Innovation Radar: Reinvention Awards Asia Pacific winners 2025

The second edition of the Qorus Reinvention Awards - APAC recognizes outstanding innovators in the Asia-Pacific region.

Financial services firms worldwide continue to push boundaries, leveraging technology to enhance their business performance and deliver innovative solutions.

The second edition of the Qorus Reinvention Awards - APAC recognizes outstanding innovators in the Asia-Pacific region. These awards celebrate cutting-edge products, services, and the creative teams driving them forward, helping top companies gain a competitive edge. This year’s eighteen finalists represent a diverse array of markets and countries across the APAC region.

The awards spotlight offerings that excel in enhancing customer experience, improving distribution, advancing ESG goals, and achieving operational excellence. They also highlight innovations that demonstrate new and effective ways of working. Additionally, the awards honor the region’s SME Bank of the Year, recognizing its role in supporting small and medium-sized enterprises.

Winners of the Qorus Reinvention Awards - APAC were unveiled on February 19 during a ceremony in Bangkok, celebrating the ingenuity and vision shaping the future of financial services in the region.

Customer Experience

The "Customer Experience" category celebrates financial institutions that have made significant enhancements in their marketing, sales, distribution, and their management of customer channels, communications, engagement, and relationships.

Gold winner

SocialPay digital wallet by Golomt Bank (Mongolia)

Golomt Bank has enhanced the customer experience it offers clients by developing a digital wallet that enables accountholders to use their mobile phones to quickly access up to 26 applications, including payments, shopping, healthcare, insurance, transport and stock trading. SocialPay and companion product SocialPay Junior use technologies such as AI, voice instruction, OCR, NFC, and QR codes to streamline and quicken transactions. (Read the full case study)

Silver winner

Cross Border QR Pay by Maybank (Malaysia)

Maybank has enabled its clients traveling in Singapore, Thailand, Indonesia, and China to make payments quickly and easily by introducing a cross-border QR payments facility on its mobile apps. The Cross Border QR Pay facility, which supports payment methods such as DuitNow, Alipay, NETS, PromptPAY, and QRIS, allows the bank’s customers to complete secure cross-border transactions without the inconvenience of currency conversion or handling cash. (Read the full case study)

Bronze winner

HSBC Gold Token by HSBC (Hong Kong SAR)

HSBC has launched a digital token that offers retail investors a convenient, safe, and affordable way to add gold bullion to their investment portfolios. The HSBC Gold Token, which gives investors fractional ownership of gold bars stored in the bank’s vault, accommodates transactions from as little 0.0001 troy ounces, can be traded on the HSBC online platform or HSBC HK mobile banking app, and is registered on the company’s secure distributed ledger. (Read the full case study)

Distribution

The "Distribution" category celebrates financial institutions that have pioneered innovative practices, reimagining distribution in response to changing customer expectations, encompassing new delivery channels, branch transformation, multi-channel integration, mobile banking, and scalable end-to-end value propositions leveraging partnerships, platforms, and the Internet of Things.

Gold winner

Financial and Digital Inclusion by BRAC Bank (Bangladesh)

BRAC Bank is working with the Gates Foundation to provide financial services to women running small businesses in underserved rural communities. It is using its digital lending platform, a network of locally-recruited women agents, and its multi-feature Astha mobile app, together with funding and skills from the US charity, to give women entrepreneurs access to finance, training and education that empowers them and supports the growth of their businesses. (Read the full case study)

Silver winner

i-ONE Bank by IBK (South Korea)

Industrial Bank of Korea (IBK) has extended and enhanced the distribution of its banking products and services by developing an online platform that supports 24/7 real-time transfers, open banking and MyData services. The i-ONE Bank platform, which has attracted four million monthly active users, has boosted the bank’s revenue, reduced distribution costs, and increased customer satisfaction. (Read the full case study)

Bronze winner

RCBC Diskartech by RCBC (Philippines)

RCBC has launched a super app tailored to the needs of underserved communities in the Philippines. The RCBC DiskarTech app allows local language speakers to use their mobile phones to access a range of banking services, such as opening accounts, payments, financing, receiving remittances, and insurance, and has significantly increased financial inclusion in the county’s remote rural areas. (Read the full case study)

Environmental, Social, and Governance (ESG)

The "Environmental, Social, and Governance (ESG)" category applauds financial institutions for their innovations that demonstrate how they have seamlessly embedded sustainability and ESG principles into their value chains.

Gold winner

Premiums4Good by QBE (Australia)

QBE Australia is encouraging positive environmental and social change by investing a portion of its customers’ premiums in impact investments that support initiatives such as renewable energy, affordable housing and community services. The insurer expects its Premiums4Good scheme, which is offered to customers at no charge, to have invested US$2 billion in impact investment bonds, funds and similar instruments by the end of 2025. (Read the full case study)

Silver winner

Three-Generation Power Walk by Taiwan Life (CTBC)

Taiwan Life, part of the CTBC financial services group, hosts an annual cross-generational power walking event to promote good health, care for the aged, environmental awareness, community building and insurance education. The Three-Generation Power Walk, which combines a variety of online activities with participation in physical exercise, has attracted more than 11 million people since it began in 2012. (Read the full case study)

Bronze winner

Owl Detect, All Detect by Taipei Fubon Bank (Taiwan)

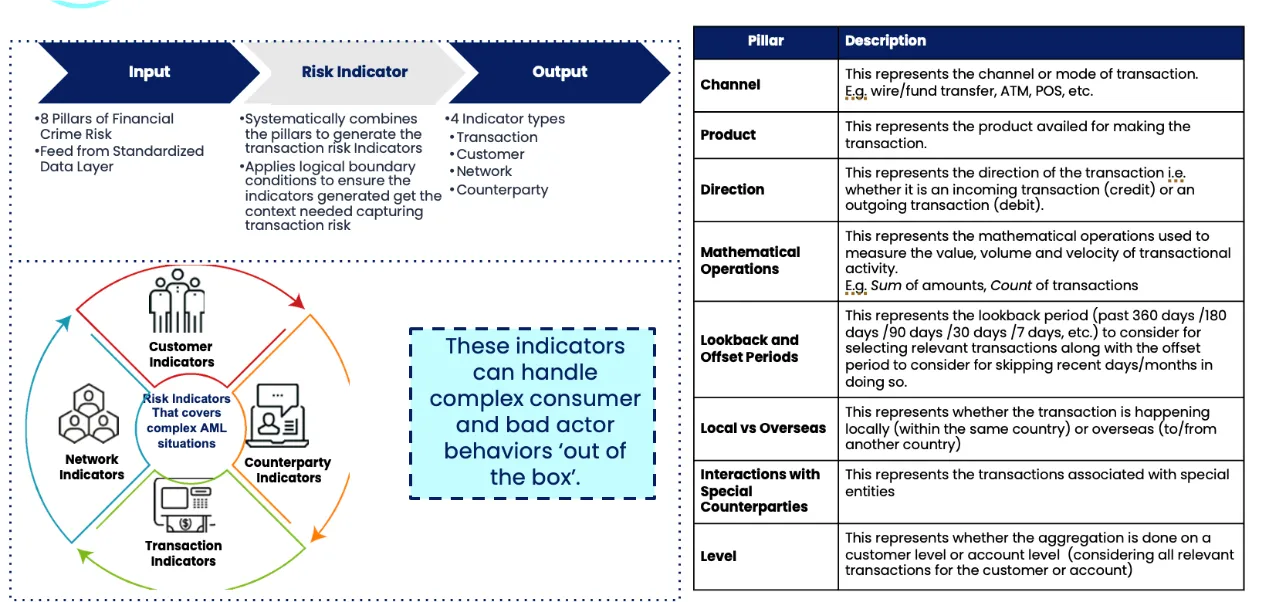

Taipei Fubon Bank has teamed up with fraud-prevention specialist Tookitaki to develop an anti-money laundering (AML) system that uses AI to identify high-risk transactions. The Owl Detect, All Detect system, which possesses self-learning capabilities that continuously improve the accuracy of its anomaly detection, has increased the bank’s AML efficiency and strengthened its commitment to ESG principles such as financial security and sustainable business management. (Read the full case study)

New Ways of Working

The "New Ways of Working" category is all about recognizing trailblazers who are redefining the future of work. This encompasses those who are pioneering remote work strategies, exploring creative ways to foster a culture of collaboration, and implementing groundbreaking productivity techniques. In this category, we celebrate innovative approaches that are transforming the traditional work landscape and shaping the way we work in today's rapidly evolving world.

Gold winner

AIA One platform by AIA (Thailand)

AIA Thailand has advanced its digital transformation by building an integrated technology platform that supports the company’s more than 50,000 sales agents. The AIA One platform, which has replaced 30 legacy applications and reduced the insurer’s annual operating costs by US$5 million, provides agents with an AI-powered leads management system, a sales tracker, a performance and incentives guide, and a sales campaign co-ordinator. (Read the full case study)

Silver winner

Aflac Assist by Aflac (Japan)

Aflac Japan has developed a generative AI solution that has increased the efficiency of its operations and enhanced the output of its employees while mitigating risks typically associated with GenAI technologies. The Aflac Assist app, which incorporates pre-defined risk controls, has reduced the time employees take to answer calls by up to 6% and has trimmed document preparation times for sales staff by as much as 25%. (Read the full case study)

Bronze winner

Robotic Precision for APOS Production by BCA ( Indonesia)

BCA (Bank Central Asia) has combined robotic precision manufacturing technologies and GenAI methodologies to improve the production of the APOS (Android Point of Sales) data capture devices it provides retail merchants. The enhanced production process, which is aligned with BCA’s digital transformation, uses advanced image recognition and dynamic process adjustments to ensure the quality of the bank’s APOS units, reduce manufacturing costs and enhance workplace safety. (Read the full case study)

Operational Excellence

The "Operational Excellence" category commends financial institutions for implementing scalable processes that drive improved efficiency, supporting a faster pace of growth for the bank's revenue stream and asset base compared to its overhead costs.

Gold winner

Real-Time Machine Learning Fraud Engine by HDFC Bank (India)

HDFC Bank has developed a real-time fraud-detection system that uses machine learning and AI to quickly identify fraudulent ATM, POS, and online card transactions. The Real-Time Machine Learning Fraud Engine, which processes six million transactions a day, analyzes cardholder data, transaction patterns, and channel attributes to generate real-time fraud likelihood scores that have enabled the bank to improve its detection rate by 30% and thereby mitigate risk and enhance the customer experience. (Read the full case study)

Silver winner

CIT Optimization and Cash Management by DBS (Singapore)

DBS has developed an analytics platform that enables the bank to optimize cash-in-transit (CIT) deliveries across its network of 1,800 ATMs and branches. The platform, which analyses historical and real-time data from multiple sources, uses algorithms and predictive models to determine cash holdings, identify potential problems and route CIT journeys, thereby improving operational efficiency, reducing costs and curbing carbon emissions. (Read the full case study)

Bronze winner

SaferPay by Westpac (Australia)

Westpac has strengthened the safeguards that protect its customers from scammers by introducing an advanced fraud-detection feature into its payments processing. The SaferPay feature, which uses AI to screen new payments and then prompt customers with dynamic security questions should it flag a transaction as high-risk, blocked attempted scams totaling A$1 million in the two months after its launch. (Read the full case study)

Innovation Awards Hub community

With Qorus memberships, you gain access to exclusive innovation best practices and tailored matchmaking opportunities with executives who share your challenges.