SME Partnership of the Year 2024 nominee: Alliance Bank Sustainability Assistance Programme

We are unveiling the candidates for the SME Partnership of the Year, showcasing collaborations that have significantly influenced the SME ecosystem by fostering growth and innovation for businesses. Take the opportunity to acquaint yourself with this outstanding nominee and draw inspiration from their remarkable journey.

Alliance Bank's Sustainability Assistance Program provides beyond banking solutions that enable businesses to improve their sustainability profile and decarbonise the value chain.

Partnership overview - how do you address primary challenges for your institution or enhance offerings for your SME clients?

The Alliance Bank Malaysia Berhad (“Alliance Bank” or the “Bank”) Sustainability Assistance Program (SAP) is developed to support the Bank’s sustainability purpose which is to help business owners adopt ESG practices. The programme is built using the 3As approach which is to drive Advocacy by raising awareness, provide practical Advice, and provide Answers via fast, simplified and relevant banking and non-banking solutions. Alliance Bank actively drives positive change through this programme by providing Malaysian businesses with the necessary support and resources to adopt sustainable practices whether it be advisory services, solution providers, training or knowledge resources. The objectives for the programme center upon increasing profitability and achieving cost efficiencies, thus improving the global competitiveness of Malaysian businesses.

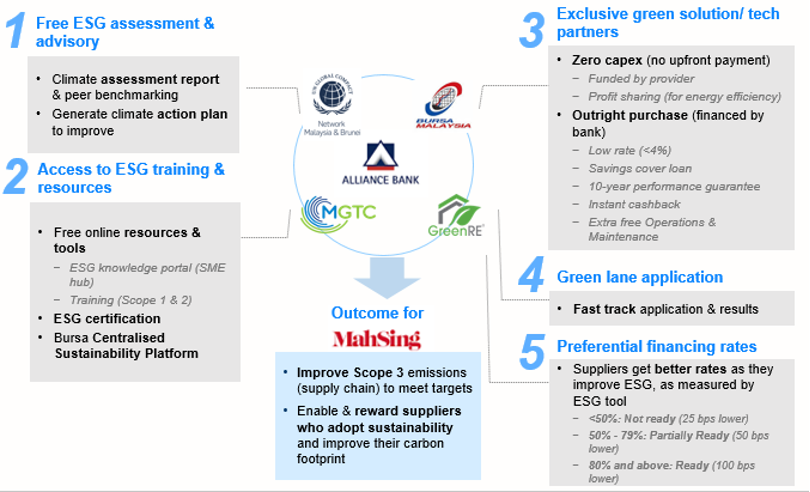

This programme is also supported by the Bank’s long-term key partners such as Bursa Malaysia (“Bursa” – Malaysia’s capital market regulator), Malaysia Green Technology Corporation (“MGTC” – Malaysia’s government-linked agency driving national policies for green economic growth), GreenRE Malaysia, SMECorp and United Nations Global Compact Network Malaysia & Brunei (UNGCMYB – official local network of UNGC)

The Sustainability Assistance Programme is also notable for its all-encompassing approach to sustainability. It focuses not just on green funding but on providing the necessary advisory and green solutions to help businesses migrate to more sustainable operations. Our long-term collaboration with key industry partners enhances its impact and effectiveness as the only financial institution in Malaysia with this range of banking and non-banking solutions for the ESG space. It is aligned to achieve the UN SDG 13 & 17 ie. Climate Action and Partnership for Goals.

Specify what unique features and advantages your partnership provides to SMEs. How do these features set the project apart from competitors in the market?

The primary issue addressed by Alliance Bank’s Sustainability Assistance Programme (SAP) is the need to positively affect climate change and encourage sustainable practices among Malaysian SMEs and listed companies. The global movement towards ESG-centricity by countries and corporate supply chains has a massive impact on businesses who lag behind in their sustainability adoption. Specifically, their ability to secure and retain new projects and enter into new markets. Meanwhile climate change poses a long-term impact to cost of operations and the environment, which makes mitigating it a primary concern for to sustain business profitability and growth.

Understanding this landscape provided the bank the blueprint to develop these unique features that directly addressed SMEs challenges in sustainability transition and thus differentiated the bank:

1. Advocacy:

To create awareness of the importance of sustainability among our customers, employees, partners and our community ecosystem. The bank has built thought leadership through affirmative action with the publication of its inaugural “ESG Insights from Malaysian SMEs: Building a Better Future Together” report which looks closely at the state of ESG among local businesses. The report obtained real feedback from Malaysian businesses and provides insights on the local business segment ESG adoption challenges, opportunities, wishlist, etc whilst raising awareness on the importance of adopting sustainable practices for the benefit of business resilience and growth. In addition to the report, the Bank has participated in national, state and ESG conferences along with our partners and gave talks, participated in forums and panel session as well as set up exhibitor booths. This enables the bank to embed the program into the ecosystem of the national and private agenda driving carbon reduction and raising sustainability advocacy.

2. Advice:

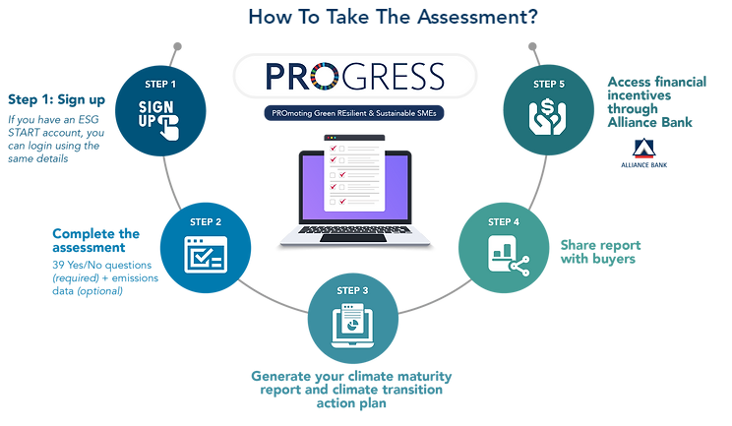

Developed an exclusive diagnostic tool called PRO-GRESS with UNGCMYB so SMEs can obtain an assessment of their sustainability status and generate a Climate Action plan for improvement. The tool is offered free of charge to the Bank’s customers or are part of the sustainable supply chain programmes offered by the Bank’s key partners. https://www.ungcmyb.org/progress

Alliance Bank is also one of only three banks who were selected as early adopters in the capital market regular, Bursa’s, Centralised Sustainability Intelligence Platform which was developed in collaboration with the London Stock Exchange Group. It enables sustainability disclosures by listed companies and suppliers in their respective supply chains. At the same time, the Bank also brought onboard its corporate partners Mah Sing Group Berhad, Lii Hen Bhd and Sarawak Energy Bhd where their supply chain partners can access the Bank’s advisory and green tech solutions which are offered at preferential rates, in order to encourage their adoption of ESG practices which has tangible financial benefits. Additionally, ABMB also signed an MoU with Bursa to work with them on their #financing4ESG program that enables the bank to work with listed companies in improving their FTSE4Good index rating which is a series of benchmark and tradable indexes for ESG investors.

Bursa Malaysia, Mah Sing and Alliance Bank Collaborate to Drive ESG Adoption

Alliance Bank's Green Journey: Sustainability and Renewable Energy Forum (SAREF 3.0)Event Highlights

3. Answers

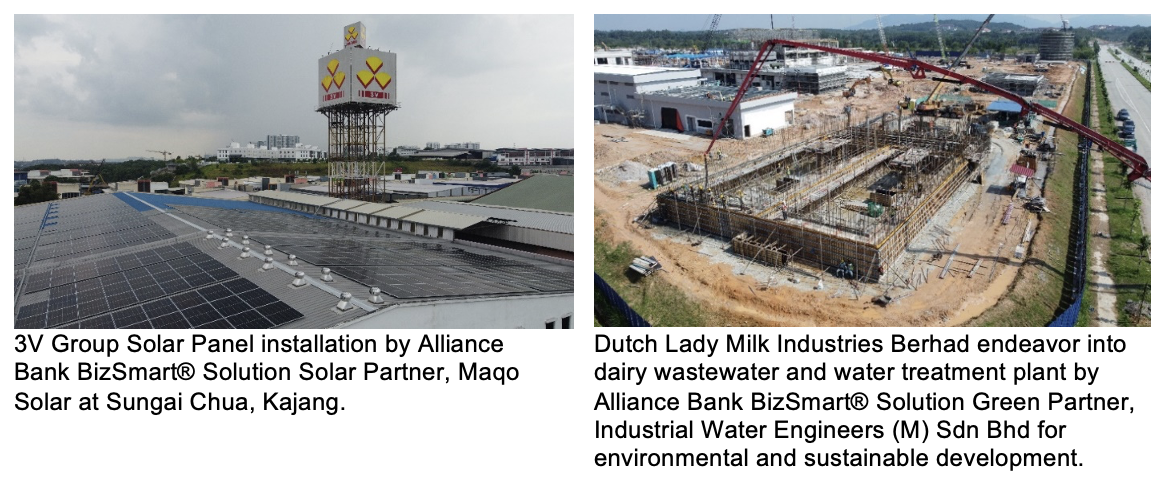

The Bank’s SAP also provides banking and non-banking solutions that meet the market’s needs for green financing and capital to enable transition towards sustainability for the industry. Our MoU with MGTC enables us to recommend a full range of green tech solutions certified with the MYHIJAU mark which is the national green recognition scheme endorsed by the Malaysian government. This not only assures quality of the product but also enables additional tax incentives based on the Green Investment Tax Exemption (GITE) program. Additionally, Alliance Bank offers green financing and sustainability linked loans with preferential rates to accelerate the implementation of green alternatives such as renewable energy, waste management, circular economy, digitization, energy efficiency, electric mobility and other green solutions. The SAP also helps businesses clients with promotion and market outreach of their sustainability improvements through the bank's digital and social media channels, e-marketplaces, and trade events.

What are the reasons for choosing a partnership for this solution? Why was a collaborative approach preferred over an independent one?

Partnerships enable us to provide a complete solution to businesses in the area of sustainability transition as described in our aforementioned "3As" pillars. The collaborative approach is preferred as we leverage the strengths of partners in the form of advisory, green tech solutions and brand advocacy.

The bank is able to piece these elements together for a cohesive offering and augment it with our financial offerings and sustainability financing products. The advantage it provides the bank are manifold as partners bring important contributions such as capacity building, green technology expertise & experience, climate assessment tools and shared industry knowledge. Additionally, it opens up avenues for the bank to reach new potential customer bases whilst embedding our financial solutions in the partner's propositions to their ecosystem.

How the partnership was formed? Did you encounter any major obstacles during its execution? What is the current situation?

The 'multiple partnerships' were formed by focusing on mutual benefit for both parties. For example, green solution providers work with the bank to finance their client projects and the capital ensures the viability to start the development and payback over time.

UN Global Compact Network MYB values the bank allocating green financing for it programs whilst we jointly develop climate action and carbon monitoring tools for SMEs to kickstart their sustainability journey.

Meanwhile working with public sector organizations such as Malaysian Green Technology and Climate Change Corporation and InvestSarawak provides the bank an important brand advocacy profile whilst we provide the resources to drive execution of the national policies and frameworks.

Obstacles such as industry adoption are expected as these are new requirements for many Malaysian businesses. It is imperative for the respective partners to acknowledge its existence and work on plans to mitigate and overcome them. Additionally, it takes time for both organizations 'working levels' to buy in to the strategic partnership and its values. These may often include the manager and administrative levels within the bank which can be caused by lack of awareness or resistance to new ideas.

Finally, the need to demonstrate success of the partnership in terms of returns for both parties has to be done frequently and broken into smaller portions such as initial / quick wins can be demonstrated and build momentum and support incrementally within both organizations.

What are the important milestones and achievements of this partnership that have made you a leader in this field?

Alliance Bank's topline has grown significantly due to the Sustainability Assistance Programme (SAP) that has contributed to the Bank successfully achieving its targeted RM10 billion in new sustainable banking business as of end of June 2023. The target’s original timeline was by financial year 2025. Accordingly, the Bank has revised the target to RM15 billion by FY2027. The programme has shown to bring about positive impact in assisting businesses adopt sustainable practices and support Malaysia’s target of becoming a net zero greenhouse gas emitting nation by 2050.

As more companies participate and benefit from SAP, the bank has drawn a wider customer base and generated revenue by answering market demand within this ecosystem. Apart from the financial growth detailed above, the program's success is are reflected via industry recognition as Alliance Bank being a market leader and winning the Star Media ESG Positive Impact Silver award for Innovative Partnerships and Partnership for the Goals Recognition presented at the UN Global Compact Malaysia & Brunei’s Forward Faster Sustainability Awards 2023.

Our strategic MoUs and partnerships with Bursa Malaysia, Malaysia Green Technology Corporation, GreenRE Malaysia and the United Nations Global Compact Network Malaysia & Brunei also validates our ability to forge meaningful collaborations that provide unique value adds to businesses we engage. These collaborations have enabled the bank to build a strong ecosystem to push sustainable practices among SMEs and public listed companies alike.

Alliance Bank also carried out a wide range of ESG marketing initiatives that reached over 2 million consumers and businesses combined. On several of these, we worked with partners to develop significant value such as how they can save energy cost and enhance their competitiveness globally via ESG adoption.

Alliance Bank's active participation in conferences and exhibitions, including in the International Greentech & Eco Products Exhibition & Conference Malaysia (IGEM) which is the largest green conference in Malaysia, enabled it to effectively connect with a varied audience of business owners, thereby increasing the reach of its sustainability message.

Via our social media channels, the bank disseminated information and engaged stakeholders across several platforms. One notable endeavour was the creation of an engaging ESG video, which featured important ESG players and customer testimonies, offering an authentic and compelling story on the benefits and impact of implementing sustainable practices.

Products wise, ABMB provides preferential rates via our green financing products such as the Low Carbon Transition Facility (LCTF), High Tech Green Facility (HTG) and Automation and Digitization (ADF). These provide capital support to businesses to embark on green technology projects such as renewable energy, waste management, energy efficiency, electric vehicles / mobility, circular economy and many more. For larger projects, we also provide sustainability linked loans (SLL) and Sukuk /Bond structures.

Internally, our commitment to sustainability is evidenced through our goal to reduce greenhouse gas emissions by 20% by FY2027, demonstrating our efforts to combat climate change and positively contribute to the environment.

SME Banking community

With Qorus memberships, you gain access to exclusive innovation best practices and tailored matchmaking opportunities with executives who share your challenges.