Innovation Radar: Reinvention Awards Europe winners 2025

Discover the most innovative projects from banks and insurance companies in Europe.

Financial services firms across the world continue to demonstrate their outstanding ability to innovate and use technology to enhance the performance of their businesses.

This second edition of the Qorus Reinvention Awards - Europe recognizes top innovators in the 'old cotntinent'. The awards highlight some of the products and services, and the creative teams behind them, that have propelled leading innovators ahead of their competitors. The eighteen finalists operate in a wide range of countries with diverse markets.

This year’s awards celebrate offerings that display exceptional ingenuity in improving customer experience, distribution, ESG and operational excellence as well as innovations that demonstrate new ways of working. The highlight of the awards is the selection of the European Innovator of the Year from among the finalists – an accolade that acknowledges a company’s exceptional commitment to innovation.

The winners of the awards were announced at a ceremony in Vienna on 14 May 2025.

Customer Experience

The Customer Experience category celebrates financial institutions that have made significant enhancements in their marketing, sales, distribution, and their management of customer channels, communications, engagement, and relationships.

Gold winner

Your Year in KBC Mobile by KBC (Belgium)

KBC has turned transaction data into an engaging customer experience that builds client trust and loyalty with the launch of the “Your Year in KBC” summary in its mobile app. The transaction summary uses a storytelling format to inform clients about their financial behavior and milestones while also alerting them to the other facilities available in the KBC mobile app. Read the full case study

Silver winner

New Ireland Assurance Customer & Broker Portal by Bank of Ireland (Ireland)

This digital self-service portal gives Bank of Ireland's customers, financial advisors and brokers quick access to life insurance and pension products. The New Ireland Assurance Customer and Broker Portal replaces legacy processes with a seamless digital solution that reduces paperwork, speeds up client onboarding, and enables real-time updates at every stage of the customer journey. Read the full case study

Bronze winner

Mortgage Hub: Digital E2E Experience by Millennium bcp (Portugal)

Millennium BCP has created a digital Mortgage Hub that has enhanced the customer experience the bank provides to home buyers. The hub guides customers through the purchasing journey, from house hunting to contract signing, and uses advanced digital technologies to simplify and speed up the mortgage application process. Read the full case study

Distribution

The Distribution category celebrates financial institutions that have pioneered innovative practices, reimagining distribution in response to changing customer expectations, encompassing new delivery channels, branch transformation, multi-channel integration, mobile banking, and scalable end-to-end value propositions leveraging partnerships, platforms, and the Internet of Things.

Gold winner

Introducing AIB life by Allied Irish Banks (Ireland)

Allied Irish Banks has created a powerful distribution vehicle for its life insurance offerings by forming a dedicated insurance subsidiary in partnership with Canadian financial services conglomerate Great-West Lifeco (GWL). AIB Life uses its extensive technology infrastructure to market a wide range of life insurance products through physical and digital distribution channels. Read the full case study

Silver winner

Cloud Driven Omnibank CRM by Bank Pekao (Poland)

Bank Pekao has improved its customer relations by implementing a cloud-native CRM platform that consolidates client data, predicts accountholder needs, and automates interactions across a variety of channels. The Omnibank platform enables the Bank Pekao to deliver hyper-personalized banking experiences and respond quickly to changing customer needs. Read the full case study

Bronze winner

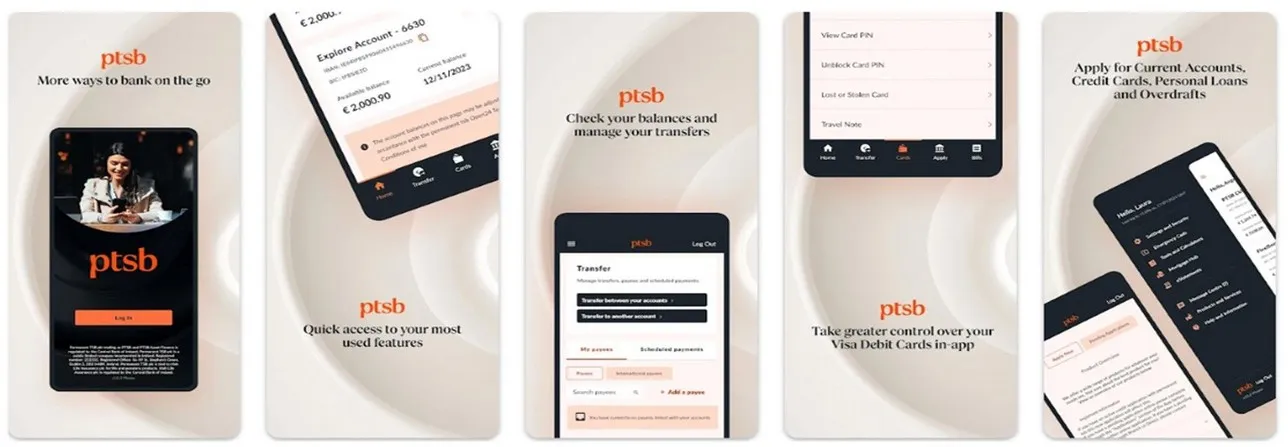

Digital Transformation by PTSB (Ireland)

PTSB has strengthened the distribution of its retail and business banking products by embarking on a comprehensive digital transformation program. The bank’s new banking platform, customer portal and mobile app provide clients with a range of increasingly popular “digital-first” offerings. PTSB has increased its active digital users by 30% in the past two years while digital activity across its channels has risen 36%. Read the full case study

Environmental, Social, and Governance (ESG)

The Environmental, Social, and Governance (ESG) category applauds financial institutions for their innovations that demonstrate how they have seamlessly embedded sustainability and ESG principles into their value chains.

Gold winner

Helping small corporate clients with sustainability transformation by Ceska Sporitelna (Czech Republic)

Česká spořitelna has developed a digital application that helps SMEs improve their sustainability. The free application comprises an ESG compass that helps companies determine their ESG status, a CO² emissions calculator, an e-mobility tool that compares the carbon footprint and total cost of ownership of EVs with equivalent conventional cars, and a photovoltaic calculator that helps companies estimate the performance and benefits of solar energy systems. Česká spořitelna developed the application to help clients turn ESG requirements into an opportunity to grow their businesses. Read the full case study

Silver winner

Green Transition Financing by Tatra Banka (Slovakia)

Tatra Bank has increased the effectiveness of its green transition financing by developing a management tool that enables it to better assess the environmental impact of the projects that its bonds fund. The ESG Portfolio Application, which collects and evaluates project data, has improved the transparency of Tatra Bank’s allocation and impact reporting. Read the full case study

Bronze winner

Waste Log by Akbank (Turkey)

Akbank has demonstrated its commitment to responsible banking by backing a venture firm that provides outlets for the recycling of waste oil, electronics, and batteries. Waste Log, part of the bank’s Akbank+ venture builder program, operates a digital network that encourages consumers, recyclers, and product suppliers to work together to reduce waste and protect the environment. Read the full case study

New Ways of Working

The New Ways of Working category is all about recognizing trailblazers who are redefining the future of work. This encompasses those who are pioneering remote work strategies, exploring creative ways to foster a culture of collaboration, and implementing groundbreaking productivity techniques. In this category, we celebrate innovative approaches that are transforming the traditional work landscape and shaping the way we work in today's rapidly evolving world.

Gold winner

Executive Master «Futuro Agente» by Generali (Italy)

With its innovative Executive Master program, Generali has equipped its insurance agents with essential business skills. The postgraduate-level program combines digital and classroom education to deliver 180 hours of instruction that helps agents run their businesses better. Subjects include marketing, finance, sales, leadership, change management, and business planning. Generali developed the Executive Master program, in collaboration with leading Italian business schools, to attract new agents and foster loyalty among its current representatives. Read the full case study

Silver winner

Smart Knowledge Base by Intesa Sanpaolo (Italy)

Intesa Sanpaolo has developed a Smart Knowledge Base that uses GenAI to help its employees access, synthesize, and apply information more efficiently. The Smart Knowledge Base has improved employee decision-making and quickened the resolution of customer inquiries. Read the full case study

Bronze winner

AI Readiness Boost by MBH Bank (Hungary)

MBH Bank is preparing its workforce to capitalize on the growing capabilities of AI. It has integrated its FreeAgent GenAI tool and several intelligent assistants into employee workflows, introduced a variety of AI training modules, and established an AI ambassador team as part of a strategic initiative to nurture a progressive AI culture across the organization. Read the full case study

Operational Excellence

The Operational Excellence category commends financial institutions for implementing scalable processes that drive improved efficiency, supporting a faster pace of growth for the bank's revenue stream and asset base compared to its overhead costs.

Gold winner

Commercial Boost Project by Odeabank (Turkey)

Odeabank’s Commercial Boost Project has enhanced the bank’s efficiency by consolidating the commercial banking tools used by relationship managers into a unified digital hub. The hub provides quick and accurate customer data as well as sales information such as the best prices for loans, client creditworthiness, performance tracking, and the budget status of key products. The Commercial Boost Project has also enhanced the bank’s customer service by reducing turnaround times for loan applications and has improved employee satisfaction by enabling relationship managers to use their time more effectively. Read the full case study

Silver winner

PredictiBank by Yapi Kredi (Turkey)

Yapi Kredi has developed an analytical tool that uses machine learning and data analytics to automatically predict quarterly performance targets for its branches and their employees. The PredictiBank tool is more efficient, flexible, and accurate than previous manual target-setting processes and has enabled the bank to increase its competitiveness and grow its market share. Read the full case study

Bronze winner

Home Insurance by Nickel (France)

Banking fintech Nickel has teamed up with insurers Lemonade and BNP Paribas Cardif to expand its business by providing users of its mobile app with an embedded insurance offering. Nickel’s advanced data management platform enables the company to tailor its Home Insurance product cover to meet the specific needs and preferences of its customers. Read the full case study

Innovation Awards Hub community

With Qorus memberships, you gain access to exclusive innovation best practices and tailored matchmaking opportunities with executives who share your challenges.