A series of developments this month highlighted the ongoing challenges and shifts within the AutoMobility ecosystem. In a disruptive initiative to get closer to the mobility end-game, VW Financial Services is launching a new mobility platform in 2025, ensuring an optimal use of vehicles, not only for the customer, but also in terms of asset value for the OEM. Focused on Electric Vehicles, BYD and Uber announced a strategic partnership to introduce 100,000 new EVs onto Uber’s platform, where it seems a smart move to push EVs where they make most sense. And indeed, Tesla's new production and delivery numbers show that any help in propping up EV Producer profitability is welcome, as its margins continue to erode due to aggressive pricing and production challenges. These challenges of the auto sector are most pronounced in the Chinese market, which has started the EV Transition much earlier than Europe, and where OEMs are forced to eat into the "EV Mass Market" to build volumes, under higher pressure on price and product adaptation. Here, traditional OEMs are grappling, as local brands like BYD and Geely dominate, showcasing the risks for incumbent OEMs if they fail to accelerate their EV & SDV development (not only in China, but also in Europe and the US).

VWFS launches new mobility platform

Volkswagen Financial Services (VWFS) is set to launch a new mobility platform in early 2025, marking a significant shift in the company's business model from car ownership to vehicle usage. Initially rolled out as the new Europcar app, the platform will expand across all relevant markets, allowing customers to lease, rent, subscribe to, or share vehicles instead of purchasing them. This shift aligns with VW’s broader strategy to retain ownership of its vehicles throughout their lifecycle, particularly focusing on electric vehicles (EVs). By 2025, VWFS aims to keep 80% of EVs and 50% of combustion vehicles within its portfolio. This approach allows VW to control vehicle resale cycles and maximize revenue through multiple leasing or rental agreements, while also keeping maintenance within the VW network, thus fostering brand loyalty. Key features of the new platform include integrated AI for pricing and residual value management across all VW brands, enhancing efficiency and profitability. With this platform, VWFS is poised to become a leading player in the global used car market, targeting sales of up to one million vehicles annually by leveraging AI-driven insights and strategic market placements.

CVA perspective:

Volkswagen Financial Services’ new mobility platform is a disruptive move towards a usage-based model that could become "the new standard" in the automotive industry. Its ambition to manage the asset life-cycle clearly goes beyond that of mobility apps of "pure mobility players" like RACs and ridehailers, more focused on customer and fleet management. By retaining ownership of vehicles throughout their life-cycle, VWFS can generate multiple revenue streams from a single asset while maintaining control over vehicle maintenance, resale, and customer data. This approach not only secures ongoing revenue but also strengthens brand loyalty by keeping customers within the VWAG ecosystem for longer periods. Especially for EVs, with a longer life-time expectancy than ICEVs, a higher risk involved in their RV development as well as higher average new car prices (for the time being), the multi-cycle business model is a unique enabling factor. Data driven RV management is an interesting component, as it allows the assessment and forecast of a battery's State-of-Health (SoH) that strongly determines a vehicle's residual value curve. However, VWFS' strategy to keep vehicles within its network poses challenges in terms of logistics, repair, refurbishing, demand-supply management... as well as a huge balance sheet. Not to talk about the impairment risks due to EV RV fluctuations. If VWFS manages to navigate these complexities and risks, it could give a significant boost to consumers' shift towards usership, while fully capturing vehicles' life-time value, in a disruptive break with the traditional OEM "wholesale" model.

BYD and Uber enter a strategic partnership

BYD and Uber have announced a multi-year strategic partnership to introduce 100,000 BYD electric vehicles onto the Uber platform across key global markets. Starting in Europe and Latin America, the partnership will expand to regions including the Middle East, Canada, Australia, and New Zealand. This collaboration aims to offer drivers "best-in-class" pricing and financing, lowering the total cost of EV ownership and accelerating the adoption of EVs globally on the Uber platform. Together, the companies aim to overcome barriers to EV adoption, such as pricing and financing challenges. While Uber drivers are switching to electric vehicles five times faster than private car owners, driver surveys show that the price of EVs and their availability of financing remain the key barriers. Through the partnership with BYD, Uber drivers should get preferred access to affordable EVs - the partnership also includes potential discounts on charging, maintenance, and insurance, tailored to drivers' needs in different markets. Furthermore, BYD and Uber will collaborate on deploying autonomous-capable vehicles on the Uber platform, leveraging Uber’s global reach to bring this technology to scale.

CVA perspective:

The BYD - Uber partnership definitely makes sense for both parties. BYD manages to place EVs with those customer who can put them to best use (high mileage, urban areas / LEZ, charge point density...) and Uber drivers finally have chances of getting the complete mobility value proposition that they require. History is littered with providers using ill-adapted 48-month leasing contracts and not-so-fit insurance products to serve this very specific customer segment. Let's not forget that Uber is said to have lost around USD 9,000 per car in its US leasing program in 2017, which shows that vehicle supply is a tricky affair. Offering competitive pricing and adapted essential services could lower barriers for Uber drivers to switch to EVs and to adapt to new EV brands (like BYD), while at the same time new customers can be attracted as Uber users will get in touch with BYD vehicles. The success of the partnership will be determined by how driver offers are set up (duration, flexibility, price level, claims policy...) and by external factors like the (fast) charging infrastructure availability, which is key for Uber drivers to ensure uptime. Also, extending the deal to Used Cars would make even more sense in terms of affordable mobility, but this would require a more complex set-up for financing / renting / refurbishing / storing... the asset, and may not meet BYD's objective of selling new vehicles. The inclusion and long-term goal to push autonomous-capable vehicles adds potential, but also complexity. Key will be how local regulations develop in terms of self-driving vehicles and how BYD and Uber manage to address "easier" use cases, which do not require universal autonomy which is still very far away.

Tesla illustrating pressure on BEV prices and demand

Tesla is facing significant challenges in 2024 as the gap between production and deliveries has widened at the beginning of the year, leading to a substantial buildup of vehicles in stock. In Q2 2024, Tesla managed to slightly reduce its pre-produced vehicle stock by lowering production and further slashing prices. However, these measures have led to further erosion of Tesla's margins, with the gross margin per vehicle decreasing by over 60% since the beginning of 2022. Tesla's aggressive pricing strategy has sparked a price war, impacting the entire automotive industry. The company's gross margin has dropped from around $15k per vehicle in 2021 to just $6k in Q2 2024. Despite these challenges, Tesla has managed to sustain some profitability through the sale of CO2 emission certificates and its Energy & Storage and Charging services. These areas have become crucial in stabilizing Tesla's overall financial performance as margins from vehicle sales alone have more than halved since 2021. The competitive landscape is tightening, with new vehicle models entering the market, increased restrictions, and CO2 fleet emission targets in Europe. Despite newly introduced import tariffs on Chinese BEVs to Europe, there are no signs of an imminent easing in the current pricing situation.

CVA perspective:

We’re not focusing on Tesla because they are performing poorly — in fact, they compare rather favorably to other EV manufacturers. What makes Tesla particularly interesting is their transparency in pricing and costs, allowing us to clearly see the link between actions and outcomes. The key takeaway from Tesla’s experience is that the EV industry is in a challenging spot. High new car prices, where Tesla has taken an aggressive stance, combined with very low used car prices, are making an EV's the total cost of ownership (TCO) unattractive for many and heightening the risks associated with EV ownership. With the initial EV excitement now subdued, the question becomes: what’s the path forward?

• The partial retreat to ICE vehicles, which was a strategy in 2023/24, will become increasingly untenable. OEMs are forced to push EV sales — because it’s their only product (as with Tesla) or to obtain the CO2 credits needed to sell ICE vehicles without incurring hefty penalties.

• Raising prices to transfer the burden to customers isn’t a viable solution either, as Tesla’s pricing and sales volume trends show that consumers have low tolerance for high prices.

Thus, the only sustainable path is to increase the appeal / value generation and reduce the cost of EVs. OEMs must cut costs in R&D, production, and sales, leverage the distinct advantages of EV assets through multicycle strategies, and maximize vehicle value capture throughout the entire lifecycle.

China showing the "EV physics" of tomorrow

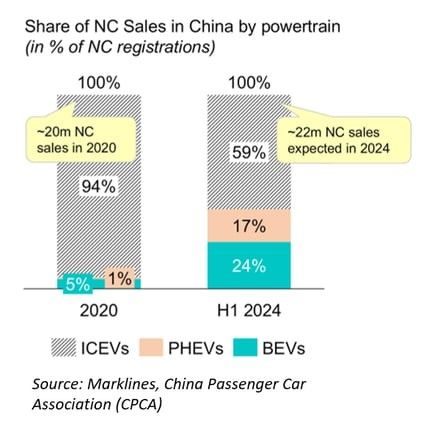

Traditional OEMs, including VWAG, Mercedes-Benz, and BMW, are grappling with significant challenges in China as the world’s largest automotive market rapidly shifts towards electric vehicles (EVs). The market share for ICE vehicles has plummeted from 94% in 2020 to just 59% in the first half of 2024, while EV and PHEV sales have increased by 35pp. Chinese manufacturers like BYD, Geely, and Li Auto are now dominating the market, with their collective share rising from 33% to 52% since 2020. Established brands, particularly German and Japanese OMEs, have seen their market presence erode significantly. Split by powertrain, it becomes visible that the strong dominance of local Chinese brands is within the growing EV market, while traditional OEMs are still dominating in the declining ICE segment, leading to a shrinking overall market share for them. In the EV market only one foreign player, Tesla, has managed to take a strong position, but is increasingly challenged by the offer of Chinese brands. On the other side, the leading player in the ICE segment, VW, has lost over 430,000 units in sales since 2020 and now faces a potential €3 billion revenue shortfall in 2024 compared to 2018. Chinese consumers increasingly demand advanced technology in their vehicles, such as smart cockpits and extensive driver-assistance systems, areas where Chinese brands excel. In contrast, Western automakers struggle to match these technological advancements, and even premium brands like Mercedes-Benz and BMW, which have historically performed well in China, are now under pressure. Mercedes has seen a sharp decline in sales of its electric and hybrid models, while BMW faces stiff competition from Chinese brands like Li Auto in the lucrative premium SUV segment.

CVA perspective:

China's automotive market serves as a testing ground for the global shift towards EVs. Two markets are actually forming, the dynamically growing EV segment and the decreasing ICE one. In the ICE segment, European, US, Japanese and Korean OEMs have traditionally had a significant technology advantage, which may even increase as Chinese competitors shift their focus to EV. In the EV segment, Chinese automakers may actually have less entry barrier than non-Chinese incumbents, as Chinese taste is less "noise, smell and vibration" driven, but they more appreciate digital features, convenience, etc. Especially "New-New Comers" like Xiaomi can develop and produce faster and cheaper, leveraging economies of scale and advanced technology to offer competitively priced, feature-rich vehicles with amazing performance. On the back of these Chinese dynamics, a market where EV transition has started way before Europe, it is interesting to project impacts on the European market. Certainly the European taste (at least of the currently car purchasing generation) is still more petrol-prone, but new buyer / user generations and usage models favoring exploration may even this out. In any case, if EV Transition is to happen in Europe (which we think is a safe bet), using current bumps in the EV dynamic to lower ambitions and speed will be fatal, as ICEV markets will inexorably shrink. So any market hesitation or regulatory delay should be used to accelerate the development of Pure Play models, not only by OEMs, but also for Captives, Banks, Insurers, etc. Import duties and Brand power will certainly delay exposure to Chinese competition, but do not make their threat go away!

Read the other editions

Authors

Markus Collet

Corporate Value Associates

Partner & Head of Automobility Platform

Amelia Bradley

Corporate Value Associates

Associate Partner – Automobility Platform

Patrick Schiebel

Corporate Value Associates

Senior Manager

Max Müller

Corporate Value Associates

Strategy Consultant