Financial Innovation Spotlight: November 2024 edition

In the seventh edition of the Financial Innovation Spotlight, we spotlight five new initiatives by Commonwealth Bank of Australia, Arab Bank, Hang Seng Bank, La Banque Postale and Revolut.

The kaleidoscope of financial services is constantly shifting, as banks, insurance companies and fintechs seek new and innovative ways to meet the evolving needs of their customers. The aim: to renew themselves, stand out from the competition, improve the customer experience and journey, and even create new sources of revenue.

In the seventh edition of the Financial Innovation Spotlight, we spotlight five initiatives that caught our eye over the past month. Join us on a global innovation journey starting in Australia, where the Commonwealth Bank of Australia is transforming its distribution network into an owned-media network. Next stop: Jordan, where Arab Bank is integrating flight ticket sales into its mobile app. We then head to Hong Kong for a glimpse of Hang Seng Bank’s new senior-friendly and pet-friendly branch enhancements. Back in France, we check out La Banque Postale’s pilot voice-enabled card for visually impaired customers. Finally, we wrap up our tour in Singapore, where Revolut is making waves with its innovative way of offering cards: a vending machine on a university campus.

A media network to unlock new revenue streams

Commonwealth Bank of Australia (CommBank) has introduced CommBank Connect, an innovative owned-media network designed to deliver personalized content to customers while creating new opportunities for partners and advertisers to engage with a highly attentive audience.

Who?

Commonwealth Bank of Australia (CommBank) is one of the leading financial institutions in Australia, serving approximately 17 million customers. The bank specializes in retail and commercial banking services and operates through several segments, including retail banking, business banking, and institutional banking and markets.

Why?

CommBank launched this initiative to diversify its revenue streams by creating an advertising network. The network enables the bank to sell advertising space across its extensive physical and digital ecosystem, offering brands access to a highly engaged customer base.

How?

CommBank Connect integrates various touchpoints, including in-branch screens (expected to exceed 2,000 nationwide by 2025), ATMs, the CommBank Brighter magazine, and digital channels. This ecosystem blends customer engagement with targeted, high-value content.

The platform is powered by CommBank iQ, a joint venture between Commonwealth Bank and Quantium. By leveraging de-identified transactional data, CommBank iQ enables advertisers to reach precise audience segments based on purchasing behaviors and preferences. This approach ensures effective targeting, enhancing value for both advertisers and customers.

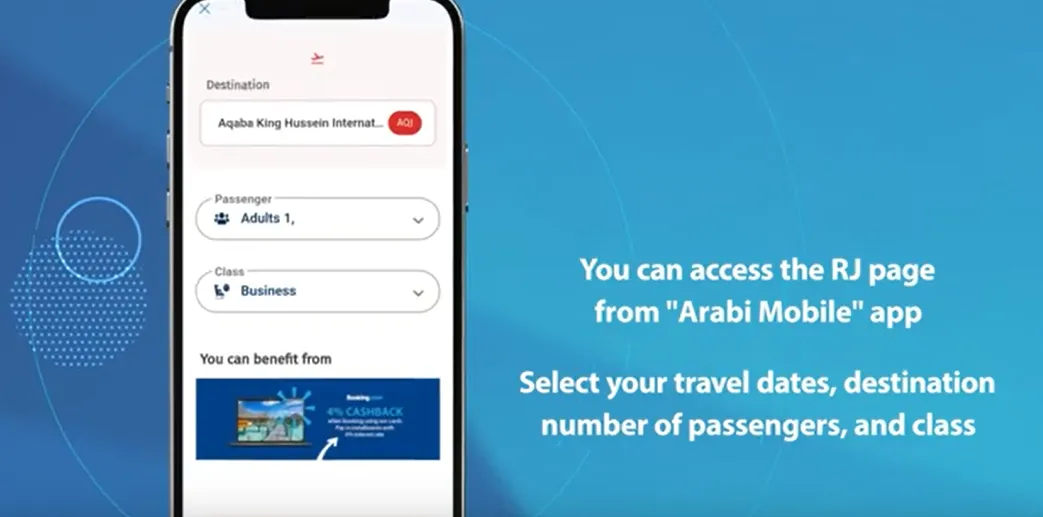

A flight booking service in a bank app

Arab Bank has launched a new digital flight booking service on its Arabi Mobile app, in collaboration with Royal Jordanian Airlines.

Who?

Arab Bank, headquartered in Jordan, operates the largest global Arab banking network with over 600 branches worldwide. It offers a comprehensive range of financial products and services to individuals, corporations and financial institutions. The bank’s core business areas include consumer banking, corporate and institutional banking, and treasury services.

Why?

Introducing an airline ticket booking service on the bank's mobile app represents a significant step toward creating a superapp. By integrating non-financial services, the bank enhances the app's functionality and delivers a convenient and engaging customer experience. Additionally, the preferential rates on tickets make the service both practical and appealing to users.

How?

The service allows customers to seamlessly plan their trips, search for available flights, and complete the booking process securely through the Arabi Mobile app in just a few simple steps. Users can also enjoy a 5% discount on Royal Jordanian tickets when booking through the app.

Additionally, the service provides flexible payment options, enabling customers to pay directly using any of their Arab Bank accounts or credit cards, making the process convenient and accessible.

Improvements for seniors and pet-friendly branches

Hang Seng Bank is enhancing select branches with pet-friendly and age-friendly features.

Who?

A member of the HSBC Group, Hang Seng Bank is renowned as Hong Kong's leading domestic bank, serving over 3.5 million customers. The bank provides customer-focused banking, investment and wealth management services for individuals and businesses.

Why?

Hang Seng Bank is setting a new benchmark for inclusive and accessible banking in Hong Kong. These initiatives aim to make financial services more welcoming and barrier-free for everyone, including pet owners and elderly clients.

How?

The bank has introduced pet-friendly areas in select branches. Pet owners can now wait in a designated lobby adjacent to a smart teller, offering convenient access to core banking services. For more involved financial discussions, pet-friendly meeting rooms are available, allowing customers to bring their pets to consultations.

At the same time, Hang Seng has designed a dedicated elderly-friendly service area to better meet the needs of senior customers. Features include ergonomic seating, accessible transaction counters, non-slip flooring and improved signage. Drawing inspiration from the Hong Kong Architectural Services Department’s Elderly-Friendly Design Guidelines, these areas also provide wheelchair access and dedicated parking, ensuring a comfortable and convenient banking experience for elderly clients.

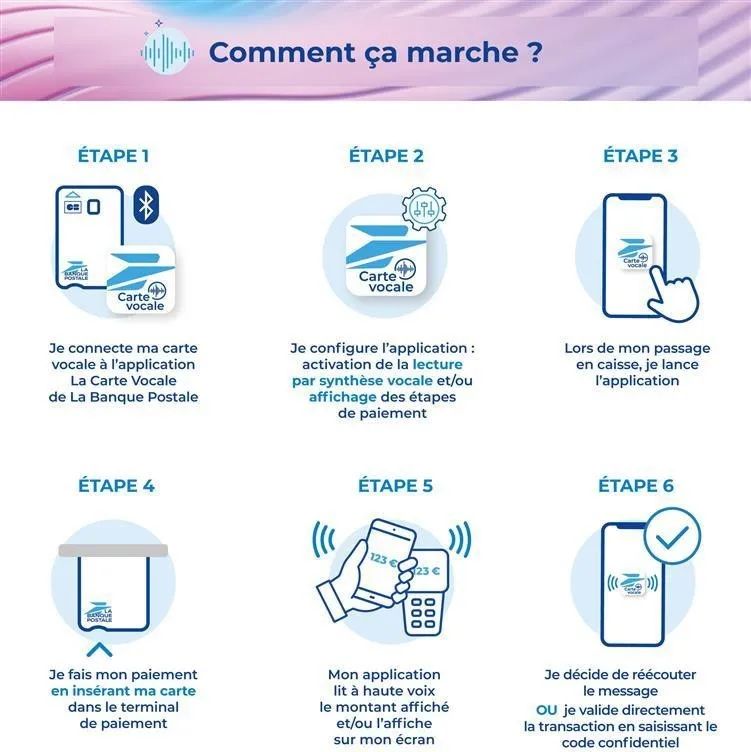

Voice-enabled card for visually impaired customers

La Banque Postale has launched a pilot program to test a voice-enabled banking card designed to simplify purchases and enhance accessibility for individuals with visual impairments.

Who?

La Banque Postale is France's postal bank, offering a range of services including retail banking, insurance and asset management, all aimed at meeting the needs of a diverse customer base. With 20 million active customers, 338,500 corporate and local public-sector clients and 30,400 employees, the bank is dedicated to making banking accessible to all.

Why?

In France, nearly two million people experience some form of visual impairment, including blindness and reduced visual acuity, which can make routine transactions challenging. This increases the risk of errors and fraud during payments. According to a study by HandSome and Ethik Connection, almost 90% of visually impaired individuals report experiencing mistakes or fraud at checkout.

How?

The VoiceCard was developed in collaboration with CB, fintech company HandSome and global security leader Thales. This innovative card features Bluetooth technology and a distinctive round notch for easy identification. Paired with the HandSome mobile app, the VoiceCard audibly communicates transaction details, enabling users to confirm the payment amount before entering their PIN. This voice-enabled feature gives visually impaired customers greater independence and security during transactions, making banking more accessible and reducing the risk of errors or fraud.

Debit card vending machine

Revolut has introduced Singapore’s first debit card vending machine at the National University of Singapore, allowing students to quickly and conveniently obtain their Revolut x Visa debit cards.

Who?

Revolut is a global financial technology company and licensed European bank, founded in 2015. It serves 50 million customers worldwide. Revolut offers a wide range of products, including banking services, currency exchange, debit and credit cards, virtual cards, Apple Pay, interest-bearing ‘vaults’, personal loans, BNPL (in regions with a banking license), stock trading, cryptocurrency, commodities and human resources tools.

Why?

With no physical branch network, these bank card vending machines enable Revolut to acquire new customers offline, expanding its reach in innovative ways.

How?

This unique approach allows students to quickly and easily obtain their Revolut x Visa debit cards. They simply retrieve a free card from the vending machine, scan a QR code and sign up for an account to activate the card. Existing Revolut users can also use the machine to replace lost or expired cards, enhancing convenience and accessibility for all customers.

Revolut’s efforts to target Gen Z extend to its app, which offers tailored features and financial tools designed with students in mind. These include budgeting tools, expense splitting, cashback offers, fee-free currency exchange, and competitive international transfer rates. The neobank also aims to improve financial literacy through an online module covering the basics of investing, enabling students to begin their investment journey with as little as $1.

Stay ahead with the latest innovations in financial services

Digital Reinvention community

With Qorus memberships, you gain access to exclusive innovation best practices and tailored matchmaking opportunities with executives who share your challenges.