About

Manage Educational expence easily

Innovation presentation

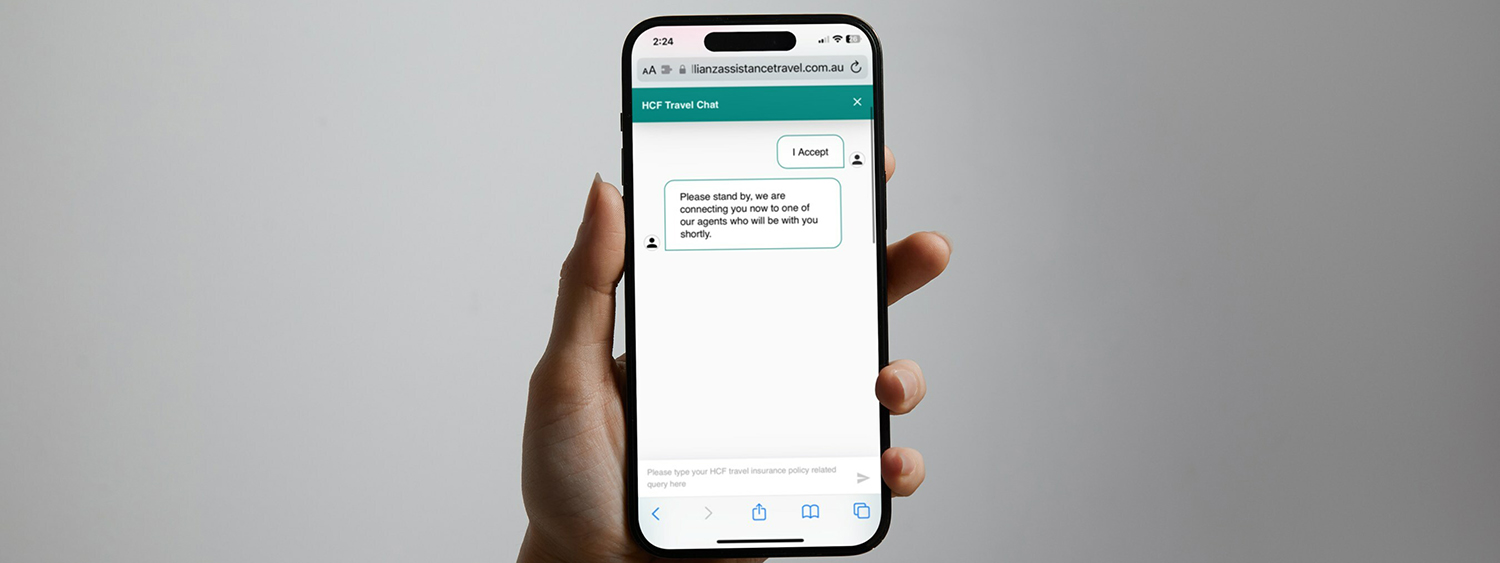

Skiply is a convenient user friendly platform owned by RAKBANK that allow more than 130k+ users to manage their family educational institution payments and activities, it become much easier and more efficient due to fast shortcuts, snappy navigation and show content which are relevant to the users, Skiply on boarded more than 200+ educational institution so far which make it the leader application in UAE educational sector.

the customer journey for both parents and educational institutions are fully digital

Parents can digitally view their kids / students term fees, transportations, uniforms and more than that they can get notifications from the schools related to their registered students Educational institutions can get their payments digitally using latest payment technology to ease the process with high standard of securities and privacy

Also the ERP integration solution through Skiply was a game changer in term of digitize the process with human touch

Uniqueness of the project

A- For schools

1- Faster, simpler payments

Reduce the need for cash. Schools will have fast, secure payments settled directly to school bank accounts.

2- Easier payment management

Skiply reduces the time spent managing payments, receipts and cash

3- Increased operational efficiency

Improved processing of school payments, minimized cash handling paperwork, easier sorting of lunch and uniform orders, improved reporting and efficient attendance to parent inquiries.

4- Enhanced experience

Parents can order and pay when they want while having access to all products and services at their fingertips.

5- Detailed reporting

Skiply delivers automated reports to improve timeliness of preparation and delivery of food and uniform orders, so staff can utilize their time more efficiently

B- For Parents

1- Reduces queues

Just like the name suggests, Skiply reduces queues at the school o!ce, uniform shop & canteen

2- Saves time

School payments can be made at a time and place that suits parents and eliminates the need for cash

3-Safe & secure

Skiply is owned by RAKBANK, rest assured that all payments are secure, no information will be stored on your device, and card information is securely managed as per RAKBANK standards.

4- Instant access

Browse all products and services and complete purchases directly form the app

5- Digital payment & receipt

Parents retain a record of transactions and review in the app or via email

6- 0% installments

By using RAKBANK Cards, parents are eligible to pay the school fees in installments up to 12 months without fees.

Wide range acceptance

Skiply offers multiple payment methods like Apple Pay, Google Pay, Credit/Debit Cards and soon we are enabling direct fund transfer

-ERP Integration

Skiply has the capability to integrate directly with the Merchants in-house ERP or ERP vendors to be part of digital reconciliation with reducing the human errors and increase time efficiency. Unique Selling Points that Set Us Apart

Skiply, our innovative product, stands out from our competitors in several ways, providing a range of unique selling points that differentiate us in the market.

First and foremost, Skiply is an in-house mobile application managed and developed by RAKBANK. This distinction ensures that we adhere to the highest standards set by the banking industry and comply with the regulations set by the UAE Central Bank. With a strong focus on safety and security, Skiply offers users peace of mind by leveraging the robust security measures implemented by a trusted banking institution. In comparison to third-party applications, Skiply provides an added layer of trust and reliability.

Secondly, our product boasts unique Enterprise Resource Planning (ERP) integrations with over four vendors across the UAE. This flexibility enables us to seamlessly integrate with various ERP systems based on the specific requirements of our clients. By offering this level of adaptability, Skiply ensures that schools, nurseries, and universities can effectively manage their financial processes within their existing frameworks. Our ability to integrate with diverse ERP systems sets us apart from competitors who may not offer the same level of compatibility.

Furthermore, at Skiply, we prioritize our customers and strive to meet their individual needs. As part of our WAVE initiatives, we assign a dedicated portfolio manager to each school, nursery, or university. This personalized approach ensures that we effectively manage our clients' expectations and address their unique requirements. By combining the advantages of a digital bank with a human touch, Skiply provides exceptional customer service and fosters long-lasting relationships with our clients.

Moreover, Skiply goes beyond the boundaries of fee collection and payment solutions. We have collaborated with a reputable visa service center to offer a direct visa service for students studying outside of the UAE. This strategic partnership enables us to streamline the visa application process for students and their families, ensuring a hassle-free educational journey.

Additionally, Skiply extends its capabilities beyond payments and fee collection. Our application offers multiple financial services that provide users with a range of options to explore. By diversifying our offerings, we empower users to take advantage of various financial tools and services, ultimately enhancing their overall experience with Skiply.

In summary, Skiply stands out from its competitors through its unique selling points. As an in-house mobile application managed and developed by RAKBANK, we prioritize safety and security, following bank standards and UAE Central Bank regulations. Our unique ERP integrations with multiple vendors offer unparalleled flexibility, ensuring seamless integration with clients' existing systems. Through our WAVE initiatives, we assign dedicated portfolio managers to schools, nurseries, and universities, providing personalized service. Additionally, our collaboration with a visa service center facilitates the visa process for students studying abroad. Finally, Skiply's diverse financial services go beyond payments, enabling users to explore a range of options. With these unique features, Skiply sets itself apart as the preferred choice for digital banking with a human touch.