Maturity of customer data in banks and insurance companies

This report shows what the current trend regarding the usage of customer data for personalization in the Financial Services sector is, but also what is the maturity level of the sector and the changes implied, and how are those changes implemented in practice.

In partnership with

Wavestone

Wavestone is a consulting powerhouse, dedicated to supporting strategic transformations of businesses and organizations in a world that is undergoing unprecedented change, with the ambition to create positive and long-lasting impacts for all its stakeholders. Drawing on more than 5,500 employees in 17 countries across Europe, North America and Asia,...

'In the context of the rapidly developing digital economy, the last decade has given companies the opportunity to diversify their business model and their customer relationships, due to a better understanding of their needs. The personalization of customer journeys has become a major stake for companies in a wide range of sectors. For example, Netflix offers personalized content based on user’s data, Starbucks’ app sends personalized advertisements to its customers based on their preferences and Spotify uses customer data to create personalized playlists. Personalization is defined by all the methods used to make the customer feel they are considered distinctive and special by the bank/company throughout the customer experience. This personalization is made through the offerings, user interface, interactions across all channels, range of operations and transactions, etc. Personalization is constantly managed and measured through KPI such as NPS, multi equipment, LFTV or client satisfaction.

At present, the market trend for personalization is accelerating and it can be explained by various factors.

First, we see a change in customer expectations that are increasingly demanding. Being able to offer a real unique experience for a customer is a strong competitive advantage. For example, customer engagement with their brands improved by 14% in 2021, and 90% of customers now spend more with a brand that offers a personalized experience.

Then, competitiveness is intensifying. Strategic decisions can deeply disrupt the standards of a given economic sector, as we see more and more new entrants acquiring a significant market share in a very short amount of time thanks to their agility. Uber, for example, has brought such changes to its market. In 2018, the revenue of the American company reached $11.3 billion, 23 times higher than in 2014 ($495 million). During the same period, the cab industry's market share decreased by 5 to 10%.

Finally, data is becoming easier to access and analyze, and corporations are driving their investments towards enabling data usage. The amount of digital data created or replicated globally has increased more than 30 times in the last decade, from 2 zettabytes in 2010 to 64 zettabytes last year, and is expected to reach 180 zettabytes by 2050.

“With the booming availability of information and advancements in IT, banks today are sitting on vast amounts of data, which if amalgamated with the power of analytics can unleash a world of opportunities that vastly improves decision making. Making use of extensive data to extract relevant and practical insights is extremely crucial in a customer-oriented space.” ― Sachin Chandna, Head of Customer Intelligence & Engagement at Emirates NBD.

Those dynamics imply that companies now need to move towards a strategy of hyper-personalization. They need to create value out of their data to be able to offer unique experiences to their customers. It’s a huge change in the way of thinking about customer personalization – usually companies use segmentation to personalize their customer’s journeys. Segmentation creates groups of customers based on their common preferences and activities, while hyper-personalization digs deeper into tiny differences that can be used to target customers individually. Hyper-personalization therefore allows for much greater granularity and refers to the notion of “segment of one”. It requires moving from the value represented by customers to what a customer really values in the relationship with the bank, which are usually the main elements used to personalize interaction, such as level of expertise, cost to serve, consideration and interaction history, range of products and services, etc.

The financial services sector is certainly not immune to this current trend. But most banks and insurance companies have not yet translated it into their operational strategy and hyper-personalization can still be leveraged to improve customer engagement. As a matter of fact, 52% of customers find banks "not fun", 48% are not "emotionally connected" and 44% do not find them "personalized enough". This observation is the same from the banks and insurance companies’ perspective.

"75% of customers are willing to pay more to shop at a business with a great customer experience, and 53% said they would leave permanently if the experience was poor.” ― Sachin Chandna, Head of Customer Intelligence & Engagement at Emirates NBD.

Given those findings, we will now take a look at the current trend regarding usage of customer data for personalization in the financial services sector, the maturity level of the sector and the changes implied, and how those changes are being implemented in practice.

Hyperpersonalization, a current theme for banks and insurance companies, whose maturity is growing

The current trend for financial services: from a segment-personalization to hyper-personalization

Today, data acts like a catalyst that pushes the banks and insurance companies to rethink their organization and products to make them more customer centric. They are forced by new entrants to catch up (A), by creating emotional connection with their customer to improve client retention (B), which requires large investments and untapped resources (C).

A. Traditional actors are forced to catch up with the competition

There is a fundamental difference between traditional players and new entrants.

Traditional players have older roots and foundations and are often large and complex organizations, which translates into less agility and strategies that were not built around data and customer personalization. Their technological maturity is less advanced than new entrants such as fintechs.

In some ways, they carry the burden of history and are mainly held back by two elements:

First, a much heavier technological legacy. Banks and insurance companies have gone through several technology revolutions, which means that their information systems division (ISD) has been built up over time and is more complicated to keep up to date.

Second, Banks and Insurers have a much more complex and extensive product portfolio than the new entrants, who in some cases still offer a restricted range of products such as a current account and a few savings products.

However, traditional banking and insurance companies also have strengths such as a much longer and more extensive data history, which allows them to better understand their customer base. These traditional players also have a large striking force, financially and in terms of size, that allows them to act quickly when distributing their new products and features to a large proportion of customers. (i.e., Crédit Agricole has 24.4 million customers whereas Boursorama, the first French online bank, has 4 million).

Banks were also among the first companies to computerize their organizations, along with the aerospace industry. The objective was to process more and more operations, while controlling costs. In 1957 in France, CIC acquired the most powerful machines, such as the IBM 705 and Bull Gamma 60. These machines occupied an entire building for the power of a digital watch nowadays.

Nevertheless, the use of data for personalization purposes has profoundly transformed uses and has allowed fintechs that have seized this opportunity to develop with personalization at the heart of their value proposition.

“When N26 was founded in 2013, the banking industry was one that was lacking in digitization, innovation, and also, personalization. N26 was designed to change this by offering 100% digital banking that was intuitive, simple, personalized and tailored to customers' financial needs. With customer-centricity as our guiding principle, we have welcomed over seven million customers across 24 markets to date." ― Gilles BianRosa, Chief Product Officer at N26.

On the other hand, the advent of fintechs has profoundly changed the way customers perceive their interactions with their banks or insurance companies. Customers are now used to evolving in an agile and personalized environment.

One of the main effects of the competition from fintechs is a stronger competitive intensity in the sector. Indeed, with their data-based model and agility, fintechs compel traditional actors to transform their organizations to be able to catch up. As a direct consequence, the usage of data is now perceived as a Critical Success Factor (CSF) in the sector.

"The traditional banking market in Bulgaria is highly saturated. […] We consider the usage of data as one of our key competitive advantages." ― Lina Varbanova, Head of CRM Department at Postbank - Eurobank Bulgaria.

This stronger competitive intensity is also causing major changes in the development strategies of traditional banking and insurance companies, as well as their investments in technology. This dynamic, which was originally expected to be a long process of change, has been accelerated by the Covid-19 pandemic. When engagement and personalization were among the priority topics of organizations, we saw a higher investment: 79.2 % of banks and 66.7 % of insurance companies declared that when personalization was one of their top five priorities, their investments were much more substantial.

B. Creating an emotional connection is essential when it comes to retention

For a bank or insurance company to catch up, especially through personalization, requires the idea of creating a link with its customers – an approach which fintechs already have in their DNA. From their origin, they were built around a customer-centric vision that allows them to create a strong emotional bond with the customer, starting from the beginning of the relationship.

"We aim to make sure that personalization is built directly into each feature we are launching […] One great example is our Shared Spaces subaccounts […] Our goal was to create a feature that would allow people to share money easily with loved ones. We built in savings targets, transaction histories, and the ability to name and choose an icon for each Shared Space created […]” ― Gilles BianRosa, Chief Product Officer at N26.

One typical example of this emotional connection created by fintechs is the creation of data-driven experiences and the use of gamification to create this strong emotional connection with the customer. For example, the fintech Qapital – a banking application that empowers users to set spending, saving and investment targets – offers rewards to its customers each time they reach their goals. The app relies on gamification with different features, which is a great incentive and increases customer loyalty and satisfaction for the ones who embrace such features. To date, this start-up has managed to attract two million users and raised $47.3 million over five rounds of financing.

Gamification allows those who use it to rapidly establish customer loyalty and ensure profitability over time. They therefore focus on building trust and long-term relationships with their customers with a logic of personalization and cost reduction by developing the right features and products at the right time.

"As is the case with many fast-growing companies, our biggest challenge is in prioritizing the right products and features in development so that we are able to deploy limited resources to drive the greatest impact with customers. This is another driving force behind why we are focusing a lot of our development efforts on features that offer customers that level of personalization, rather than focusing solely on a finite set of use cases with the resources we have." ― Gilles BianRosa, Chief Product Officer at N26

The difference with traditional banks and insurance companies is that they historically focused on capturing value quickly, leaving customer experience aside. With a non-optimized customer journey, it’s more difficult to understand the nuances that can influence the customer’s decisions and therefore perfect his experience. The direct consequence is an increase in customer acquisition costs and a decrease in retention rates. This is a major issue, especially in an era of digitalization and customer volatility that also applies to banks and insurers. As an example, the French legislative body adopted a law on bank mobility (Macron Law), making it easier and less expensive for the customer to switch banks. It requires and enables banks to conduct the administrative tasks implied by the change of bank for the customer. As for insurance companies, an equivalent regulation – the Lemoine law (2022) – gives more power to the consumer by allowing him to cancel his insurance contract at any time, facilitating the transfer to another insurance company.

Some traditional players have already taken the step of personalization and have been able to demonstrate that a change in data and customer-centric strategy is bearing fruit. It results in improved retention rates, more customer engagement, a better understanding of their needs and therefore enhanced customer satisfaction. Moreover, traditional banks can capitalize on the customer’s trust in the institution, its solidity and durability, a feeling that is much less present with fintechs. For example, French customers’ level of confidence in their insurance company is nearly 90% for home insurance, more than 87% for health insurance, and 84.5% for car insurance. As for banks, 89% of French customers say that they feel their bank is part of their daily life and their level of confidence in the institution is up to 72%.

As an example of success, CIBC (Canadian Imperial Bank of Commerce), a traditional Canadian bank, has seen its multichannel customer acquisition rate increase by 65% thanks to major efforts in terms of personalization.9 On a broader level, 40% of financial institutions report that their return on investment (ROI) is faster (under two years) when they have linked their investments with a personalization strategy.

C. A change that requires investment and untapped resources

We are therefore in the midst of huge change for financial services players. The use of data has more than ever become a strategic issue, and even more so at a time when segment-based personalization is proving less effective than hyper-personalization.

This strategic change requires banks and insurance companies to update their technology. Technological maturity is being considered as a real Critical Success Factor (CSF), and therefore it results in massive investments in recent technologies, and in particular artificial intelligence technologies: 67.5% of banks and insurance companies say that technology investment for engagement and personalization was one of their main investments over the last five years.

Given the amount of data that can be harvested and the difficulty of processing it correctly, there is a real need to update information systems management. One way to do so is to implement effective data governance to avoid data silos within companies, and to ensure that data usage is well aligned with business goals.

“For achieving better personalization, banks need to build software architectures that allow collecting high quality data, enable business lines to implement new ideas at lower costs, and interconnect the whole eco-system." ― Bora Üzüm, Vice President of Analytics and Data Governance at Yapi Kredi.

Personalization is often viewed as costly by banks and insurance companies. On the contrary, we believe it should be managed through a profitable mindset, as the lack of personalization can generate a reduction of revenue stream that in the long term has a strong impact on profitability. Profitability is a consequence of personalization, not a root cause. With a digital-first strategy, personalization costs by customer are diminishing. The key idea here is to see personalization as an investment not a cost.

Financial services and hyper-personalization: Sector's maturity assessment

“We are a digitally advanced company, ranked #8 among the top 100 global digital insurers with the highest NPS (as per third party research) and one of the lowest grievance ratios (as per the regulator).” ― KV Dipu, President – Head of Operations & Customer Service at Bajaj Allianz General Insurance.

This dynamic, which tends to close the gap, is explained by the cooperation of 3 distinct factors. The reinforcement of the capabilities around the data (A) allows Bank and Insurance companies to create personalization across all channels in real time (B) but this reinforcement needs to be supported through internal changes (C).

A. Data collection and analysis: a real strategic challenge

First, there is a real need for capacity building around data to enable leverage. Using collected data requires a high level of analysis capacity, AI technologies, an efficient information system management and clear data governance to avoid data silos that lead to poor data dissemination. There is thus a real strategic challenge to be able to collect, clean and analyze data properly.

“The biggest challenges we face are obtaining all the necessary data, and then their quality, which we have largely overcome through the formation of easy data as a central place to store all data with their automatic updating.“ ― Azra Hadziomeragic, Retail Board Member at Bosna Bank International.

We can divide data sources in two major categories: internal and external data. These two sources can then be subject to cross analysis and aggregated to provide key information for corporations.

“Our personalization use cases are based on myriad forms of data. From a form factor perspective, it is a rich mix of paper (both handwritten and printed forms), soft copies, email, text messages, voice data, videos, etc. From a data classification point of view, it encompasses demographic data, behavioral data, transactional data, legitimate third-party footprint, etc. We enrich data in a variety of ways. When customers interact with us throughout the lifecycle, we leverage every touchpoint to enrich the data provided to us at the stage of origination.” ― KV Dipu, President Head of Operations at Bajaj Allianz.

Among the data coming from internal sources, there are mainly three distinct types of data. The first type, personal data (age, place of residence, height, marital status, etc.), is mostly used because it can be easily collected, and very often filled in directly in by the customer.

"Demographic information, location and spend behavior in different channels or sector are still determining personalization for us.” ― Dr. Yakup Akgul, Senior Manager Private Banking at Kuwait Finance House.

“There's a huge set of data which is available, for example, in life insurance. Let's suppose if one can find out a customer’s last policy, when they were unmarried, their current marital status, whether they have a family, etc. Such information will determine whether their protection needs have increased. We can thereby contact them with product offers that better cater to their needs,” said Rajiv Malhan, Head – Strategic Projects & Business Transformation at Aditya Birla Sun Life Insurance.

Transactional data is also used extensively. It is information recorded from transactions performed by the customer. It is generated through various applications during the execution or support of business processes. This data is one of the most granular levels of data at the customer level.

"Enriched transactions are displayed within the digital platforms to assist customer understanding of a specific transaction and avoid unnecessary queries about what the transaction was for. Transactions are enriched with more specificity as to the brand, shop, or website in which the transaction was made.” ― Rob Fleming Head of Data, Analytics & CRM at HSBC UK.

Lastly, there is a consistent use of behavioral data, which is obtained from the observation of a behavior proven by the different interactions of the customer via various communication channels. A purchase history can be an example of behavioral data, as it reflects the customer’s buying behavior on a website.

“We are mainly relying on first party data and deduction methods to build our behavior groups. We have close to a hundred combinations of segments that define our customer groups and we are using them heavily to personalize messages and to identify meaningful events in the customer journey.“ ― Lina Varbanova, Head of CRM Department at Postbank - Eurobank Bulgaria.

Data from external sources allows banks and insurance companies to complement their internal data with information from cross-industry partnerships, data ecosystems, or other external sources. By synchronizing this information, and doing so across all communication channels, it helps create the personalized and omnichannel experiences expected from the customer’s digital interactions. In practical terms, external data allows companies to fill in knowledge gaps and identify behavioral traits that are not evident from the customer’s interactions with the company and its various interfaces. Common examples of this type of information include social media posts, credit scores and business partnerships.

“Data used in the personalization use case comes from hundreds of different core systems, external data from bureaus, Brazilian Central Banking, etc. Data is ingested into our big data analytical environment, where we merge the many different inputs, and at the end we have a 360 degree view of our customer profile, risks, assets, etc. With that we can make real-time decisions in order to deliver the best credit solution for our customer.” ― Janaina Antoniassi, Executive Superintendent at Banco Bradesco.

B. The need to move towards personalization in each interaction and at the right time

As a direct consequence of better data usage, the objective is to offer a multichannel personalized experience, almost in real time.

To offer a personalized and frictionless experience to their customers, banks and insurers must move towards omnichannel personalization. Customers are already used to multichannel interactions between their digital and physical environments. For example, companies in the luxury industry like Hermès call their customers six months after they purchased a leather bag in a store or online, to remind them that they have a free cleaning to perform in store.

However, most banks and insurance companies are still pursuing personalization strategies solely on one or a limited number of channels. This is a sign that they are lagging behind fintechs that already offer personalized experiences across all their channels. Personalization on a single channel can lead to poor or incomplete targeting and render out of date the personalization efforts made.

Today, 72% of banks and insurance companies do not have multichannel personalization.12 However, those who invest in and develop multichannel strategies do better: 89% of banks and insurance companies that use omnichannel personalization have a return on Investment (ROI) of less than two years.13 Aware of the need for multichannel personalization, banks and insurers placed it among their main short-term objectives.

“The ultimate goal is to create an omnichannel environment in which we will be able to provide clients with a superior experience regardless of the channel through which they communicate with the bank.” ― Azra Hadziomeragic, Retail Board Member at Bosna Bank International.

Also, the investment and implementation of multichannel personalization is correlated to the investment in customer relationship management (CRM) technologies that allow them to interconnect all the data and to ensure an accurate customer follow-up.

“In order to ensure relevant and timely interactions with customers, investment in CRM technology is critical. There need to be real-time data flows and multichannel connectivity, such that both customers and front-line staff are communicated with effectively.” ― Rob Fleming Head of Data, Analytics and CRM at HSBC UK.

The goal is to be able to offer near real-time personalization across those channels. Designing a real-time decision environment to create customer journeys contributes significantly to improving results. Nearly 83% of banks and insurance companies that personalize their customer journeys in real time have a return on investment (ROI) of less than two years.

“With this data in place, it is crucial to have a robust real-time analytical engine with an ‘always on feedback’ loop and recursive learning algorithms to generate real-time insights from customer data and use them for effective targeting.” ― Rob Fleming Head of Data, Analytics & CRM at HSBC UK.

Overall, financial services players are still rather lagging behind and real-time personalization represents a future development axis. Currently, only 20% of banks and insurance companies personalize the customer journey in real time.

C. Internal changes to support personalization ambitions

There is also a need to make internal changes on both the strategic and technological levels. It is therefore necessary that we see a real paradigm shift within financial corporations.

Integrating hyper-personalization into a company cannot be done by implementing it on a single use case, it must necessarily result in internal changes and more generally in a new company culture, to converge towards a new global strategy. This represents a real challenge for the different actors, to pivot their strategy that has been focused on capturing value rather than customer experience quality for decades.

“The biggest obstacle, for a traditional bank, is to implement a new culture of work, while keeping the experience and the knowledge from 80 years.”― Janaina Antoniassi, Executive Superintendent at Banco Bradesco.

Banks and insurers must build new strategies that are customer-centric. By placing the customer at the heart of the value chain, they ensure better customer retention, and therefore generate added value in the long run (since acquiring a new customer is five times more expensive than retaining an existing one).

“Customer-centricity is an evergreen focus area, given that the ground beneath us is constantly changing. Our current focus areas include hyper-automation and keeping pace with the latest trends to be ahead of the curve on innovation, to continuously provide our customers the best-in-class products and services.” ― KV Dipu, President – Head of Operations & Customer Service at Bajaj Allianz General Insurance.

It is also necessary to ensure that each interaction with the customer is useful. Indeed, today's customers are being constantly solicited by different brands and from various sectors all at once. It is therefore capital to be to ensure the relevance of each customer interaction in order for it to deliver the best value possible.

“Customers have been given so many choices, but at some point, customers also get tired. There are so many things which they are being bombarded with, and they have very limited time to share.” ― Rajiv Malhan, Head – Strategic Projects & Business Transformation at Aditya Birla Sun Life Insurance.

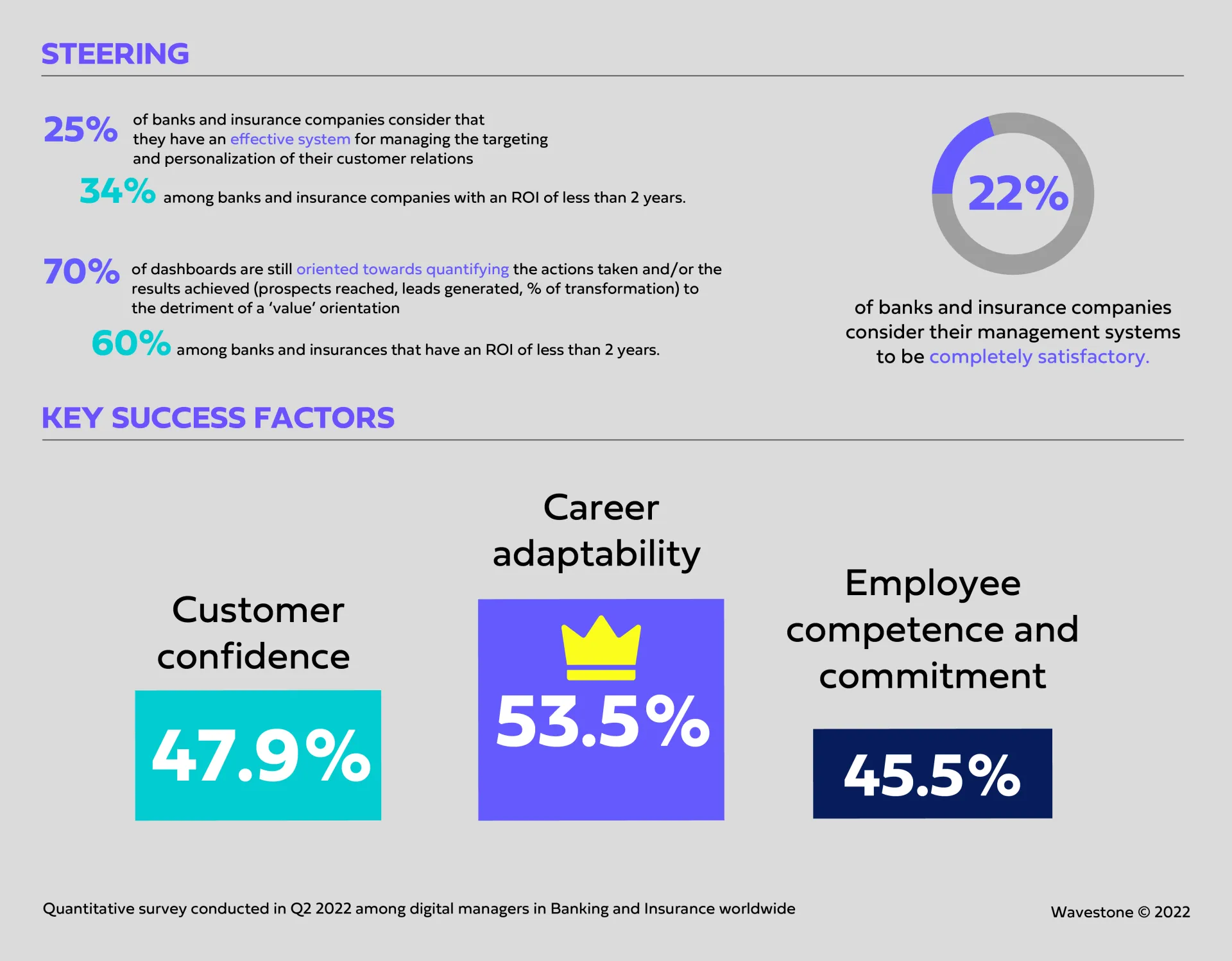

This strategy shift can only be achieved under two conditions: The ability to meet the challenges of technological adaptation (1), and to recruit a qualified team able to work using new technologies while keeping business objectives in mind (2). As an example, today 45.5% of banks and insurance companies declare that the skills and commitment of their employees is a key success factor.

“The most important success factor is an engaged and experienced team. From the managerial perspective, trust and support from project stakeholders are also very important especially in tough moments.” ― Krzysztof Pałuszyński, Deputy Director of Omnichannel Banking at mBank.

IV. From market theory to practice: ways and means used by financial services actors to attain the hyper-personalization grail

Having discussed the market trends and the maturity level of different actors, one question remains: how do traditional financial services players cope with market evolution? Here, we can discuss three specific cases of transformation from segment-based marketing to a personal customer engagement approach: Swedbank’s adoption of ‘next-best-action’ technology to personalize interactions across all channels, Banco Bradesco’s real-time hyper-personalization tool Brain, and Emirates NBD which developed its own Enterprise Data Platform to manage data on a large scale.

A. Swedbank: from segment-based marketing to personal customer engagement in a multichannel environment

Swedbank is a 200-year-old organization with over 300 physical branches across four countries within the Nordic and Baltic regions. From its long-lasting heritage, the bank has inherited strong values that are still driving its goals of operational and relational excellence today. At its core, Swedbank wants to be perceived by its customers as ‘open, simple and caring’, promoting a sound and sustainable financial situation for their nine million customers across the regions.

Like many other businesses over the past decade, Swedbank has invested a lot to achieve a successful digital transformation. Swedbank’s transformation had already started back in 2012 with the digitization of the back office in lending operations and mutual fund administration. This was followed by the development of a mobile loan origination platform which automated the entire process from application to disbursement. With the customer relationship management (CRM) initiative though, the project and potential return on investment were drastically bigger.

One of their key recent projects was to develop a market-leading mobile application, through which their customers could easily process their needs, be it a loan application or requesting a new card. Within this context, the bank has seen a significant shift in the way it interacts with customers, processing over five million digital customer interactions every day, the majority through their mobile channels. One would think that, with such an increase in digital traffic, the need for traditional channels would decrease. However, this was not the case, as the use of physical branches and telephone remained the same over this period.

As stated previously, Swedbank is known as an institution that prioritizes customer relations and satisfaction. This meant that while continuing to develop digital channels, it was still necessary for them to meet the needs of all customers regardless of their channel preference.

Swedbank began a new journey, which started by reframing its view of itself. They decided they would be a digital bank with physical meeting points rather than a physical bank with a digital presence. This demanded a complete overhaul of their CRM with the aim of creating a true omnichannel customer experience for customers. To achieve this goal, their CRM initiative was broken down into several key steps.

First, they focused on capturing all their customer data and creating a single view of the customer that they would be able to use across all channels. Then they had to create a new capability that would enable them to share proactive recommendations to their customers. This was their version of ‘next-best-actions’. It was an essential part of the bank’s customer engagement strategy since it would enable them to provide the right recommendation for their customers regardless of its nature, be it a sales, service or information message. The goal here was clear: no more segment-based marketing, the time had come for true one-to-one personalized customer engagement. To achieve this goal, Swedbank worked with Pegasystems, a company that provides CRM solutions. The bank implemented a Pega technology named Customer Decision Hub which is based on a low-code approach. This technology helps in rapidly structuring the ‘next-best-actions’ portfolio by exploiting past machine learning models. One of key advantages is that it helps IT, CX and marketing teams to truly collaborate and create value for the bank’s customers.

As a result, Swedbank saw a drastic improvement in reach, relevance, and proactivity in its customers’ experiences. They successfully implemented 300 customer offers live, reaching 95% of their active customers on a regular basis without manual intervention. Additionally, they were able to deliver an increase of over 200% in proactive unique ‘next-best-actions’ year on year. This resulted in an increased customer satisfaction score, reaching over 86% for their first time ever, and an additional revenue per customer of €20 per year.

“We’re transforming the way we communicate with customers. Going from what we want to say, to what they want to know. From one message fits all, to one message fits one. To make it happens, we rely on people and data, and the people who know data.” ― MariAnne Ygberg, Head of Customer Value Communication at Swedbank.

B. Brain: a successful example of real-time hyper personalization by a bank

Bradesco, a Brazilian bank, is among the most advanced in terms of digitalization in the South American market. It has created an internal tool called ‘Brain’ that aims to improve the way banks offer and develop their credit products for their clients. Brain allows proposals, prices and decision support in real time by optimizing and personalizing their financial products.

Brain is part of the digital transformation program of the company’s credit products, a program that was born to bring the bank up to speed in terms of technological maturity, in a strong competitive context. This tool is based on high performance, hyper-personalization, omnichannel distribution, data, customer orientation, front-to-back action, agile working, and real-time decision making.

Brain is based on a new real-time decision architecture. This means that products are offered in real time based on customer data, providing a different and personalized experience for each customer. This architecture, resulting from Bradesco’s recent investments in personalization, is based on streaming, which allows the massive use of unstructured data in the decision process, integrated with machine learning algorithms. With all this information, the system performs a real-time mapping and weighs each possible scenario to decide and respond with the most suitable product for the client.

“For example, when a customer is looking for a car on the internet, they can get an instant, personalized quote for a loan or, in the case of debt, the system suggests the credit that best suits each customer’s financial organization.”

The implementation of this tool is based on precise data models and has direct business impacts, as KPIs improve and ultimately result in better customer engagement.

“This allows more than 38.5 million customers to benefit from a daily review of their credit, with +55% of credits released, +22% of renegotiations performed, 41% reduction in defaults on loans more than 30 days overdue after 3 months of granting, 3 times more transactional models using machine learning and artificial intelligence, 10 times more propensity models, machine learning and artificial intelligence, and a 38% increase in billing digitization.” ― Janaina Antoniassi, Executive Superintendent at Banco Bradesco.

This tool, which represents a technological breakthrough, is supported by a new corporate culture. Project teams were restructured according to agile concepts, with multidisciplinary teams. This had the effect of transforming the mindset of the organization, with rapid and incremental delivery of value to the customer, considering the end-to-end view of the process.

Finally, in this case, real-time personalization also allows for financial education and risk prevention with customers.

“Our solution also provides for real-time credit reassessment of our customers, so that we become aware of their limits according to their new financial condition. It also provides financial management tools to help customers manage their budgets and thus for the bank to avoid late payments.” ― Janaina Antoniassi, Executive Superintendent at Banco Bradesco.

C. Emirates NBD and the evidence of the need for good data management

Emirates NBD is rich in examples of innovation for customer personalization. The UAE-based bank is an example of a large, traditional player that finds itself in an increasingly competitive environment and has built its strategy around this.

“Given the aggressive way in which companies are trying to personalize content and reach customers effectively, it is critical to ensure that all customer interactions are meaningful and generate maximum value through effective implementation.” ― Sachin Chandna – Head of Customer Intelligence & Engagement at Emirates NBD.

Emirates NBD has developed a data model and governance that allows them to compete in the market today. This model is based on three pillars: understanding the customer DNA, a powerful analytics engine, and a personalized program per customer. Thus, the bank has created an Enterprise Data Platform (EDP) which gives them a way to manage data on a large scale. This project had a colossal budget of €94 million and is part of Emirates NBD’s strategic digital transformation plan. The aim of this tool is to be able to offer data integration across the company for all activities (retail banking, wholesale banking, head office, etc.) and to all subsidiaries worldwide. For this tool to work and be operational, data is captured from 50 different sources. These data sources are both internal and external with enriched data. Data is then redirected to data lakes and data warehouses that are layered. Emirates NBD uses Hadoop and SAP HANA technology, which are already existing open-source solutions for processing and storing large volumes of data.

To move towards real-time personalization, data is updated daily with big data management tools, and real-time events are recorded with Kafka, an open-source solution that aims to provide a unified, real-time, low latency system for handling data streams. This data model goes hand in hand with the creation of a framework called ‘the multiplier effect’, which aims to ensure that the bank moves from a product and acquisition-centric view to a customer-centric view. It ensures that there is good personalization from end to end of the value chain.

“This framework uses all the data available on the bank’s customers to provide them with the most personalized offers, which is the best example of the use of big data for the bank’s customer strategy to date.” ― Sachin Chandna, Head of Customer Intelligence & Engagement at Emirates NBD.

The framework is based on three key questions: Who to target? What to sell? How to communicate? A practical use of it is the C2S2 (customer call & service score), an initiative implemented in January 2022 with the goal of prioritizing customers in the call center.

“Emirates NBD’s call center plays a critical role in interacting with its customers and meeting their requirements. To move away from the traditional call service model, we adopted a data-driven approach to change the customer service narrative. The actual reasons for calls were assessed through text mining using multiple data sources to design a customer-centric framework.”

Emirates NBD’s goal is therefore to analyze the relationships to predict the customer’s next calls, develop groups of customers with similar calling behavior, and prioritize the customers.

Conclusion

The trend of personalization is expected to be long-lasting and to undergo several significant evolutions that will require investments and new technologies, allowing more use cases and possibilities in the future.

“Personalization and user data analysis have already been a dominant trend in the fintech market over the past 2-3 years, but we expect an even stronger presence in the future across product offerings and conceptualization, communicating with and gaining new customers, and the improvement of the customer experience.”

Hyper-personalization is becoming an essential part of any successful strategy, in addition to an ever-challenging technological evolution, an increasingly competitive market and increasingly demanding customers. Today, customers are looking for added value from their banks and insurances and expect innovative and personalized experiences from them.

The Interviews

Download your study now

Digital Reinvention community

With Qorus memberships, you gain access to exclusive innovation best practices and tailored matchmaking opportunities with executives who share your challenges.