Financial Innovation Spotlight – March 2025 edition

This month’s Financial Innovation Spotlight features five eye-catching initiatives from around the world by Burbank, KasikornBank, ING Spain, CIMB Bank Berhad and Discovery Vitality.

Banks, insurers and fintechs are innovating all over the world. Among the financial services companies making waves with intriguing new projects, this month we feature Burbank, KasikornBank, ING Spain, CIMB Bank Berhad and Discovery Vitality.

Whether it's offering a more secure online payment solution, a platform dedicated to managing small and medium-sized hotels, a tool for calculating customers’ environmental impact, opening a golf lounge for VIP customers, or enhancing fleet safety through behavioral science, here are the five innovations that caught our eye in the financial services sector over the past month.

Online card-present payment, enhancing digital security

Developed by Welsh company Burbank, Card-Present over Internet (CPoI) enables merchants to process online transactions as securely as in-store payments.

Who?

Burbank is a Welsh fintech firm founded in 2021. It specializes in authentication, payments and identity solutions.

Why?

Online merchants currently lose over US$40 billion annually to fraud and chargebacks, with payment fraud increasing by 69% per year. Additionally, false positives – where legitimate transactions are mistakenly flagged as fraudulent – cost merchants an estimated US$443 billion annually. According to Burbank CEO Justin Pike, 65% of blocked transactions fall into this category, and 41% of affected customers never return to the retailer.

How?

Burbank's Card-Present over Internet (CPoI) technology requires customers to physically tap their card against their mobile device and enter their PIN when paying for online purchases. By ensuring that only the cardholder can complete a transaction, CPoI minimizes fraud risks while enhancing the customer experience. It also removes the need for complex anti-fraud systems, streamlining operations for online merchants. Consumers benefit from a seamless and secure online checkout, eliminating concerns over storing card details or navigating complicated payment processes.

A hotel management solution

Kasikornbank has launched KONCIERGE+, a groundbreaking platform designed to revolutionize hotel management in Thailand.

Who?

Founded in 1945, KasikornBank is one of Thailand's leading banks, serving more than 23 million customers across its 830 branches.

Why?

Thailand's hotel industry faces challenges, including marketing struggles, labor shortages and limited access to technology. Hotels, particularly small and medium-sized establishments, need a technological edge to thrive.

How?

The KONCIERGE+ platform includes a comprehensive suite of solutions, from a property management system that tracks room availability and guest check-ins, to an AI-driven revenue management tool that adjusts room prices for maximum profitability. KONCIERGE+ also offers digital marketing tools and an AI chatbot to enhance customer service, helping hotels reduce their reliance on online travel agencies while increasing direct bookings.

Tool to calculate customers’ CO2 and water footprints

Mi ECOHuella is a new digital service from ING Spain, enabling customers to track their carbon and water footprints based on their banking transactions.

Who?

ING Spain was launched in 1999 as the country’s first digital bank. Its 1,700+ employees serve over 4 million retail customers as well as enterprises.

Why?

The initiative aligns with a broader effort to promote responsible banking and empower customers with tools to make environmentally conscious decisions.

How?

Available through the ING app, Mi ECOHuella analyzes account and card transactions to estimate carbon dioxide equivalent (CO2e) emissions and water consumption. Customers can view their environmental impact over time, broken down by category and transaction. The tool also allows users to refine calculations through a lifestyle assessment, access personalized recommendations to reduce their footprint, and compare their consumption against national averages. Other features include data visualizations and equivalences to help customers better understand their impact and the methodology behind the calculations.

An exclusive golf lounge for high value clients

CIMB Bank Berhad, one of Malaysia’s leading financial institutions, has introduced ‘The Golf Lounge for CIMB Preferred’, an exclusive golf facility designed to offer a premium experience for its Preferred clients.

Who?

Headquartered in Malaysia, CIMB Group is the fifth-largest banking group by assets in ASEAN, with over 33,000 staff and around 28 million customers.

Why?

The project reinforces the bank's commitment to offering tailored lifestyle benefits to its Preferred customers. The Lounge is an extension of the CIMB Preferred Golf Series which was launched last year, offering high value clients the opportunity to compete at top golf courses around Malaysia.

How?

Developed in partnership with Wedge Golf, the Lounge is available exclusively for CIMB Preferred clients. It features two private suites equipped with advanced indoor golf simulators. Clients can access a selection of over 50 world-class golf courses, making the facility a versatile space for both casual and competitive play. The Lounge provides a venue for social engagement, networking and skill development, with CIMB Preferred clients enjoying a three-hour complimentary session in the private suites, subject to terms and conditions.

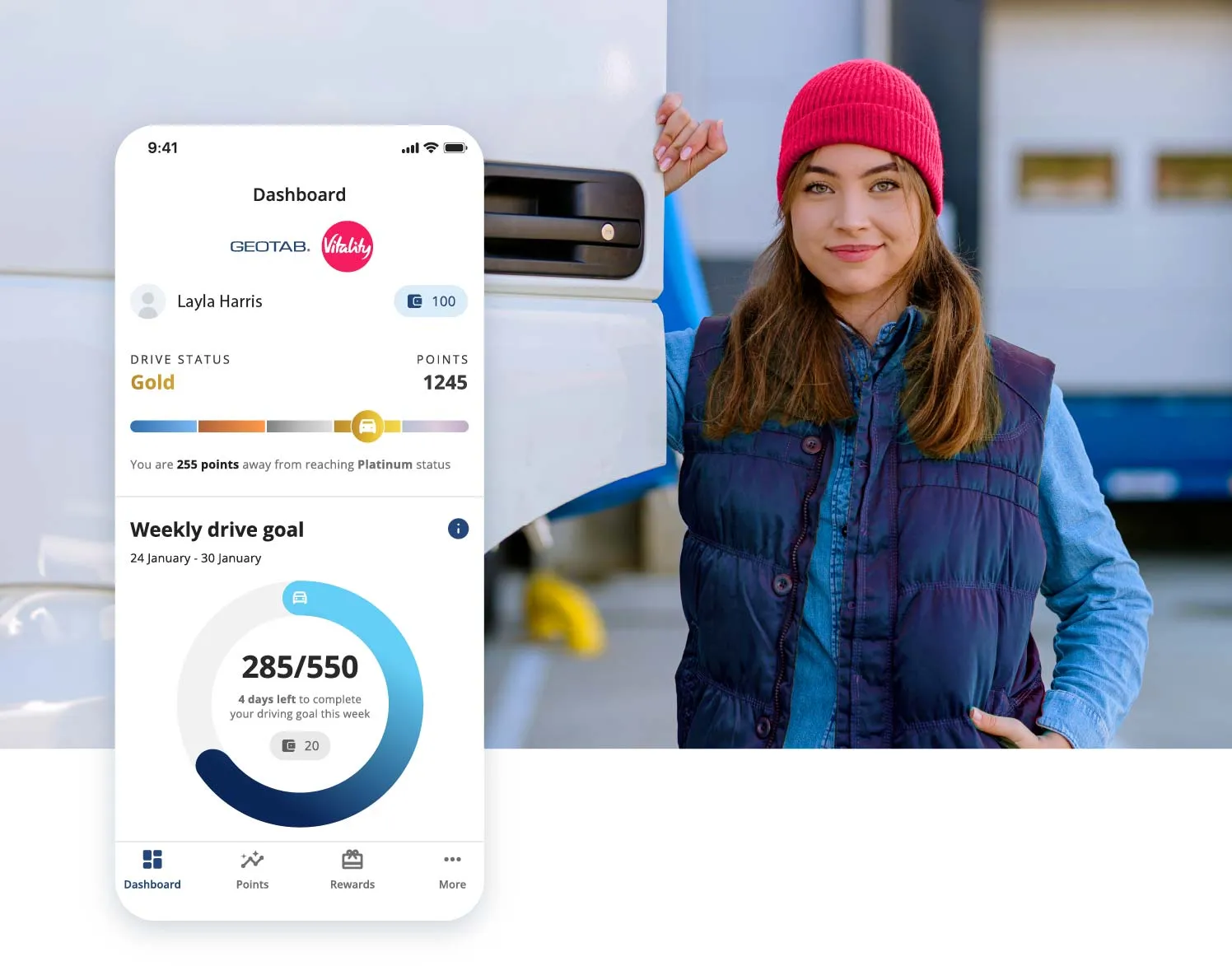

Enhancing fleet safety through behavioral science

Discovery Vitality and Geotab have formed a joint venture to enhance commercial fleet performance, reward driver safety and reduce risk.

Who ?

Launched by South Africa’s Discovery Group, Vitality Global is the world’s largest behavioral change platform. It offers personalized health, wellness and safer driving solutions designed to inspire and reward healthy behavior change for Discovery’s insurance and banking clients, partners and employees. Geotab is a leading provider of connected transportation solutions.

Why?

Drivers face increasing pressures on the road. The main goal of this solution is to improve driver behavior to create safer roads, lower costs for businesses, and support a more responsible driving culture. Additionally, it aims to improve driver well-being, which is expected to aid retention and recruitment efforts.

How?

The partnership introduces a behavior change platform that rewards drivers for safer habits. Vitality's experience in behavioral incentives, demonstrated by its Vitality Drive insurance program – which has led to 55% fewer claims and significantly lower road fatalities – will be integrated with Geotab’s extensive telematics network of over 4.7 million vehicles and AI-powered predictive collision analytics. The initial offering from the joint venture provides fleets with a comprehensive toolset to promote positive driving habits through incentives and rewards.

See the previous editions

Digital Reinvention community

With Qorus memberships, you gain access to exclusive innovation best practices and tailored matchmaking opportunities with executives who share your challenges.