The new year has started with no shortage of news in the industry, showing that tectonic shifts are squeezing out gradual adjustment. Honda and Nissan are exploring a landmark merger, with a potential for Mitsubishi (and Renault?) to join. At the same time, we have first tangible evidence that European OEMs are pushing EVs to meet strict 2025 emissions regulations, setting the tone for commercial action for the year(s) to come. Meanwhile, Tesla’s latest financial results reveal that an emerging "EV normality" is catching up with the historic front-runner, leading to pressure on market share and declining margins.

Beyond these headlines, our Qorus-CVA Mobility Community this month explored the fundamental role of battery strategy in the EV transition, highlighting a need for systematic management and adaptation of the ecosystem, which will be a precondition of successful and profitable scale-up (watch the replay). Looking ahead, our next event will dive into the growing role of usership over ownership (book your seat).

We look forward to navigating 2025 together with you. As always, we welcome your feedback on the key topics shaping the industry - let us know what insights matter most to you!

Honda and Nissan discuss merger - Mitsubishi could join

Honda and Nissan have announced discussions on a potential merger that could create the world’s third-largest automotive group, with combined revenues exceeding $192 billion. The move aims to strengthen both companies’ positions in the rapidly evolving automotive market by enhancing synergies in manufacturing, supply chains, and electric vehicle development.

The OEMs cite the accelerating pace of technological change and growing competitive pressure - especially from Tesla and Chinese EV OEMs - as key drivers for the potential deal. While Nissan and Honda already collaborate on software-defined vehicles (SDVs) and EV technology, a full merger would allow them to integrate management resources more deeply. Additionally, there are speculations about Mitsubishi joining the merger, given its historical ties to Nissan. Initially, also Renault has been said to be interested to participate without any confirmation up to now. In any case, this merger could lead to a complex and very significant M&A deal in the automotive ecosystem. The companies expect to finalize their strategic direction by mid-2025, with an official merger, if agreed, targeted for 2026.

CVA perspective:

Scale matters - especially in today’s automotive landscape, where SDVs, battery technology, and data-driven ecosystems demand massive investments. From that perspective, Honda and Nissan’s potential merger makes strategic sense, providing them with greater global coverage and a stronger foundation for future development. However, size alone is not enough. The key question remains: does either company currently hold a leadership position in the critical domains of SDV, data, or next-generation battery technology? While both Honda and Nissan have made progress, neither is considered a dominant force in these areas today. This raises concerns about whether the merger would be large enough to truly compete with global EV leaders or if it could instead become a combination of two companies still searching for a breakthrough edge. This is where Renault’s potential participation could become a crucial factor. Renault has invested heavily in EVs and software-driven vehicles, with strong experience in electrification. Its involvement could provide the missing technological leadership that a Honda-Nissan combination alone might lack. Ultimately, the future of this merger - and its ability to deliver real competitive advantage - will depend not just on scale, but on technological depth. Consolidation alone is not the answer.

Decreasing EV prices across Europe

European OEMs are ramping up price reductions and incentives to accelerate EV adoption ahead of 2025’s stringent EU emissions regulations. A recent example is VW's aggressive leasing campaign, reported by Automobilwoche, which has made the ID.3 Pro more affordable than the petrol-powered Golf. The initiative, available in Germany until February 10, 2025, allows customers to lease an ID.3 Pro for €249 per month, significantly lower than the Golf’s €334 monthly leasing price.

VW is not alone in this strategy - other brands, including Renault with Dacia, Stellantis with Fiat, and Tesla, have also reduced EV prices across Europe to boost sales and avoid heavy CO₂ fines. Jato Dynamics reports that between 2018 and 2024, the price gap between EVs and combustion engine vehicles in the Eurozone shrunk from 53% to 22%. With manufacturers expected to further adjust pricing strategies, 2025 could mark a tipping point where EVs become a mainstream financial alternative to petrol vehicles.

CVA perspective:

Recent price adjustments are a compound phenomenon, combining short-term regulatory pressure and long-term trends reshaping the industry. Regulation is currently felt as the dominating factor, as strict EU CO₂ targets mean automakers must boost EV volumes to avoid fines, putting sustained downward pressure on prices. But in the longer term, production and sourcing costs will decrease with larger scale, advanced manufacturing processes and cheaper, more efficient batteries (LFP, solid-state). These longer-term effects first hit the sector via Tesla and Chinese OEMs as front-runners. In the short term, regulations and customer demand will cater for increasing price pressure, to which incumbent OEMs will react to their specific margins / CO2 penalty situation until cost leadership on EVs will become the dominant factor. OEMs will need to think already now how to make sure to be in shape for the “end game”.

Tesla’s turning point: Market pressure and future strategy

On January 29th, Tesla announced its full-year results, marking a significant shift. For the first time, both vehicle production (-4%; -73k) and deliveries (-1.1%; -19k) declined. More concerning for shareholders is the drop in Q4 gross margin (16.3%) and operating margin (6.2%) bringing it down to the profitability level of "normal" OEMs.

Tesla’s sales rose in China (+8.8% YoY) but declined in Europe (-13%) and faces potential declines in the

U.S. if BEV subsidies are revoked under a Trump administration. In Europe, CEO Elon Musk’s political stance is creating a potential for anti-Tesla sentiments, which is currently anecdotal, but may complicate sales development. Additionally, potential EU regulatory changes could reduce Tesla’s lucrative emissions credit income, impacting margins by 2-4 percentage points. In response, Tesla is diversifying beyond automobiles with Optimus robots, autonomous taxis, and energy storage. Within the auto sector, it is cutting costs (COGS down ~4% YoY) and preparing lower-cost models, though whether this means a simplified Model 3/Y or an all-new “Model Q” remains unclear.

CVA perspective:

The numbers show that Tesla faces increasing challenges. The company is losing market share (in % of BEV sales) in all major regions as both traditional and new OEMs strengthen their BEV offerings. Additionally, regulatory support for BEV-only manufacturers is expected to weaken.

In the coming months, Tesla is set to clarify its plans for lower-cost models, which will likely once again serve as a benchmark for competitors. The company has already demonstrated in China its willingness to fight for market share through aggressive price cuts. A more affordable Model 3/Y, built on existing production lines to leverage economies of scale, could push prices below $25,000–$30,000—even before potential new subsidies, such as those being discussed in Germany. A renewed price war in Europe would likely intensify pressure on competitors but also keep Tesla’s profitability well below shareholder expectations—a scenario we see as highly probable.

Beyond automotive, Tesla continues to promote its AI, energy storage, and robotaxi ambitions, but these remain largely aspirational and are unlikely to generate significant revenue or profit before 2026. This may shift Tesla's unique investor base even more towards the high conviction / high risk segments.

Qorus-CVA mobility event

We kicked off our 2025 webinar series with a discussion on: "Electromobility: Batteries as the key asset to making it work". Our speakers from Bib Batteries, BYD and Société Générale showed the importance of having a clear battery value chain strategy in order to make Electric Vehicles work and avoid value loss on the battery second / recycling life. Having a core understanding of the battery value & status requires a lot of data (and even chemical analysis) but is crucial to be able to price new and used Electric vehicles correctly, as well as supporting products such as insurance & warranties. Here partnering with OEMs has a clear advantage to get real-time and accurate access to data for insights.

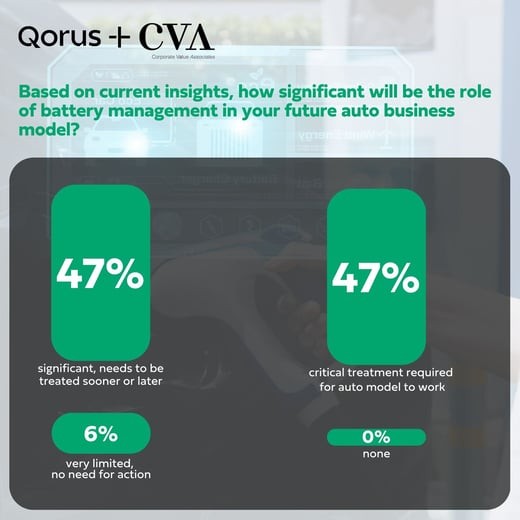

The audience highlighted their agreement that batteries are a structurally important factor that needs to be treated, with 93% seeing as critical or significant to the auto model. At the same time, there was less clarity on exactly who should be involved, with all player types considered to be definitely or potentially relevant to take a role in battery management - clearly an ecosystem challenge to solve.

Next Event:

We'll be back on February 25th at 10am CET with a webinar on: "Usership: Exploring emerging factors impacting shift from ownership to usership". With the shift towards EV also driving changes in customer usage patterns and product choices, understanding the role of usership can be a critical fact to both sales and also broader asset management. Do already register below to join us / receive the recording & materials.