Financial Innovation Spotlight: September 2024 edition

In this fifth edition of the Financial Innovation Spotlight, we showcase five new projects that caught our eye in the past month.

Banks, insurance companies and fintechs are in a constant race to meet the ever-evolving needs of their customers. The goal is to innovate, distinguish themselves from competitors, enhance the customer experience and journey, and even uncover new revenue streams.

In this fifth edition of the Financial Innovation Spotlight, we’ve handpicked five new projects that caught our attention over the past month. It’s a global journey that begins in France, where fintech epargnoo offers life insurance based on a community model. Next stop: the UK, where building society Nationwide is offering dementia clinics in some of its branches, and Santander has launched a campaign featuring deepfake videos to raise awareness about AI scam risks. Then we head to India, showcasing DBS Bank’s new tailor-made priority program for seniors. Finally, in the US, Ally has created a financial wellness program focused on money psychology.

Life insurance based on a community model

Epargnoo offers savers the opportunity to design their ideal savings product, with the launch of the first community life insurance.

Who?

Launched in November 2023, the French fintech company epargnoo is a marketplace that brings together all savings products and special offers on a single platform, supported by the experience of a community. The fintech’s goal is to democratize saving by putting investors' interests at the heart of its strategy. Epargnoo already lists more than a hundred savings products and aims to reference over 500 products within a year and more than 5,000 within five years.

Why?

To promote a more transparent savings management system, tailored to the expectations of savers. The goal is to allow them to actively participate in managing their savings by involving them in the design process of a savings product.

How?

Epargnoo offers life insurance based on a community model. By voting each quarter to determine asset allocation across multiple categories, such as euro funds, money markets, bonds, unlisted real estate, stocks and private equity, this participatory approach gives savers a direct role in managing their savings by involving them in the design process of a savings product that will be available on the platform.

The voting and discussion process on the epargnoo platform ensures complete transparency: members can not only vote but also discuss and share the reasons for their choices.

The asset allocation is reviewed and adjusted every quarter based on members' votes. This flexibility allows for quick responses to market changes and new investment trends, providing dynamic management of this life insurance product.

Offering dementia clinics at bank branches

Nationwide is set to launch a pilot program offering dementia clinics at branches across Wiltshire, with plans to expand throughout the UK.

Who?

Nationwide is the largest building society in the UK, offering a wide range of retail financial services and products, including mortgages, credit cards, personal loans and insurance. Approximately 75% of their funding comes from customers, and over 95% of their lending is secured by residential properties.

Why?

Currently, around one million people in the UK live with dementia, and that number is projected to rise to 1.6 million by 2040. The annual cost to the UK economy is expected to reach £90 billion by the same year. Nationwide aims to help people live their best lives for as long as possible and address dementia, the country’s leading cause of death.

How?

Nationwide will use its network of branches to offer specialized dementia clinics aimed at addressing the disease. This initiative will help over 100,000 people living with dementia across 200 branches.

Free clinic appointments will be available at set dates for anyone affected by dementia, including family members and caregivers. These services will also be offered to non-Nationwide customers.

In-branch dementia services will provide both health and financial support, including help in understanding a dementia diagnosis, addressing concerns about symptoms, guidance on how to care for someone with dementia, and advice on financial, legal and emotional issues.

Using deepfakes to raise awareness of AI scam risks

Santander UK has launched a new campaign featuring deepfake videos to warn the public about the growing threat of AI-driven scams.

Who?

Santander UK is a British bank wholly owned by the Spanish Santander Group. It is one of the leading personal financial services companies in the United Kingdom and one of the largest providers of mortgages and savings. The bank employs around 20,000 people, serves 14 million active customers, and operates 64 corporate business centers.

Why?

New data reveals that over half of Brits (53%) have either never heard of the term ‘deepfake’ or misunderstand its meaning, with only 17% confident in their ability to identify a deepfake video. Additionally, more than half (54%) of Brits are concerned about deepfakes being used for fraud, and 51% fear that a family member could fall victim to a deepfake scam.

How?

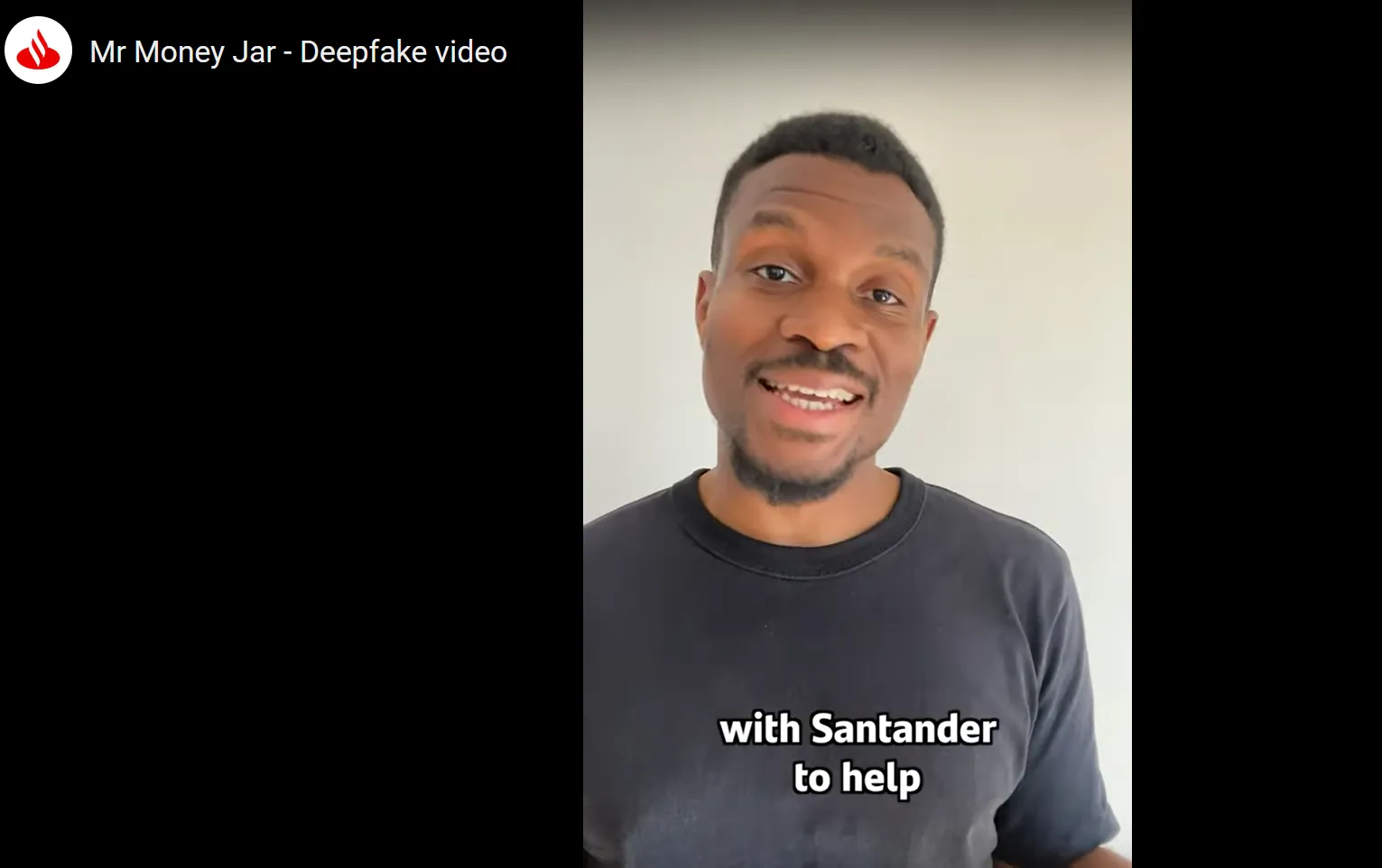

Santander has partnered with ‘finfluencer’ Mr. Money Jar to deliver a stark warning about AI deepfake scams, a growing tactic used by fraudsters.

As part of this initiative, Santander has created deepfake videos of Mr. Money Jar and Santander fraud lead Chris Ainsley to demonstrate how realistic deepfakes have become and how Brits can protect themselves. The videos are available on social media to raise awareness.

A priority banking program for senior citizens

DBS Bank India has announced the launch of the DBS Golden Circle, a comprehensive priority banking program meticulously designed to meet the unique needs of senior citizens.

Who?

Headquartered and listed in Singapore, DBS is a leading financial services group in Asia with a presence in 19 markets. With a 30-year history in India, DBS Bank India operates as a wholly owned, locally incorporated subsidiary of the global bank, providing a range of banking services to large, medium and small enterprises as well as individual consumers.

Why?

The India Ageing Report 2023 by the United Nations Population Fund highlights income insecurity as a significant vulnerability in old age. Managing savings effectively during this stage of life is further complicated by rising living costs and the challenge of accessing funds without undermining investments.

How?

DBS Golden Circle is designed to make banking easier and more convenient for senior citizens, with a focus on trust, safety and convenience. The program offers a suite of exclusive benefits and services, simplifying banking and making it more rewarding for Indian residents aged 60 and above.

Key features include an attractive interest rate on savings accounts and deposits, as well as cyber insurance coverage to address security concerns, which are especially important to senior citizens.

Additional benefits of the DBS Golden Circle include:

• Special overdraft rates against fixed deposits and loans on deposit.

• Zero transaction fees for NEFT and RTGS (online fund transfers), free duplicate statements, and unlimited free domestic ATM transactions.

• Lifetime free debit cards.

• Discounts on locker rentals, offering a safe and affordable option for storing valuables.

• Access to products from leading life insurance companies and ecosystem partners, including curated health and wellness benefits, discounts on healthcare services and pharmacies, hospice cash benefits, and comprehensive annual health check-ups.

A financial wellness program focused on money psychology

Ally Financial has introduced Money Roots, a free financial wellness program designed to help individuals understand how their emotions and mindset influence their financial decisions.

Who?

Ally is a US-based financial services company serving approximately 11 million customers through a wide range of online banking services, including deposits, mortgages, credit card products, securities brokerage and investment advisory services. The company also has a strong corporate finance division, offering capital to equity sponsors and middle-market companies, along with auto financing and insurance options.

Why?

Historically, banks have focused on teaching skills and providing tools to help people manage their finances. However, Americans continue to accumulate record levels of debt and experience heightened financial stress. A recent Ally Bank survey revealed that nearly half (46%) of Americans allow emotions to influence their spending, while 36% never seek emotional support when managing personal finances.

How?

Money Roots is a free financial wellness program that helps people uncover how their money mindset affects their spending, saving and investing decisions – and vice versa. Based on money psychology, Money Roots moves beyond traditional skills-based financial education.

Ally collaborated with leading experts in behavioral finance, financial therapy and money psychology to create a proprietary curriculum featuring four one-hour virtual workshops. Facilitators will guide participants through the process of uncovering money beliefs and values, rewriting financial stories and creating personalized financial health roadmaps. Participants can register for the workshops online on Ally's website.

The workshops include:

• Money + You: Explore the emotions tied to money and how to manage them to make better financial decisions.

• Money + Story: Reflect on early money memories and their influence on financial behavior. Identify patterns and create new, healthier habits.

• Money + Values: Define core values to set personal goals and create a plan to achieve them.

• Money + Love: Gain guidance on navigating common financial stressors and difficult conversations with romantic partners.

Stay ahead with the latest innovations in financial services

Digital Reinvention community

With Qorus memberships, you gain access to exclusive innovation best practices and tailored matchmaking opportunities with executives who share your challenges.