Generative AI in insurance: The game-changer you can’t afford to ignore

Generative AI (GenAI) isn’t just a buzzword – it’s set to completely revolutionize the industry in ways we’re only starting to grasp.

What if the next big breakthrough in insurance came from a technology that could think, predict, and personalize like never before? Generative AI (GenAI) isn’t just a buzzword – it’s set to completely revolutionize the industry in ways we’re only starting to grasp.

The excitement around GenAI isn’t just hype – it’s a wake-up call for the entire insurance industry. After witnessing the first wave (modest yet undeniably encouraging) of innovation and creativity it inspired during the 2024 awards, I’m convinced we’ve only scratched the surface.

Just a year ago, it seemed like a sci-fi concept, but in a remarkably short time, ChatGPT has seamlessly entered both my life – and yours. Today, it’s an integral part of our personal lives, effortlessly handling tasks like conducting research or drafting various administrative letters. Meanwhile, our children rely on it to summarize their lessons or even complete their homework assignments.

In the professional world, it has become the driving force behind what we now call the "new ways of working." It holds the potential to turn each of us into a one-person powerhouse, managing a team of virtual workers. The incredible progress this technology enables – and will continue to enable – is undeniable. That’s why we’re putting generative AI front and center at the Qorus Innovation in Insurance Awards 2025, celebrating its game-changing impact on the future of insurance.

95% of insurance professionals expect GenAI to make a big splash

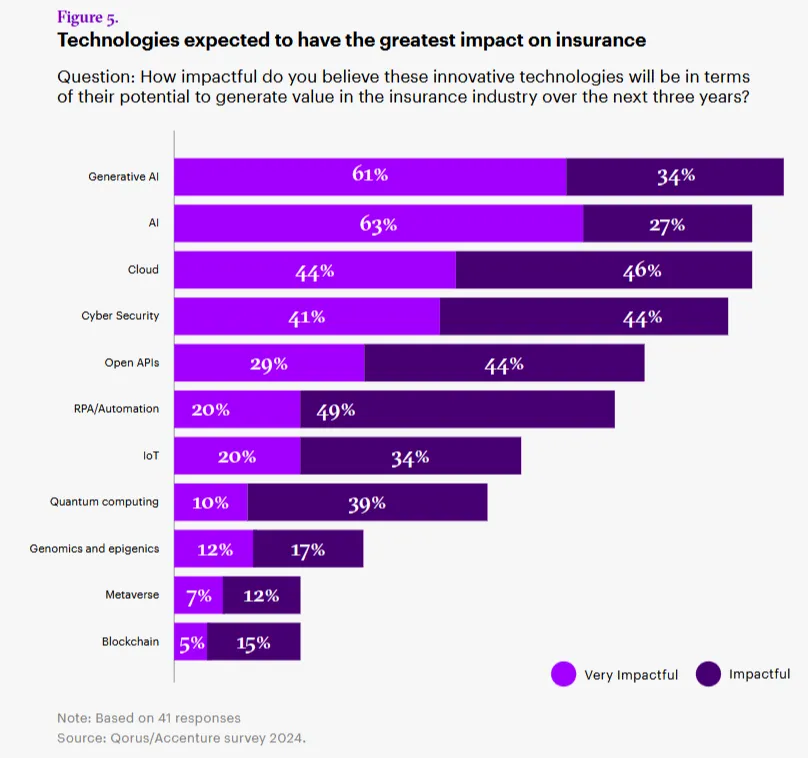

Generative AI is rapidly gaining traction in the insurance sector. Although only a handful of projects submitted to the Qorus Innovation in Insurance Awards 2024 featured this technology, industry innovators believe its potential impact will be massive. According to a recent Qorus and Accenture study conducted among our community of insurance executives, GenAI tops the list of transformative technologies: 61% of respondents expect it to be ‘very impactful’ in the next few years, while 34% predict it will be ‘impactful’.

With many insurance companies announcing groundbreaking generative AI initiatives this year, I expect the number of GenAI-related project submissions to soar in 2025. To celebrate this momentum, we are introducing a new special category for the Qorus Innovation in Insurance Awards 2025: GenAI Innovation of the Year. Selected projects from various categories will be nominated, and the most impressive will claim the gold, silver and bronze trophies. I’m ready to be surprised — and maybe even amazed — by what you bring to the table.

Four key areas where GenAI is set to transform insurance

Generative AI’s universal appeal lies in its versatility, as noted by Rob Galbraith, author of the bestseller "The end of insurance as we know it: How millennials, insurtech, and venture capital will disrupt the ecosystem" and one of our esteemed jury members. “Generative AI is getting the lion’s share of attention, and rightly so because of the enormous potential it offers across multiple use cases,” he said in an interview I conducted last year. But in the insurance sector, four areas stand out as particularly ripe for transformation. These insights were highlighted in a recent article for Qorus by Fatih Ogun, Head of Strategy at Akbank:

• Enhanced risk assessment: GenAI analyzes diverse data sources – social media, IoT devices, and historical claims – to predict risks with precision. This helps insurers tailor policies, refine pricing models and reduce large payouts.

• Automated claims processing: Using natural language processing and image recognition, GenAI automates claims from filing to payout. This streamlines workflows, reduces errors and improves customer satisfaction.

• Personalized customer experience: By analyzing behavior and preferences, GenAI enables tailored policy recommendations and adaptive pricing models that evolve with customers’ risk profiles.

• Fraud detection: GenAI identifies anomalies in large datasets to detect fraud early, helping mitigate losses and strengthen prevention strategies.

Spotlight on two inspiring GenAI projects

Among this year’s early submissions, two standout projects feature GenAI-powered personal assistants. One is designed for employees, and the other is created for customers:

• Agent Virtual Assistant by Santalucía Seguros (Spain): Designed to democratize organizational knowledge, this tool provides employees with quick access to critical information, accelerates strategic decision-making and fosters team collaboration.

• TopGPT by Topdanmark (Denmark): This customer-facing assistant is tailored to individual insurance terms, delivering personalized, 24/7 interactions. TopGPT has dramatically boosted customer engagement and generated a tenfold increase in positive reviews compared to the insurer’s previous rule-based chatbot.

Show me what you’ve got!

The clock is ticking: submissions close on 26 February. I can’t wait to see how you’ll harness generative AI (but of course, not just this technology—other technologies, approaches, and ideas are more than welcome) to redefine insurance innovation. Impress me – and maybe even leave me in awe!

Insurance & Embedded Insurance community

With Qorus memberships, you gain access to exclusive innovation best practices and tailored matchmaking opportunities with executives who share your challenges.