Shift to services exposes banks to lurking risk of revenue leakage

The complex legacy systems that support many of the banks’ new fee-based services frequently leak revenue. It’s a risk that can erode margins, trigger compliance penalties, and damage customer trust.

The complex legacy systems that support many of the banks’ new fee-based services frequently leak revenue. It’s a risk that can erode margins, trigger compliance penalties, and damage customer trust.

The shift from selling interest-earning products to delivering fee-based services is helping banks protect margins, offset declining interest income, and tap new revenue streams. But it also introduces a hidden risk: revenue leakage.

The complex and fragmented systems that support the services provided by banks leak revenue. Missed charges, incorrect billing, and failed collections frequently go unnoticed and result in significant loss of revenue, says Siva Subramaniam, Senior Industry Principal at Infosys Finacle.

As banks respond to customer demand for more services, the systems and processes needed to support those offerings will become increasingly complex. And if banks continue to rely on legacy systems the likelihood and scale of revenue leakage will rise sharply.

Bank services that involve many third-party providers are especially complex and opaque. Matching fees with services in such environments is particularly difficult.

“Revenue leakage is a silent killer that eats away at a bank’s bottom line. And often new services-based business models, new approaches to monetization, amplify the effect of revenue leakage,” adds Paul Mullins, Banking Partner at consulting firm Finkr.

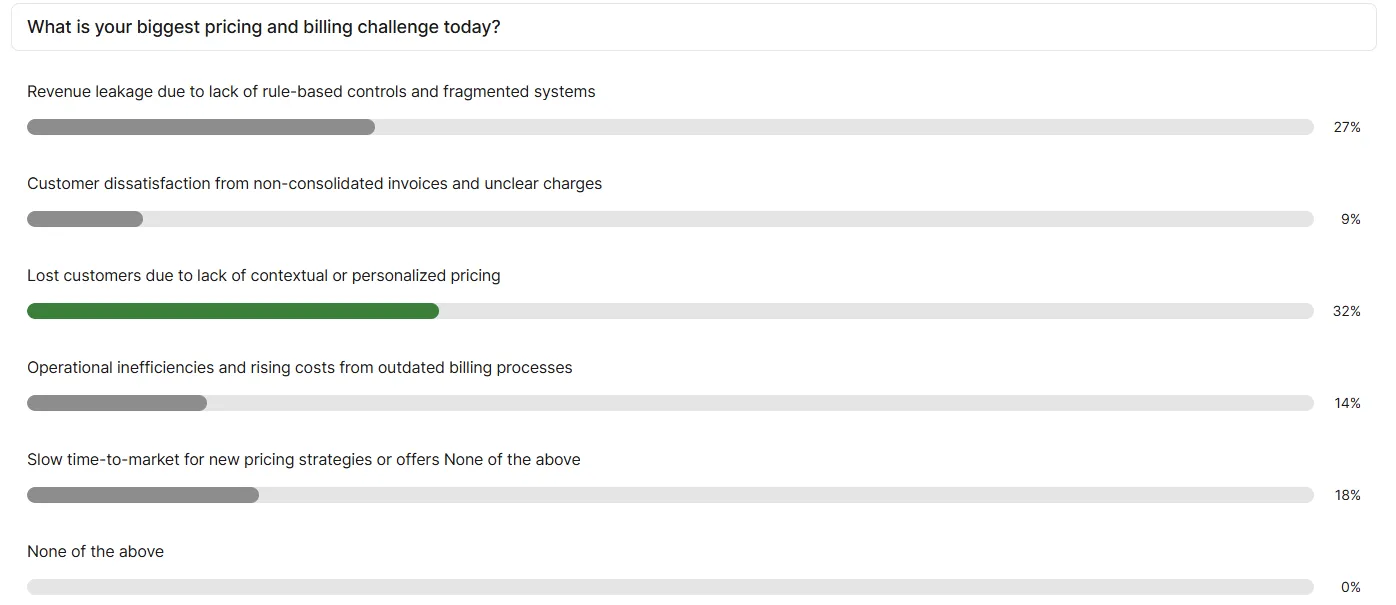

Subramaniam and Mullins discussed how banks can strengthen revenue management at an online event hosted by Qorus and Infosys Finacle. They also explored ways banks can improve their pricing and billing. Banking executives polled at the event rated revenue leakage as one of their top concerns (See poll results below). It ranked just below the fear of losing customers because their institutions couldn’t offer contextual or personalized pricing.

Pricing flexibility and revenue leakage are closely tied. Both require banks to manage their billing with precision.

Subramaniam points out that banks still running legacy technology systems, without rule-based controls, will struggle to get a full picture of the services their customers are using and the fees they should be charging for those offerings. And they are also unlikely to have an accurate account of the service revenue they collect.

“Most banks are not able to track their services revenue and get insight into what revenue they are losing.”

He adds that services offered free or as promotions often go untracked in revenue reporting systems. Such oversight causes banks to miss opportunities to monetize new offerings or recover associated costs.

Subramaniam points out that poor revenue management can further weaken a bank’s financial performance by damaging its relationships with clients. Incorrect and inflexible billing undermines trust, triggers customer churn, and blights business reputations.

Banks that do not have firm control of revenue management can also easily overcharge clients. Such errors not only aggravate customers but can also expose banks to regulatory penalties. In many countries, regulators view over-pricing as a serious compliance violation.

Subramaniam identifies three priorities for plugging revenue leakage:

1. Track customer commitments to ensure they align with the services that each client is accessing.

2. Monitor all services, including free or promotional offers, to prevent unmonetized delivery, identify new income sources and strengthen revenue assurance.

3. Analyze customer transaction data to discover revenue opportunities, refine pricing, and close potential revenue gaps.

To achieve this level of control and precision, banks need more than process improvements. They require advanced revenue management platforms built to handle the complexity of modern service-based banking. Such platforms provide features such as real-time assurance to confirm that all charges are accurately calculated, billed, and collected.

Unlike legacy systems, modern platforms help banks differentiate and respond faster to customer and market demands. They can develop new offerings that incorporate features such as flexible, personalized and contextual pricing as well as consolidated billing that combines multiple accounts.

Subramaniam says the technical foundation that supports modern revenue management should comprise five key components:

1. Open architecture: Seamless integration with multiple parties provides flexibility for further innovation.

2. Composable design: Microservices and modular libraries speed up product development and reduce time to market.

3. Real-time foundations: Event-driven and dynamic pricing and billing overcome the constraints and delays of legacy batch processing.

4. Multiple capabilities: Multi-Star functionality supports complex banking operations across currencies and time zones at scale.

5. Cloud native: Scalable cloud-based technology infrastructure handles high transaction volumes cost-effectively without heavy hardware investment.

The shift to a modern revenue management platform, which features the five components identified by Subramanian, requires much more than a technology upgrade. It calls for an extensive transformation that encompasses business processes and systems as well as technology.

Bank executives speaking at the event described how they are tackling this transformation. Platforms need to accommodate co-ownership so that accountability and alignment are shared across the bank, says Devrim Ziya Tavil, Head of Transformation at Turkish bank TEB. Representatives from business units, finance, legal, compliance, technology, and branches all share some responsibility for revenue management.

“Everybody today is responsible for revenue management in the bank. People have to all work together.”

Tavil adds that volatile inflation in Turkey, which recently passed an annual rate 80%, tests local banks’ agility when managing revenue.

“It's a very challenging environment for pricing and billing because the traditional strategies don't work. Every day things are changing. It’s very easy to lose the trust of your customers.”

By ensuring their revenue management business models are flexible, banks can quickly adjust to changes initiated by competitors or regulators, says Tavil. He adds that intelligence pricing methodologies and smart controls, supported by AI, enable banks to keep a tight rein on revenues.

Othman Tawfeqe, GM of Retail Banking at Kuwait International Bank, agrees.

“With advances in AI technology revenue leakage has become much easier to control. The big challenge in Kuwait, where 90% of people are willing to pay more for digital experiences, is to find new revenue streams and then to develop the right products and pricing methodologies.”

Tawfeqe adds that new banking products in Kuwait must comply with both regulatory and religious requirements. Local banks need to structure their products so they can generate revenue by meeting customer needs while also ensuring they comply with external constraints.

Modernizing revenue management is about more than just plugging leaks. It requires banks to overcome a structural threat to their profitability, compliance, and customer relations. Institutions that transform their revenue management with modern technology platforms and strong business disciplines will be well placed to thrive in a banking market increasingly geared to the provision of services. Those that are slow to shift and remain locked in legacy systems risk slipping behind bolder competitors.

Watch the replay

Digital Reinvention community

With Qorus memberships, you gain access to exclusive innovation best practices and tailored matchmaking opportunities with executives who share your challenges.