ANZ released its 2022 MoneyMinded Reach Report revealing the financial education program delivered across Australia, New Zealand, Asia and the Pacific has supported almost 55,000 people to complete the program since September last year, and almost 850,000 since its inception 20 years ago.

Developed in Australia in 2002, MoneyMinded is a financial education program for adults seeking to build money management skills, knowledge and confidence.

ANZ’s Chief Executive Officer Shayne Elliott said: “While pandemic-related restrictions eased in 2022, this year has still provided many challenges for households including increasing cost of living pressures.

“For 20 years MoneyMinded has been a valuable resource for many community workers and financial counsellors as they support lower income and disadvantaged communities and continues to be so during these challenging times.”

Highlights from the 2022 MoneyMinded Reach report include:

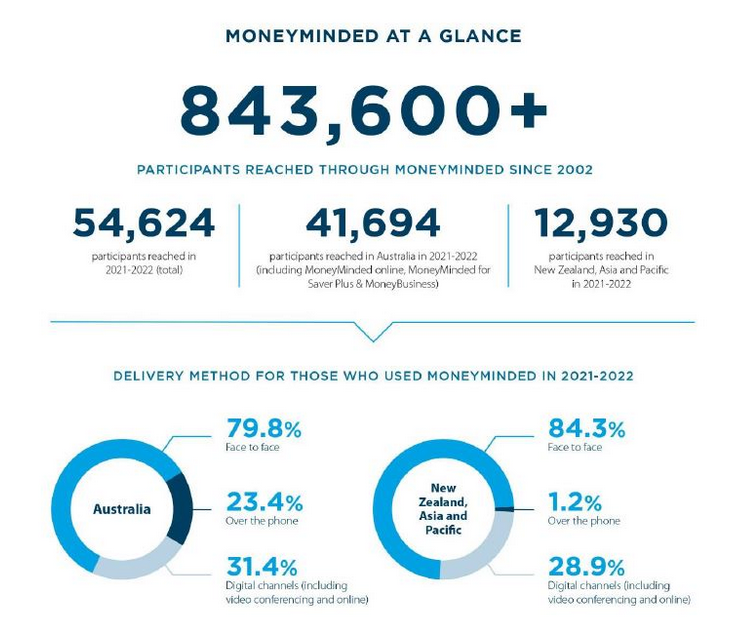

• Since 2002, more than 843,600 people have participated in MoneyMinded.

• From 1 October 2021 to 30 September 2022, an estimated 54,624 people participated in MoneyMinded across Australia (41,694) and the Asia Pacific region, including New Zealand (12,930).

• While most MoneyMinded coaches used the resources face-to-face with their clients in the last 12 months, while 31.4% in Australia and 28.9% in New Zealand, Asia and the Pacific used MoneyMinded via digital channels.

• Three-quarters (76%) of participants in Australia were female and 24% male. Just over half (51.1%) of participants in New Zealand, Asia and the Pacific were female and 48.9% male.

• More than one third (36.2%) of participants in Australia were sole parents, 24% were unemployed and 20.3% spoke a language other than English at home. People with disability and carers also participated in MoneyMinded (10% and 8.8% respectively).

• Half of all participants (50%) in New Zealand, Asia and the Pacific spoke a language other than English at home. More than one-third (36.4%) were seasonal workers and almost one-quarter (23.6%) were students.

Download a full copy of the latest MoneyMinded report