has saved over 24,000 kg of food. In all initiatives imagin has become the loudspeaker that promotes, involves others in and raises awareness about society's major challenges in achieving a sustainable future.

Four million imaginers

imagin is a lifestyle platform promoted by CaixaBank that offers digital, financial and non-financial services that help its users, mainly young people under 30, with their daily lives and future projects. It currently has a community of 4 million users, a figure that is constantly growing thanks to the wide range of content and services—many of them free to access—and to how easy it is to sign up and access products, something that, unlike traditional banks, does not necessarily involve registering as a financial customer.

The imagin digital content is organised around five core areas: sustainability (imaginPlanet), music (imaginMusic), video games (imaginGames), trends (imaginCafé) and technology (imaginShop). imagin also offers special experiences and advantages in areas such as travel, urban mobility and educational training.

In addition, imagin’s platform provides a range of financial products to support young people to save and ease them into the ctransition into adulthood as they start to have their own income and their own lifestyle projects. In that regard, imagin is adhering to the characteristics that have turned it into the leading bank for young people: mobile only banking (the services are provided exclusively through the app, with no branches and no website, which solely fulfils an informative purpose), with no fees for the user and its own simple and clear language, especially suited to directly communicating with young people.