Financial Innovation Spotlight: May 2024 edition

We have selected five new innovative projects that we found particularly interesting. A world tour that takes in France with insurer MAAF and its use of video games to promote road safety; Australia, where bank NAB is offering a year's cyber defense to its SME clientele, while insurer Allianz Partners is chatting with travel insurance customers of its partner HCF; the United States with insurer HSB developing a cyber insurance offer for vehicles; and finally Canada, where Scotiabank talks finance to its customers with a more empathic approach.

When it comes to financial services, banks, insurance companies and fintechs are vying with each other to meet the sometimes-new needs of their customers. The aim: to renew themselves, stand out from the competition, improve the customer experience and journey, and even create new sources of revenue.

We have selected five new innovative projects that we found particularly interesting. A world tour that takes in France with insurer MAAF and its use of video games to promote road safety; Australia, where bank NAB is offering a year's cyber defense to its SME clientele, while insurer Allianz Partners is chatting with travel insurance customers of its partner HCF; the United States with insurer HSB developing a cyber insurance offer for vehicles; and finally Canada, where Scotiabank talks finance to its customers with a more empathic approach.

Road safety promotion with a video game

French insurance company MAAF Assurances has selected Fortnite, one of the world's largest online gaming communities, to raise awareness among young people about road safety. With Home Run, MAAF aims to offer young gamers a unique and entertaining experience while teaching them essential driving skills.

Who?

A brand of the Covéa Group, MAAF is one of the leading general insurers in France. It offers its 3.8 million members and customers comprehensive insurance solutions (auto, home, professional risks, health, life insurance, and more) and high-value-added services (assistance, loans, etc.). Alongside artisans since its inception, MAAF now has over 790,000 professional clients.

Why?

Preventing road accidents is a top priority for MAAF, especially among young adults aged 18-24, who are disproportionately affected. In 2023 alone, over 500 young people lost their lives in road accidents in France, making it the leading cause of mortality in this age group.

How?

From an invitation to go to the bar with friends to returning home, players will be led through an adventure full of challenges and obstacles, with the sole objective of getting home safely. It's a fun and entertaining adventure designed to test their reflexes, analytical skills and ability to make the right decisions – but above all, it serves as a reminder that in real life, there are no second chances!

Fortnite is known for developing players' visual and spatial attention, as well as their problem-solving abilities. Players will have a central role in the experience: their choices will have a direct and significant impact on the final score. The various hazards they encounter along the way, as well as traffic jams and the effects of substance consumption, will make them realize that the car is not always the safest mode of transportation, and that alternative means should be preferred to avoid putting their lives in danger. To guide players in their choices, prevention and explanation screens will be integrated into the experience. This is a way for players to directly assimilate prevention messages through gameplay.

Free cyber defense for SMEs

National Australia Bank (NAB) is encouraging small businesses to enhance their cybersecurity. To support this effort, they are offering a year of free cybersecurity software to business customers.

Who?

National Australia Bank is one of the four largest financial institutions in Australia in terms of market capitalization, earnings and customer base. NAB is also Australia’s largest business bank.

Why?

A study by NAB late last year revealed that SMEs are among the least prepared sectors when it comes to cybersecurity. The research found that only 15% of SMEs provide extensive training on scams and cybersecurity risks, while four in 10 had "not much training at all".

How?

To help businesses enhance their cybersecurity measures, NAB, in collaboration with the global cybersecurity firm CrowdStrike, is offering eligible small business customers a free one-year subscription to CrowdStrike Falcon Go. This initiative aims to support and strengthen SME defenses against ransomware, data breaches and cyber threats. In partnership with CrowdStrike, NAB will cover the AU$ 450 annual cost of the cybersecurity software subscription for eligible small business customers for one year and offer a 15% discount thereafter. In addition to the software offer, NAB's efforts to help its small business customers stay safe online also include a free cybersecurity assessment in partnership with Microsoft.

Instant online chat for travel insurance customers

Allianz Partners Australia has taken a significant stride in revolutionizing customer service for customers of its travel insurance partner HCF, with the introduction of an advanced online chat feature. Designed to provide real-time assistance, this innovative chat platform is set to redefine the way customers interact with their travel insurance provider.

Who?

Allianz Partners is a world leader in B2B2C insurance and assistance, offering global solutions that span international health and life, travel insurance, automotive and assistance.

Why?

The need for advice, information or assistance when traveling abroad can be very stressful in an age when customers are accustomed to immediacy.

How?

The chat service is available Monday to Saturday via HCF's travel insurance website. While all chats are currently handled by live human agents, artificial intelligence capabilities are being developed. The incorporation of AI will allow frequently asked questions and common service requests to be managed automatically 24/7 through a virtual assistant.

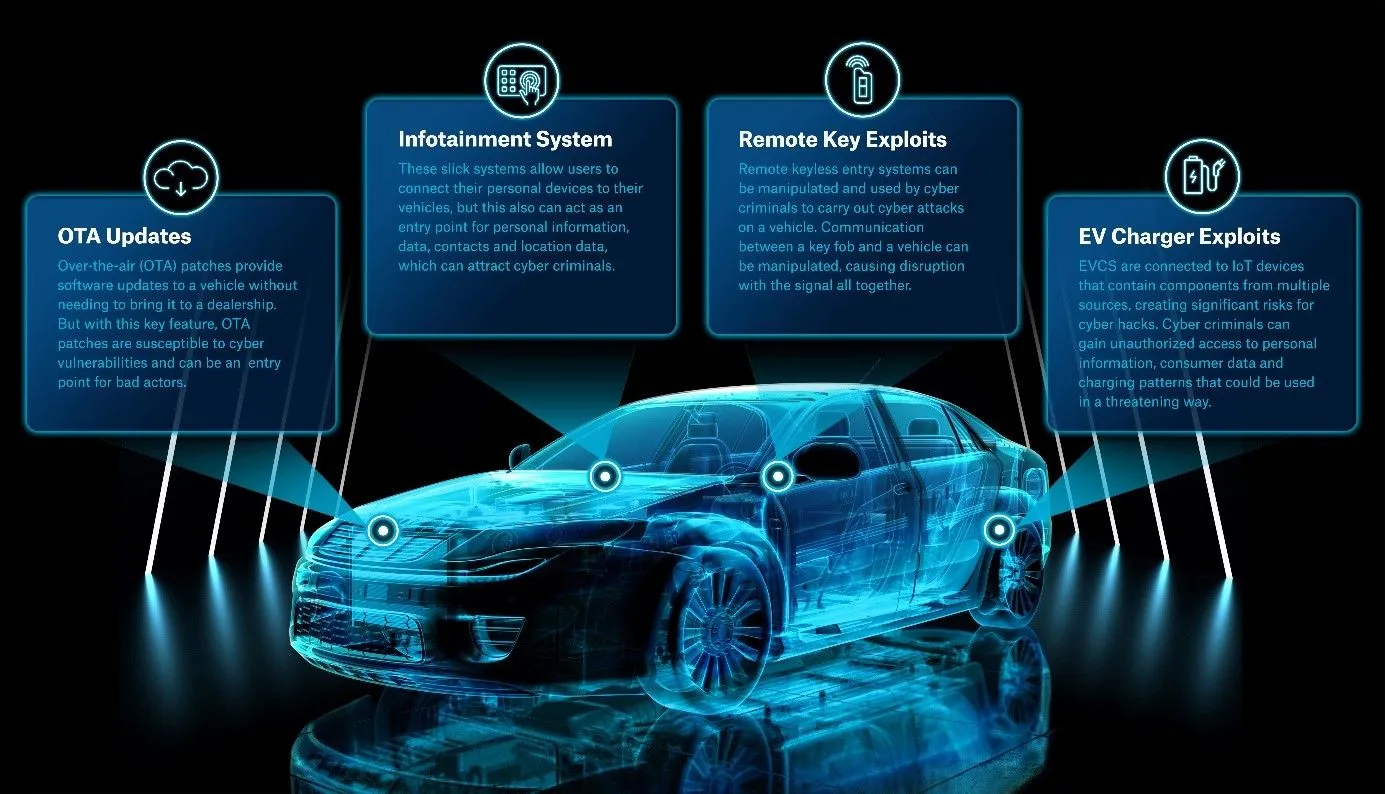

Cyber insurance for vehicles

HSB, a specialty insurer in the US, has introduced Cyber for Auto, a new insurance product aimed at protecting vehicle owners from cyber threats. With the increasing integration of technology in automobiles, such as sensors and connected systems, the risk of cyber attacks rises. Cyber for Auto is designed to safeguard personal data stored in vehicles and connected to cloud-based and wireless networks.

Who?

HSB, part of Munich Re, is a multi-line specialty insurer and provider of inspection, risk management, and IoT technology services. HSB insurance offerings include equipment breakdown, cyber risk, and specialty liability, among others.

Why?

Passenger vehicles built after 2020, and many older models, have sensors, computers and other connected technology, making them potential targets for cyber attacks. When drivers connect their smartphones with their vehicles, they could expose their personal data and connected technology to hackers and other cybercriminals, leaving them vulnerable to cyber attacks, online extortion and identity theft.

How?

Specialty insurer HSB is helping consumers respond with Cyber for Auto, a new insurance product protecting automobile owners against cyber attacks. HSB’s unique coverage helps safeguard private information stored in personal vehicles and connected to cloud-based and wireless communication networks.

Core coverage can include cyber attacks, including malware and viruses, and ransomware demands to release information or threats to make confidential data public. Identity recovery coverage and services are not limited to information stored in the vehicle but can apply any time personally identifying information has been compromised. Additional benefits can include payment for towing, labor and temporary transportation charges while affected auto systems are restored.

A tool for improved financial conversations

Canadian bank Scotiabank has introduced Money Style, an online tool available through Scotia Advice+, aimed at fostering empathy and emotional intelligence in financial discussions.

Who?

The Bank of Nova Scotia, commonly referred to as Scotiabank, is Canada’s third largest chartered bank. Incorporated in 1832, the bank has established itself as Canada’s most international bank through extensive operations throughout Latin America, the Caribbean, Central America, and parts of Asia.

Why?

Money is a common trigger in personal relationships, often leading to conflicts.

According to a recent survey by Scotiabank, nearly half of Canadians say arguing about money is adding stress to their lives, with 47% having had the same argument about money with loved ones more than once.

How?

To help Canadians break through these communication barriers, Scotiabank created Money Style, an online tool that helps build financial literacy with a focus on empathy and emotional intelligence in relation to money. Drawing on real-world scenarios, Money Style explores the basic universal needs that may lie behind a person's actions, outlooks and behaviors in money situations. By taking the 15-question quiz, people will learn their dominant Money Style and how it manifests in everyday situations.

Stay ahead with the latest innovations in financial services

Digital Reinvention community

With Qorus memberships, you gain access to exclusive innovation best practices and tailored matchmaking opportunities with executives who share your challenges.