Mortgages – Ready for digitization

In this article, we aim to lay a comprehensive framework to innovation covering three dimensions - business model, organizational capabilities, and value creation and delivery, that would help financial institutions achieve success in this space.

In partnership with

Infosys Finacle

Inspiring better banking across 100+ countries.

For millions of aspiring homeowners, the journey to securing their dream home begins with a simple desire—speed, convenience, and clarity in the borrowing process. As they navigate this crucial financial milestone, their expectations are higher than ever before. They want instant approvals, transparent pricing, and hassle-free experiences that fit into their digitally driven lifestyles. On the other side, emerging new breed of lenders is opening the doors for major structural changes in the mortgages space.

The global e-mortgage market is growing at a rapid pace - expanding at a CAGR of nearly 18 percent, from US$ 12.1 billion in 2024 to US$ 62.1 billion in 2034 (Source: Fact.MR). And this accelerated growth promises to roil long-standing traditional models and legacy technology.

Fintech innovators, digital-native banks, and forward-thinking traditional lenders have, to varying degrees, demonstrated the viability and importance of end-to-end digital mortgages beyond digitizing the customer touchpoints. While evolution in digital lending is inevitable, the journey to full digitization still involves hurdles due to resistance to change among banks and employees, over-reliance on obsolete technology, and a lack of alignment with the overall digital strategy.

Over and above making the most of digitization and possibilities with new technologies, innovations in business models will be imperative to make notable waves going forward. Contemporary mortgage/lending-based models developed around embedded finance, marketplaces, and digital-only propositions show the greatest potential, expected to deliver improved productivity, satisfaction, and profitability for all stakeholders involved.

As the industry prepares and adopts, it is clear that the potential returns of digital mortgages and their ability to transform lending operations have never been more promising. In this article, we aim to lay a comprehensive framework to innovation covering three dimensions - business model, organizational capabilities, and value creation and delivery, that would help financial institutions achieve success in this space.

Innovating the digital mortgage business model

Of the eight new business model archetypes featured in the latest Innovation in Retail Banking report presented by Infosys Finacle and Qorus, embedded finance, marketplaces, and digital-only propositions show the greatest potential in lending. In fact, respondents named lending among the top three areas where their partially or fully deployed transformation initiatives were delivering to expectations.

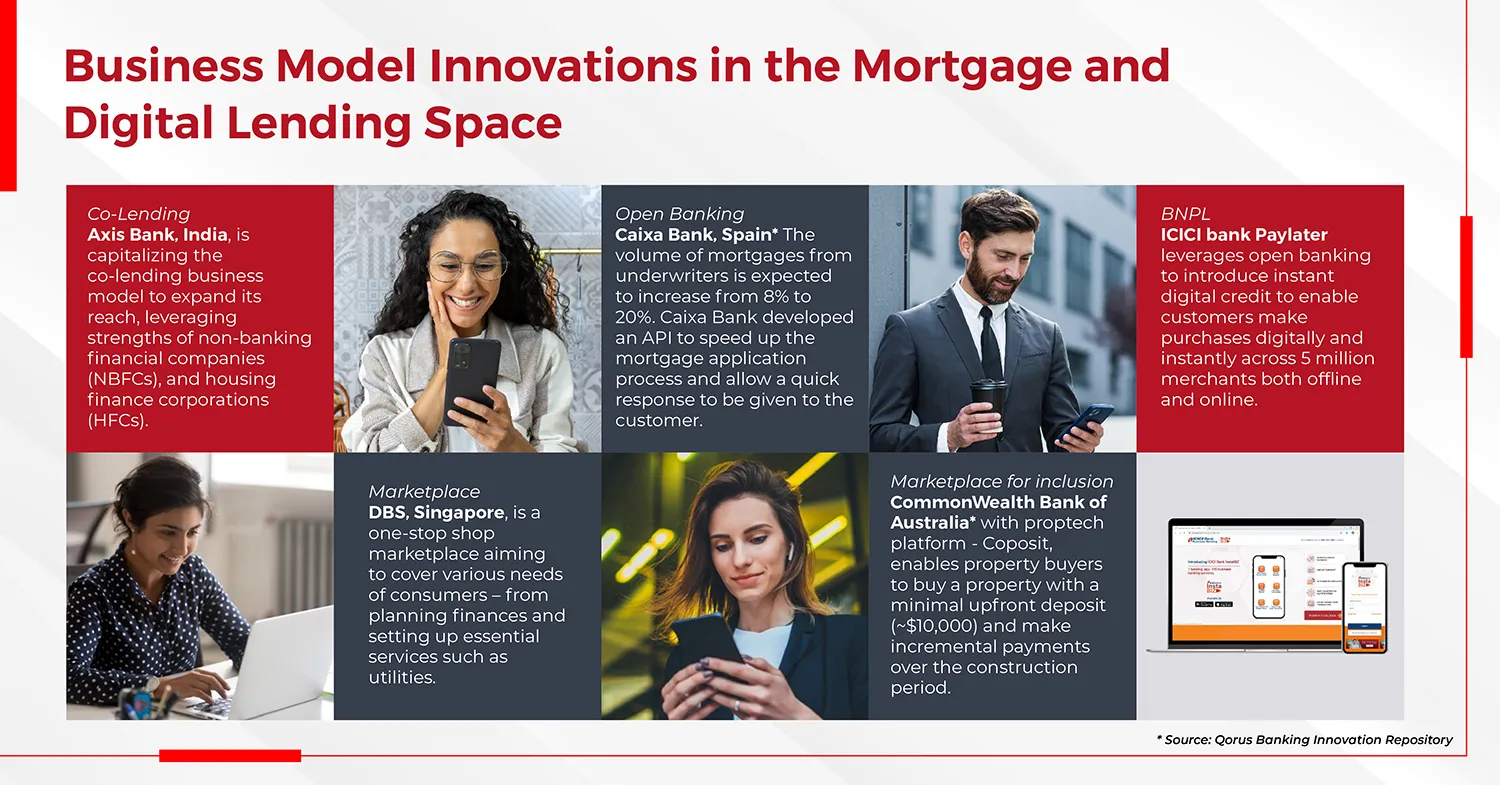

To get more reach into new customer segment, acquire customers in the primary journeys and play a larger role in the digital lives of customers, it is imperative for banks to adopt these models. Here are some of the banks that have successfully adopted innovative digital mortgage/lending models:

Axis Bank has adopted co-lending (similar to banking as a service) in partnership with non-banking financial companies (NBFCs) and housing finance corporations (HFCs). It’s a win-win arrangement where the Bank has reached “new to bank” segments to acquire nearly 100,000 customers and earn INR 5 billion in business value, and in return, is offering access to its banking license so that the partners can offer their own lending services. Other benefits to the Bank include cost-efficiencies from partner-led loan origination, servicing, and collection, and also financial inclusion.

Stater, the largest mortgage service provider in Benelux, serves banks across the region with a banking utility model. It offers a complete range of services across the mortgage and consumer lending value chain with deep capabilities in digital origination, servicing and collection. Stater services 1.7 million mortgage and insurance loans for about 50 financial institutions in the Netherlands and Belgium.

DBS Bank, Singapore, has several marketplace platforms, including one for real-estate, which helps customers search for properties, pay utility bills, assess their housing affordability, and secure a loan.

At Spain’s CaixaBank, where the volume of mortgages from underwriters is expected to go from 8 percent to 20 percent, APIs are being used to speed up mortgage applications. This has improved productivity, customer satisfaction, service experiences, resource allocation, and profitability. Also, the reduction in administrative workload is enabling staff to focus on high-value customer interactions.

Building organizational capabilities

Scaling success with technologies like AI, cloud, and APIs will be the next priority, enhancing a bank’s ability to deliver hyper-personalized, frictionless experiences at scale. AI-driven analytics provide sharper credit assessments and risk predictions, while cloud platforms offer agility, resilience, and cost efficiency. Meanwhile, APIs enable seamless integration across ecosystems, streamlining processes from application to approval and servicing, and positioning banks to meet the evolving expectations of digital-first customers.

Take for example, KBC Bank, Belgium, whose virtual assistant, Kate, offers comprehensive solutions in housing, energy and mobility including advice, installation support and financing. Today, the Bank is perceived as a pioneer in tech-driven solutions for modern living.

BankWest, Australia has created DocBox, a single, secure location in its portal for brokers enabling them to share customers’ supporting documents which are automatically scanned, checked, and indexed using artificial intelligence and machine learning. The Bank, which is considered a “broker-first” lender because of its digital capabilities, has dramatically reduced document upload time and freed up staff capacity.

Better.com leverages modern technology—especially artificial intelligence (AI), machine learning (ML), and cloud-native platforms—to transform the traditionally slow and paper-heavy mortgage process into a fast, digital-first experience.

Members of Desjardins, Canada, can get fully digital, pre-approved loans in less than 5 minutes, including counteroffers if required. This has improved customer satisfaction and loyalty, streamlined operations, and also encouraged digital adoption among members.

Transforming value creation and delivery

The digital mortgage landscape presents abundant opportunities for innovation in product creation and delivery. Banks must enhance their capabilities to rapidly design and deploy tailored solutions that cater to diverse customer segments—whether it's addressing unique life stages, responding to regional events that drive housing demand, or meeting specific lifestyle needs. Incorporating elements like gamification can further enrich the customer experience, making the mortgage process more engaging and user centric. To stay competitive, banks must strengthen their ability to co-create with partners, build flexible platforms, and empower customers to personalize offerings to suit their evolving requirements.

Some prominent examples here include Discovery Bank, South Africa, that offers an interesting shared-value home loan which, in a first for the industry, dynamically reduces interest rates for clients who proactively manage their finances. It also offers customers access to the Discovery Home Ecosystem, where they can avail benefits from green power solutions to premium home furnishing discounts. The Bank’s partnerships with providers of energy efficient home solutions are influencing customers to choose sustainable housing options.

Emirates NBD in the UAE is innovating in several ways to make home loans more attractive and convenient for customers. They offer features like MPR (Mortgage Payment Reduction) loans that reduce monthly payments, special deals with property dealers where profits are shared, mortgage insurance for better protection, and alerts for early repayments (CPR alerts) to help customers stay on top of their finances. These initiatives are aimed at making the mortgage journey smoother and more customer friendly.

Conclusion

Lenders that are still hesitating to digitize their offerings because of the challenges mentioned earlier, are not only missing out on opportunities but also losing ground to innovative competitors. A comprehensive approach to transformation, built on innovative business models, scaled organizational capabilities, and better ways of value creation and delivery, will help providers beat the challenges of digitization and embrace its opportunities.

Digital Reinvention community

With Qorus memberships, you gain access to exclusive innovation best practices and tailored matchmaking opportunities with executives who share your challenges.