Big revenue opportunities for banks willing to help SMEs go green

Supporting SMEs on their journey to sustainability offers banks the chance to grow revenues while advancing their own sustainability and bolstering the reputation of their brands.

Supporting SMEs on their journey to sustainability offers banks the chance to grow revenues while advancing their own sustainability and bolstering the reputation of their brands.

Banks are playing a leading role in the global transition to a sustainable economy by working with their corporate clients to help them curb their carbon emissions. But finance providers often overlook SMEs when promoting sustainability despite the huge contribution small businesses make to economies across the world.

However, farsighted banks can generate significant revenue by marketing “green” products and services that help small businesses become more sustainable. And, by supporting SMEs on their journeys to sustainability, they can further advance their own sustainability and strengthen the reputation of their brands.

“SMEs perform a crucial role in the global economy. Enabling them to adopt green banking solutions will not only help them reduce their environmental footprint, it will also enhance their competitiveness,” says Adlen Bouchenafa, Partner and Director of Sustainability at TNP Consultants. Benefits to SMEs that go green include access to attractive finance, lower energy costs, exposure to new markets and support from influential business partners.

Bouchenafa was speaking at an online event hosted by the Qorus SME Banking Community. The event examined how banks can promote sustainability among a diverse range of SMEs. Speaking alongside Bouchenafa were representatives from two European banks that are already backing SMEs on their sustainability journeys, Swedbank and Raiffeisen Bank International.

“Sustainability is an integral part of Swedbank’s strategic direction. It’s very much in our interest to help SMEs in their sustainability transition. And the financial opportunities are fantastic,” says Tomas Zimmermann, senior advisor for group sustainability, at Sweden’s Swedbank.

“There are lots of opportunities to design new sustainable finance products,” agrees Katharina Neugebauer, Senior Sustainable Finance Advisor, at Raiffeisen Bank International. She points out that sustainable banking offerings for SMEs can stretch well beyond simple green loans and incentives.

“We are offering leasing and finance products for electric mobility, photovoltaic installations and property refurbishing, for example, that we combine with public subsidies.”

Neugebauer adds that SMEs across all business sectors are potential partners for banks looking to provide sustainability. But approaches to providing assistance will differ.

“Sectors such as real estate, where you have access to EPC (Energy Performance Certificate) data, are easier to support than some others. But agriculture, for instance, where it might be challenging to access data, offers huge potential. It’s important not to neglect SME customers in industries that still have a lot of work to do to transition. Helping those companies is one of our big challenges.”

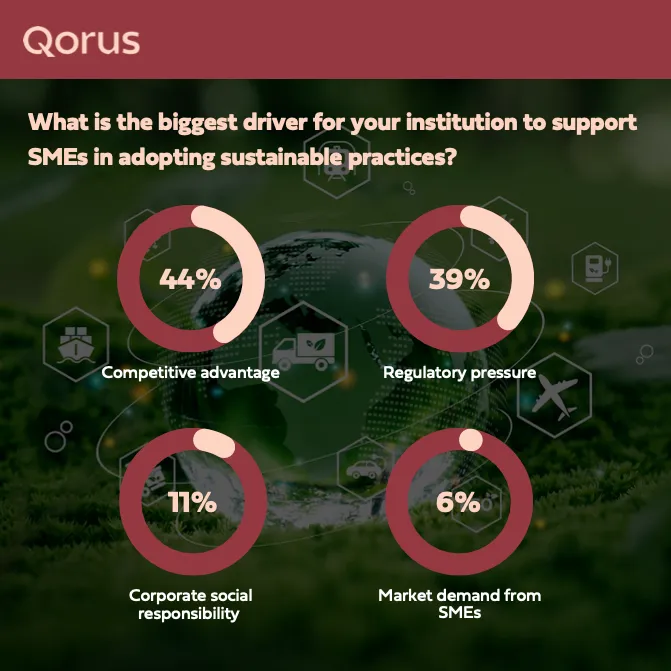

Many of the bank executives who attended the online event share the speakers’ optimism. Around 44% of those polled at the event believe competitive advantage is the main incentive for banks to help SMEs become more sustainable. Competitive advantage is deemed more important than regulatory pressure (39%), corporate social responsibility (11%) and market demand from SMEs (6%).

Integrated green banking solutions

TNP’s Bouchenafa says banks looking to help SMEs improve their sustainability should tailor their financial products to meet the specific needs of small businesses and deliver them as part of integrated solutions. Such combined offerings might comprise green loans, participation in carbon credit schemes, or access to green bonds, says Bouchenafa.

“Banks can also offer a platform of services that could help SMEs accelerate their sustainability transformations.”

Education and training, risk management services, ESG tracking and reporting, support in accessing green subsidies, and introductions to potential sustainability partners are just some of the services SMEs need to become more sustainable.

Raiffeisen Bank International has developed several innovative sustainability solutions for SMEs. They include a short-term sustainable deposit facility and ESG-linked factoring that gives small businesses quick access to funds for ESG-compliant transactions.

“To support our SME customers in their ESG reporting we are collaborating with OeKB bank in Austria. Together we have developed an ESG reporting hub that enables companies to manage and share their ESG data,” says Neugebauer.

Raiffeisen Bank International promotes sustainability awareness among SMEs by running workshops, webinars, training programs and incentive schemes. It recently launched a carbon-footprint tracking facility on its digital channels that enables SMEs to measure their impact on the environment.

Neugebauer estimates that about half of the bank’s SME clients have responded to the organization’s promptings and started working to improve their sustainability.

Swedbank is advancing its commitment to sustainability by building an ecosystem through which customers can connect with a wide range of solution providers, advisory agencies and peer-to-peer initiatives. It has also launched an SME platform that offers small businesses tailored sustainability offerings that include financial products, advisory services, technical support and a variety of incentives.

“In excess of 80% of our credit exposure is related to properties. So, accelerating the transition in properties is where we can make the biggest difference. Scale is our superpower,” says Zimmermann.

Swedbank serves more than seven million retail customers and around 550,000 business clients. Close to 20% of its lending and advances is directed to SMEs. Zimmermann points out that many SMEs are being encouraged to improve their sustainability by bigger businesses in their value chain that need to meet green targets.

Challenges to providing SMEs sustainability support

All the key speakers at the event acknowledge that banks face challenges in their efforts to help SMEs become more sustainable. They include:

- High cost of sustainable technologies and green solutions that make them unaffordable to SMEs.

- Lack of awareness of among small businesses of resources, subsidies and incentives available to help them become more sustainable.

- Complex ESG reporting requirements that SMEs often view as burdensome.

- Absence of sustainability data for SMEs that makes incentivizing, monitoring and rewarding green transitions difficult. Unlike their corporate counterparts, SMEs are not required by regulators to report their progress in curbing carbon emissions.

Key components to SME green banking strategies

To successfully guide SMEs towards sustainability, banks should adopt multifaceted strategies that improve the accessibility and inclusivity of green banking solutions, says TNP’s Bouchenafa. Such strategies could include:

- Tailored green financial products that are affordable and incentivize SMEs to adopt sustainability practices.

- Education and awareness initiatives, comprising workshops, webinars and support material, that inform SMEs about sustainability and green incentives.

- Easy-to-use application processes that employ digital technologies to reduce administrative processes and quicken turnaround times.

- Government partnerships that enable banks to provide SMEs with sustainability solutions that include access to subsidies and incentives.

- Risk mitigation initiatives such as the provision of guarantees, subsidies, and insurance that reduce the financial exposure of SMEs that adopt green practices.

- Green partnerships and networks that link SMEs with other small businesses seeking to improve their sustainability and also connect them to start-ups, service providers and consultants.

- Credit-scoring systems that reward SMEs that adopt sustainable practices by providing them with favorable financing.

- Centralized digital platforms that offer SMEs easy-to-use tools for carbon tracking and ESG reporting.

- Advisory services that guide SMEs on how to integrate sustainable practices into their businesses and also help them identify market opportunities.

Banks looking to start supporting SMEs on their sustainability journeys should begin by conducting an internal inventory of their product portfolios. Many of their current offerings might support sustainability initiatives.

“We conduct inventories where we discover financial assets that we can classify as green. These assets are sometimes overlooked because customers haven’t been asking for them. But we can use them to help SMEs,” says Swedbank’s Zimmermann.

Bouchenafa at TNP urges banks to focus on enhancing inclusivity and ensuring that SMEs, regardless of their demographic composition or geographical location, have access to green banking products.

“SMEs are a very important part of the global economy and they need support on their journey to sustainability.”

Helping SMEs in their transition to sustainability is a big opportunity for banks to drive revenue growth, strengthen client relationships and support the shift to a greener global economy. By developing tailored solutions, simplifying access to green resources, and building collaborative partnerships, banks can become key partners in the sustainable transformation of small businesses.

SME Banking community

With Qorus memberships, you gain access to exclusive innovation best practices and tailored matchmaking opportunities with executives who share your challenges.