Financial Innovation Spotlight – May 2025 edition

From reversing payments with a tap to tailoring services for retirees, banks across Europe are rethinking what it means to serve customers in a digital-first world.

From reversing payments with a tap to tailoring services for retirees, banks across Europe are rethinking what it means to serve customers in a digital-first world. These five new features – from real-time mortgage checks to ESG-driven investments – show how financial institutions are stepping up with smarter tools, greater transparency and a more personalized touch. Here's a look at what's new – and what’s next – in banking innovation.

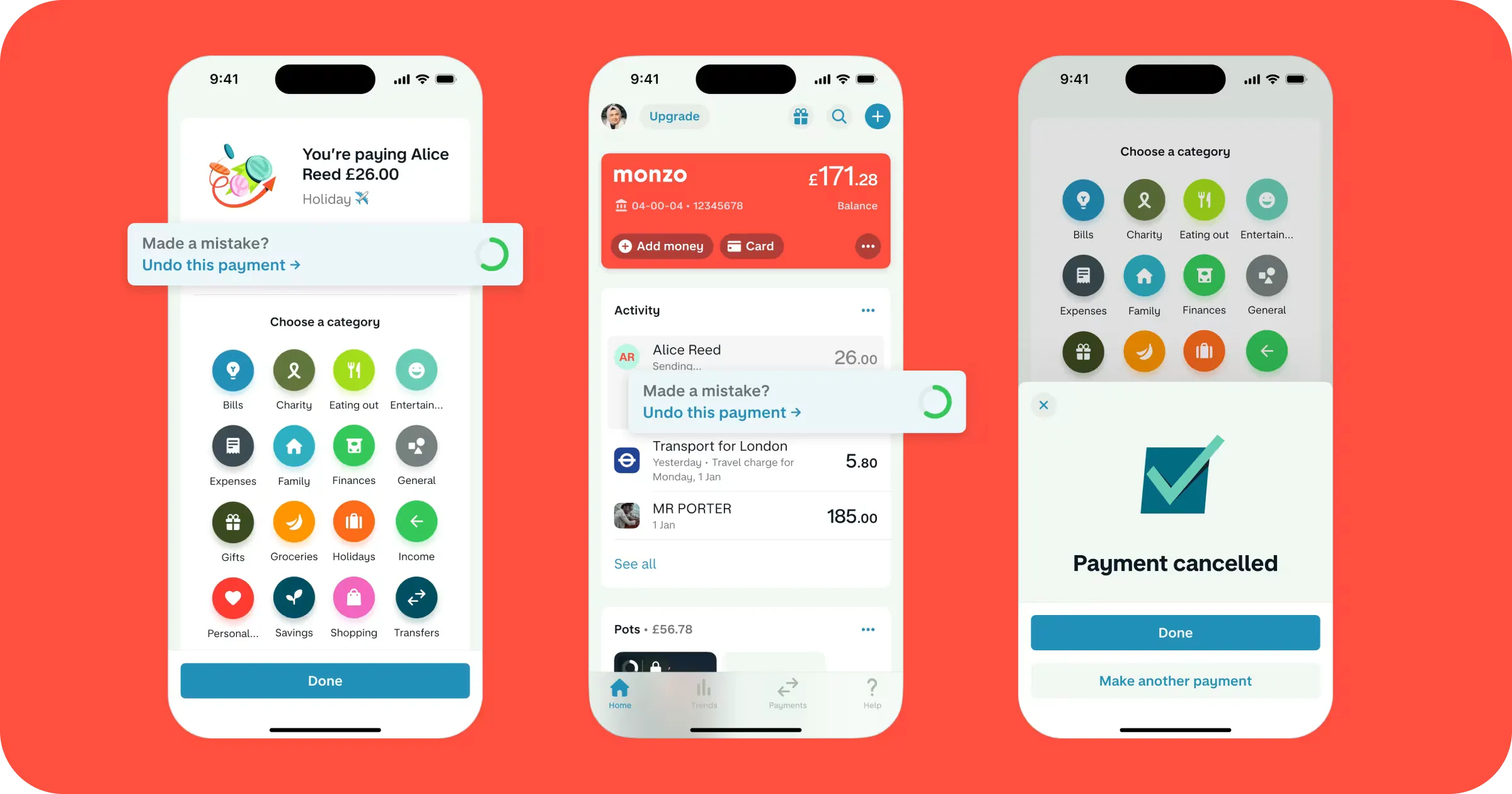

‘Undo payment’ feature

UK digital bank Monzo has introduced a new feature that allows customers to undo a payment shortly after sending it – making it the first bank to offer this kind of control.

Who?

Monzo is a UK-based digital bank, founded in 2015 as one of the first app-based challenger banks. Since becoming a regulated bank in 2016, it has grown to serve over 12 million personal and business customers, supported by a team of 3,700+ employees working from London and across the globe.

Why?

According to Moneyhub, 1 in 10 people in the UK have sent money to the wrong person – often a stressful and hard-to-fix mistake. Monzo’s new feature helps users quickly correct payment errors, making everyday banking less stressful.

How?

By default, Monzo provides a 15-second window to cancel a payment, adjustable to 10, 30 or 60 seconds in the app’s privacy & security settings. If ‘Undo payment’ is tapped within the time limit, the money remains in the account and the intended recipient is never notified. The feature is entirely optional and can be turned off for those who prefer instant payments.

A banking & lifestyle package for seniors

CaixaBank has launched Generation +, a comprehensive range of products and services aimed at addressing the financial and lifestyle needs of Spain’s growing population of retirees.

Who?

With 20.2 million customers, more than 45k employees and 4,130 branches, CaixaBank is one of the leading banks in Spain, with a significant presence in other European countries and a growing international footprint.

Why?

With over 12 million Spaniards aged 60 or older – a figure expected to grow sharply by 2030 – CaixaBank’s 2025–2027 Strategic Plan targets this key demographic, which now holds nearly 40% of the country’s net wealth, by developing new strategies around retirement, health and daily living.

How?

Generation+ is CaixaBank’s dedicated offering for retirees, combining financial tools and everyday services to support a smooth transition into retirement. It includes tailored advice, annuities, senior protection insurance, and investment solutions from CaixaBank Asset Management.

The program also offers equity release options like reverse mortgages and the sale of bare ownership with lifelong use of property. Beyond finance, a growing service marketplace provides help with domestic tasks, mobility, home adaptations and opportunities for learning or volunteering – addressing all aspects of post-retirement life.

ESG-based investment segmentation

La Banque Postale is rolling out a new segmentation for its financial savings products, aligned with environmental, social and governance (ESG) criteria.

Who?

La Banque Postale is France's postal bank, offering a range of services including retail banking, insurance and asset management, all aimed at meeting the needs of a diverse customer base. With 20 million active customers, 338,500 corporate and local public-sector clients and 30,400 employees, the bank is dedicated to making banking accessible to all.

Why?

ESG is now central to financial advice, going beyond compliance to reflect client expectations and the bank’s mission-driven values. By offering clearer, more transparent options, the bank enables clients to align their savings with environmental and social goals.

How?

La Banque Postale is introducing an ESG-based segmentation of its savings products to make responsible investing more accessible. The offering is structured into three tiers, each reflecting a growing level of ESG commitment:

• Level 1 excludes companies in controversial sectors like tobacco, chemical weapons, high-impact fossil fuels, deforestation and human rights violations.

• Level 2 adds positive selection for companies with strong ESG practices and excludes fossil fuel firms not transitioning to cleaner models.

• Level 3 focuses on high-impact investments that directly support environmental and social goals, such as renewable energy, sustainable mobility, healthcare, education and biodiversity.

A lifestyle premium account

Lloyds Bank has introduced its new Premier account, designed for individuals with higher incomes or significant assets. It combines traditional banking with a wide range of financial and lifestyle services, offering a more comprehensive and tailored experience.

Who?

Lloyds Bank is one of the UK’s largest and most established financial institutions, with a history dating back to 1765. It offers a wide range of personal, business and corporate banking services. The Lloyds Bank Group – which also includes brands like Halifax and Bank of Scotland – has over 27 million customers and 63,000+ employees.

Why?

Lloyds Bank aims to establish a strong position in the UK market among affluent and mass affluent clients – a profitable segment – by offering a modern, lifestyle-oriented proposition that goes beyond traditional banking.

How?

Lloyds Bank’s new Premier account combines financial benefits with lifestyle and wellness services. It includes savings and mortgage perks, access to financial coaching, and digital tools like a Net Worth Calculator and Wealth Forecasting.

A key feature is a Bupa Family GP & Wellbeing subscription, offering remote access to healthcare professionals, including mental health and physiotherapy support. Customers also enjoy lifestyle perks such as a Disney+ subscription, cinema tickets or a Gourmet Society membership, plus fee-free spending abroad, a £100 interest-free overdraft, and no investment management fees for the first year.

Real-time property lending check

Nationwide has launched a new digital feature that offers potential buyers a real-time assessment of whether a specific property is likely to qualify for a mortgage – before they even book a viewing.

Who?

With over 16 million members, Nationwide is the largest building society in the UK. It offers a wide range of retail financial services and products, including mortgages, credit cards, personal loans and insurance. Approximately 75% of Nationwide’s funding comes from members, and over 95% of its lending is secured by residential properties.

Why?

With average home sales in the UK still taking over five months to complete, the need for greater efficiency has become more pressing. The new feature is part of Nationwide’s broader effort to simplify and modernize the mortgage experience.

How?

Nationwide’s new smart new property lending check gives homebuyers real-time insight into how likely they are to get a mortgage on a specific property – before a viewing and well ahead of making an offer. The digital tool evaluates key risks that could impact lending, such as flood risk or short lease lengths, helping buyers make more informed decisions earlier in their search. It's all about boosting confidence and cutting uncertainty from the very start of the homebuying journey.

Digital Reinvention community

With Qorus memberships, you gain access to exclusive innovation best practices and tailored matchmaking opportunities with executives who share your challenges.