Open finance leader Brankas has today announced a new feature enabling instant bank account opening as an "embedded finance" experience on third-party applications. The API is the first of its kind in the region, launched first in Indonesia and the Philippines. As a bundle with Brankas' market-leading data and payment solutions, any merchant or consumer app can provide fintech experiences to their users.

Using the new Account Opening API as part of Brankas' wider banking API suite, companies offering financial management, e-wallets, brokerages and more can now offer their users interest-bearing, regulated savings accounts as an embedded feature. HR platforms, ecommerce marketplaces and lenders can also provide users with savings accounts for collections and disbursements. The new Brankas solution also helps small businesses to unlock new revenue by onboarding newly banked customers in hard to reach areas.

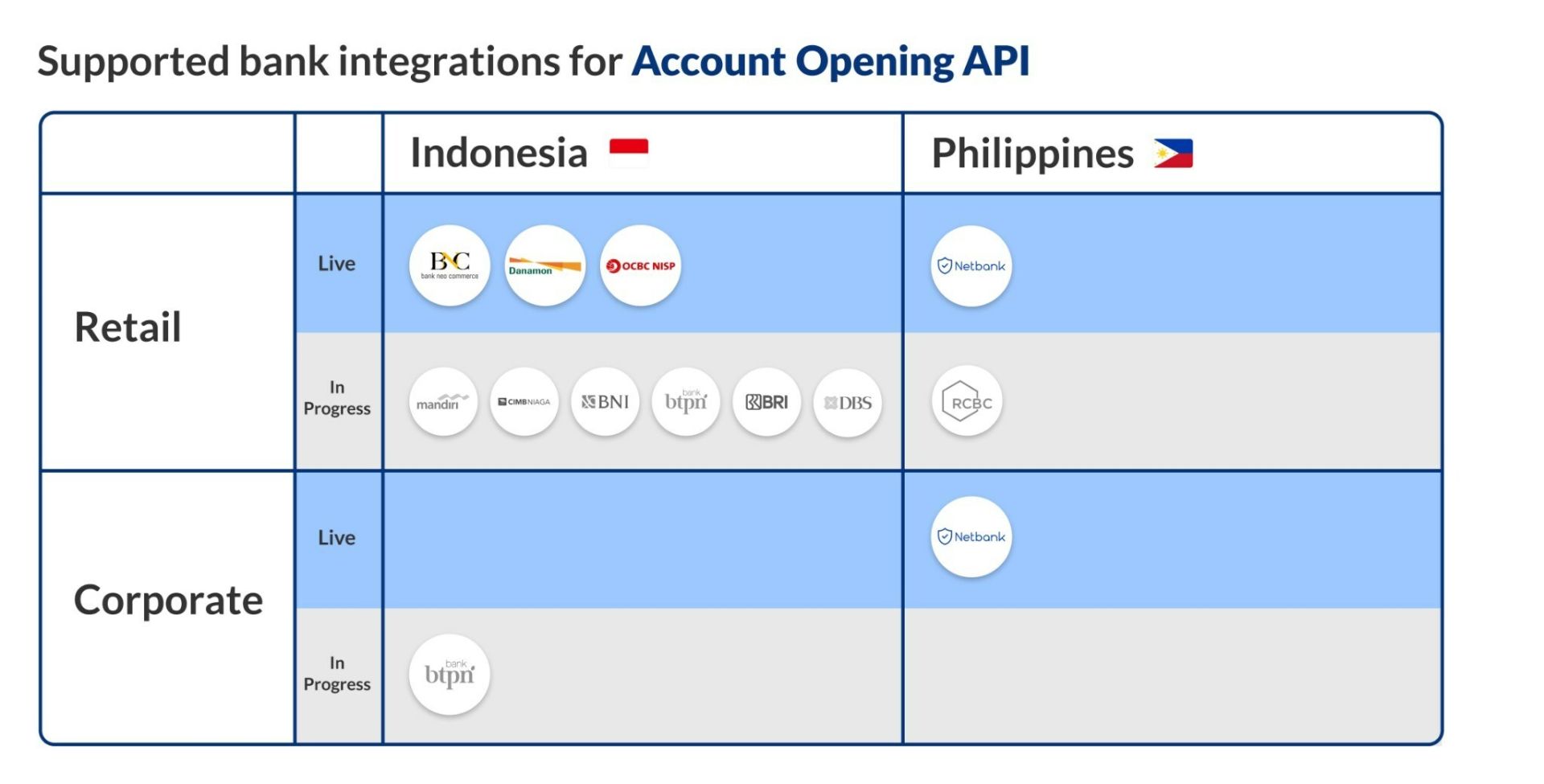

Brankas expects banks and merchants to partner up to offer attractive sign-up bonuses, while consumers and corporate customers can enjoy a fast, rewarding sign-up experience. Most businesses will be able to test the API and go live in less than a week.

In Indonesia, more than 50% of the population are unbanked, defined as not having access to the services of a bank or similar financial organization. This denies them access to basic financial services including loans, credit cards, and interest savings accounts.

"As a Bank Indonesia (BI) licensed financial services provider, Brankas sees tremendous potential in reaching out to the unbanked and underserved population across the region to get access to modern financial services. Banking-as-a-Service helps to power everyday financial services relevant to communities as diverse as fisheries, farms, drivers, accounting, and HRMS. We are excited to see our new Account Opening API being used to give consumers and SME/UMKM access to loans, investments, and a wide range of payment methods." said Husni Fuad, Country Manager, Brankas Indonesia.

At present, Brankas' Account Opening APIs supports account creation for OCBC NISP, Danamon, and BNC in Indonesia. Brankas also offers retail and corporate account creation in the Philippines, powered by Netbank. With an established network across the Asia-Pacific region, Brankas is integrated with over 100 enterprise partners to enable broader financial inclusion, and just recently announced a partnership with Arab Financial Services to strengthen the open finance infrastructure in the Middle East and North Africa (MENA) region.

"We are continuously expanding our menu of embedded finance offerings to support our customers across Asia-Pacific. Our Account Opening API provides a single integration across multiple banks that enables access to the unbanked and provides essential infrastructure for the next generation of fintech solutions." said Todd Schweitzer, CEO and Co-founder of Brankas. "Open Finance can be a catalyst for financial inclusion, and requires close partnerships between forward-thinking banks, API technology experts, and our enterprise customers onboarding new account holders. We are proud of the impact and access that Brankas and our partners have created, and I hope this will encourage more industry participants to consider new ways to reach the unbanked and underserved."