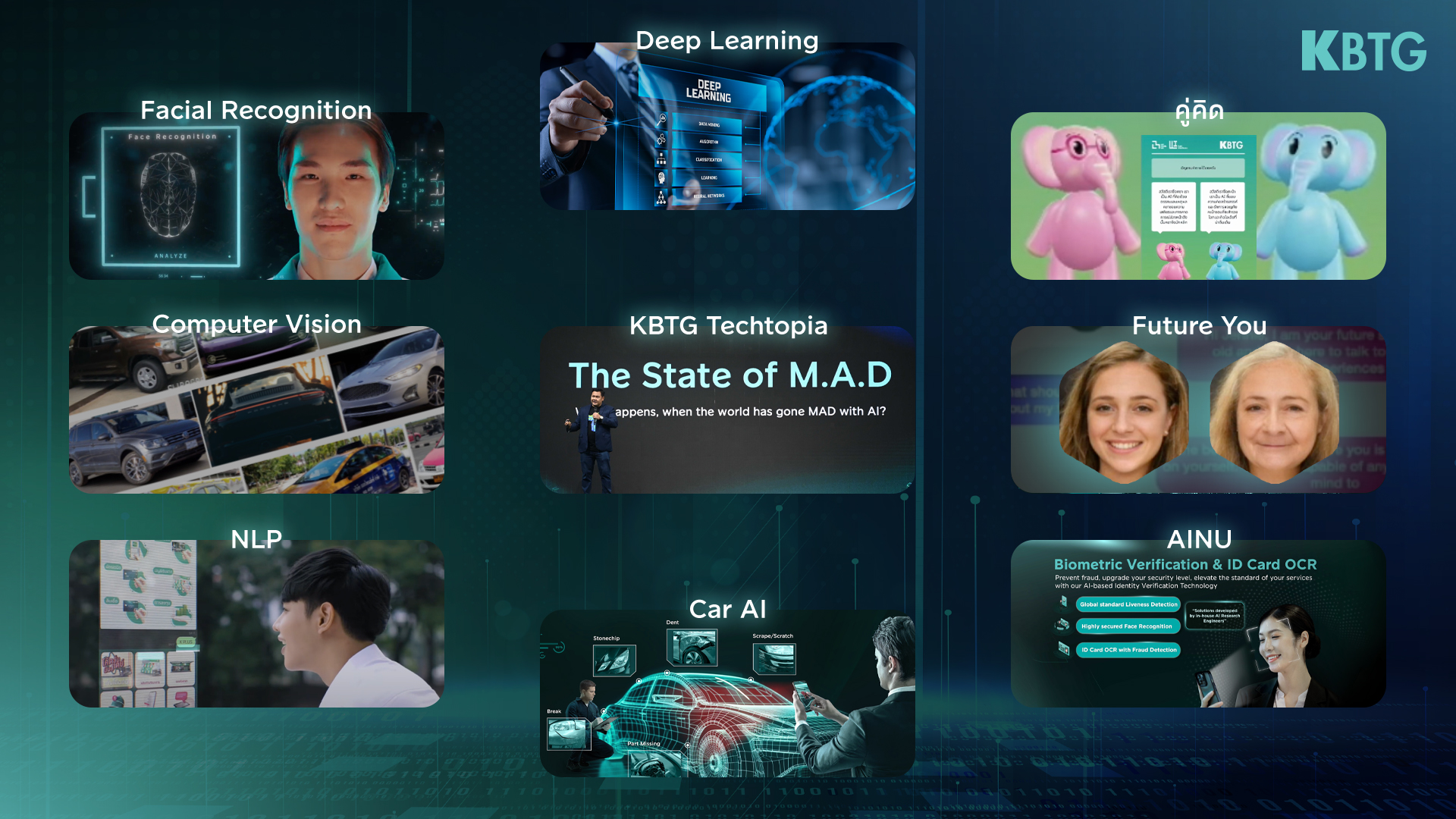

KASIKORN Business-Technology Group (KBTG) is undergoing a transformative shift from an "AI-First" to a "Human-First" organization, focusing on Machine Learning, AI, and Data (M.A.D.). KBTG Labs, their innovative research arm, has introduced groundbreaking technologies like AINU for identity verification and Car AI for insurance.

Breaking boundaries: New ways of working in financial institutions

In 2024, KBTG aims to apply its research for tangible benefits to the broader community. Mr. Ruangroj Poonpol, Group Chairman of KBTG, highlights the dual emphasis on research and real-world applications, ensuring that advanced technology serves a "Human-First" purpose.

KBTG Labs, with one of Thailand's largest AI research teams, adheres to global standards in M.A.D. research. Collaborating with MIT Media Lab, they explore futuristic projects like "Future You" and "Kookid," showcasing KBTG's commitment to pushing technological boundaries.

The integration of M.A.D. technologies into KBank's products and services, such as marketing intelligence and fraud detection, has proven immensely valuable, exceeding 500 million Baht. KBTG prioritizes operational efficiency with tools like Copilot and fosters knowledge sharing through the M.A.D. Guild.

Success stories extend to commercialization, with products like AINU and Car AI earning accolades, including the Asian Technology Excellence Award. KBTG actively supports the AI community through initiatives like the M.A.D. Bootcamp program and KBTG Techtopia.

Looking ahead, KBTG is set to transition from "AI-First" to "Human-First" in 2024. The launch of the KXVC fund, a 3.5 billion Baht initiative targeting AI, Web3, and Deep Tech, reflects KBTG's commitment to global collaborations and introducing new AI technologies to Thailand.

In conclusion, KBTG's relentless pursuit of excellence in M.A.D. solidifies its leadership in technology, emphasizing the practical application of Deep Tech research for societal and national benefit.