The IAA in Munich has - again - been a reflection of sector trends, with Batteries and ADAS / AD as well as Chinese OEMs as the dominant topics. Politicians have been slightly more present than in last years, as the sector transition is stretching the European industrial and social fabric, and ecologically ambitious demand-side regulation ("Greening Corporate Fleets") is worrying most of the market participants. It's in this dynamic environment that Qorus and CVA could present the 2025/26 Mobility Report "Owning the Future of Mobility" to the audience of our September webinar, addressing the many facets of the Ecosystem Transition.

IAA insights

The IAA MOBILITY ran from 9–14 September in Munich. With 500,000+ visitors and ~750 exhibitors from 37 countries, attendance topped that of record 2023. Many OEMs were present, with an astounding Chinese contingent (116 exhibitors). Politicians seemed to be more present than in previous editions (e.g. Chancellor Friedrich Merz), as the transition of the automotive sector is gaining social and political relevancy. Sources indicate more than 350 world premières, including BMW's Neue Klasse with the iX3, Mercedes' all-electric GLC, Volkswagen's urban EVs & autonomy stack, Chinese OEMs' localization (BYD Hungary factory start and "flash charging"...), plus many OEMs exposing recent models in central Munich.

CVA perspective:

Rebranding to “Mobility” signalled a shift beyond metal. Closer inspection allows to pinpoint how this reflects the evolving structure of the automotive sector: The "wow" effect of the metal is still there, but exhibitions show the domination of technology and efficiency. Many incumbent OEMs have renounced to mega-stands, and some have actually not joined. Of those who did join, much of communication has been on the "Tech Stack" (batteries, AD / ADAS), as revealed by the huge VW stand. And Chinese OEMs definitely have impressed spectators by products that are competitive, even before factoring in a significant price advantage. Supplier presence has been modest, except for the battery (CATL...) and AD / ADAS majors (Aumovio...). Many liken the future of the IAA to a “European CES”. Which may be partially true, except the magnetic effect that the beauty of cars and fascination about flawless mechanics still has on automotive management and the public, at least partially and for now.

OLX buys La Centrale

OLX Group (Prosus) agreed on 26 Sept 2025 to acquire La Centrale for €1.1 billion in cash. OLX and Prosus management called La Centrale a “natural fit” strengthening its European ecommerce ecosystem and AI investments. La Centrale counts ≈4.5 million monthly unique visitors, ~350k active listings, and supports >10,000 automotive professionals OLX operates motors marketplaces in 8 countries with ~29 million monthly users and sees France as a structurally attractive autos market. The seller Providence Equity had acquired La Centrale from Axel Springer in 2021 for ~EUR 400m. Heavy investments in technology including AI, steered by Philippe Chainieux, MD of La Centrale, have massively transformed the site. Technology will be the main driver of synergies with the new owner.

CVA perspective:

The used-car market is fragmented, making lead aggregation via portals decisive, weakening individual dealers’ bargaining power. OEMs and Dealers are trying to build up competing customer acquisition channels, but have difficulties to overcome the barrier of brand and traffic generation of majors (Autotrader, mobile.de, Leboncoin...). The avenue that used car portals have in front of them is to use their granular, real-time data, as well as seamless digital customer journeys to bring together customers and assets. This can go way beyond the intermediation role, bundling financing, insurance and services and eventually facilitating or even concluding the transaction and managing the trade-in. The race is between these portals and other web players (Amazon...), integrated Tech companies (Auto1...), and initiatives by OEMs (Spoticar / Aramisauto...) and Dealers (Autosphere...). The "pot of gold" is not only the used car market, but also the new car market, on which some of the portals (Autotrader, mobile.de...) have started to move aggressively.

Green corporate fleet - Insights from call for evidence

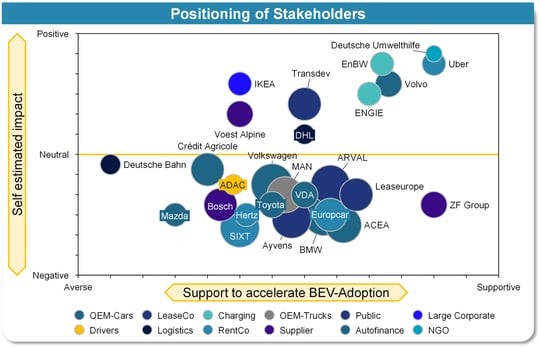

Between July 25th and September 8th, European citizens, associations and corporates have been asked to position and bring evidence on the expected impact of "Green Corporate Fleet Regulation by the European Commission.

From over 480 responses we have selected the most important ones (representative for player groups in the automotive ecosystem) and have analyzed them along different criteria. Overall the responses do not support new regulation, without however completely condemning it. There is a large consensus of players (with notable exceptions) that regulation would impact them negatively.

CVA perspective:

The proposed "Greening Corporate Fleets" regulation by the EU has the potential to significantly change the market dynamics (volumes, prices) but also the ability of players to operate their current business models. High fixed BEV shares have the potential to reduce overall vehicle demand - especially if surrounding infrastructure (charging, etc.) doesn't keep up. The Call for Evidence plays an important role in the legislative process in the EU and should contribute towards a fact-based discussion: combining the global interest of reducing CO2 emissions with the necessity to keep business models, jobs, affordable mobility... alive. The answers show a strong rebuttal of the regulation, with little effort to propose alternative and feasible approaches on how to regulate in a smarter way, working towards lower emissions while allowing market participants to thrive. We believe that a constructive feedback, highlighting alternative ways to achieve CO2 reductions without threatening the functioning of the automotive ecosystem is needed.

Qorus & CVA Mobility Community update

We restarted our Qorus webinars in September with the launch of our Automobility Annual Report on "Owning the future: Financial Services at the heart of disruption" and a discussion with key banking players on some of the hot-topics for the industry.

We were joined by Ashley Barnett (Lloyds), Vincent Carre (Credit Agricole), and Alejandro Vila-Trias (Caixa) to do a speed-perspective on EV transition (very different landscape per country...), Chinese OEMs (gaining in capabilities in both China & Europe), and Partnerships (critical in today's environment). Polling the participants, developing the EV business model and controlling costs are seen as the key areas to work on in the industry today.

We have a great set of webinars coming up in the next months and invite you to join our next one on October 23rd: "Is the pre-Covid world gone forever? Auto Volumes and Prices amid regulatory changes."