Financial Innovation Spotlight: October 2024 edition

In the sixth edition of the Financial Innovation Spotlight, we showcase five new eye-catching projects from around the world.

Banks, insurance companies and fintechs must continually adapt and innovate to meet the rapidly changing needs of their customers. Successful players in this dynamic arena offer outstanding customer experiences that set them apart from competitors, whether enhancing existing services or tapping into new sources of revenue.

In the sixth edition of the Financial Innovation Spotlight, we showcase five new eye-catching projects from around the world. This month’s innovation journey begins in Italy, where Banca Sella offers a health insurance solution with advanced digital services. Over in Belgium, we check out another noteworthy health insurance product from Belfius, integrating solutions that enhance employee well-being and productivity. Next stop: Kuwait, taking in Warba Bank’s AI-powered personal banking advisor, followed by France, where CIC has created a flexible mortgage for non-traditional workers. Finally, our journey ends in Australia, with a spotlight on NAB’s innovative new tool to help customers avoid bill shock.

Health insurance solution with advanced digital services

Italy’s Banca Sella, in partnership with HDI Assicurazioni, has launched a new health insurance product designed for individuals and microenterprises. This solution integrates advanced digital services focused on health prevention and personalized care, addressing the growing demand for accessible healthcare and prevention tools.

Who?

Banca Sella has a national presence in Italy, with nearly 300 branches and over 2,400 employees. It is widely recognized for its excellence in private banking, payment systems, e-commerce and digital solutions.

Why?

People are increasingly aware of the importance of health and prevention. It’s essential to offer solutions that improve quality of life and reduce healthcare costs. This new product also reflects the growing integration of digital services in healthcare, empowering individuals and businesses with greater control and support over their well-being.

How?

This policy covers up to 10 individuals, regardless of family ties, making it ideal for businesses wanting to protect employees. A key feature is the 'care manager,' a service which provides counseling through digital channels during illness or injury, assessing medical needs and facilitating access to social services. Two apps, MyAssistance and MyClinic, allow users to book appointments, access 24/7 video consultations, manage medical records and track claims. Additionally, every adult policyholder receives a preventive health check-up every two years, and entrepreneurs get a daily allowance during work interruptions due to illness or injury.

Holistic health insurance package with AI tool

In Belgium, Belfius Bank and Insurance is moving beyond traditional health insurance models by offering innovative solutions that enhance employee well-being and productivity.

Who?

Belfius Bank and Insurance is a bancassurance group owned by the Belgian federal government. Belfius consists of a bank, an insurance company, and several other subsidiaries, serving 3.5 million individual clients, independent professionals and small businesses.

Why?

This comprehensive approach is designed to reduce employee absenteeism, boost morale, and position employers as leaders in promoting workplace health – an increasingly important factor in today’s competitive labor market.

How?

In partnership with the insurtech firm Alan, Belfius offers a holistic health insurance package that provides access to doctors, psychologists, sports coaches and other health professionals through the Alan app. Employees benefit from teleconsultations, fast reimbursement of medical expenses within 72 hours using AI, and personalized prevention plans. For companies with more than 50 employees, reporting tools and anonymous surveys help assess team well-being and offer recommendations for improvement.

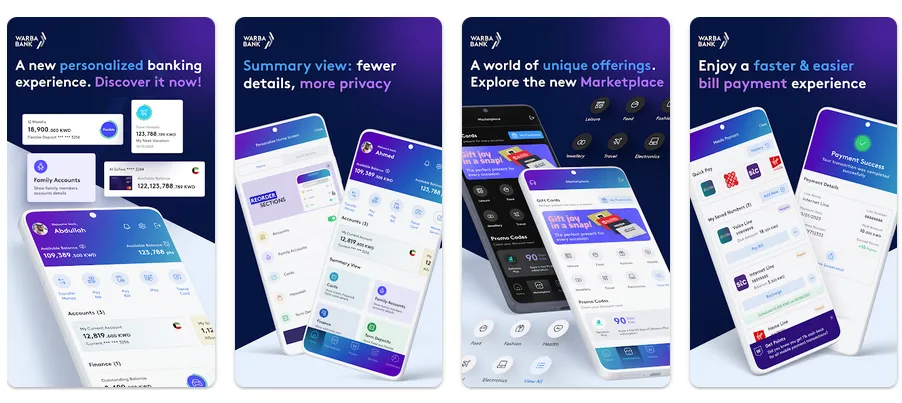

AI-powered personal banking advisor

Warba Bank has introduced Warba Advisor, Kuwait’s first AI-powered personal banking advisor, as part of its digital transformation strategy. This service aims to enhance customer service by providing personalized financial advice through advanced artificial intelligence.

Who?

Warba Bank is a public company that operates within the banking sector, delivering a full range of banking services for its own clients as well as for third parties, in accordance with the principles of Islamic Sharia.

Why?

This initiative reflects the bank’s commitment to automating services and improving operational efficiency. Warba Bank views this initiative as part of its social responsibility, aiming to meet the essential needs of various community segments.

How?

Warba Advisor offers personalized suggestions to clients based on their usage of Warba’s various products, including accounts, cards, savings accounts, financing and investment deposits. This ensures that the recommendations align with the client’s immediate and long-term financial goals. Additionally, it suggests various services to help achieve these goals through interactive and continuously updated text consultations, eliminating the need to visit branches or contact the call center.

Flexible mortgage for non-traditional workers

In France, CIC has introduced the Prêt Immo Nouvelles Formes d'Emploi (‘New Employment Forms Mortgage’). This mortgage is designed for clients without a traditional full-time employment contract (CDI), offering flexible repayment options that adapt to fluctuating incomes.

Who?

CIC, a French holding company and retail bank in the Paris region, oversees five regional banks and specialized subsidiaries across all areas of finance and insurance, both in France and internationally.

Why?

Obtaining a mortgage can be challenging for those without a CDI. Freelancers, temporary workers, micro-entrepreneurs and other non-traditional employees often face difficulties securing home loans, despite making up nearly 4 million workers in France – about 13% of the workforce. CIC sought to develop a mortgage that aligns with its commitment to supporting a diverse and modern workforce in achieving homeownership.

How?

CIC’s new mortgage helps non-CDI workers by considering factors such as job continuity, income growth and savings capacity. The loan allows borrowers to adjust their monthly payments by up to 50% for one to four months each year, depending on their financial situation. These adjustments can be made up to 10 times over the life of the loan, without any fees or extra paperwork.

The process is user-friendly – applicants can apply through the CIC app, where a simulator helps them see how payment adjustments affect their budget and overall loan cost.

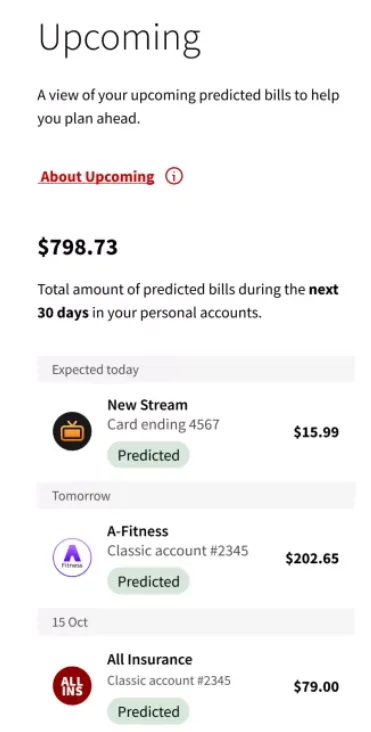

Tool to help customers avoid bill shock

National Australia Bank is one of the four largest financial institutions in Australia, ranked by market capitalization, earnings and customer base. NAB is also Australia’s largest business bank.

Who?

National Australia Bank is one of the four largest financial institutions in Australia, ranked by market capitalization, earnings and customer base. NAB is also Australia’s largest business bank.

Why?

Despite increasing financial awareness, NAB data indicates that one in four Australians missed a bill payment in the last quarter, with utilities such as water, electricity, phone and internet being the most frequently missed. Younger Australians (ages 18-29) were particularly affected, with 41% missing payments compared to just 9% of those over 65. Additionally, women were more likely to miss a payment (29%) than men (22%).

How?

To help Australians plan for their bills, subscriptions, and regular payments like school fees, NAB has rolled out Upcoming, a new bill predictor tool within its app. This tool provides a view of predicted upcoming bills for the next 30 days based on previous outgoing bills, allowing customers to incorporate these amounts into their budgeting and eliminating the surprise factor.

Stay ahead with the latest innovations in financial services

Digital Reinvention community

With Qorus memberships, you gain access to exclusive innovation best practices and tailored matchmaking opportunities with executives who share your challenges.