Financial Innovation Spotlight: August 2024 edition

In this fourth edition of the Financial Innovation Spotlight, we showcase five new projects that caught our eye in the past month.

Banks, insurance companies and fintechs must continually adapt and innovate to meet the rapidly changing needs of their customers. Successful players in this dynamic arena offer exceptional customer experiences that set them apart from competitors, whether enhancing existing services or tapping into new sources of revenue.

In this fourth edition of the Financial Innovation Spotlight, we showcase five new projects that caught our eye in the past month. This global innovation journey begins in France, where Solly Azar offers a family health insurance plan covering people and pets. Then we head to Germany, where the European Payments Initiative (EPI) has launched Wero, a cutting-edge digital payment wallet, with expansion to other European countries already under way. In Spain, CaixaBank has not forgotten the self-employed, who are often in difficulty when retirement arrives, offering them a dedicated savings plan. Meanwhile, N26 customers across Europe can now take out car subscriptions with a significant discount via the bank’s app. And in Australia, Commonwealth Bank offers travel booking services for more than 6 million customers through its mobile app and website.

Family health insurance plan covering people and pets

French insurance broker Solly Azar is innovating by offering the first health insurance plan that covers the medical expenses of the entire family, including dogs and cats.

Who?

Solly Azar is a wholesale broker that designs, distributes and manages property and casualty insurance as well as personal insurance, catering to both individual and professional clients. Solly Azar is also a recognized player in the rental risk insurance market. With products distributed through a network of 10,000 intermediaries, the company generates €50.6 million in revenue. It is a wholly-owned subsidiary of Verspieren, the leading independent French brokerage firm.

Why?

France is home to some 22.6 million dogs and cats, with more than half of French households (52%) owning at least one pet – yet less than 8% have pet insurance. Although solutions exist to insure pets, the French have not yet adopted this habit as widely as some other European countries.

How?

Solly Azar has created a unique and unprecedented subscription process, offering coverage for all family members, including dogs and cats, with the ‘Family Vet’ option, starting at just €3.90 per month. The coverage offered is comprehensive, including routine care and hospitalization, with limits up to €2,200 per year.

As Solly Azar celebrates 40 years of providing pet insurance, the company is working to change mindsets so that every owner considers insuring their pet from a young age, ensuring they are well covered throughout their lives. By including pets as members of the family, this innovative new offering both reinforces the importance of pet insurance and simplifies the process of obtaining coverage.

A sovereign payment solution for consumers across Europe

The European Payments Initiative (EPI) has launched Wero, a cutting-edge digital payment wallet, in Germany, Belgium and France, with further rollouts to come soon.

Who?

The EPI was formed in 2020 by 16 banks and financial service companies, with the aim to revolutionize digital payments in Europe by offering a consistent solution across all major retail scenarios, including peer-to-peer (P2P), point of sale (POS) and online commerce.

Why?

This initiative aligns with Europe’s push towards instant payments, echoing calls from European authorities for banks and payment providers to develop an independent, alternative payment system based on instant payment schemes.

How?

The EPI launched its digital payment wallet Wero in Germany in early July. This service is a collaboration with founding members DSGV and DZ Bank, with Deutsche Bank set to join later this year. German customers can now enjoy instant, account-to-account money transfers through their banking applications.

Wero’s first feature is person-to-person transactions, enabling users to send and receive money within 10 seconds using just a phone number, email address, or an app-generated QR code. This service eliminates the need for intermediary accounts, making transfers seamless and instantaneous.

Following the German launch, Wero was introduced in Belgium for KBC customers at the end of July, and the rollout in France is now under way with Société Générale customers the first to benefit. All EPI bank members will adopt Wero within the next six months.

A retirement savings plan dedicated to the self-employed

CaixaBank has introduced the ‘MyBox Retirement Self-Employed’ service, a new offering tailored specifically for self-employed individuals.

Who?

CaixaBank is a Spanish financial services company. It is Spain's third-largest lender by market value and has the most extensive branch network in the Spanish market, with 5,397 branches serving its 15.8 million customers.

Why?

According to data from the National Statistics Institute, Spain has more than 3 million self-employed individuals, whose average retirement pension comes to €959 per month, whereas other employees enjoy an average retirement pension of €1,597. The aim of this service is to reduce the financial risk faced by self-employed workers during their retirement and help with their financial planning.

How?

CaixaBank's ‘MyBox Retirement Self-Employed’ aims to reduce financial risk during retirement by setting a target capital based on each customer's age and income. Monthly savings plans are then established to meet this target, leveraging tax-advantaged pension plans, liquid unit-linked insurance, and personal and family life insurance.

Key features:

• encouraging regular savings to mitigate market volatility

• significant tax breaks

• liquidity for emergencies

• protection in cases of total permanent disability or death.

Customers can monitor their savings, earn loyalty rewards and adapt their plans annually to suit changing needs.

Offering discounted car subscriptions via banking app

Leading European mobile bank N26 has teamed up with car subscription company Bipi to offer subscriptions directly through the bank’s app, with a substantial €400 discount for customers when they pay with their N26 card.

Who?

N26 is Europe’s leading digital bank with a full German banking license. It offers simple, secure and customer-friendly mobile banking to millions of customers in 24 markets across Europe. N26 processes over €100 billion in transactions a year and currently has a 1,500-strong team of more than 80 nationalities.

Why?

The inclusion of Bipi in the N26 app’s Perks section enhances the app's value proposition by providing users with a practical and economical transportation solution. This offer also gives the bank's customers the opportunity to reduce their carbon footprint.

How?

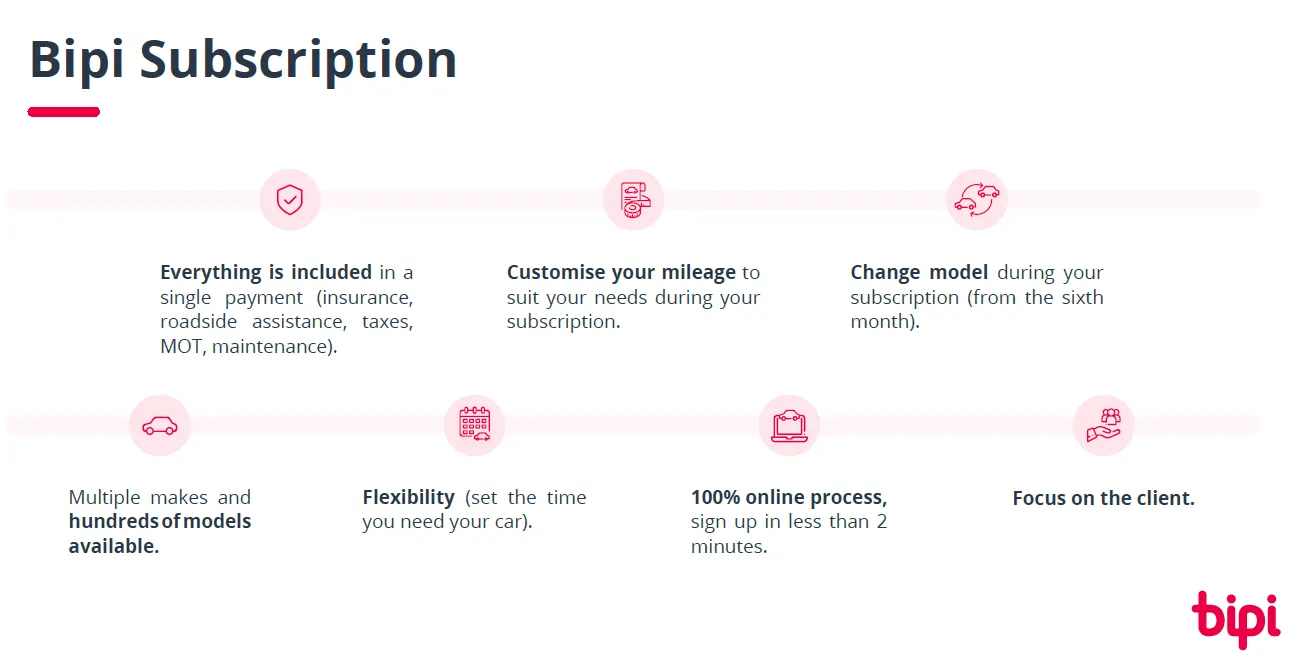

N26 has integrated Bipi into the Perks section of its app, offering customers a €400 discount on car subscriptions when they pay with their N26 card. This collaboration marks a significant step in expanding N26’s customer benefits and highlights the growing trend of flexible car ownership solutions.

Bipi, acquired by Mobilize Financial Services, distinguishes itself by offering a fully digital experience and complete flexibility. Customers can choose their subscription duration, ranging from one to 36 months, and have the option to switch car models at any time. This flexibility is particularly beneficial for users whose needs may change over time, such as families who might need to upgrade from a small car to an SUV.

A travel booking service via banking app

Commonwealth Bank has launched a travel booking service through its mobile app. This service, powered by global online travel agency Hopper, aims to streamline travel planning, booking and payment processes for over 6 million eligible customers.

Who?

Commonwealth Bank of Australia (CBA/Commbank) is an Australia-based bank that focuses on providing retail and commercial banking services predominantly in Australia. It serves approximately 17 million customers. The company's segments include retail banking services, business banking, institutional banking and markets.

Why?

Travel is important to CBA's customers. The latest CommBank iQ Cost of Living Insights Report shows an uptick in expenditure on travel experiences – spending was up 4% in the past year, boosted by a 16% annual lift in spending on online travel bookings. Travel is also the most popular type of savings goal customers set in the CommBank app.

How?

This service, powered by global online travel agency Hopper, aims to streamline travel planning, booking and payment processes for over 6 million eligible customers.

Available on the CommBank app and NetBank website, the travel booking service enables customers to search, book and pay for flights and hotels from hundreds of airlines and hundreds of thousands of hotels. The service is integrated with CBA's customer recognition program, CommBank Yello, and credit card awards program, allowing users to further reduce out-of-pocket travel expenses.

The CommBank-Hopper collaboration brings innovative travel features including:

• Price prediction: Algorithms analyze millions of data points daily to predict future flight prices, helping customers decide whether to book now or wait.

• Auto price drop: Automatically refunds the price difference if a booked flight price drops within 10 days of purchase.

• Price watch: Monitors flight prices 24/7 and notifies customers of good deals.

• Best price guarantee: Offers a travel credit if a cheaper flight is found within 24 hours of booking.

Stay ahead with the latest innovations in financial services

Digital Reinvention community

With Qorus memberships, you gain access to exclusive innovation best practices and tailored matchmaking opportunities with executives who share your challenges.