Innovation in insurance was historically indulged in the periphery of the business, under-funded and watched with expectations of incremental rather than transformative change in business operations or performance.

This has changed. We now hear insurers frame innovation as increasingly strategic, purposeful and critical to their success.

The evidence is all around us. Consider the many innovations in product development and distribution, including embedded insurance, usage- and behaviorbased models and the convergence of insurance, health and wellness. The proliferation of insurtechs has been one of the most notable new features of the industry in the last decade. Additionally, in 2020, AM Best began to include innovation criteria in its ratings.

The Qorus Innovation in Insurance Awards launched in 2016 with 225 submissions. It has since grown as a global industry recognition program and has, to date, evaluated nearly 3,000 submissions from carriers and insurtechs alike. Each year, we examine and analyze the evolution of innovation in insurance. In this report, we explore our latest insights and identify key enablers of value generation that point the way forward.

Through this research we uncovered

• Where innovation is focused

Insurance organizations are focusing innovation efforts on product development.

• The payback of innovation

Most innovation initiatives are meeting or exceeding insurers’ expectations in delivering both financial and non-financial returns.

• Challenges confronting innovators

Innovators—particularly in large organizations—face persistent and significant challenges, especially as they accelerate their efforts, including an increasingly complex regulatory landscape and a resistant company culture.

The demand for better products, improved efficiency and greater personalization will only intensify. To be competitive in this industry, innovation will be increasingly critical. It’s time to master the art and science of innovation in insurance.

What is driving innovation in insurance?

Incumbent insurers are under immense pressure to improve their operating model, offerings, and experiences and financial performance.

These aren’t new challenges, but they are greatly intensified by emerging technologies that are helping established competitors accelerate both the speed and scale of transformation efforts and removing barriers to entry for newer competitors.

As a result, innovation—once comfortably a fringe activity in this field—is rapidly becoming critical to their success.

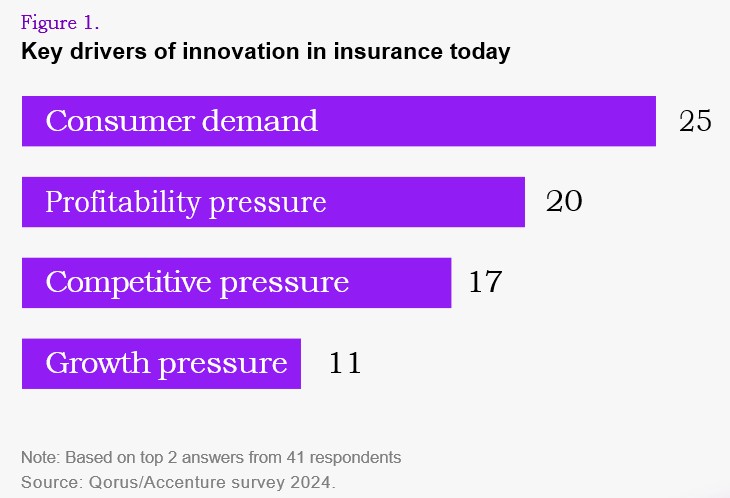

Our survey of 41 of the most prolific participants in the Qorus Innovation in Insurance Awards attests that familiar forces that have long shaped the industry are now driving efforts to increase innovation.

Insurer perspective

"Insurance is a risk business, but we need to think about the risk of not doing things, the cost of inaction. This requires a change of mindset culture.” Dr. Christian Roland, Chief Strategy and Digital Officer, AIA Thailand.

Where is innovation focused?

In recent years, the focus of insurance innovation has shifted to products.

In 2019, innovations in Product Development made up 18% of all program launches submitted as entries to the Qorus Innovation in Insurance Awards.

This tripled to 57% in 2023, which far exceeded Marketing & Distribution programs at 15% of all submissions and Claims Management programs at 13%.

While most carriers have had the capital to fund innovation, high interest rates and continuing inflation may discourage investment. Multiple insurers noted the conflict between reflexive cut-backs and the desire to capture the cost and variable-pricing benefits of innovations in automation and the cloud.

Insurer Perspective

“I would say that the predominant driver in the market right now is cost- cutting. There is a pressing need for insurers to contain costs, also through the use of AI, as much as possible to avoid being overwhelmed by inflation.” Insurance Executive requested anonymity

Is innovation paying back?

Insurance innovators are outperforming their competitors. Between 2017 and 2023, 72% of P&C carriers that entered the Qorus Innovation in Insurance Awards achieved a combined ratio equal to or above their country’s average (2019 to 2022). In emerging markets, where the focus is on top-line growth, 80% of innovators achieved premium growth on a par with or above their country’s average over five years.

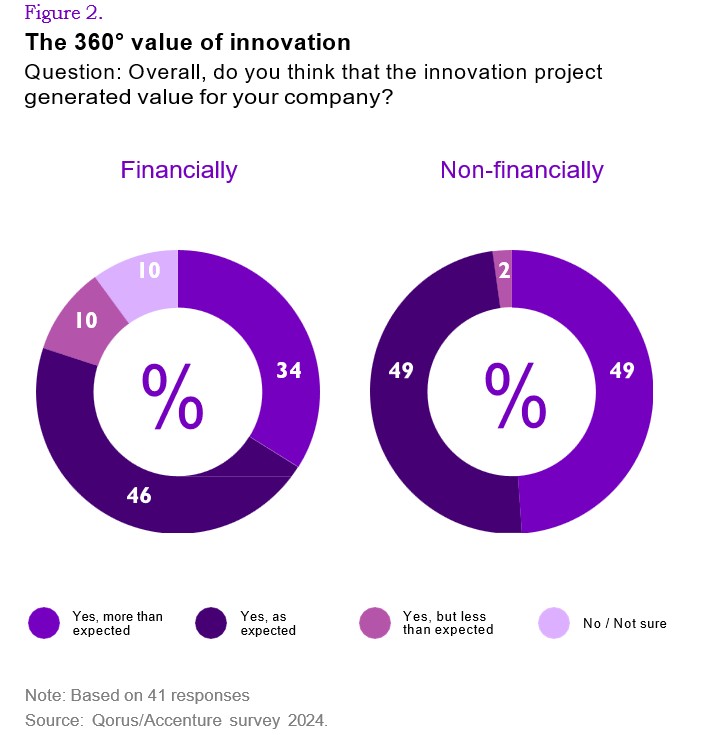

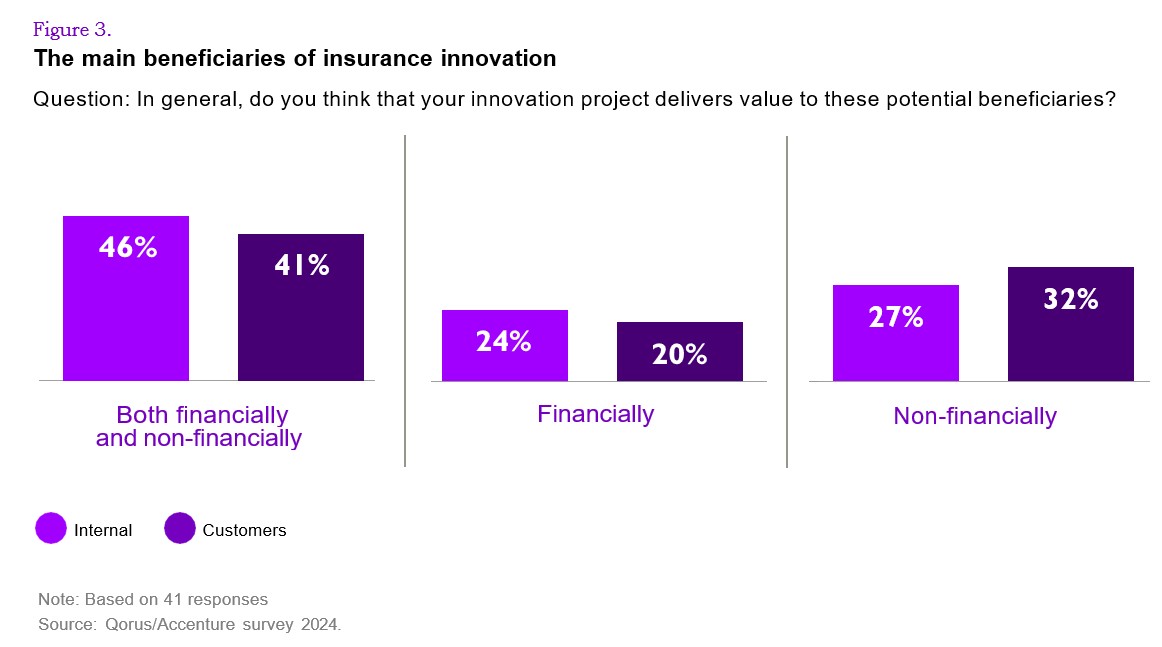

Moreover, a large majority (80%) of our research respondents say their innovations either met or surpassed the financial outcomes they expected.

When it comes to their non-financial goals, such as customer engagement and satisfaction, brand strength and employee loyalty, the figure rises to 98%.

And most innovations are being brought to scale. Of the projects submitted to the Qorus Innovation in Insurance Awards, 73% have progressed to the scale-up stage. Insurance innovators say the biggest beneficiaries of these initiatives are their internal stakeholders and their customers.

What are the challenges confronting innovators?

Insurance innovators say they face significant challenges, particularly as they try to accelerate:

1 - Lack of innovation culture

The first innovation hurdle is an organizational culture that is resistant to change. People are often incentivized to master rather than question and improve the status quo.

“We need to change the mid-management mentality…managerial courage and vision are what’s required.” Jean-Marc Pailhol, Chief Global Strategic Partnerships Officer, Allianz SE

2 - Rare combination of necessary skills

It is difficult to find people with both a clear vision of how an insurance process or product could be transformed and an understanding of how one or more new technologies could be harnessed to achieve this.

"Innovation is not a part-time job. If you're relying on people to do their day jobs and innovate at the same time, you’re setting yourself up for failure." Deon Kotze, Chief Commercial Officer, Discovery Health

3 - Regulation as both enabler and impediment

Insurers looking to disrupt their markets must navigate a complex web of local and international rules and laws. Some of these may support innovation, while others restrict and delay it.

"At Zurich, we recognize the transformative potential of AI in the insurance value chain, making processes simpler, faster, and more valuable for our customers. Since our business is all about trust, we always prioritize effective control and governance mechanisms to ensure the safe, robust, and responsible use of AI. Our AI framework, introduced in 2022, equips our global workforce with robust processes and tools to ensure transparency, fairness, and accountability. This is not something we want to gamble with, as there's a lot at stake, including customer data and customer experience." Joel Agard, Head of Group Innovation, Zurich Insurance Group

4 - Clamor for payback in a volatile economy

Economic volatility may both impede and spur innovation, but in most instances, it reduces firms’ tolerance of long ROI lead times.

“As investors, we prioritize understanding ROI within the next 18 months. If returns extend beyond this period, the investment thesis is a lot more challenging. This is because insurance companies are primarily motivated by immediate bottom line improvements, leaving little incentive for long-term innovation.” David Castellani, Operating Partner, Brewer Lane Ventures, and Accenture Insurance Luminary

Seven enablers of value generation

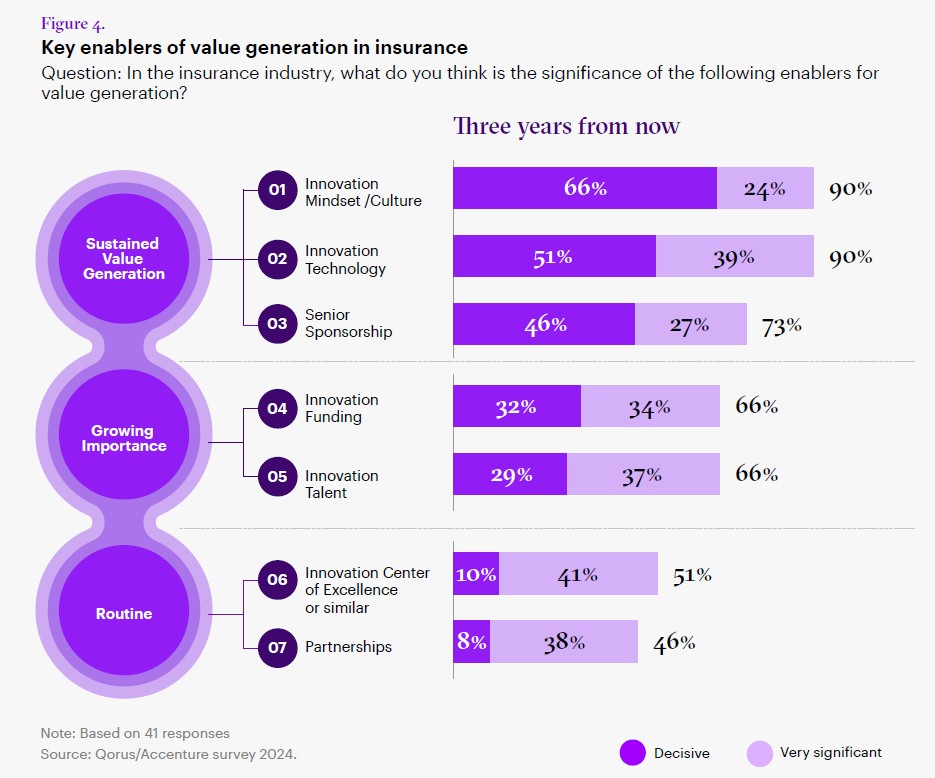

How is it that some companies are able to produce a steady stream of innovation while for others the well remains dry? The successful companies understand that it takes a deliberate and sustained strategy and an environment in which disruptions are encouraged, innovators are rewarded and the necessary enablers are in place. Two key enablers stand out for their sustained value generation—an Innovation Mindset/Culture and Innovation Technology.

An innovation mindset and culture

Insurance innovators say the most critical enabler of innovation in the near future will be an organizational culture that encourages change. In these organizations, leaders initiate and support change programs even when the potential cost of a disappointing outcome exceeds the potential reward of success. They work to eliminate institutional barriers, replacing them with incentives and an enabling operational framework. They establish and give overt support to dedicated innovation teams and ensure that all innovation is tightly aligned with the business strategy. They further see that expected financial and non-financial outcomes are quantitatively defined and rigorously measured.

Innovation technology

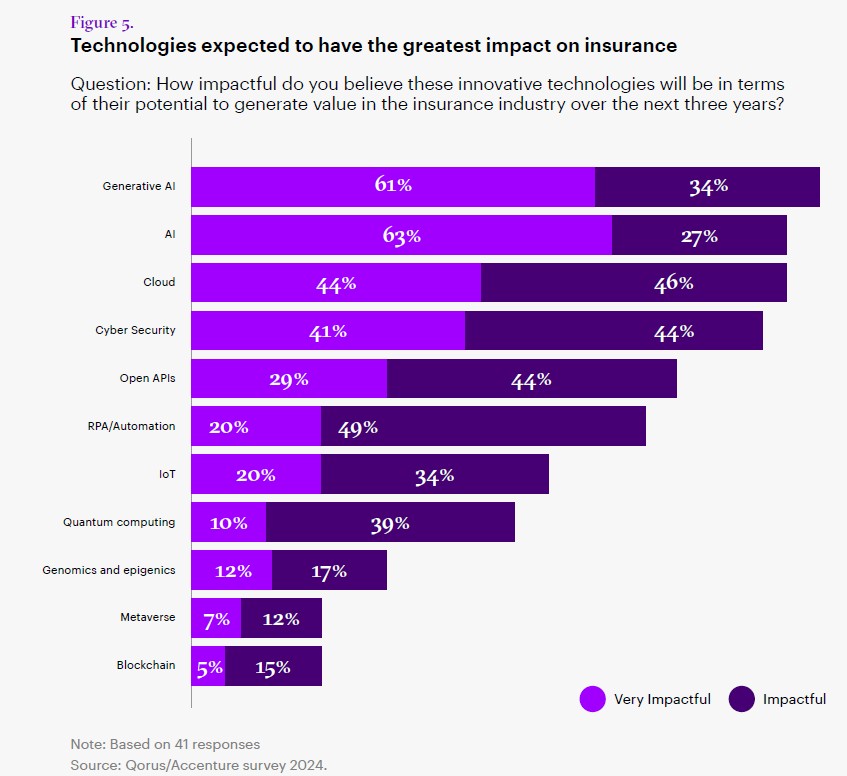

The rapid emergence of modern technologies is another key enabler. Gen AI is the most recent and clearest example.

With its wide array of applications, gen AI has massive potential to materially improve process efficiency and decision effectiveness.

Classical AI and Cloud are also recognized for their impact. AI is the transformative technology in insurance and a critical differentiator for insurers, while Cloud is the enabler that makes innovation at scale possible.

Both are essential as insurers continue to innovate in their products and get closer to customers through ongoing risk mitigation and management.

Conclusion

Innovation initiatives may be difficult to justify, especially during times of intense cost pressure. And taken individually, such initiatives may not result immediately in lower costs or higher revenues. However, by cultivating a favorable culture and developing capabilities that support innovation, insurers can overcome the challenges and enable continuous reinvention across the enterprise.

“I really think that innovation in insurance is currently a no-brainer; it’s a question of life or death. If you don’t lead the transformation, you are killed by the transformation.” Jean-Marc Pailhol, Chief Global Strategic Partnerships Officer, Allianz SE

Read the full document now

Get ahead with Qorus’ proprietary insights into key industry shifts.