Generation Next – Financial institutions’ offerings for kids

What could be more universal than children? And yet, curiously enough, the topic of providing financial products and services for children has received very little attention. Traditionally, such offers were very basic: a bank account, a savings account, student insurance, a piggy bank in which the child kept their savings. With the development of new technologies, the products and services offered by banks, as well as insurance companies, are starting to grow.

What could be more universal than children? And yet, curiously enough, the topic of providing financial products and services for children has received very little attention. Traditionally, such offers were very basic: a bank account, a savings account, student insurance, a piggy bank in which the child kept their savings.

With the development of new technologies, the products and services offered by banks, as well as insurance companies, are starting to grow. There is of course financial literacy, a founding and unavoidable pillar, but also the possibility to manage one’s money in a completely digitalized way with sometimes very elaborate and fun PFM tools along with means of payment. And these new tools are paving the way for the development of offerings that are beginning to go beyond banking and even financial services, leading to the appearance of ecosystems built around the child and the family.

This study would not have been possible without the financial professionals who agreed to talk to me about their experience and I would like to thank them for their testimonials.

I would also like to thank RFi Global who agreed to share the results of a survey conducted with parents in Australia during the year 2021. I relied on these results, assuming that they would be similar in other countries, but this may not be the case and it is important to point this out.

I hope you enjoy this study.

Financial literacy first

It seems that the educational system does not offer convincing financial training for children and that the impact is felt later when they become adults and put themselves in financial danger. Banks that feel they have a responsibility to rectify this often do so through their foundations or their Corporate & Social Responsibility departments.

“Financial capability is a skill that is insufficiently taught in Austrian schools. The lack of this knowledge has great impact on the development of societies, leading to ever increasing levels of indebtedness,” says Barbara Strachwitz, who worked on the conception and content development of Erste Financial Life Park (FLiP). A challenge that is not unique to Austria. “A decade ago financial literacy was largely absent from the core New Zealand school curriculum,” explains Mark Graham, Head of Community, Sponsorship and Events at ASB, a New Zealand bank that launched ASB GetWise lessons in 2010.

This is all the more problematic as it blocks the social elevator, as the least educated families have the least access to this knowledge. “In Maybank, our mission, through the Cashville Kidz Financial Literacy program, is to ensure that access to financial education isn’t a privilege to a select few but a basic human right for all children. We aim to give the gift of financial literacy to the next generation, one child at a time,” says Tan Sri Zamzamzairani Mohd Isa, Chairman of Maybank in Malaysia. The Cashville Kidz project gained recognition in the banking world by winning gold at the inaugural Efma-Accenture Banking Innovation Awards in 2013.

In addition to educating future citizens, banks also hope to attract the interest of their family customers and draw attention to their banking offers for children. “We use it to promote accounts for children and to get parents to onboard their children with us,” says Emma Granfeldt, Chief Product Manager - Digital Channels, at the Swedish bank Handlesbanken, talking about its clever ‘‘Pocket Money Calculator’’, an online coach that serves both children and their parents.

A very diverse offering

Traditionally, banks have first prioritized the physical channel by offering courses in schools, in their branches or even sometimes in specially designed spaces. These programs are presented by trainers, by teachers who have received training from the bank, and sometimes even by robots.

To accompany these traditional in-person forms of learning, banks have developed course materials ranging from comic books to cartoons and games. These course materials are sometimes selfsufficient and are then put online by the banks without any face-to-face classes. This seems to be increasingly common since the COVID epidemic hit our countries. “Our advice is to design a blended learning program: combine digital education with live trainings from the very first moment. The streams and e-learning materials supplement live trainings well to provide a complex financial education program,” says Ildikó Csejtei, Managing Director of OTP Fáy András Foundation, which runs an ambitious financial education program in Hungary, Romania and Moldova for OTP Bank.

These lessons are often organized by age group. Generally, there is a first age group for elementary school children (6-10 years old) and a second for secondary school children (11-16 years old and up). Indeed, it is impossible to create a program that would address everyone. You can’t talk to all ages in the same way and the content for a 7-year-old child would not be appropriate for a 14-yearold and vice versa.

Nothing beats practical experience

Reading books, watching videos and attending classes are all activities that are rich in lessons, but nothing beats practical experience to memorize them. This is one of the advantages of video games, which allow children to be in a real-life situation. This is the case, for example, with Island Saver, the financial education game offered by NatWest in Great Britain. “Island Saver came about because we knew we wanted to break financial education out of the classroom and put it in kids’ hands in an immersive way”, says Thom Kenrick, Head of Social Strategy & Impact at NatWest Group.

And this can sometimes be very close to the real thing thanks to the contribution of virtual reality. ‘‘Regarding financial literacy, we didn’t want to tell the students what their financial behaviors should be, but to actually let them experience it almost like in real life through an engaging story. Thanks to this approach there is a much higher chance for students to understand more deeply why some financial choices are better than others and also the reasoning behind that,’’ explains Ludovit Cibulka, Innovation Development Manager at Slovak bank Tatra Banka, which launched the VR Generation Z virtual reality game.

Another way to put lessons into practice is to offer children banking services in their own institution and sometimes even allow them to experience being a banker. This is what PNC Bank has tried in the United States and also Bank Windhoek in Namibia. “It’s important to introduce kids to the concept of financial responsibility and what it’s like to be accountable for other people’s money. They also get to see the process of opening a bank account, which hopefully introduces them to smart saving habits and how spending behaviors can positively affect outcomes,” explains Chris Spolyar, branch manager at PNC Bank.

It is also an experience that KidZania theme parks offer to their young customers in different countries. In the Philippines where BPI was the official partner of KidZania Manila (now closed), Maria Cristina Go, President of BPI Family Savings Bank, explains: ‘‘Ultimately, children gain financial awareness as they have the liberty to manage their own kidZos – from budgeting to spending and saving. Kids learn that they can earn money by being productive and useful, that they can use the money for their needs and wants, and that they can save money for their future, to achieve bigger dreams.’’

What is the impact of all these solutions offered by banks? “It is really hard to measure direct impact on financial literacy (as kids have lots of influences) but we have done a number of ‘before and after’ surveys that show improved understanding of key concepts, and even intent to change behavior,” says Thom Kenrick. This before-and-after comparison is also done at Erste Financial Life Park and the results are encouraging. “The findings show that FLiP imparts a clear improvement in knowledge among its visitors. The written feedback gathered at the end of the tour also indicates that the visitors understand the importance and impact of their decisions on their own financial well-being,” says Barbara Strachwitz. It is worth noting, however, that not all banks seem to be doing this, some simply assuming that the children will have acquired more knowledge by the end of their training, which is no doubt the case.

The solutions adopted are very diverse and can be combined. Here are the different financial education experiences we have been able to identify:

- Playful teaching in branches

- Playful teaching in the classroom

- Comic books

- Video games

- Funny videos

- Banker/client role playing

- Online written articles and tutorials

- Live performance

- Investment simulation

- Dedicated learning spaces

Giving children their first financial tools

Giving experience also means giving children the tools to manage their micro-budget. In the past, and very often still, children have a piggy bank in which they keep the money they receive from their parents and family, and which they use when they feel like buying themselves a little gift. Nowadays we live in an increasingly digital world. Shopping is done online and so is payment. Banks have therefore launched personal finance management tools and savings accounts for children, which are of course under the supervision of parents. These accounts are sometimes accompanied by a physical piggy bank to make the link between physical and digital. This is for example the case of Digipigi Kids by Credit Suisse in Switzerland. “The kids enjoy managing their money. This means checking their account balance of virtual money and physical money. They can count their physical money with the help of the Digipigi Kids app,” explains Patrick Lehner, Head of Everyday Banking at Credit Suisse.

A recent study by RFi Global shows that cash is still the order of the day for children. “When parents give pocket money to their children, two in five (44%) give them cash. One in five parents (22%) transfer money to their child’s bank account. Cash is still the primary way children receive money regardless of their age,” says Anna Perera Shaw, Director of Consumer Credit, Deposits and Payments, RFi Global.

This does not prevent parents from also saving money for their children by opening a bank account in their name. Nearly one in two parents with children between the ages of 5 and 11 have opened a bank account in their child’s name.

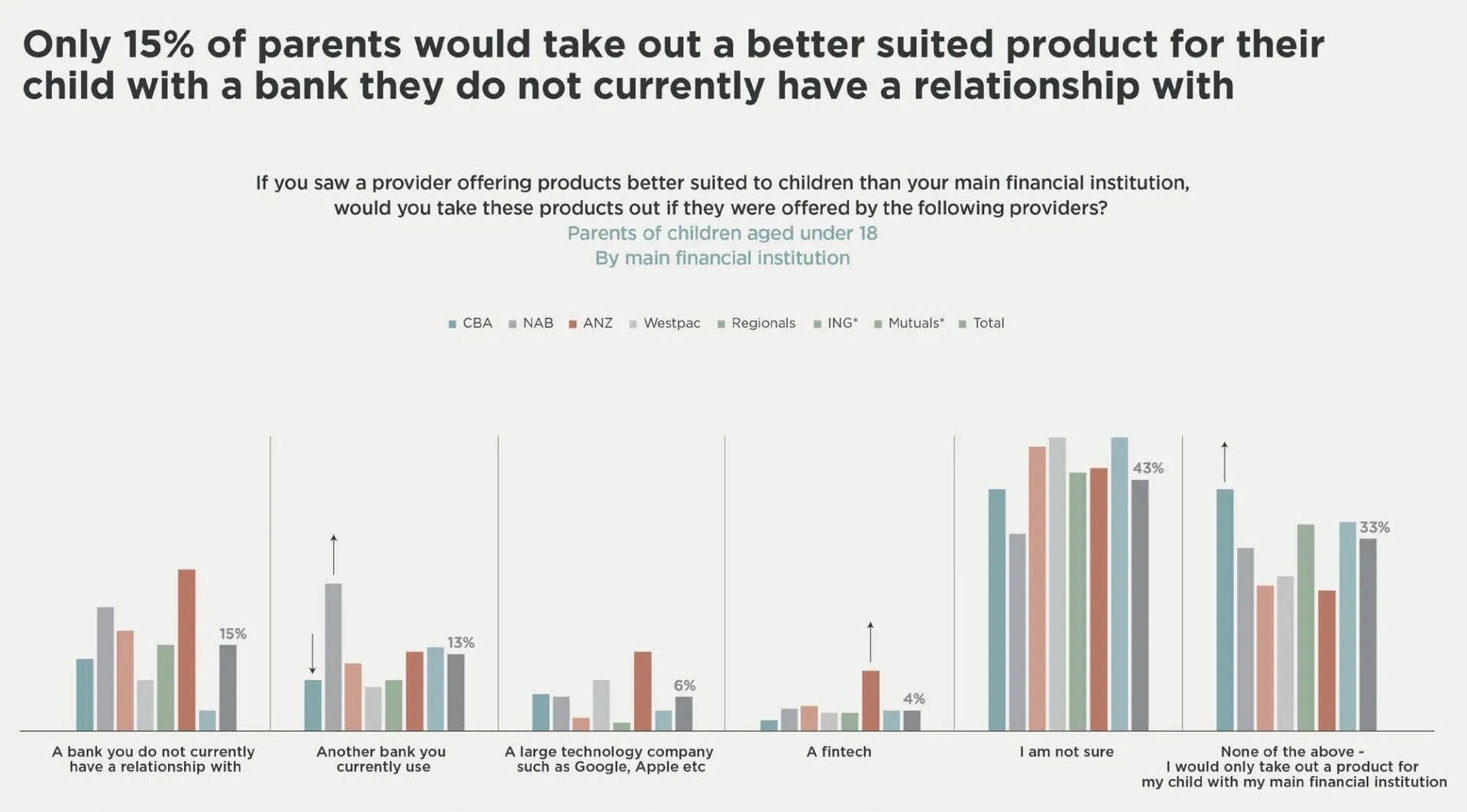

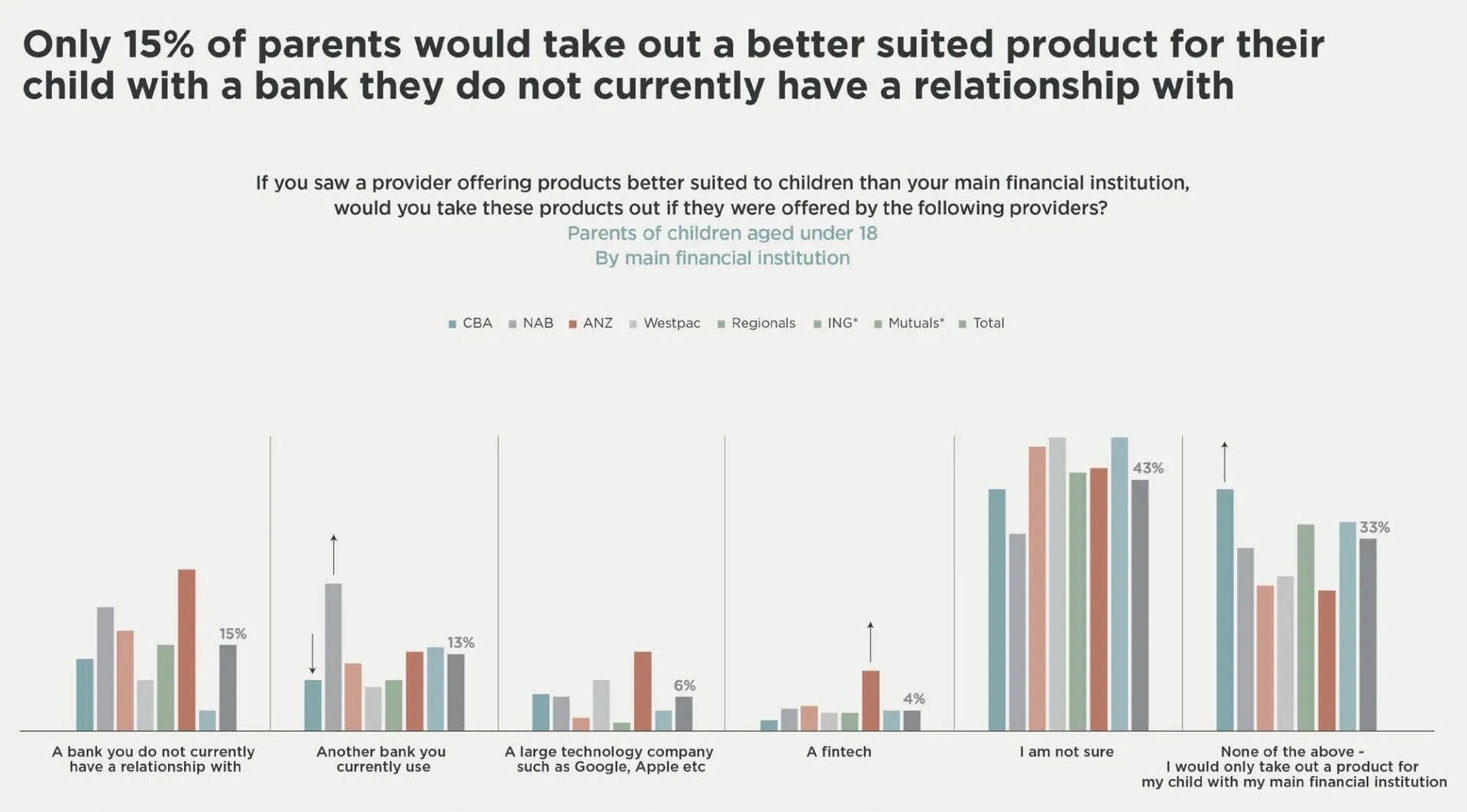

And the bad news for banks is that parents who open an account for their children do so primarily at their own bank. Probably because it’s simpler and they are looking for something very basic. “While main bank relationships are no longer such strong influencers over banking decisions as they were 5 to 10 years ago, data shows that people still go to their main bank first, for new products,” says Anna Perera Shaw. However, there is still hope that things will change: “Over one in ten (15%) parents would take out a product with a bank they do not currently have a relationship with if the products were better suited than those offered by their main bank,” she adds.

One might expect these figures to discourage banks from offering innovative products and services for children. Fortunately, this is not the case and some very good initiatives are emerging. If these products and services do not attract many new customers, they will at least have the advantage of securing the loyalty of parents who are already customers and who will have the satisfaction of offering good financial tools to their children and, why not, the loyalty of the children who will be future customers.

Innovation has been possible thanks to the emergence of new technologies. In Poland, at Pekao Bank, the team in charge of PeoPay KIDS App is always on the lookout for the latest technological developments to improve its product and stay ahead of competitors: “We keep an eye on such technologies and trends as new payment methods using smartphone or wearables (NFT, QR codes, BT), virtual wallets or virtual cards, and also high-tech service supported by chat and voice bots, as well as AI-solutions helping to provide right-in-time and helpful advice crafted for individual users’ needs,” they explain.

This knowledge of both the market and the needs of its customers has enabled Pekao Bank to offer an impressive and useful “Coach” feature in its PeoPay KIDS app. “An interaction with a coach combines financial education with fun, because that way, children learn better and faster than from books or websites. The child can choose from three coaches and can define a nickname that should be used to address him or her. Each coach character in the app is unique and has its own style, voice, set of gestures, expressions and animation of movements,” says the app team. Among the most popular features on kids’ apps are “Saving Goal” and also “Tasks” or “Earn” features allowing kids and parents to agree on a number of tasks to complete in order to receive a small reward. “At PKO Junior, a child can set up money boxes to save for a specific purpose, e.g. a dream game, cinema ticket, bicycle, etc., as well as undertake challenges set by parents. The parent can set a task to do – for example, take the dog out for walks all week – and a child will receive a reward for completing the challenge,” says Małgorzata Witkowska, in charge of communication at PKO Bank Polski, a Polish bank that offers these two features in its kids’ app.

Payment remains a problem

While having a bank account or savings account is well accepted, giving your child a bank card, whether it’s a prepaid card or a debit card, remains problematic for many parents. Only one in ten parents are willing to let their children withdraw cash, transfer money or make purchases, especially online. “Many parents are likely to restrict their child’s ability to withdraw money at an ATM (41% prefer restricted access), transfer money to other accounts (40% prefer restricted access) and make purchases (39% for in-store purchases and 47% for online purchases)”, notes Anna Perera Shaw.

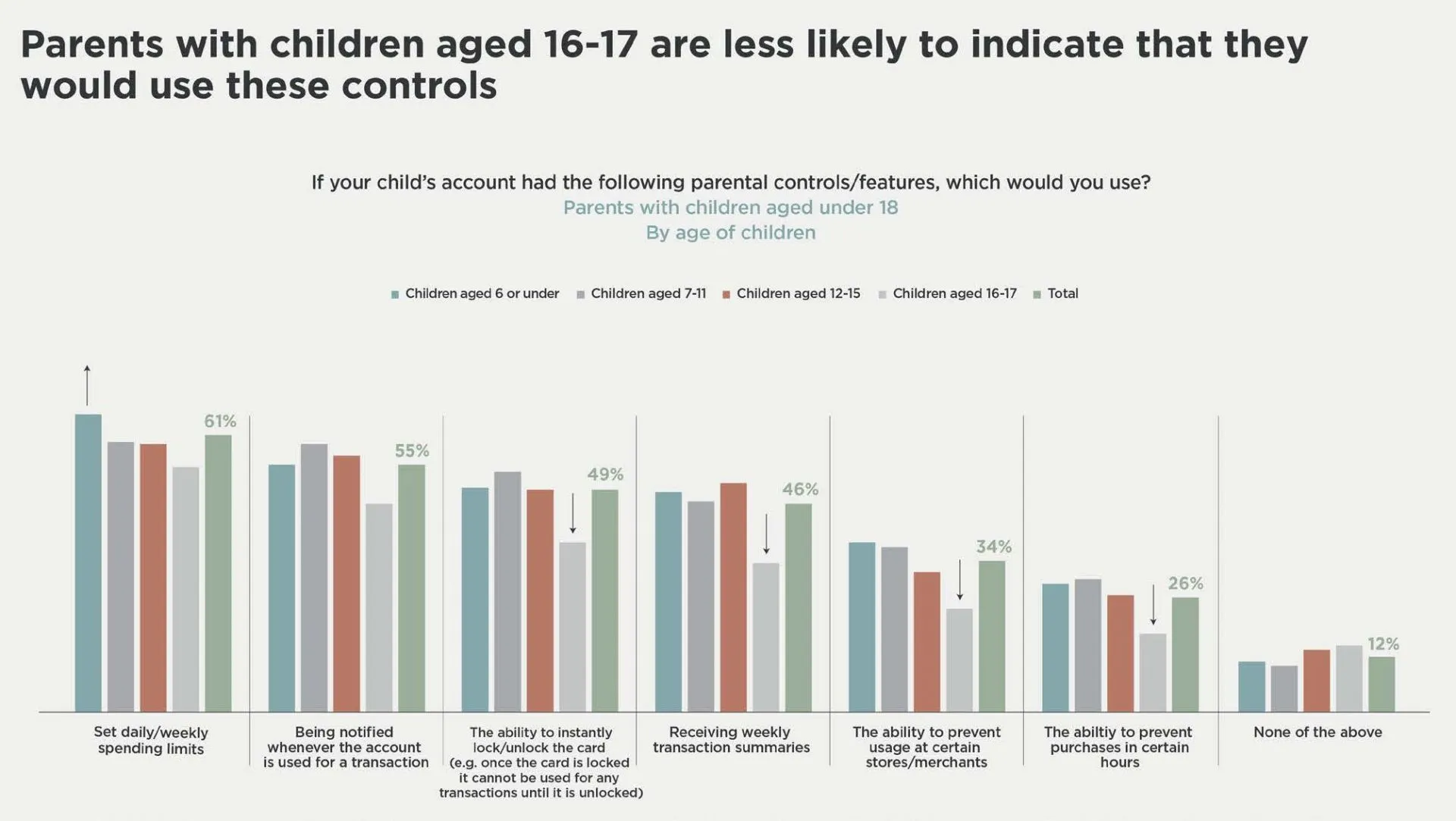

So what can be done to convince parents to give their children some independence in using a card or other digital payment method? The solution lies in tools allowing the parents to control expenditure or to prevent any incident. Parental control solutions are of great interest, especially for parents of children under 16 years old.

This reluctance of parents does not prevent some banks from offering prepaid cards or debit cards to children. POSB, the Singapore postal bank owned by DBS Group goes even further by offering school children a smart watch that allow them to make contactless payments.

Overview of products and services offered to children by financial institutions:

- Prepaid or debit card (with parental control)

- NFC Smart watch

- Moneybox with digital screen

- Money app/PFM

- Saving goal feature allowing the child to set a goal and save to reach it

- Financial challenges awarded with e-badges

- Calculator to discover how much money the child could make by depositing an amount over

a period of time, according to the account’s current interest rate - Savings plan feature to specify a proportion of savings to be put in predefined piggy banks

and the proportion to be kept in the account as liquid savings - Loyalty program which awards purchases

- Virtual coaches that provide guided messages, hints and education about how to intelligently

manage finances - “Tasks” or “Earn” features allowing kids and parents to agree on a number of tasks to

complete in order to receive a small reward - Spending limits & control

- Crowdfunding (inviting family/friends to contribute to the savings goal)

- Chatbots (conversational banking)

Towards the construction of youth ecosystems?

As we have seen, the tools offered to children by banks range from training and educational material (tutorials, games, etc.) to basic banking products (current accounts, savings accounts, prepaid cards) clearly presented with a pleasant and playful design. But how can we go further? Can we imagine building a complete financial ecosystem for children? The answer is no. Kids are not consumers like any others. It would be neither ethical nor legal to go further by offering them bank credit for example or a multitude of other services, whether financial or not.

But banks are trying to go further. In Russia, Tinkoff Bank has started to venture off the beaten track and is developing a lot of areas that are not directly related to financial services. These are lifestyle products such as cinema tickets booking, P2P chats and gamification to develop social engagement, as well as chatbots to automate solutions to customer problems prior to contacting a support operator.

However, the idea of an ecosystem more broadly centered around kids, or to be clearer, an ecosystem built around the needs of the family, seems quite possible. It even seems to be emerging, in small steps, when we take a closer look at the non-banking services offered by financial institutions to parents.

In Poland, Unum Insurance offers ‘‘Better Start’’ a savings product akin to life insurance that allows parents to give a sum of money to their children when they come of age. “We know that it’s needed and that aware parents are open to such solutions,” says Borys Kowalski, board member and Chief Actuary at Unum Poland.

In Russia, Sberbank offers a Child Benefit Calculator service that allows parents to find and claim the various parental allowances to which they are entitled.

In Italy, BNP Paribas Cardif insurance protects children from harm on social networks with the Bodyguard app. “Our objective is to integrate this solution into a full cyber-insurance product. This will be part of the full insurance service,” explain Giacomo Losa and Roberta Avanzini, from the Research & Development team at BNP Paribas Cardif Italy.

Homework help is another service offered by mBank in Poland, which provides parents with a mathematics textbook which clarifies subjects that sometimes seem complicated in school books, or La Banque Postale, in France, which in the midst of the COVID crisis offered a year’s subscription to online tutorials from the homework help platform Maxicours.

There’s even something for babies with the amazing bAIby application from Generali that translates a baby’s cries, helping parents to understand their needs.

Finally, some insurers offer their services even before the child is born. This is the case with JOY from Religare Health Insurance in India, which insures pregnant women, or UnitedHealthcare’s Healthy Pregnancy mobile app and maternity program in the United States, which supports expectant mothers during their pregnancy. As for Sanitas, in Switzerland, or Beazley in the UK, they offer plans to cover very expensive fertility treatments.

The possibilities therefore seem to be there for one or more financial institutions to launch an ecosystem aimed at family customers and thus achieve a marketing positioning that could be a winner. Especially since the family gives rise to a need for credit: real estate loans for a larger home, loans to pay for studies later, etc.

Anna Perera Shaw also sees real customer interest in these family-friendly ecosystems. “Based on our data, all-inclusive offerings are indeed attractive to consumers since many look to consolidate product relationships with one provider. These offerings would need to be customizable (each family and their needs are unique), transparent and simple. Indeed, perhaps even more so since the pandemic, consumers look for simple and straightforward products that can be carried forward into the future with transparent fees and charges so there are no unexpected costs down the line,” she explains.

Overview of beyond-banking products and services offered to children by financial institutions:

- Child’s insurance with accident protection

- Life insurance

- Lifestyle products such as cinema ticket booking

- Homework assistance

- P2P chats

- Child benefit calculator for parents to find out what payments they can count on and what

they need to do to receive them - Cybersecurity prevention tool to protect the child online

- Baby translator device

Go further:

ESG community

With Qorus memberships, you gain access to exclusive innovation best practices and tailored matchmaking opportunities with executives who share your challenges.