Big banks need to change tack on SMEs and deliver tailored solutions

Big banks must sharpen their SME strategies and strengthen client relationships or risk becoming lending utilities. Check out highlights form our recent SME Banking Community event.

Big banks must sharpen their SME strategies and strengthen client relationships or risk becoming lending utilities.

SMEs are a huge business opportunity for banks that are looking to expand their services and drive up revenues. They dominate most economies and are hungry for finance and business services. But banks’ traditional approaches to SMEs rarely meet the needs of most small businesses and frequently fail to provide sufficient profit margins for banks.

Banks eager to succeed in the SME business need to do more than roll out new digital offerings. They must develop fresh customer acquisition strategies that sharpen their client targeting, improve delivery models, and strengthen customer relationships. If they stick to their traditional approaches they risk losing their existing clients, missing cross-selling opportunities, and becoming just lending utilities. Fintech firms and digital platforms are already capturing a significant share of the SME banking business with flexible, on-demand services tailored to small businesses.

Incumbent high street banks in the UK, for example, have seen their share of SME lending fall from more than 80% to less than 40% in the past 10 years, says Conrad Ford, chief product and strategy officer at fast-rising fintech firm Allica Bank. Ford adds that medium-sized SMEs, what Allica Bank terms established SMEs, have been particularly hard for big banks to serve.

“They are too complex for a consumer banking operating model, but they're too low value for corporate banking.”

Ford was speaking at a Qorus online event that examined the go-to-market strategies that banks need to protect and grow their SME business. Other speakers included representatives from consulting firm McKinsey & Co and major multinational bank DBS.

Most of the bank executives who attended the online event acknowledge that their organizations are still trying to get to grips with the SME market. Only 14% of the executives polled by Qorus believe their banks have a clear and effective approach to serving SMEs. The majority, 59%, believe their banks are making progress but still need to improve, while 17% are figuring out their SME strategies and 10% recognize they need a new approach.

Representatives from McKinsey, Andras Havas and Alexander Verhagen, identified five go-to-market strategies that could help banks better serve SMEs.

- Analytics-enabled digital sales: Improving sales through increased traffic and customer journey optimization. A big central European bank, which is a client of McKinsey, pushed up the digital component of its SME sales by 29% in three months and increased the number of current accounts opened digitally by 122% in six months. It used a combination of traffic levers such as media campaigns, SEO, and email together with improvements in the analytics-guided conversion capabilities of the customer journey and additional marketing resources.

- Beyond banking one-stop shop: Building a digital ecosystem to cater for customer needs. Fintech firm Square in the US has built an ecosystem of a range of financial services that supports more than four million merchants that use its POS systems. It uses data from its POS systems to assess client loan applications and has granted loans totaling US$25 billion to 750,000 businesses in the past two years.

- Segment-specific propositions: Targeting SME sub-segments with tailored offerings. UK digital bank Revolut has expanded its foreign exchange services to provide business clients with a variety of seamless offerings that include multicurrency accounts, instant currency transfers and currency risk management tools and alerts.

- Third-party partnerships: Collaborating with third-party platforms and start-ups to unlock new or improved offerings. Santander in Spain has bought start-ups and secured ties with digital platform providers to build an ecosystem of services for SMEs. The ecosystem offers services such as payments, human resources, cash management, trade finance, and foreign exchange and also links SMEs to training and business coaching opportunities.

- Embedded finance: Integrating bank services into established SME platforms. ING in Germany has entered into a partnership with Amazon to use the technology company’s ecommerce platform to provide loans to SMEs. The bank uses merchant data provided by Amazon to assess the credit risk of loan applications

Bank executives at the online event have high hopes for embedded finance. As much as 40% of them pointed to embedded finance as the best go-to-market strategy to acquire and serve SMEs. It ranked ahead of analytics-enabled digital sales (27%), segment-specific propositions (20%), third-party partnerships (10%) and beyond banking one-stop-shop (3%).

However, McKinsey partner Alexander Verhagen warns that while embedded finance offers banks an opportunity to improve product distribution and increase sales it also carries a risk of disintermediation. In the Netherlands and UK, for example, where intermediaries already dominate SME lending, banks are at risk being replaced as credit providers, says Verhagen.

“Giving away the customer relationship to somebody else and acting as a utility just for your balance sheet is extremely dangerous for the banking industry.”

It’s important that banks protect and strengthen their customer relationships, says Verhagen. If banks allow themselves to become just providers of credit, they will be increasingly vulnerable to competitors, lose opportunities to deliver value-added services and be limited to performing utility services with low profit margins, he cautions.

Already, customer relationships with SMEs are becoming more fragile. Small businesses are far more likely to switch banks than in the past. Research by McKinsey in seven major economies last year found that 53% of SMEs already use more than one bank and 20% of SMEs are at risk of changing their main bank. Pricing changes are the most common cause of dissatisfaction.

Verhagen advises banks looking to embedded finance to grow their SME business to become ecosystem orchestrators and incorporate human touch points within their digital customer journey.

“Banks should have an active strategy to keep the strength and the intimacy of their customer relationships.”

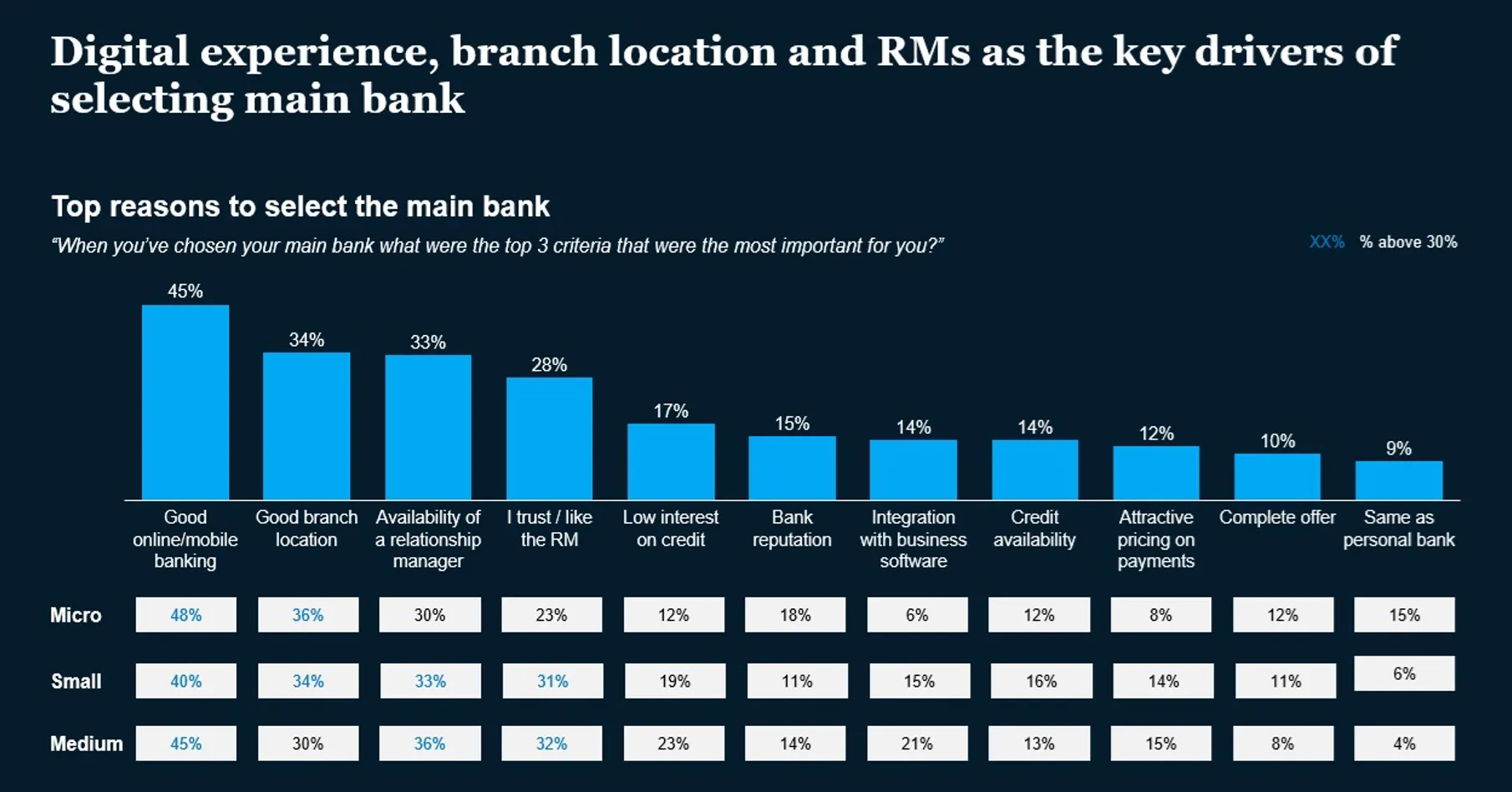

Relationship managers, who can support and advise small businesses, remain key to successful SME banking strategies. When choosing a bank, SMEs look for access to relationship managers, together with good online and mobile banking services and favorable branch locations, according to McKinsey.

Source: McKinsey & Company

Andras Havas, partner at McKinsey, advises banks to focus their strategies on the needs of SME customers instead of building their approaches around products.

“By understanding the needs of their customers, banks can lead with propositions that provide SMEs with solutions rather than just promote products.”

Holistic approaches to serving SMEs, which focus on propositions, are likely to include a combination of the five go-to-market strategies identified by McKinsey. Effective customer segmentation and data analysis, backed by artificial intelligence, are key features of such approaches.

Asian bank DBS is integrating a wide range of third-party data sources with automated segmentation processes to grow its extensive SME business. In India, for example, DBS is using a variety of public data sources and automation tools to generate sales leads and digitally onboard SME clients. It has also embedded credit offerings in industry-specific ecosystems that facilitate activities such as steel procurement and shipping logistics. Greater access to key customer data has enabled DBS to make faster, risk-adjusted lending at scale.

“Data is substituting collateral risk,” says Tapobrata Kumar, senior vice president and product head for SME lending at DBS India.

He adds that the combination of data resources and digital technologies is enabling DBS to reduce its operating costs while it increases the support it provides SMEs.

“It creates operating leverage. It allows the bank and its customers to operate at a lower cost.”

UK fintech Allica Bank has adopted a “high-tech, high-touch” approach that combines seamless digital banking with access to relationship managers for complex needs.

“We had to get into a position where customers would do their day-to-day banking digitally but could still talk to a relationship manager in the big moments that matter,” says Ford at Allica Bank.

The strategy is paying off. Allica Bank is one of the UK’s fastest growing companies. It became profitable in 2023, just three years after securing its banking license, and has already lent SMEs more than £3 billion and received deposits of £4 billion.

To succeed in the SME business, big banks, like their fintech competitors, need to develop go-to-market strategies that deliver solutions that meet the specific needs of small business clients. Extensive data resources and advanced digital technologies will likely be essential but deep customer relationships and human intervention will be the qualities that distinguish the winners from the laggards.

SME Banking community

With Qorus memberships, you gain access to exclusive innovation best practices and tailored matchmaking opportunities with executives who share your challenges.