Innovation Masters: Bold banks take the lead in breaking down barriers to financial accessibility

Innovation Masters, banks that are developing innovative solutions to the industry’s most pressing challenges, are making their products and services more accessible to people with disabilities.

Innovation Masters, banks that are developing innovative solutions to the industry’s most pressing challenges, are making their products and services more accessible to people with disabilities.

Forward-thinking banks are standing out from their competitors by developing innovative solutions that enable people with disabilities to more easily access their products and services. These Innovation Masters are harnessing new technologies, collaborating with advocacy groups and gathering insights from employees to remove barriers to financial inclusion and deliver more equitable user experiences.

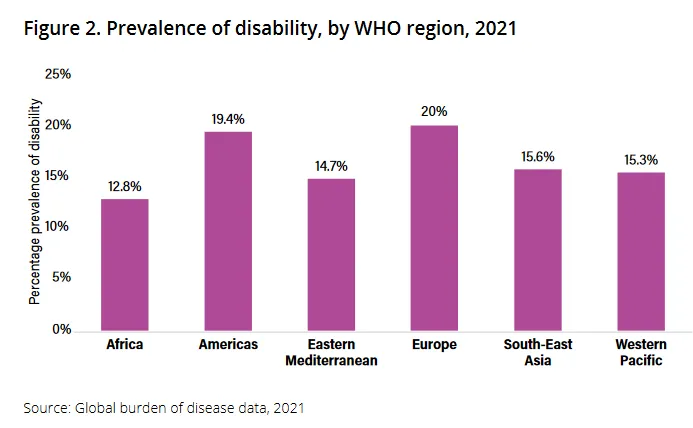

Close to 1.3 billion people have a significant disability, according to the World Health Organization. That’s around 16% of the world’s population – one in six people. And many of them have limited or no access to banking services because of their disability.

Four Innovation Masters have stepped out and committed their organizations to improving the accessibility of their products and services. They’ve developed innovative solutions that have overcome long-standing barriers to financial inclusion. Each of their impressive innovations has been submitted for Qorus Banking Innovation Awards.

Union Bank of India

Union Bank of India has embarked on an extensive program to ensure that people with disabilities as well as senior citizens can access the company’s products and services. It has launched new products, enhanced its digital platforms, created specialized customer support teams and provided its staff with accessibility training and resources.

New products introduced by Union Bank of India include a Braille-embossed debit card and a voice-activated mobile app. The company has boosted the accessibility of its digital platforms by incorporating screen reader compatibility, keyboard navigation, and high-contrast modes into its mobile app and internet banking user interfaces. It has introduced a dedicated email channel, alongside specialized telephone and branch customer services, to support clients who have disabilities or who are elderly. And employees at Union Bank of India now have access to webinar and workshop training that help them better understand and serve clients with disabilities. Furthermore, the bank is issuing its customer service staff with user guides in Braille, large font, and audio formats.

Launched in May 2022, the “Union Access” program is part of the bank’s drive to promote social equity and economic inclusion. Union Bank of India aims to provide all its customers with equitable access to financial services. Read the full case study

Alternatif Bank

Alternatif Bank, in Turkey, has been making its products and services more accessible to people with disabilities for close to five years. The company is committed to ensuring that its offerings are equally available to all its clients. It advocates such accessibility throughout the local banking industry.

One of the bank’s recent innovations is an accessible glossary of banking terms for customers whose hearing is impaired. The Accessible Banking Terms Glossary uses sign language, audio descriptions, and simplified texts to describe more than 100 words and expressions customers may encounter when engaging with a bank.

Alternatif Bank recognized that a lack of understanding of financial terminology was inhibiting people who are hearing-impaired, as well as those who are elderly or are without financial knowledge, from accessing banking products and services. The bank developed the Accessible Banking Terms Glossary with a team of sign-language experts, academics, and NGO representatives. The glossary initially comprised 25 words phrases and was later extended, with support from the Development Facility of the European Fund for Southeast Europe, to more than 100.

The idea for the Accessible Banking Terms Glossary emerged from one of the “ideathon” events staged by Alternatif Bank. The bank holds regular ideathon and hackathon events at which undergraduates are introduced to a rights-based approach to people with disabilities and encouraged to develop innovations that address their needs. Read the full case study

ICBC Argentina

ICBC Argentina, a subsidiary of the Industrial and Commercial Bank of China, teamed up with local nonprofit En Buenas Manos to improve the accessibility of the company’s products and services.

The bank contracted En Buenas Manos to instruct its staff in sign language so they could better assist customers who are hearing impaired. More than 100 staff at ICBC Argentina received Argentine Sign Language training that was delivered by video communications during 12 sessions in 2020 and 2021.

ICBC Argentina aims to have at least one person trained in sign language, who is able to understand and serve deaf customers, at each of its more than 100 branches.

Founded in 2011, En Buenas Manos (In Good Hands) develops self-sustaining projects run by people with disabilities. Its services include catering, food deliveries, massage and the digitalization of records as well as sign language instruction. The organization strives to overcome resistance to the hiring of people with disabilities while also enhancing the autonomy and quality of life of its workforce.

ICBC Argentina has also launched a x2 inclusivity program, together with the Baccigalupo Foundation, which encourages bank employees to exercise with athletes who have intellectual disabilities. The Baccigalupo Foundation uses sport to improve the quality of life experienced by young people with intellectual disabilities and to promote their inclusion into society. Read the full case study

Taipei Fubon Bank

Taipei Fubon Bank in Hong Kong has recognized the important role of product and service accessibility in corporate social sustainability. It has launched a program, that strives to provide people with disabilities with equal access to its financial services. Key to the “Friendly Financial Services for People with Disabilities” program is the bank’s co-operation with other companies and organizations.

The Taipei Fubon Bank accessibility program meets the standards set by the United Nations (UN) Convention on the Rights of Persons with Disabilities (CRPD). It also supports the UN’s Sustainable Development Goals (SDGs) that foster social inclusion by removing barriers to accessibility and promoting the financial equality. Read the full case study

Driving the quest for more equitable and accessible banking are six powerful forces

Regulatory compliance: International and local laws are forcing banks, as well as companies in other industries, to make their services available to all people. The new European Accessibility Act, for example, requires businesses such as banks to ensure their products and services are accessible for people with disabilities. The act, which comes in force next year, is in line with the EU’s support for the United Nations Convention on the Rights of Persons with Disabilities. Local legislation, such as the Americans with Disabilities Act (ADA) in the US and Rights of Persons with Disability (RPWD) Act in India are adding further impetus to the opening of banking services to all customers.

Social responsibility: Banks like many other organizations are increasing their commitment to corporate social responsibility (CSR) and environmental social and governance (ESG) initiatives that promote equity and inclusion in the societies they serve. Financial institutions that are addressing the social component of ESG tend to outperform competitors, according to consulting firm BCG.

Public reputation: Banks, especially retail operators, frequently promote themselves as positive contributors to society through their provision of capital, expertise and employment. Giving people with disabilities better access to their products and service elevates a bank’s standing among consumers and builds brand loyalty. UK bank Barclays, for instance, points out that accessibility can not only strengthen a company’s reputation it can also mitigate risk, improve customer experience and increase employee productivity.

Market opportunity: The removal of barriers that previously excluded many people from accessing banking services gives financial institutions an opportunity to secure large numbers of new customers. Advocacy group Purple, for example, estimates that banks and building societies in the UK are losing around £935 million (€1.09 billion) a month because they fail to adequately meet the needs of consumers with disabilities.

Advances in technology: Improvements in technology, particularly in AI and voice recognition technologies, are enabling banks to develop products and platforms that are far more accessible than in the past. Screen readers, voice-activated applications and AI-assisted services, for example, are increasingly common.

Growing collaboration: A growing number of fintechs, NGOs and advocacy groups are providing banks with the technology, knowledge, and resources they need to improve the accessibility of their products and services. The emergence of Open Banking, in particular, has quickened technology collaboration.

Innovation Awards Hub community

With Qorus memberships, you gain access to exclusive innovation best practices and tailored matchmaking opportunities with executives who share your challenges.