Financial Innovation Spotlight – February 2025

This month’s Financial Innovation Spotlight features five eye-catching initiatives from around the world by Nubank, Standard Chartered, Tune Protect, Banco Sabadell, and BBVA.

This month’s Financial Innovation Spotlight features five eye-catching initiatives from around the world. In Brazil, Nubank has made its debut in the brick-and-mortar world thanks to a special partnership with Burger King. Meanwhile in Asia, Standard Chartered has launched a unique forex insights solution for its mainland Chinese clients, with other regional markets soon to follow, and Malaysia-based insurer Tune Protect is offering lounge access vouchers to customers facing flight delays. Finally, two Spanish banks have earned their place in the spotlight for innovative new app features: Banco Sabadell’s real-time card transaction geolocation tool and BBVA’s enhanced AI virtual assistant.

A fast-food restaurant rebranded in a bank’s colors

Nubank and Burger King have teamed up for an innovative marketing initiative in Brazil, transforming a Burger King restaurant into the country’s first-ever Nubank ‘non-branch’.

Who?

Nubank is one of the world’s largest digital banking platforms, serving over 100 million customers across Brazil, Mexico and Colombia.

Why?

Digital brands, such as Nubank, don’t have physical branch networks. As a result, they must find ways to establish a presence in the brick-and-mortar world to connect with their customers and increase brand awareness.

How?

A Burger King restaurant in São Paulo will feature Nubank’s signature purple branding, customized self-service kiosks, and a special perk: customers will receive either a free drink refill or a small fries when paying for select menu items with a Nubank debit or credit card. Those without a Nubank card won’t be left out – select franchise locations will feature professional ‘huggers’ offering symbolic gestures of inclusion.

AI-powered video to provide clients with real-time market insights

Standard Chartered has launched an industry-first AI-powered video column, the Standard Chartered Wealth Management FX Intelligent Expert, to provide clients with real-time foreign exchange market insights.

Who?

Standard Chartered is a leading international banking group, operating in 53 of the world's most dynamic markets and serving clients in 64 more.

Why?

Foreign exchange is a crucial aspect of diversified asset allocation, but its fast-changing nature makes it difficult for investors to keep up.

How?

The Standard Chartered Wealth Management FX Intelligent Expert provides timely, digestible and interactive updates, enabling clients to make well-informed trading decisions.

The AI-powered insights offer significant advantages:

• Faster market analysis: AI-generated content delivers instant updates on FX trends.

• Scalability and accessibility: On-demand videos make complex data easier to understand.

• Enhanced client experience: The service improves engagement through visually compelling insights.

Following its debut in Mainland China in December 2024, the service will expand to Singapore, Hong Kong and Taiwan in the coming months.

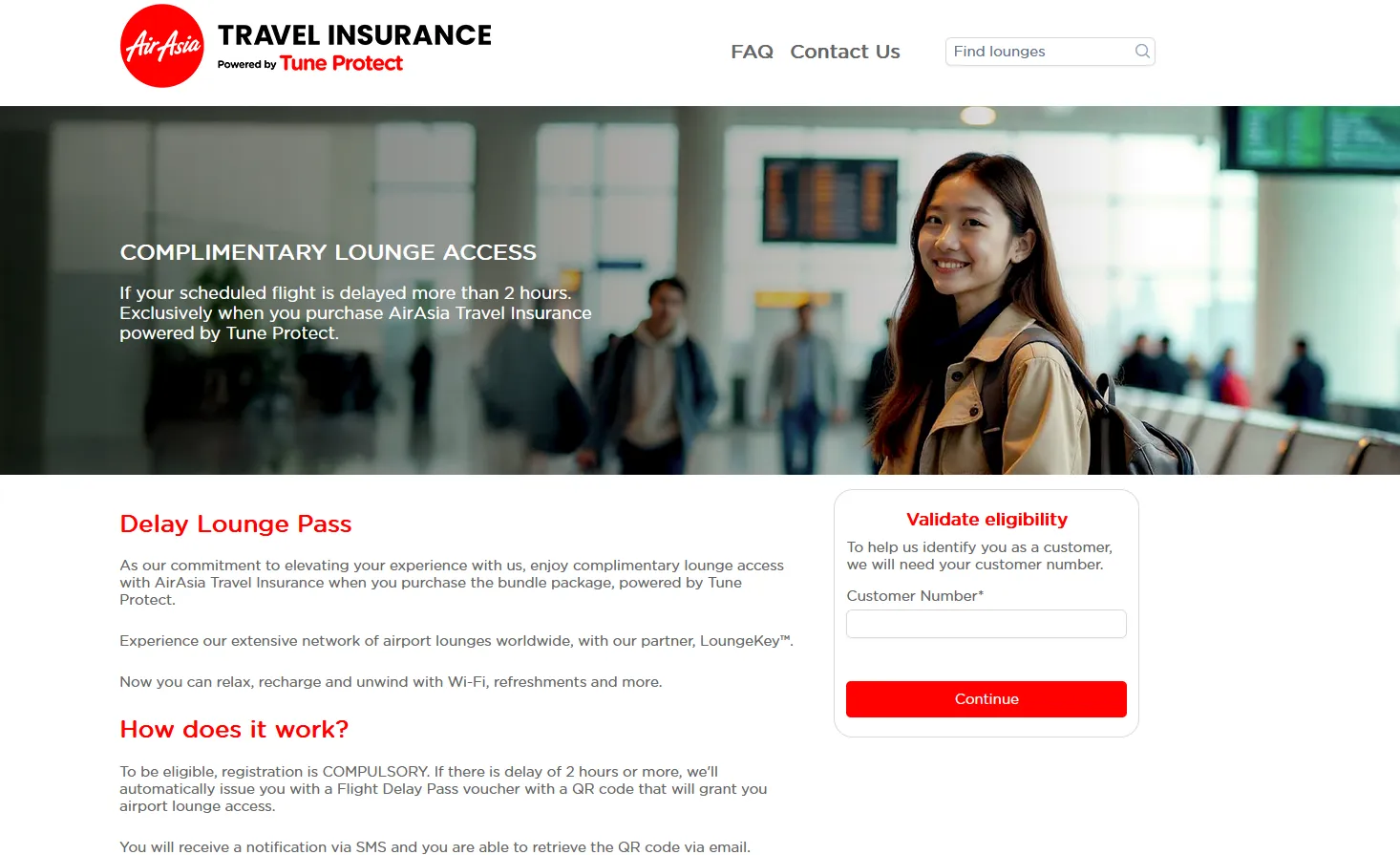

Enhancing travel experience amid flight delays

Tune Protect Group has teamed up with Collinson International, a leader in airport experiences and loyalty solutions, to offer added convenience to travelers impacted by flight delays.

Who?

Malaysia-based Tune Protect offers tailored protection plans through its general insurance and reinsurance businesses in over 60 global markets, with a strong presence in Thailand and the Middle East.

Why?

Even if travelers are insured against flight delays and will receive compensation, they often face long, uncomfortable waits in airports. Lounge access vouchers are a great incentive to purchase a particular insurance plan.

How?

The initiative, called Delay Lounge Pass, is available to travelers who purchase specific AirAsia travel insurance plans powered by Tune Protect. If a flight is delayed by two hours or more, these policyholders will automatically receive a notification of the delay and a digital lounge access voucher, allowing them to relax in lounges at over 1,600 airport lounges globally.

Enhancing digital banking with real-time transaction geolocation

Banco Sabadell has announced a strategic partnership with Snowdrop Solutions, a leading provider of location-based technology services, to enhance the digital experience for its customers through real-time geolocation of card transactions.

Who?

Banco Sabadell is the fourth-largest private banking group in Spain, comprising various banks, brands, subsidiaries and affiliated companies. It serves around 11.5 million customers across Spain, the UK and Mexico.

Why?

Checking past transactions on a banking app isn’t always easy due to the lack of detailed information provided by banks. This service could definitely be improved.

How?

By integrating Snowdrop’s MRS API technology, Banco Sabadell enables its customers to view the precise locations of their card transactions on an interactive map within the bank’s mobile app. This feature provides additional details such as the name and logo of the merchant, offering greater transparency and ease of tracking expenses. The initiative is aimed at improving financial management while ensuring greater security for users.

Introducing AI-powered virtual assistant for customers

BBVA has enhanced its digital banking capabilities with an upgraded version of its virtual assistant, Blue, integrated into its mobile app.

Who?

BBVA is a Spanish multinational bank, serving 71.5 million customers in over 30 countries. It is one of the largest financial institutions in Europe, with total assets of around €700 billion and a workforce of over 120,000 employees.

Why?

Answering customer questions 24/7 is one of the biggest advantages of chatbots. However, chatbots that can effectively handle complex queries, dynamic and nuanced interactions are still relatively rare.

How?

The updated Blue is designed to handle up to 150 queries and transactions, responding to more than 3,000 potential customer questions. It uses advanced language models to interpret user intent, recognize context and provide tailored responses. Key features include managing dynamic conversations, allowing topic switches without losing progress, and the option to cancel transactions or request human help at any time. BBVA prioritizes security and privacy, ensuring that personal and transactional data stays within the bank’s systems and is not stored after the conversation ends.

See the previous editions

Digital Reinvention community

With Qorus memberships, you gain access to exclusive innovation best practices and tailored matchmaking opportunities with executives who share your challenges.