Banks rethink RM roles to boost SME business

Many banks are changing how they support RMs by aligning digital tools, simplifying workflows, and giving them greater opportunity to build strong client relationships.

Many banks are changing how they support RMs by aligning digital tools, simplifying workflows, and giving them greater opportunity to build strong client relationships.

Banks have invested heavily in digital technologies to grow their SME revenues. But their gains have often been disappointing. Digital systems intended to help relationship managers (RMs) have instead added complexity and hampered efforts to serve SME clients.

Now many banks are working to improve the effectiveness of their SME outreach by striking a better balance between digital tools and human expertise. They are rethinking how to support RMs, simplifying their work, and giving them more scope to build strong client relationships.

The shift will require banks to overcome the limits of their legacy infrastructure and reverse the shortfalls of earlier attempts to strengthen RM performance. Many RMs currently have to contend with digital systems that are fragmented, misaligned, and lack integration with their bank’s core data systems. This results in inefficient workflows, incomplete understanding of client needs, and missed revenue opportunities.

The proliferation of digital systems and their lack of integration is the biggest challenge facing RMs, according to banking executives polled by Qorus. Lack of time for RMs to engage deeply with clients is next.

Ulf Erik Lett, partner at consulting firm Corporate Value Associates (CVA), says digital systems intended to support RMs need to be designed around their specific needs. Applications rolled out from the IT department, for example, won’t succeed.

“There has to be an understanding of the RM’s clients, their pain points and how data and analytics can alleviate those pain points.”

Lett adds that many banks have introduced systems that prompt RMs about next-best-sales in an effort to increase SME revenues. However, RMs frequently resist such prompting, he says.

“What RMs really like are tools that automate their agendas, provide client information before meetings, and help them identify where they can sell more. RMs want tools that make their job easier.”

Lett was speaking at an online event hosted by the Qorus SME Banking Community on how banks can better equip RMs to drive SME business. Other speakers were Susan Davies, head of Business Banking at Santander UK, and Lalatendu Mohanty, executive VP and head of trade and working capital at Rakbank in the UAE.

Davies points out that Santander and other major banks must contend with fragmented customer data, often split across multiple systems, that makes it difficult for them to provide RMs with a comprehensive view of their clients.

“You’ve got the challenges of duplication and maybe mismatches as well as a combination of personal customer records and business customer records. It’s very challenging to get a single customer view.”

The lack of data and systems integration not only limits RM productivity. It can also undermine the quality of SME client relationships. Without a complete, coherent view of the client, RMs cannot properly address customer needs. Nor can they build long-term relationships with clients, provide additional support, or identify potential sources of new revenue.

Santander is increasing the support it provides its RMs by simplifying their workflows, improving data integration, automating routine tasks, and giving them better insights and tools to deepen client relationships. Training RMs to become specialists who can provide clients with detailed information about sustainability, investment opportunities, new markets and regulatory requirements is also a key focus, says Davies.

“The role of the RM is changing. They are becoming specialists who use real time information as well as AI to help clients and identify the next best action that they should take.”

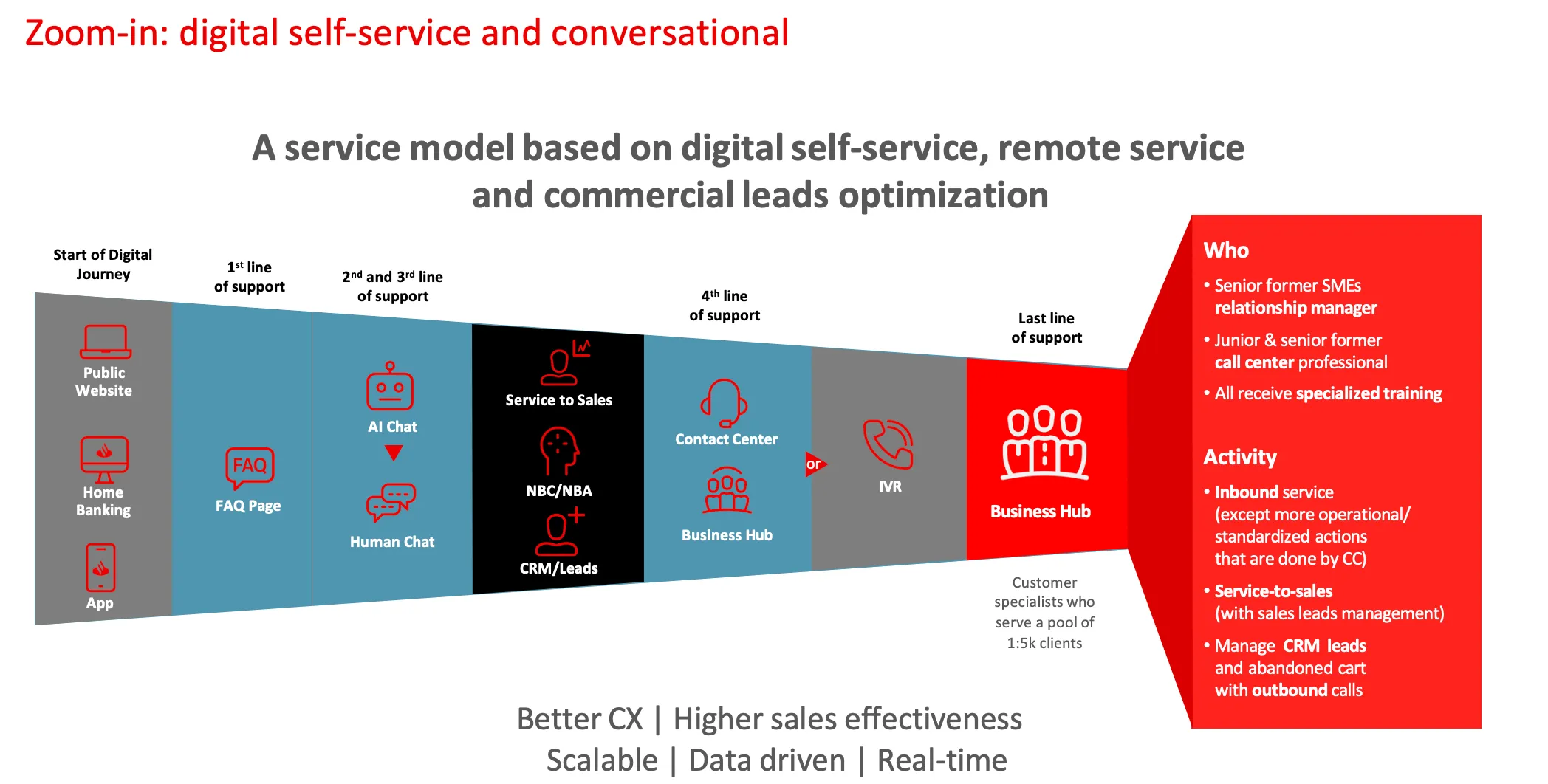

Santander is building an SME business model that combines digital channels and tools with the expertise and experience of specialized RMs. Its SME Go-To model stretches from digital onboarding through various levels of support that culminate in guidance and sales performed by RM specialists in a dedicated business hub (See illustration).

Source: Susan Davies, Head of Business Banking, Santander UK

Davies says Santander aims to get a detailed understanding of its SME clients through their engagement in multiple channels so that at key moments in their business, such as when they’re planning an acquisition or raising funding, the bank is close at hand.

“If you can put clients in touch with the right level of specialization at the right moment, then you can start to move through to a sale. The sale could be an assisted sale with an RM or a direct sale through a digital channel.”

Rakbank, which serves more than 92,000 SMEs in the UAE is also equipping its RMs to be strategic advisors.

“Our RMs are engaging with clients at a higher level than in the past. And we can see that our investment in our RMs is enabling us to earn more value from our customers,” says Rakbank’s Lalatendu Mohanty.

In the past five years Rakbank has transformed itself into a digital bank, automating processes such as client onboarding, credit reporting and lead generation, but has worked to retain its human engagement with clients.

“What distinguishes us is the use of technology with a human touch or to put it another way, human availability.”

Mohanty adds that Rakbank is using its digital platform to empower and incentivize its RMs to better respond to clients when they are most needed. Such requirements include dispute resolution as well as sales opportunities.

“There is no better form of engagement than an RM picking up the phone when a client calls or promptly responding to an email.”

Rakbank uses its digital platform to retain close ties with customers once they have been onboarded. “Cross-selling on the platform is very important to us because in a very competitive market it enables us to retain the customer and provide them with all they need.”

The bulk of the RMs’ sales leads are now generated by a digital platform using internal data and propensity models. The bank estimates that the introduction of digital technologies has doubled RM productivity in the past four years.

Mohanty says Rakbank is striving to further improve RM performance by relieving them of mundane tasks, such as assisting with onboarding, and equipping to engage more closely with clients.

Most of the banking executives polled by Qorus say their organizations are using data to support their RMs by giving them client insights through digital dashboards or CRM systems (See poll results). Some are using AI or predictive analytics to guide RMs.

CVA’s Lett says RM performance will improve significantly once banks have transformed their data infrastructure and integrated real-time internal and external data sources.

“The traditional reactive approach, which is where we are now, requires banks to mine internal data and then build campaigns based on that internal data. In the next best action approach, which is where I think we’re going, the whole process changes.”

Banks will be able to access a continuous feed of internal and external data, from their CRM systems and from third-party sources such as comparison sites. They will see in real time how clients are looking for solutions to their problems, says Lett. They could then feed that data into their analytics engines and alert their RMs about the next action they should take to address the client’s need.

By transforming their data infrastructure and integrating analytics and AI capabilities, banks will be able to significantly improve their engagement with SME clients. However, Lett cautions that banks must ensure their front-end systems, that support client engagement, address the requirements of their RMs.

“RMs need to believe that whatever changes are made add value for them. The use cases that really work are those that ruthlessly prioritize RMs.”

Banks at the forefront of SME banking will increase returns on their investments in digital technologies by overhauling their data infrastructure and integrating real-time data sources. They will also ensure their digital systems give RMs the insights, efficiency and freedom they need to build stronger client relationships and grow revenue.

SME Banking community

With Qorus memberships, you gain access to exclusive innovation best practices and tailored matchmaking opportunities with executives who share your challenges.